Does cutting interest rates mean they will definitely rise? What is the connection between interest rate cuts and Bitcoin?

▎Recommended reading: Will Bitcoin rise after the Fed opens the door? Understand in one article how raising and lowering interest rates affect the price of Bitcoin

As we mentioned in our previous article introducing the Federal Reserve, interest rate cuts are usually in response to slowing economic growth or expected inflationary pressures. When the overall economy is facing difficulties or even at risk of recession, interest rate cuts can reduce borrowing costs, which means that "obtaining funds" becomes cheaper and can effectively promote economic activity.

Loose policies will increase the flow of funds into the market. In addition to increasing liquidity, they also indirectly reduce the cost of holding cash. At this time, investors will tend to look for markets with higher returns , which will not only promote the rise of traditional assets such as the stock market, but also indirectly affect the prices of risky asset markets. Bitcoin, as an investment tool considered to be high-risk and high-return, of course Quite popular!

How long does it take for interest rates to start rising after a cut: market lag is usually 1 to 3 months

Since the market began to recover at the end of last year, interest rate cuts have been one of the main narratives of this bull market. Not only the financial market has speculated on a wave of interest rate cut expectations, but some people also believe that interest rate cuts have actually been priced in.

I believe what everyone wants to know most is, after interest rates really start to be cut, when will they start to increase?

Looking back at Bitcoin's performance during several interest rate cut cycles, it can be seen that the rise will not occur immediately after the interest rate cut, but will lag behind for a certain period of time. According to past interest rate cut cases, the lag time is generally 1 to 3 months . The length of the lag time depends on the speed of the market digesting the interest rate cut policy and the state of the global economy. Let’s take a look at the trend of Bitcoin after the past few interest rate cuts.

The interest rate cut cycle after the 2008 financial crisis

After the interest rate cut cycle from September 2007 to December 2008, market liquidity increased significantly. However, Bitcoin, which was born in 2009, is still in its early stages of development and will not begin to transform from a niche hobby into a public investment target until a few years later. . Starting in 2010, as interest rate cuts and quantitative easing continued, the price of Bitcoin rose from a few cents to $1,000 in 2013. The increase between this cannot be specifically quantified, but it somewhat represents Bitcoin’s potential in the interest rate cut cycle.

The interest rate cut cycle of trade war and economic slowdown in 2019 - started to pick up after 6 to 8 months, with an increase of 250% in half a year

Due to the escalation of the U.S.-China trade war and the slowdown in global economic growth, the Federal Reserve cut interest rates three times from July to October 2019 in an attempt to stimulate the economy. The price of Bitcoin has risen from $3,800 at the beginning of the year, reaching a level of $3,800 in June. The high was around $13,000 . Although the price fell back in the second half of 2019 due to uncertainties such as the trade war, the effect of the interest rate cut cycle in driving Bitcoin prices is still quite significant.

