The price has returned, but the money in the leeks' accounts has decreased a lot

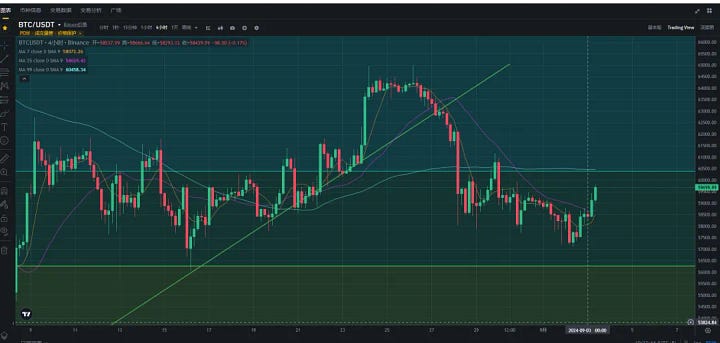

After yesterday's rise, BTC has returned to the price after the U.S. stock market closed last Friday. It is currently above $59,500. It has fallen, but it also seems not to have fallen.

However, the price of Altcoin is much lower than that on Friday. The worst thing about trading is that you make a lot of trades, but the price remains the same, but the money in your account is gone. You are working hard to make money, but in the end you are losing money.

Saturday and Sunday made the young leeks develop the inertial mindset of shorting on rebounds. The market situation from yesterday to now has taught these people who rely on regular trading a lesson. It is really difficult to accurately grasp each type of leek.

Why do you start reminding me to open a position and buy?

There are a few points:

1. Keep your own pace. The experience of several bull and bear markets tells me that the time has come.

2. The adjustment of the disk has come to a certain point;

3. Yesterday I saw various media reports of bearishness and selling, and most of the market is still immersed in bearish and bearish sentiment;

4. The correction before the non-agricultural data and interest rate cut has already occurred, and the decline is weak. We must maintain a keen sense of smell before big data events;

5. The current price of opening a position is very profitable;

Can Bitcoin Return to 60,000?

The time to enter the market is from the end of August to the beginning of September! At present, this range is completely correct.

The market's anxiety level has reached a certain bottleneck, and it's time to take action. When everyone is about to lose patience, the market will come!

Today is Tuesday, and this week is expected to be an upward volatile market:

Some Altcoin will follow independent trends. Bitcoin is currently around 59,000 and ETH is currently around 2,500. After stabilizing here, they will continue to break upwards.

Today's market analysis:

From the K-line, the 1-hour and 4-hour levels are in an upward trend, the 12-hour level is just today's upward trend, and the daily level has a stop-loss signal. The intraday pressure level is 61200, and the support level is 57200.

Pay attention to around 64,000 on the daily level. As long as it holds this position, it will take off in the future. It is still in a period of shock adjustment, so you can focus on the related Bitcoin ecology.

Opportunities often appear when market sentiment is extremely pessimistic!

Regarding the overall market, today I would like to share with you a very simple and easy to understand truth. As long as you understand this, you will not be anxious at all.

Regarding the current market trend, if the market outlook is bearish or the current market is a bear market, then if there is any rebound after the decline on August 5 or August 15, the market will fall instantly. The reason is simple: fall from a high level and exit with profits.

But this is not the case at present. Instead, it has been testing support at a high level and then rebounding. Every time it falls down, it will rebound quickly. Obviously, this is not the trend that a bear market should have at a high level, so after the consolidation is over, there is only one direction, up!

Today is September 3rd. Let me say it again, the market is slowly recovering and the copycat market is about to come!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background