Author: Paul Timofeev, Gabe Tramble Source: Shoal Research Translation: Shan Ouba, Jinse Finance

Digitalization of financial services

Throughout the history of human civilization, technology and capital markets have developed side by side. The origins of written language can be traced back to account books, dating back thousands of years to the Sumerian cuneiform script in ancient Mesopotamia, when people used symbols on clay tablets to record ownership of livestock and goods. Doing so effectively made the Sumerians the most advanced ancient civilization of their time, as they were now able to effectively manage economic resources, facilitate trade and taxation, and allocate goods and labor within city-states.

The ability to accurately record and verify ownership of assets ultimately forms the backbone of civil society and the modern economy. Without such mechanisms, chaos reigns. The tulip bubble, the stock market crash of 1929, and the financial crisis of 2008 are all historical examples of the consequences of failing to provide reliable settlement and ownership guarantees of economic assets.

As human civilization has evolved, so have ledgers; from clay tablets and paper certificates to computers and software programs. Technological innovations may often conform to existing market structures, or conversely, new technologies may create opportunities to disrupt the existing structure of a market, changing its underlying architecture, operations, and the players involved.

Often, the financial services industry’s adoption of new technology is not voluntary, but a response to an emergency that needs to be addressed. The paperwork crisis of the 1960s led to the creation of NASDAQ, the world’s “first electronic stock market,” in 1971. This marked the biggest change yet to the system for clearing and settling securities transactions. In 1973, the Depository Trust Company (DTC) was created to eliminate the liquidity of certificate transfers by holding them in a single depository with unified accounting books. However, it wasn’t until after 9/11 and the grounding of U.S. air travel that the 21st Century Check Clearing Act was passed, making it legal to clear images of paper checks instead of paper copies. It wasn’t until 2012 during Hurricane Sandy that the DTCC vaults were flooded and nearly 1.7 million security certificates were damaged that people finally got rid of paper checks.

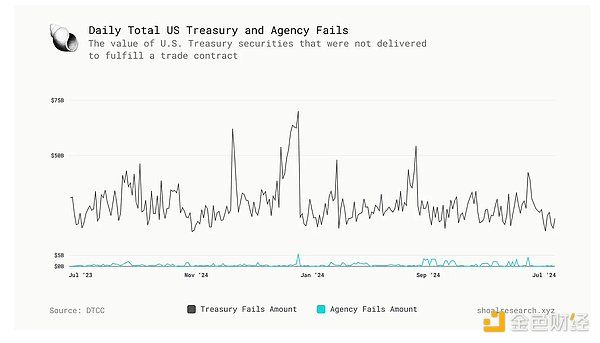

Today, there is still a lot of room for improvement. Data from the DTCC shows the real cost of this rather complex and outdated system, with tens of billions of dollars of traded contracts going undelivered every day .

The DTCC explains the risks well: “Not only could the original transaction fail, but the party that purchased the securities may have pledged those securities in a subsequent transaction that will now also experience a delivery failure, creating a ripple effect.”

This begs the question – can blockchain solve this problem?

The role of tokenization

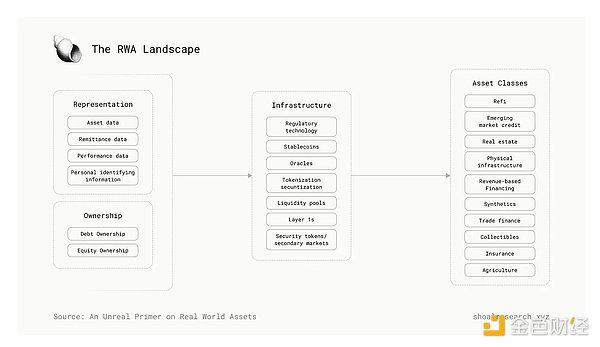

At a high level, tokenization is the process of encoding assets of economic value and their associated ownership claims on a blockchain, a digital distributed ledger that records and stores transaction information, providing immutability (barring theoretical but increasingly difficult or costly attack vectors) and transparency of events, enabling public observability, where anyone can observe and verify that an event occurred.

“Real-world assets” (RWAs) have become a colloquial term for a wide range of tokenizable non-crypto assets. (Kyle Samani of Multicoin Capital notes that the term “real world” is redundant, “You’re telling people who don’t use crypto that you don’t live in the real world and that you want the real world to be some weird crypto world,” but for the sake of convenience, this article will continue to use the term RWAs.) Real-world assets can range from financial assets like fiat currencies, commodities, stocks, and bonds to illiquid assets like real estate.

