Author: Revc, Jinse Finance

Preface

If the financial market is compared to an AI model with huge data and sample size, then the main factor affecting the trend of US stocks and crypto assets in the model is the Federal Reserve's upcoming monetary policy adjustment. Powell recently said at the Jackson Hole Conference that the time has come to adjust monetary policy. Prior to this, the minutes of the Federal Open Market Committee (FOMC) meeting in July released by the Federal Reserve showed that most Federal Reserve officials strongly preferred to decide to cut interest rates at the September meeting.

As financial markets wait with bated breath for interest rate adjustments, where will the crypto market go? We try to find the answer from the recent performance of U.S. stocks and ETFs.

Recent performance of US stocks

This week's U.S. stock market data and events reflect investors' confidence in economic recovery, but at the same time they remain cautious about future policy expectations and market volatility. The Conference Board Consumer Confidence Index for August, released on Tuesday, rose for the second consecutive month to 103.3, showing that consumers' optimism about the economy has increased, which may indicate an increase in consumer spending. However, although Nvidia's second-quarter earnings report exceeded expectations, the market reaction was not satisfactory, showing that investors' expectations for technology stocks are already high, and although the earnings report is good, it did not bring new surprises.

Specifically, the market performed mediocrely in the first three trading days of this week, with the correction intensifying. However, at the time of writing this article, the fourth trading day had a rebound of nearly 1%, as shown in the figure below.

Market sentiment has shifted from optimism at the beginning of the week to caution. Despite optimistic economic data and the Dow Jones Industrial Average hitting a new record high, the performance of the Nasdaq and S&P 500 showed concerns about technology stocks and overall market volatility. Investors are adjusting their positions and looking for new investment opportunities, and the market's reliance on technology stocks may be decreasing.

The decline in US stocks may trigger a series of reactions, which may eventually lead to looser monetary policy and fiscal stimulus. Readers can pay attention to the possibility of a 50 bp interest rate cut at the September interest rate meeting .

Recession concerns

Macquarie analysts recently released a report expressing concerns about the outlook for the U.S. economy. If the Federal Reserve does not cut interest rates soon, the likelihood of the U.S. economy falling into recession will greatly increase. The report is mainly based on the following:

Weak labor market: The latest consumer confidence report showed some worrying signs in the U.S. job market, such as a decrease in the proportion of respondents who said job opportunities were plentiful and an increase in the proportion who said jobs were hard to find.

Other economic indicators are poor: Indicators such as hiring and quit rates also show weak trends, similar to levels seen during the 2015-2017 period.

Market expectations: Investors generally expect the Federal Reserve to cut interest rates by a massive 99 basis points by the end of the year.

Weakness in the labor market will lead to rising unemployment, which will in turn drag down economic growth. In contrast, the European Central Bank has a relatively hawkish stance as it focuses on controlling inflation. This divergence in central bank policy has led to a recent weakening of the U.S. dollar, but Macquarie believes that this trend may be coming to an end.

ETF Recent Performance

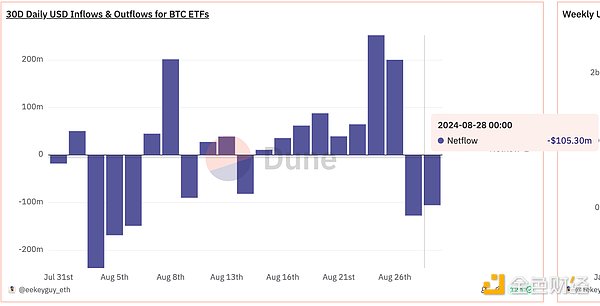

The performance and fundamental analysis of Bitcoin spot ETFs this week show the complexity of market sentiment. In terms of capital flows, Bitcoin ETFs experienced a shift from net inflows to net outflows this week. The net inflows for eight consecutive days totaled $756 million, but net outflows began on Tuesday, with a net outflow of $ 105 million yesterday, indicating that market sentiment may be changing and investors are adjusting their positions. Despite the outflows, the net asset ratio of Bitcoin ETFs remained at 4.64% (market value to the total market value of Bitcoin), reflecting the persistence of long-term confidence in Bitcoin. At the same time, Ethereum spot ETFs have experienced net outflows for nine consecutive days, showing that the market has low interest in Ethereum.

