With the active deployment of traditional financial giants such as BlackRock, Fidelity, and JPMorgan Chase, the concept of RWA tokenization has gradually moved from the margins to the mainstream, attracting widespread attention. The Hong Kong Monetary Authority has also recently launched the Ensemble Sandbox to support institutions in tokenizing RWA, testing and developing innovative solutions based on blockchain technology. This indicates that RWA tokenization will become an important trend in the future financial market.

RWA (Real World Assets) tokenization refers to the process of converting tangible assets such as real estate and gold or intangible assets such as bonds and equity into digital tokens on the blockchain after the ownership of the assets is registered on the blockchain. This article will discuss the successful practice of BlackRock's tokenized fund BUIDL and reveal why the giants are rushing to attack the RWA market.

BUIDL, BlackRock’s RWA Practice

BUIDL (BlackRock USD Institutional Digital Liquidity Fund) is the first tokenized fund launched by BlackRock, the world's largest asset management company, in March this year. This marks an important milestone in the process of asset tokenization, and means that institutions have successfully explored the transfer and change of real asset ownership in blockchain, a bookkeeping tool. People can witness the future of finance where blockchain technology realizes the seamless integration of digital assets and real-world assets.

BUIDL tokens maintain a stable value of $1 per coin and have "security" attributes. The BUIDL fund invests 100% of its total assets in cash, U.S. Treasury bills and repurchase agreements. Holders' wallets receive daily accumulated dividends "airdrops" every month, and investors receive financial management income while holding blockchain tokens. BUIDL's initial ecosystem participants include Anchorage Digital Bank NA, BitGo, Coinbase and Fireblocks, as well as other market participants and infrastructure providers in the crypto industry.

So, how does the BUIDL fund work? Generally speaking, RWA tokenization includes five steps: asset confirmation, asset evaluation, token issuance, token management, and asset redemption. Let’s take the BUIDL fund as an example.

Asset confirmation clarifies the ownership of assets and ensures that assets are legal and traceable. BUIDL's underlying assets include U.S. Treasury bills, Treasury bonds and other securities guaranteed by the U.S. Treasury, repurchase agreements, and cash.

Asset valuation, which assesses the value of assets and determines their value during the tokenization process. PricewaterhouseCoopers has been appointed as the auditor of the fund.

Token issuance converts assets into tradable digital tokens and issues them on the blockchain through smart contracts. The fund is issued on Ethereum in the form of ERC20, with a "whitelist" mechanism that complies with KYC and AML. Tokens can only be circulated in addresses that have passed the Securitize Markets whitelist review.

Token management, management of tokens, including trading, holding, transfer and other operations, to ensure the liquidity and security of tokens. BlackRock Financial Management will serve as the investment manager of the fund, and Bank of New York Mellon will serve as the custodian and manager of the fund's assets. Securitize Markets will serve as the placement agent to provide the fund to qualified investors. Securitize acts as a transfer agent and tokenization platform, managing tokenized shares and reporting on the subscription, redemption and distribution of the fund.

Asset redemption, converting tokens back to original assets when needed, to achieve flexible use of assets and value recovery. In order to improve the liquidity of BUIDL tokens, BlackRock cooperated with USDC issuer Circle to establish a USDC pool controlled by smart contracts, which can be exchanged with BUIDL tokens 24/7, giving play to the core advantages of tokenized assets, high efficiency and full transparency.

According to asset tokenization company Securitize, BUIDL has paid $7 million in dividends to investors since launching the investment fund in March 2024. The latest data from RWA asset analysis platform Rwa.xyz shows that the BUIDL fund has accumulated more than $500 million in assets under management, making it the largest tokenized fund to date. The successful practice of BUIDL provides players on the chain with a channel to obtain real-world returns, and also makes it possible for stable real-world financial returns to flow into DeFi.