The design of blockchain offers many compelling benefits for the tokenization of RWAs and virtually any tradable asset. First, the atomicity of blockchain mitigates the primary settlement risk of cash-on-delivery systems, as blockchain transactions typically exist as multi-legged operations where either all legs succeed or all legs fail. Using blockchain also eliminates the need for various intermediaries, thereby reducing costs for both buyers and sellers. This, in turn, can improve the efficiency of markets that oversee the buying and selling of various assets. Greater efficiency, coupled with the information transparency provided by blockchain, opens up new opportunities for the accessibility of financial assets. Another key benefit that tokenization can achieve is increased liquidity, making certain asset classes more accessible, allowing more potential market participants to participate, allowing the liquidity of their markets to grow and deepen over time. This goes hand in hand with the emergence of fractional ownership, which has yielded great results for a “new generation” of financial services businesses such as Robinhood.

Tokenization is not a new concept. One could argue that the history of tokenization can be traced back to colored coins on Bitcoin; the core idea was proposed by Meni Rosenfeld in a 2012 research paper, which was to “color” a small portion of Bitcoin with additional metadata, effectively creating a unique token that could represent ownership of an asset other than Bitcoin itself, such as a commodity, stock, or bond. Although colored coins were very popular at the time, the idea became obsolete as the crypto industry developed further. Another early version of tokenization was DigixDAO, founded in 2014 and based in Singapore, the first crowdfunding and main DAO on Ethereum. Digix will allow the existence of assets to be publicly verified through its chain of custody through its Proof of Provenance (PoP) protocol, which is built on top of Ethereum and the InterPlanetary File System (IPFS). Tether has been minting USDT on-chain since 2015 by depositing an equivalent amount of fiat currency into its reserve bank account and then issuing a corresponding number of USDT tokens on the blockchain. Circle has also been doing the same thing with USDC since 2018. According to the Rwa.xyz dashboard, at the time of writing, the total value of RWA on-chain exceeds $175 billion, with stablecoins accounting for the vast majority ($164 billion).

Disadvantages of Tokenization

Some, including Larry Fink, believe that the tokenization of financial assets such as fiat currencies, commodities, stocks and bonds is the future of the financial industry. In theory, anything with economic value can be tokenized. However, while some of the main benefits of trading assets on the blockchain may be compelling, it is important to consider the disadvantages of tokenization and, therefore, consider whether there are other financial tools that can more efficiently trade assets on the blockchain.

Overall, tokenizing RWAs requires significant effort and diligence to manage from an operational and custody perspective. To ensure that the tokenized assets accurately reflect their physical underlying assets, token issuers must purchase the underlying assets every time a new token is minted, or sell the underlying assets every time a token is burned. Depending on the asset involved, the issuer must also be able to manage any operations related to the physical asset (i.e., a precious metal token issuer must manage the storage, insurance, delivery, and procurement of the metals in addition to managing the asset reserves). Overall, this can be a daunting task that is costly and requires a significant amount of time to implement in practice, especially at a scalable level.

From a regulatory and legal perspective, the adoption of tokenized assets still requires significant progress and action, which is often a lengthy process as the circumstances vary from country to country. In the United States, the past four years have been largely unfavorable to crypto products and services. Meanwhile, in the European Union, the MiCA regulatory framework will be implemented by the end of this year, while Singapore and Hong Kong have been pursuing more crypto-friendly policies. There are also legal complexities in determining ownership and handling the ensuing disputes, and local laws and regulations (i.e. at the state or city level) make the process even trickier.

What if investors don’t want ownership, but simply want exposure to the price of these assets in a simpler, lower-cost, and overall more efficient way? This is where synthetic assets come into play. A synthetic asset is a financial instrument that is designed to mimic the value of an underlying asset without the investor having to hold that asset. Synthetic assets can be created and traded on a blockchain without actually having to go through any of the complex logistical processes associated with tokenization, thus simplifying the creation of on-chain markets. So far, only one synthetic derivative has been particularly successful — so all roads lead to Rome.

The role of perpetual bonds

Perpetual swaps (perps) are a type of derivative contract that allows investors to speculate on the future price of an asset without a predetermined expiration date. These financial instruments can be held indefinitely, which is an important difference from traditional derivative contracts that involve an expiration date and must be settled before or during the expiration date. Similar to contracts for difference (CFDs), perpetual swaps provide investors with a financial instrument that allows them to speculate on the price movement of an asset for an indefinite period of time using leverage, but do so while maintaining a single, unified contract.

Although perpetual futures draw much inspiration from the Hong Kong Gold and Silver Exchange’s perpetual futures market, they were first proposed by Robert Shiller in a 1992 research paper in response to the lack of liquid derivatives markets for many components of global wealth, such as human capital/labor costs, real estate, private financial assets, and macroeconomic indices.

