By Arthur Hayes, Co-founder of BitMex

Compiled by: Liam Carbon Chain Value

(Any opinions expressed in this article are the author's personal opinions and should not be used as the basis for investment decisions, nor should they be regarded as recommendations or suggestions for participating in investment transactions.

What do you do when the market is down and you have to win an election?

If you are a politician, the answer is simple. Your primary goal is to secure reelection. Therefore, you print money and manipulate prices to go higher.

Let's say you're Democratic presidential candidate Kamala Harris, facing a formidable opponent. You need everything to go right because a lot has gone wrong since the last time you were vice president. The last thing you want on Election Day is a global financial crisis.

Harris is a savvy politician. Given that she is Obama's lackey, I bet Obama was whispering in her ear what would happen if the 2008 global financial crisis came to her doorstep a few months before the election. President Slow Joe Biden is busy in his vegetable garden, so people think Harris is in control.

In September 2008, Lehman Brothers collapsed, triggering the global financial crisis, just as George W. Bush was finishing his second term as president. Given that he was a Republican, one might have thought that Obama’s appeal as a Democratic president was that he was a member of the other party and therefore not responsible for the recession. Obama went on to win the 2008 presidential election.

Let's return to Harris' dilemma: How should she respond to the global financial crisis caused by Japan's massive yen carry trade? She can let the free market destroy over-leveraged companies and let wealthy baby boomer financial asset holders experience real pain. Or, she can instruct US Treasury Secretary Yellen (Bad Gurl Yellen) to solve the problem by printing money.

Harris, like any politician, regardless of party or economic beliefs, will instruct Yellen to use the monetary tools available to her to avoid a financial crisis. Of course, that means the printing presses will be running in some way, shape, or form. Harris doesn’t want Yellen to wait—she wants Yellen to act forcefully and immediately. So if you agree with me that the unwinding of the yen carry trade could cause the entire global financial system to collapse, then you also have to believe that Yellen will act before Asian trading opens next Monday, August 12.

To give you an idea of the size and magnitude of the potential impact that could result from the unwinding of the carry trade for Japanese companies, I will present an excellent research note from Deutsche Bank dated November 2023. Then, I will present how I would structure a bailout if, for some reason, I were in charge of the U.S. Treasury.

The Widowmaker

What is a carry trade? A carry trade involves borrowing a currency with a lower interest rate and using that currency to buy a financial asset that has a higher yield or is more likely to appreciate in value. When the loan needs to be repaid, if the borrowed currency appreciates relative to the currency of the asset purchased, you lose money. If the borrowed currency depreciates, you gain money. Some investors hedge their currency risk, while others do not. In this case, Japanese companies do not need to hedge their borrowed yen because the Bank of Japan can print an unlimited amount of yen.

Japan Inc. is the Bank of Japan, businesses, households, pension funds and insurance companies. Some of them are public, some are private, but they act together to improve Japan, or at least they intend to.

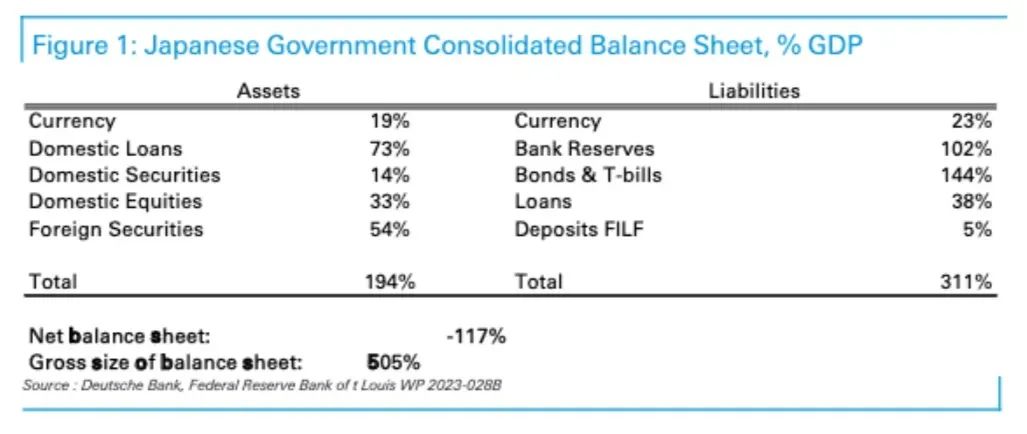

Deutsche Bank wrote a fascinating report titled "The World's Largest Carry Trade" on November 13, 2023. The author asks a rhetorical question: "Why didn't the yen carry trade explode and bring down the Japanese economy?" The situation today is very different from the end of last year.