Source: Rwa.xyz

RWA Tokenization Revolution and Regulation

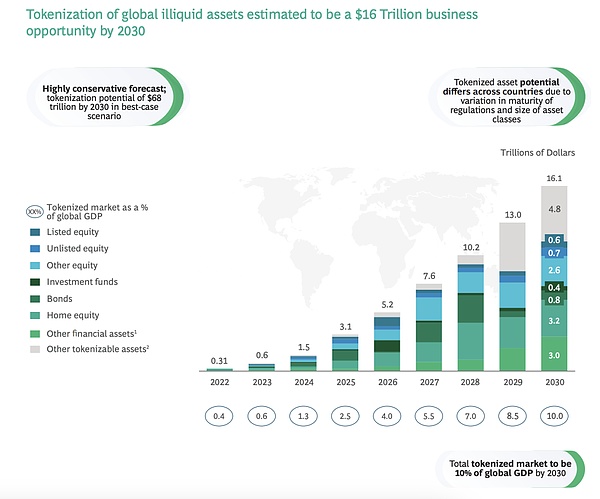

The Boston Consulting Group (BCG) pointed out in a report released in 2022 that "most of the world's wealth is currently locked in illiquid assets, and it is predicted that by 2030, the total size of illiquid assets, including real estate and natural resources, may reach 16.1 trillion US dollars." Today, the emergence of RWA tokenization has solved this pain point well and eliminated the disadvantages of poor liquidity of traditional assets.

Source: World Economic Forum

RWA tokenization enables assets other than digital assets to be connected to the blockchain, creating a more transparent, efficient, liquid, and low-systemic risk financial system. RWA token issuers mint digital tokens through distributed ledgers (i.e., blockchains), which have transparent and immutable property rights; tokens improve the efficiency of asset transfers by utilizing smart contracts; high-value assets can be divided in the form of tokens, providing opportunities for more investors; on-chain circulation reduces asset middlemen, eliminates the need for centralized registration, and avoids the cost of multiple verifications...

Although blockchain technology aims to build a more open and trustless financial ecosystem, the reality is that every innovative product that integrates with it is subject to the legal jurisdiction of its location and the regulatory system shaped by the specific application scenario.

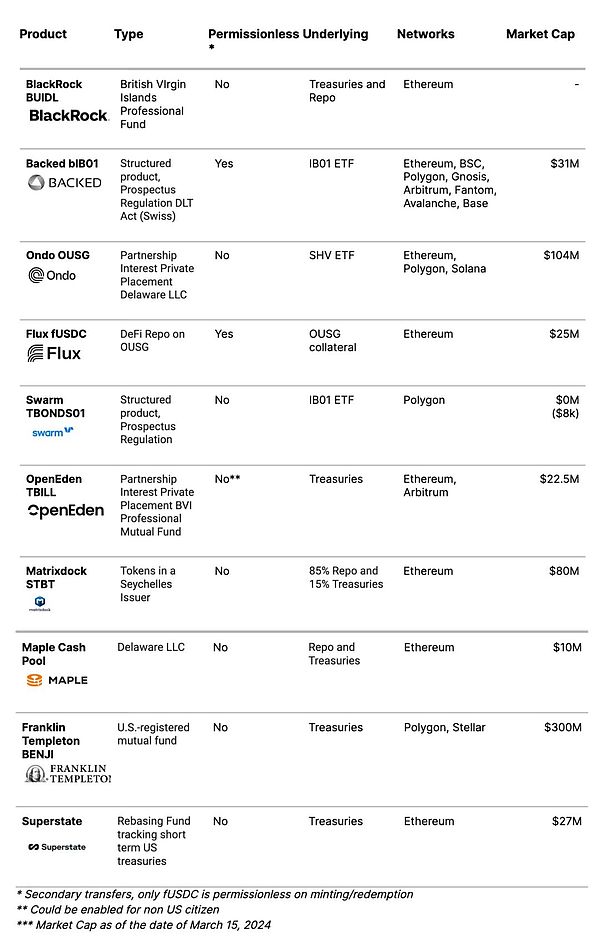

Just as BUIDL is subject to the US Patriot Act, in order to prevent it from being used for money laundering, terrorism or other illegal activities, only investors who have passed the "white list" verification can participate. Reading the Steakhouse Financial research report, it is not difficult to find that the US debt RWA products in the table (except Flux fUSDC) all need to be licensed for token issuance to meet compliance requirements.

