There will be non-agricultural data tonight, please pay attention to short-term fluctuations. I looked at a lot of data this morning. Combined with the market, I would like to talk about the current trend expectations. First of all, the price has been falling recently and the market sentiment is pessimistic. The BTC is fluctuating back and forth and falling. The harvesting contract has caused the spot cottage to be very poor. Many people have begun to change their thinking and chase short contracts. Or high leverage for volatility, which is also the thinking that the current dealers need to cultivate.

A few days ago, I analyzed the main data of the big B network. From the current point of view, combined with the 24-hour and 7-day contract liquidation charts, and some Altcoin in the market have shown some resistance to falling. I think this is a short-term turning point, so don't chase the shorts .

① The price is sluggish and only leverage can be used to gain profits. The main force is currently cultivating air force and shock players for subsequent harvesting. In the process of BTC continuous decline, the long positions of B.com have increased by more than 6,000 BTC in the past few days. Ethereum has also increased, but not as much as BTC.

②24 hours to 7 days of contract liquidation chart, if the BTC falls to around 54000, it can get about 600 million liquidity . This is the only inventory of the long army at present. On the other hand, after the cultivation of the past few days, the short position has increased rapidly. If it reaches 60,000, it can liquidate nearly 2 billion liquidity . There are 1 billion short orders around 57500-58000. The gap between the two sides is too big

③ The current daily line is equivalent to a trend of a secondary test low. Comprehensive observation of the market shows that some altcoins have stopped falling and started to show resistance in batches. Because the altcoins are currently at the bottom of the daily line of the big cycle, many have fallen back from the last high, so they are not willing to fall too much. The contract rates of most currencies in the market are at a historically low level, and the fear index is also at a low level.

Based on the above judgment, the worst performance is to use the data to get the remaining long inventory near 54,000 at night, then let the market panic intensify and chase the shorts, and then quickly pull back to start harvesting the shorts!

Secondly, today's data is positive. After directly harvesting the air force, it is slowly fluctuating and falling. The main position building cycle of Dab.com has not yet been completed.

We conducted a forecast analysis on whether the Federal Reserve will announce a rate cut on the 19th and the base issue:

From a macro perspective, the first question that everyone is most concerned about is how much the interest rate cut base will increase or decrease.

The interest rate was cut by 25 basis points in September, and the expected interest rate cut was realized, which was bearish and fell.

The interest rate was cut by 25 basis points in September, inflation was contained, the economy was running smoothly, good news, rising

The interest rate was cut by 50 basis points in September. The economy has problems. The interest rate was cut to make up for the loss. It is bad news and the market is falling.

The interest rate cut in September was 50 basis points, which was beyond expectations. It was good news and the market rose.

There is an old Chinese saying: Buy when there is disagreement, sell when there is agreement.

There is an old Chinese saying: Don't release the eagle until you see the rabbit.

Therefore, the point expressed above is that, as the endogenous narrative of the crypto is exhausted, BTC ETH, as a stock narrative of US technology stocks; without fundamentals, they can only go with the flow and fluctuate weakly. Because the current market game environment is very twisted

The military and the air force are like two wild dogs fighting to the death. In my opinion, both dogs are exhausted. If someone gives them some stimulants, the chances of winning will be greater.

The full text of the sentence above is: "Buy when divergence turns to consensus, sell when consensus turns to divergence." If you can't catch that point, catching that range is also good

We are experiencing the darkness before dawn, the last baptism before the main uptrend

I think now is the bottom range of the bear market, and the bull market has not yet arrived. I don’t know. The bottom range of the bear market can make you surrender your chips through various ways of washing the market, among which the extreme shock, including the downward killing

I know that the entire economic cycle led by the Federal Reserve is shifting from tightening to easing.

I know that the interest rate cut is not just one time, but 25%, 25% at a time, several times 25%, which is the exact opposite of the interest rate hike cycle.

I also know that interest rate cuts are real money releases, which means real money starts to flow into the market, and this money will push up the prices of assets denominated in US dollars.

I am greedy for lower-priced chips. I want to swim in the turbulent waves and seek to maximize profits. I know it is risky, but I can't control my greed.

Follow me and go through the super bull market together!!!

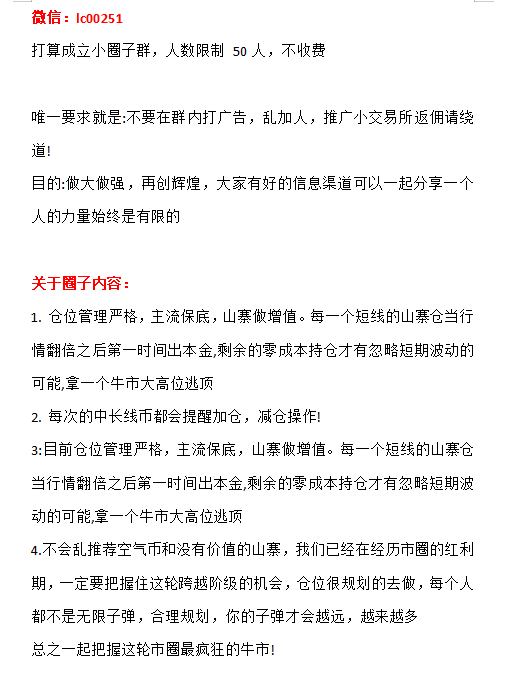

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background