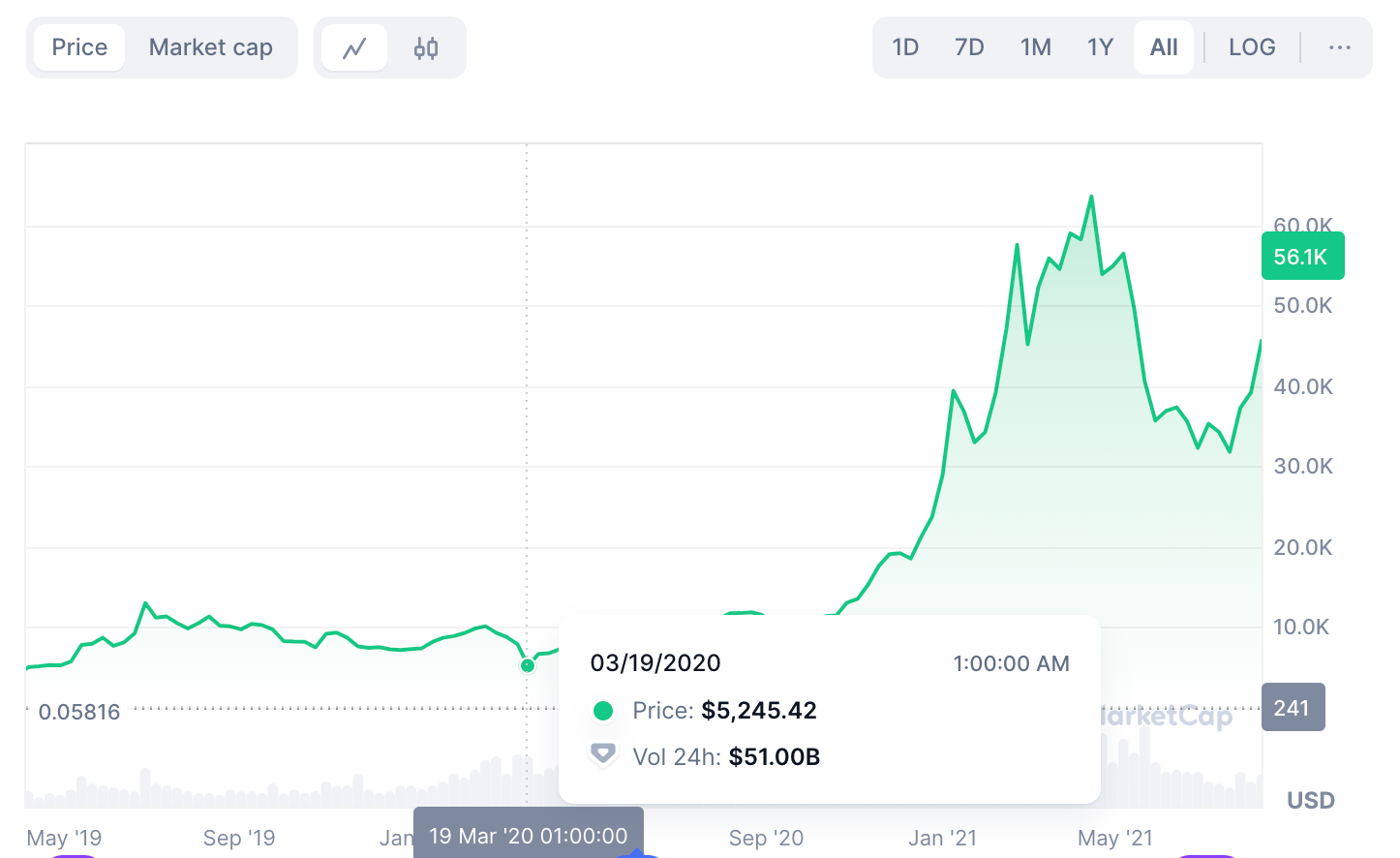

2020 COVID-19 interest rate cut cycle - started to pick up after one month, with an increase of 500% in 8 months

The COVID-19 epidemic swept the world in 2020, and the shutdown of many important supply chains around the world led to rapid inflation. The Federal Reserve began emergency interest rate cuts in March to respond to the impact of the global economy, lowering interest rates all the way to near zero levels. However, global markets plummeted due to panic in the early days of the interest rate cut, and Bitcoin also fell to a low of about $4,000 in March 2020. Until the Federal Reserve injected liquidity and expectations for economic recovery increased, Bitcoin began to rebound strongly from April, breaking through the historical high of $20,000 by the end of 2020.

Therefore, based on this trend, we can guess that after the first interest rate cut in 2024, the financial market may begin to gradually rise from October to December.

Which one is better to buy before the interest rate cut: Which one has risen more, U.S. stocks or Bitcoin?

The boosting effect of interest rate cuts on the financial market will not only appear on Bitcoin, but will also be reflected in the world's largest financial market - the U.S. stock market. Since the price of Bitcoin has become increasingly linked to the stock market in recent years, of course we must also pay attention to the past few years. The performance of the stock market following interest rate cuts.

When the Federal Reserve cuts interest rates, the U.S. stock market usually experiences a short-term rebound. Although Bitcoin's performance sometimes lags behind that of the stock market, it often shows larger gains later!