Source: Steakhouse Financial

It can be seen that in the process of RWA tokenization, institutions have adopted a variety of strategies to deal with supervision, such as KYC and AML, which shows the importance of compliance supervision.

Bitrace helps RWA tokenization compliance

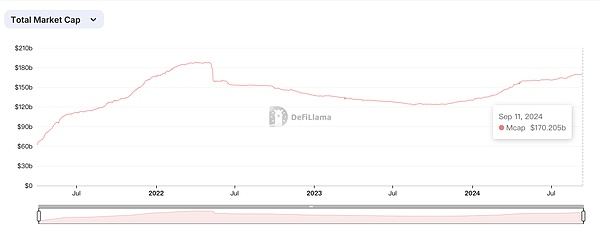

As of the time of writing, DeFi Liama data shows that the total market capitalization of stablecoins, which first applied tokenization technology to blockchain, has exceeded US$170.2 billion.

At the same time, participants in online gambling, black and gray industries, money laundering and other activities are using cryptocurrencies including USDT to launder funds. This makes the practitioners who join the RWA tokenization wave passively collect risky funds and face compliance risks.

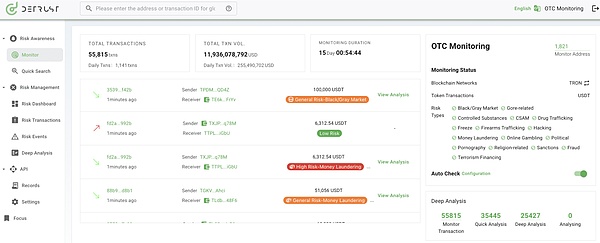

In this context, Bitrace launched the Detrust on-chain risk fund monitoring and management platform to provide effective compliance support for enterprises participating in the RWA tokenization wave:

During the token issuance phase, Detrust helps clients conduct risk investigations on technical service providers and token custody addresses in advance based on on-chain KYT and KYA capabilities, and identify the proportion of risky transactions.

During the circulation of tokens, Detrust provides 24/7 automatic detection of on-chain transactions and comprehensive risk assessment services. Based on pattern analysis, behavioral deviation analysis, and cluster analysis, it can provide prompt warnings and assist in handling risky funds as soon as they are discovered, thereby reducing the risks of criminal fund association and business compliance.

During the token redemption phase, based on the Detrust platform’s criminal risk label database, address profiling, and criminal funds monitoring and early warning capabilities, compliance reviews of capital inflows and outflows are completed, helping companies minimize the negative damage to their business operations caused by risk control activities.

Detrust Client

As Grayscale expressed its views on the future of RWA tokenized finance in Grayscale Research, “Many digital finances are transitioning from closed platforms hosted by centralized intermediaries to open and decentralized platforms based on public blockchain infrastructure.”

In the future finance that combines RWA tokenization and blockchain, regulatory compliance is equally important. While embracing the new era and actively participating in RWA tokenized finance, relevant industry institutions should also strengthen their awareness of fund risk control, actively establish cooperation with local law enforcement agencies, and access threat intelligence services provided by security vendors to perceive, identify, prevent, and block risky encrypted funds, and protect their own business addresses and user addresses from contamination.

References

https://securitize.io/learn/press/blackrock-launches-first-tokenized-fund-buidl-on-the-ethereum-network

https://www.businesswire.com/news/home/20240411966052/en/Circle-Announces-USDC-Smart-Contract-for-Transfers-by-BlackRock%E2%80%99s-BUIDL-Fund-Investors

https://www.grayscale.com/research/reports/public-blockchains-and-the-tokenization-revolution

https://www.sec.gov/Archives/edgar/data/97098/000119312521247816/d214273d485apos.htm

https://drive.google.com/file/d/1JZG6sPetgbKoT-9ETeqb692n7lcXLYUI/view