Japan is widely believed to be deeply indebted. Hedge fund brokers are betting on an imminent collapse of the Japanese economy. But those who bet on a collapse of the Japanese economy always lose. This is not some “widowmaker” trade. Many macro investors are too bearish on Japan because they do not understand the country’s combined public and private balance sheets. This is an easy psychological mistake for Western investors who believe in individual rights. But in Japan, the collective is supreme. Therefore, certain actors that are considered private in the West are simply substitutes for the government in Japan.

Let's talk about the liabilities first. These are the things that fund the carry trade. That's how yen is borrowed. They come with interest costs. The two main items are bank reserves and bonds and treasury bills.

Bank reserves – This is the money that banks hold with the Bank of Japan. This amount is quite substantial because the Bank of Japan generates bank reserves when it buys bonds. Remember that the Bank of Japan owns nearly half of the Japanese government bond market. Therefore, bank reserves are huge, accounting for 102% of GDP. The cost of these reserves is an interest rate of 0.25%, which is paid by the Bank of Japan to the banks. In contrast, the Federal Reserve pays an interest rate of 5.4% on excess bank reserves. This funding cost is almost zero.

Bonds and Treasury Bills – These are Japanese government bonds issued by the Japanese government. Due to the market manipulation by the Bank of Japan, the yields on Japanese government bonds are at historically low levels. At the time of this posting, the current yield on 10-year Japanese government bonds is around 0.77%. This financing cost is negligible.

When it comes to assets, the broadest line item is "foreign securities." These are financial assets owned overseas by the public and private sectors. One of the largest private holders of foreign assets is the Government Pension Investment Fund (GPIF). At $1.14 trillion, the fund is one of the largest, if not the largest, pension funds in the world. It owns foreign stocks, bonds, and real estate.

When the Bank of Japan prices bonds, domestic loans, securities, and stocks all do well. Finally, due to the massive creation of yen liabilities, the depreciation of the yen lifts domestic stock and real estate markets.

USD/JPY (white) rose, meaning the yen was depreciating against the dollar. The Nasdaq 100 (green) and Nikkei 225 (yellow) also rose.

In general, Japanese companies have taken advantage of the financial repression implemented by the Bank of Japan to raise funds and have been highly rewarded by the depreciation of the yen. This is why the Bank of Japan can continue to pursue the loosest monetary policy in the world even as global inflation rises. The profits are fucking crazy.

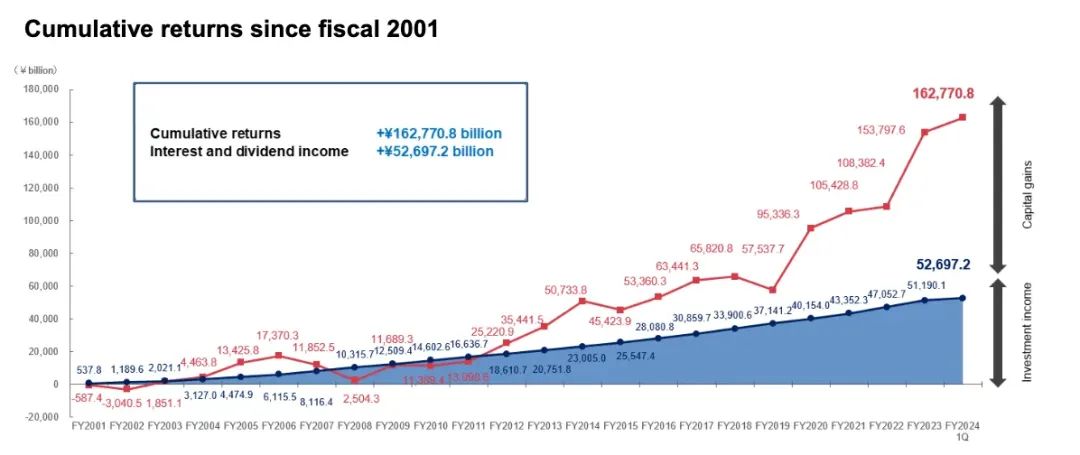

Source: GPIF

GPIF has performed well, especially in the past decade, when the yen has depreciated significantly. As the yen has depreciated, the returns on overseas assets have soared.