Market performance during the 2008 global financial crisis interest rate cut cycle

U.S. stock market gains : The Federal Reserve cut interest rates multiple times from September 2007 to December 2008, gradually reducing interest rates from 5.25% to nearly 0%. The S&P 500 index rebounded after bottoming in March 2009, starting at 676 points and rising to approximately 1,257 points by the end of 2010, an increase of approximately 85% . In the long term, as the economy recovered, the S&P 500 continued to rise, reaching over 3,300 points by early 2020.

Bitcoin increase : Bitcoin was just born in 2009, and the price at that time was close to zero, so it is impossible to calculate the specific increase. But since Bitcoin began to gain acceptance, the price has risen from a few cents in the early 2010s to over $1,000 in 2013, reflecting market demand for new assets after the financial crisis.

Market performance of the trade war, economic slowdown and interest rate cut cycle in 2019

Gains in U.S. stocks : In 2019, after the Federal Reserve cut interest rates three times from July to October, benefiting from the increase in market liquidity after the rate cuts, the S&P 500 index rose from 2,950 points in July to approximately 3,230 points at the end of 2019, an increase of approximately 9.5% .

Bitcoin gains : Bitcoin rose in the first half of 2019 in anticipation of interest rate cuts, rising from about $3,800 at the beginning of the year to a high of about $13,000 in June, an increase of more than 240% . However, with the impact of the trade war, Bitcoin prices retreated in the second half of the year, and the price at the end of the year was about $7,000.

Market Performance of the 2020 COVID-19 Interest Rate Cut Cycle

Gains in U.S. stocks : In March 2020, the S&P 500 Index plummeted due to the impact of the epidemic. Subsequently, driven by the Federal Reserve's interest rate cuts and stimulus policies, the S&P 500 Index rebounded from a low of 2,237 points in March to approximately 3,700 points by the end of the year, with an increase of 65% .

Bitcoin gains : Bitcoin once fell to about US$4,000 in March 2020. After the interest rate cut, it began to rebound and reached US$20,000 at the end of the year, an increase of more than 400% . As loose monetary policies continue to push, Bitcoin prices surged further in 2021, reaching an all-time high of $65,000 .

So based on past data, we can see that the increase in Bitcoin after the rate cut has the potential to reach hundreds of percentage points! In line with the agency’s previous forecast of 100,000 to 150,000!

▎Recommended reading: Bitcoin is worth $250,000. Are institutions more optimistic about BTC than you? Taking stock of the Bitcoin price predictions of 6 financial institutions in 2024

How long do interest rates usually rise after they are cut? Rise duration and market sentiment

Bitcoin's rise during a rate cut cycle typically lasts from several months to a year , depending on market liquidity, investor risk appetite, and economic fundamentals. Taking 2020 as an example, Bitcoin began to rebound from the low in March and continued to rise to the high in April 2021, with a total increase of more than 1,500% .

Conclusion: Bitcoin’s Likely Performance After 2024 Rate Cut

Therefore, we can briefly summarize:

・Looking back at the past two interest rate cut cycles, Bitcoin’s price performance outperformed U.S. stocks.

・The market generally lags for 1 to 3 months, and there is an opportunity to start an upward trend 1 to 3 months after a rate cut.

・The past two interest rate cutting cycles brought about rising cycles that lasted from several months to nearly a year.

・Bitcoin’s increases in the past two interest rate cut cycles were 240% and 400% respectively. This time the increase in interest rates may be expected to exceed 100%, which means it has the opportunity to exceed 100,000 US dollars.

Of course, Bitcoin's price volatility is high, and the specific size and duration of the increase will vary depending on market sentiment and macroeconomic environment. Therefore, even if interest rate cuts have a boost to the price of Bitcoin, investors must still grasp the rhythm and carefully evaluate global economic dynamics.

If you want to keep up with market changes, welcome to subscribe to Daily Biyan’s weekly newsletter. Two e-newsletters every week will take you through all aspects of macroeconomics, on-chain data, financing status, and the latest project trends, allowing you to quickly interpret cryptocurrencies. Market: https://bit.ly/3SV5FZl