Market Analysis

After a sluggish weekend, the price continued to rebound on Monday (9th), and began to fluctuate higher at around US$55,000 after 11 o'clock last night, reaching a high of US$58,135 at around 5 o'clock this morning.

However, selling pressure emerged afterwards, and the increase in the past 24 hours narrowed to 3.62%. If the market breaks through the 60,000 US dollar mark, it can be regarded as a reversal. Otherwise, it can only be regarded as a rebound adjustment after the decline!

Combined with the 4H sub-chart indicator just crossing the first black horizontal line, I personally think that the current short-term downside target can be set at 54750. This is a short-term structural support area, and it is also the support shown by the main chart indicator.

Now we are very close to the bottom, just waiting for the gold pit to crash and pick up the bargains!

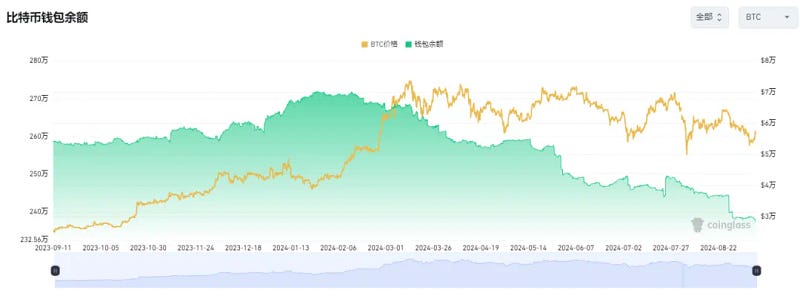

The number of Bitcoin and Ethereum hit a 5-year low on the exchange. September is definitely a good time to buy the dips. The main uptrend is between October 24 and March 25. Judging from the situation in past election years, there is usually a continuous copycat market in the crypto from October to November. 2020 is also a half-year decline, with an increase of 33% in October.

The main issues that everyone is concerned about at present are:

Will the interest rate cut lead to a rise in prices? When will the bull market begin?

Let me first talk about my views on the current market. Based on past experience, expectations of interest rate cuts are often overhyped. The situation where hot expectations become cold facts is similar to last year's Bitcoin ETF and this year's halving market. Therefore, the impact of interest rate cuts is similar.

When the interest rate cut is actually implemented, both market sentiment and capital flow will definitely have a boosting effect on the crypto, but this is not the beginning of a bull market. It is likely to only trigger a short-term rise, which may then fall back.

The arrival of the bull market may have to wait until Trump returns to power. He may launch a series of policies to stimulate consumption, which is expected to push the crypto market into a larger stage of development.

For Altcoin, they have reached the point where they can no longer fall, and a market rebound will inevitably come as expected. It is still necessary to say here that you should not rush to buy the dips, because the bottom is left for the dealer . If you eat its meat, what will it eat?

From today's perspective, it is absolutely correct to buy high and not buy low. How many people are busy buy the dips and are shocked by the turning point of the market. There are many people who think they are smart, but they don't know that there are many people who continue to do so, and in the end they are just crushed by the meat grinder of the market and see no hope.

There is no need to be so hesitant at this time. As long as your coin is right, then if you stand in a slightly farther perspective, you will find that the initial fluctuations were just a joke, and the prices were all very low. Many people sold at the lowest point and fell before dawn. A good hunter must have a strong belief and learn to enjoy loneliness.

Take BTS and EOS, the most promising coins in 2018, for example. Their performance in the bull market was terrible, while DOGE, the least promising coin at the time, had an amazing return. This also involves the most primitive investment theory. While choosing a coin that you are optimistic about, you also have to choose a coin that you are not optimistic about.

There will always be an opportunity for a market reshuffle, and every reshuffle brings about danger and opportunity . Some people lose all their wealth overnight, while others gain an extra zero overnight. It mainly depends on how you look at the reshuffle and the crisis. Many people turn opportunities into dangers and fall before dawn, while others turn dangers into opportunities and suddenly gain two more zeros in their wealth. It depends on how you look at it and with what mentality.

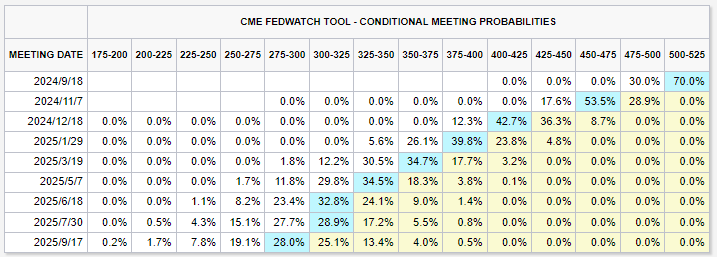

This week's CPI is the last major data release before the Federal Reserve's September 18 meeting.

70% of investors expect the Fed to cut interest rates by one basis point at its September meeting.

Behind the epic madness, no one knows what will happen...

If you have been chasing ups and downs, often being trapped, and have no latest news in the crypto and no direction, please scan the QR code below. I will try my best to answer any questions you have recently. If you are confused about the future, I will share the strategy layout with the small circle! You are welcome to join us to grasp the next hot spot and maximize the return on investment together!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!