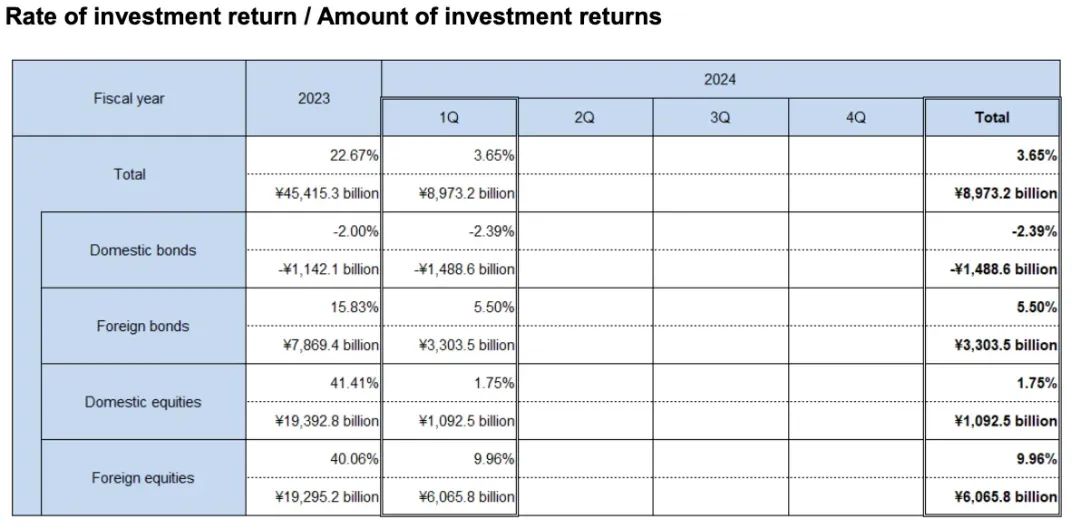

Source: GPIF

The GPIF would have lost money last quarter if it weren’t for the stellar returns on its foreign stock and bond portfolio. The domestic bond losses came as the Bank of Japan withdrew from YCC, causing JGB yields to rise and prices to fall. However, the yen continued to weaken as the interest rate spread between the Bank of Japan and the Fed widened more than Sam Banman Friedman’s eyes when he found an Emsam pill.

Japanese companies are massively involved in this trade. With a GDP of about $4 trillion and a total exposure of 505%, they are taking on $24 trillion worth of risk. As Cardi B said, “I want you to park that big truck in this little garage.” She must be talking about the Japanese men in power in the land of sunset.

The trade apparently worked, but the yen became too weak. In early July, the dollar-yen exchange rate reached 162, which was unbearable given the high inflation that was rampant at the time and is still raging today.

The Bank of Japan does not want to close this trade immediately, but intends to exit it slowly over time... they always say so. Mr. Ueda succeeds Mr. Kuroda as Governor of the Bank of Japan in April 2023. Kuroda was the chief architect of the massive trade. He took advantage of the situation and got out. Among the many candidates who were interested in closing the trade by unwinding their positions, Ueda was the only fool. The market knew that Ueda would try to get the Bank of Japan out of this carry trade. The question was always the pace of normalization.

Closing a Position

What would a disorderly liquidation look like? What would happen to the various assets held by Japanese companies? How much would the yen appreciate?

To close its position, the Bank of Japan would need to raise interest rates, stop buying JGBs, and eventually sell them back into the market.

What about liabilities?

Without the Bank of Japan's continued suppression of JGB yields, yields would rise as the market demands, at least in line with inflation. Japan's consumer price index (CPI) rose 2.8% year-on-year in June. If JGB yields rise to 2.8%, higher than any bond yield on the yield curve, the cost of debt of any maturity will increase. The interest costs of bond and short-term Treasury bill liabilities will surge.

The BOJ would also have to raise the interest it pays banks on reserves to prevent money from escaping its control. Again, this cost would go from virtually nothing to huge given the notional amounts involved.

In short, if interest rates were allowed to rise to market-clearing levels, the BoJ would need to pay billions of yen in interest each year to maintain its position. With no revenue from selling assets, the BoJ would have to print large amounts of yen to service its debt. Doing so would only make the situation worse; inflation would rise and the yen would fall. Therefore, assets would have to be sold.