Judging from market sentiment and analysis, investors remain cautious about the short-term volatility of Bitcoin, but are optimistic about the future/Institutional movements such as BlackRock's Bitcoin ETF (IBIT) have shown strong capital inflows, showing recognition of Bitcoin as an asset class. Despite the net outflow of funds in the short term, in the long run, the asset size of ETFs and the participation of institutional investors show that they still have confidence in the long-term value and potential of Bitcoin, and the market is looking for a suitable entry point.

Bank of Japan rate hike latest news

The previous yen interest rate hike caused a flash crash in the financial market, and the crypto market was not spared. Investors should also pay attention to the actions of the Bank of Japan.

Recent comments by Bank of Japan Deputy Governor Yoshizo Himino and Bank of Japan President Kazuo Ueda have indicated that the Bank of Japan will consider further interest rate hikes if the economic and price outlook continues to improve. This stance not only strengthens the market's expectations for future interest rate hikes, but also hints at the possible direction of policy adjustments, reflecting confidence in economic recovery and the necessity of adjusting easing policies.

In addition, the Bank of Japan's expectations and actual rate hikes will have a significant impact on financial markets. First, as a major investor in overseas assets, Japan's rate hikes have led to higher domestic yields, reduced demand for foreign assets, and prompted the sale of existing assets, which in turn affected global financial liquidity. Second, the yen's strength amid expectations of rate hikes shows the market's sensitivity to policy changes, especially against the backdrop of the Fed's expectations of rate cuts, where the yen's attributes as a safe-haven currency are more prominent. In addition, the Bank of Japan's policy adjustments are related to the Fed's policy direction and may have complex effects on global markets. Analysts predict that if the Bank of Japan's confidence in the economic cycle increases, it may raise interest rates by 25 basis points every six months in the future , and it is expected that interest rates may reach 0.75% or higher by 2025 , marking a major shift in Japan's monetary policy.

Crypto Market Recent Performance

Crypto market sentiment showed uncertainty and volatility this week, and investor confidence was affected by the macroeconomic environment, such as the Fed's policy adjustments and global economic turmoil. These factors led to a decrease in large capital inflows, affected market liquidity, and changed investor behavior from long-term holding to short-term and frequent trading, showing the market's preference for quick profits and PVP forms.

The regulatory environment has also had a significant impact on the crypto market. The interest rate hikes and regulations in the previous cycle restricted the entry of incremental funds and increased market volatility. Although the top crypto assets performed well in the technology and developer communities, market demand failed to keep up, probably due to different expectations for future policies and economic environment. The market's decline before and after the rate cut was considered normal, but the market rebound was not fully realized because the liquidity injection did not meet expectations, showing that although the activity of retail investors was high, there was a lack of large funds to promote it, and the overall market performance was weak.

Correlation between US stocks and crypto markets

At the beginning of the year, due to the surge in crypto assets, they were non-correlated and negatively correlated with U.S. stocks, but after April, the correlation was restored to a certain extent, and the focus of the crypto market shifted from Bitcoin halving to expectations of interest rate cuts.

As shown in the figure below, although the U.S. stock market fell this week, the impact on the cryptocurrency market was not completely consistent. The performance of the cryptocurrency market has its own logic, which is affected by the U.S. stock market but not completely synchronized.

The correlation between Bitcoin and the S&P 500 can be attributed to factors such as falling inflation and the Federal Reserve’s pause in rate hikes, creating a favorable environment for risk-on trades. Despite the correction, both have recently seen a bullish rally on expectations of rate cuts.

When Bitcoin's correlation with traditional stock markets increases and its correlation with gold decreases, it indicates that Bitcoin is more of a risk-on asset than a safe haven. Investors tend to invest in both stocks and digital currencies when seeking high returns. The increased participation of institutional and retail investors in the stock and cryptocurrency markets, and their joint buying and selling decisions may lead to consistent price movements of these assets, that is, higher correlation.

summary

The market's expectation for a rate cut in September 2024 has been made clear, which has eased market uncertainty to a certain extent and may drive funds from traditional financial markets to high-yield assets such as cryptocurrencies. However, the expectation of a rate cut has been digested by the market, and the actual implementation may not bring about a sharp rise, and even a rate cut lower than expected may lead to market disappointment and affect the trend of crypto assets.

Before and after the rate cut, investor behavior may diverge, with some entering the market early to push prices up, while others wait and see or turn to other assets, increasing market volatility. Rate cuts usually signal an economic downturn, but they also reduce the opportunity cost of holding fixed-income assets, which may prompt funds to flow into the crypto market. Despite good technical performance, market demand may be suppressed due to uncertainty in the macro environment, and the long-term impact of rate cuts on the market depends on economic recovery and policy sustainability.