What happens on the asset side?

The biggest headache for the Bank of Japan is how to sell its huge pile of junk JGBs. Over the past two decades, the Bank of Japan has destroyed the JGB market through its various quantitative easing (QE) and yield curve control (YCC) programs. For all intents and purposes, the JGB market no longer exists. The Bank of Japan must force another member of Japanese corporate to do its job and buy JGBs at prices that won’t bankrupt the Bank of Japan. If in doubt, call your bank.

Japanese commercial banks were forced to deleverage after the real estate and stock market bubble burst in 1989. Since then, bank lending has stagnated. Since companies no longer borrow from banks, the Bank of Japan has been forced to join the money printing. Given that banks are in good shape, it is time to put trillions of yen worth of Japanese government bonds back on bank balance sheets.

While the Bank of Japan can ask banks to buy bonds, banks also need to get money from somewhere else. As JGB yields rise, Japanese companies seeking profits and banks holding trillions of dollars in overseas assets will sell those assets and repatriate the capital to Japan and deposit it in banks. Banks and these companies will buy large amounts of JGBs. As the yen appreciates due to capital inflows, JGB yields will not rise to a level that the Bank of Japan cannot maintain its business while reducing its holdings of bonds.

The main victims were the decline in the prices of foreign stocks and bonds sold by Japanese companies to raise funds for capital repatriation. Given the sheer size of this carry trade, Japanese companies are the marginal price setters for stocks and bonds worldwide. This is particularly true for any U.S.-listed security, as its market is the preferred destination for funding capital in the yen carry trade. Given that the yen is a freely convertible currency, many of the trading finance trading books reflect the position of Japanese companies.

As the yen depreciated, more and more investors around the world were encouraged to borrow yen to buy U.S. stocks and bonds. Because the leverage ratio was high, when the yen appreciated, everyone rushed to cover their positions at the same time.

I showed you a chart earlier that shows what happens when the yen depreciates. So what happens when the yen appreciates a little bit? Remember that chart from earlier? It showed the appreciation of the USD/JPY from 90 to 160 over 15 years. In 4 trading days, the yen appreciated from 160 to 142, and here are the results:

If the USD/JPY (white) appreciates by 10%, the Nasdaq 100 (white) falls by 10%, and the Nikkei 225 (green) falls by 13%. The ratio of the appreciation of the yen to the decline of the stock index is roughly 1:1. Further deduction, if the USD/JPY reaches 100, which is a 38% change, the Nasdaq will fall to about 12,600 points and the Nikkei will fall to about 25,365 points.

There is a high probability that the USD/JPY exchange rate will reach 100. A 1% reduction in the carry trade of Japanese companies is equivalent to a nominal reduction of about $240 billion. This is a huge amount of capital at the margin. Different players in Japanese companies have different priorities. We saw this with Norinchukin, Japan's fifth largest commercial bank. Their carry trade partly collapsed and they were forced to start unwinding their positions. They are selling their foreign debt positions and taking USD/JPY forward foreign exchange hedges. This news was announced months ago. Insurance companies and pension funds will be under pressure to disclose unrealized losses and exit trades. In addition, as currency and stock volatility increases, all copy traders will be liquidated by their brokers very quickly. Remember, everyone is unwinding the same trade at the same time. Neither we nor the elites responsible for global monetary policy know the total size of the yen carry trade positions lurking in the financial system. As the market focuses on this highly leveraged part of the global financial system, this opacity means that the market can quickly overcorrect in the other direction.

Frightened

Why is Yellen worried?

Since the 2008 global financial crisis, I think China and Japan have saved the United States from a worse recession. China has implemented one of the largest fiscal stimulus programs in human history, using debt to build infrastructure. China needs to buy goods and raw materials from the rest of the world to complete its projects. Japan has printed a lot of money through the Bank of Japan to expand its carry trade. Japanese companies use these yen to buy US stocks and bonds.

The U.S. government receives huge revenues from capital gains taxes, which are the result of a stock market boom. From January 2009 to early July 2024, the Nasdaq 100 rose 16-fold and the S&P 500 rose six-fold. Capital gains tax rates range from about 20% to 40%.

The US government is running deficits despite record high capital gains taxes. To finance the deficits, the Treasury must issue Treasury bonds. Japanese companies are among the largest marginal buyers of Treasury bonds…at least until the yen starts to appreciate. Japan helps afford US Treasury bonds for profligate politicians who need to buy votes with tax cuts (Republicans) or various forms of welfare checks (Democrats).

Total U.S. debt outstanding (yellow) is rising, moving to the right. However, the 10-year Treasury yield (white) has been volatile, showing little correlation to the growing debt.

My view is that the structure of the U.S. economy requires that Japanese companies and those that copy them continue to engage in this carry trade. If this trade ends, the U.S. government's fiscal situation will be in trouble.

Rescue

The reason I am assuming a coordinated bailout of carry trade positions by Japanese companies is because I believe Harris will not have her chances of being elected diminished because some foreigners decided to exit some trade that she may not even understand. Her voters certainly don’t know what is going on and don’t care. Their stock portfolios either go up or they don’t. If stocks don’t go up, they won’t vote Democrat on Election Day. Voter turnout will determine whether Trump or Harris becomes the “clown emperor.”

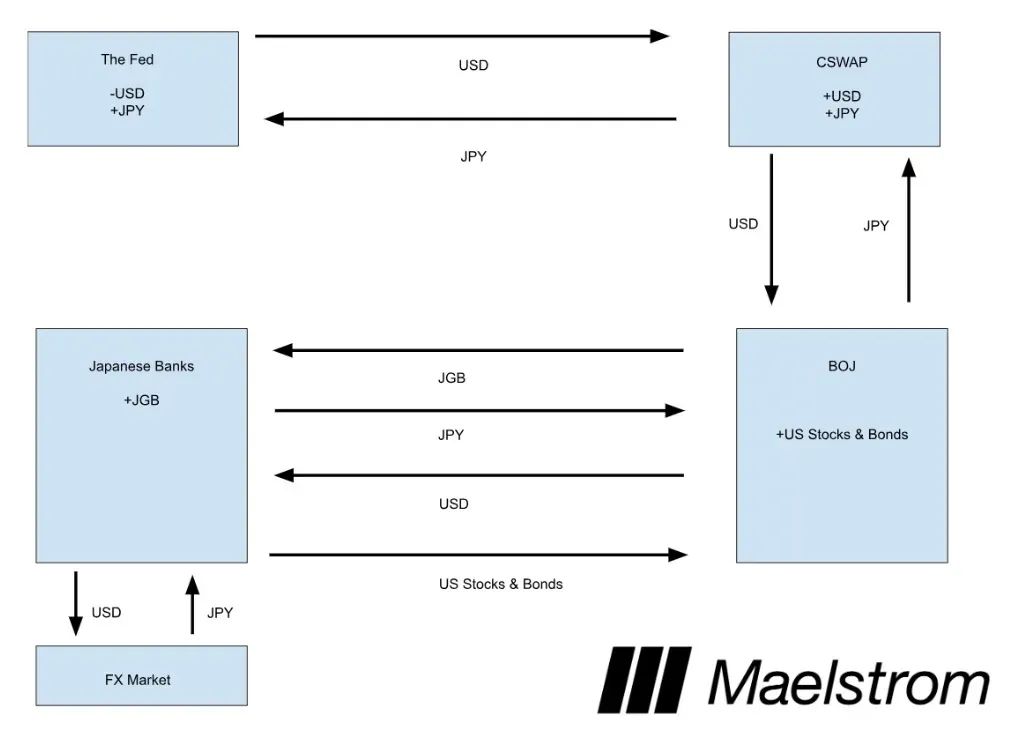

Japanese companies have to close their positions, but they can't sell certain assets on the open market. This means that some U.S. government agency has to print money and then lend it to some members of Japanese companies. Please allow me to reintroduce myself. My name is Central Bank Swap Agreement (CSWAP).

Let me explain how I would conduct a bailout if I were Yellen.

On Sunday evening, August 11, I will make an announcement ( I will be speaking as Yellen ):

The U.S. Treasury, the Federal Reserve, and our Japanese counterparts had a lengthy discussion about last week's volatile market conditions. During the call, I reiterated our support for the use of the U.S. dollar-yen central bank swap lines.

That's all. To the public, it seems completely harmless. This is not a statement of capitulation by the Fed, which is slashing rates and restarting quantitative easing. This is because the public knows that doing so will cause inflation, which is already uncomfortably high, to accelerate again. If inflation is rampant on Election Day and can be easily traced back to the Fed, Harris will lose the election.

Most American voters have no idea what CSWAP is, why it was created, or how it can be used to print unlimited amounts of money. However, because of the way the mechanism is used, the market will correctly view it as a hidden bailout.

This transfers ownership of overseas assets held by Japanese companies and banks to the BoJ. These private entities hold USD and repatriate capital to Japan by selling USD and buying JPY. They then buy JGBs from the BoJ at the current high prices/low yields. The result is an inflated CSWAP outstanding that is equal in USD to the amount of money printed by the Fed.

I made an ugly box and arrow diagram that helps illustrate the flow of money.

The final result is what matters most.

The Fed - they increase the supply of dollars, in other words, in return they get the yen that they previously generated through the carry trade.

CSWAP - The Bank of Japan owes the Federal Reserve dollars. The Federal Reserve owes the Bank of Japan yen.

Bank of Japan - They now hold more US stocks and bonds, and since the amount of dollars rises due to the increase in CSWAP balances, the prices of these stocks and bonds will also rise.

Bank of Japan - they now hold more Japanese government bonds.

As you can see, this has no impact on the US stock or bond markets, and the total carry trade exposure of Japanese companies remains unchanged. The yen appreciates against the dollar, and most importantly, US stock and bond prices rise due to the Fed printing money. Another benefit is that Japanese banks can issue unlimited yen loans with newly acquired Japanese government bond collateral. This trade re-inflates the US and Japanese systems.

Timeline

The carry trade for Japanese companies will happen, I have no doubt about it. The question is when the Fed and Treasury will print money to weaken their influence on "America".

If the U.S. stock market plunges on Friday, August 9, causing the S&P 500 and Nasdaq 100 to fall 20% from their July all-time highs, some kind of action could be in the cards over the weekend. Support is at 4,533 for the S&P 500 and 16,540 for the Nasdaq 100. I also expect the two-year Treasury yield to be around 3.80% or lower. This yield was reached during the regional banking crisis in March 2023, when it was addressed through the Bank Term Funding Program rescue measures.

If the yen weakens again, the crisis will end immediately. The crisis will continue, albeit at a slower pace. I believe the market will freak out again in the September-November period as the USD/JPY exchange rate moves towards 100. There will definitely be a reaction this time as the US presidential election will be held in a few weeks or days.

Trading in crypto is hard.

Two opposing forces influence my cryptocurrency holdings.

Liquidity Positive Factors:

After a quarter of net restrictive policy, the US Treasury will be a net injector of USD liquidity as it will issue T-bills and potentially drain the Treasury General Account. This policy shift was already explained in the recent quarterly refund announcements. TL;DR: Bad Girl Yellen will inject between $301 billion and $1.05 trillion between now and the end of the year. I will explain this in a follow-up post if needed.

Negative Forces of Liquidity:

This is the strength of the yen. The unwinding of trades leads to a coordinated global sell-off of all financial assets because yen debts must be repaid and the price of yen debts increases over time.

Which force is stronger really depends on how quickly the carry trades are unwound. We can't know that in advance. The only observable effect is the correlation between Bitcoin and the USD/JPY exchange rate. If Bitcoin trades in a convex fashion, i.e. it rises when the USD/JPY exchange rate strengthens or weakens significantly, then I know that if the yen is too strong and the liquidity provided by the US Treasury is sufficient, the market anticipates a bailout. That's convex Bitcoin. If Bitcoin falls with a stronger yen and rises with a weaker yen, then Bitcoin will move in line with the TradFi market. That's correlated Bitcoin.

If the trend in Bitcoin is convex, then I would aggressively add to my position as we reach a local bottom. If the setup is correlated with the trend in Bitcoin, then I would wait and see for the market to eventually capitulate. An important assumption is that the Bank of Japan does not change course and cut the deposit rate to 0% and resume unlimited purchases of Japanese government bonds. If the Bank of Japan sticks to the plan it laid out at its last meeting, then the carry trade will continue.

That's all I can say for now. As always, these trading days and trading months will determine your returns in this bull cycle. If you must use leverage, use it wisely and monitor your positions at all times. If you hold a leveraged position, it's best to be bullish on your Bitcoin or Altcoin. Otherwise, you will face liquidation.

Friends, I am off to enjoy the last bit of vacation in August.

Set sail!