“In order to create a market for the present value of the cash flows represented by some index of dividends or rents, we need to create a permanent claim on the cash flows represented by that index.” — Shiller

Shiller, motivated by the lack of hedging tools in markets with infrequent pricing and poor liquidity, proposed that perpetual futures contracts are an excellent comprehensive risk management tool for a wide range of use cases such as labor cost markets, commercial real estate, commodities, and agriculture. Given the large spreads these markets often face, Shiller believes that perpetual contracts can save hedgers significant costs and reduce basis risk. In short, perpetual futures are designed to facilitate price discovery for assets with poor liquidity or difficult prices to measure.

Unfortunately for Shiller, the difficulties in implementing perpetual futures contracts have hampered their adoption in the capital markets and financial services sectors. These include regulatory hurdles, lack of adequate infrastructure, and the complexity of properly pricing the underlying assets, but ultimately, perpetual futures are traded almost exclusively in the over-the-counter (OTC) market.

Believe it or not, the first use case for perpetual contracts was cryptocurrency trading, and it remains the only active use case to date.

Perpetual Contracts in Cryptocurrency

In 2011, Alexey Bragin sought a way to differentiate his Bitcoin futures exchange, ICBIT, from other exchanges on the market, which led to the creation of “inverse perpetual contracts” where contracts are settled in Bitcoin but priced in USD. However, it wasn’t until BitMEX launched its first perpetual leveraged swap product, XBTUSD, that perpetual contracts began to gain widespread adoption. BitMEX renamed its derivative contracts to perpetual swaps and introduced features designed to attract smaller, crypto-native traders rather than large financial institutions, including small contract sizes, Bitcoin-inspired contract design, minimum margins, and lower trading fees.

At the time, cryptocurrencies were primarily traded off-chain through centralized exchanges (CEXs), but this would soon begin to change with the rise of spot decentralized exchanges (DEXs) in the late 2010s. A DEX at its core is simply a set of smart contracts, plus an interface for users to interact from their wallets, allowing anyone to trade any supported asset while having full custody of their own assets. The first derivatives DEX was born in August 2017 when Antonio Juliano launched dYdX on Ethereum, eventually shifting focus to become the first perpetual DEX in April 2021 with dYdX v3.

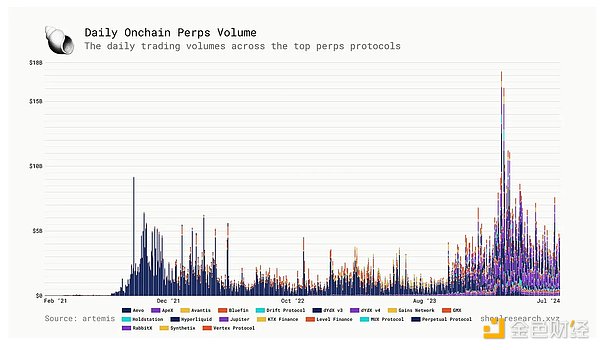

Since then, the number of perps on DEXs has continued to grow with the rise of L2, and according to Artemis data, the trading volume of on-chain perps has exceeded $2.7 trillion.

Perpetual swaps have some common key features, such as funding rates and underlying price discovery mechanisms. Perpetual swaps have no expiration date, so a continuous payment mechanism is needed where counterparties pay each other based on market conditions at a particular time . When the funding rate is positive, longs pay shorts. When the funding rate is negative, shorts pay longs.

Nonetheless, the increasing number of Perp DEXs has resulted in a variety of designs and functional implementations worth dissecting.

Order Book

Order books have long been the default price discovery mechanism on exchanges, where buy and sell orders are listed and matched on a unified matching engine. A common adaptation of this model is to utilize an off-chain order book for trade matching, while executing and settling trades on-chain. This model enables protocols to avoid incurring gas fees and being hampered by network performance, while still benefiting from the transparency of on-chain settlement and trader self-custody. Going a step further is a fully on-chain order book, where the matching of trades also occurs on-chain. This model has historically been difficult to implement, as latency and throughput limitations of the underlying chain have enabled sophisticated actors to conduct front-running and mezzanine attacks and extract value at the expense of uninformed retail traders, who in turn receive worse price settlement on their trades. However, the rise of high-performance execution environments — whether new general-purpose L1s, application-specific chains, or rollups — seek to mitigate this problem by significantly reducing block times, thereby minimizing information asymmetry between market participants.

Peer-to-peer mining pool

Peer-to-peer pooled perpetual decentralized exchanges use a self-matching algorithm where buy and sell orders are routed through a central liquidity pool and matched using a price feed oracle. Pioneered by GMX, this model operates with two counterparties - liquidity providers (LPs), who lend funds to the central pool, and traders use these funds to complete trades. While LPs bear inventory risk, they can be subsidized through trading fees, liquidation rewards, and funding fees, while traders benefit from price execution on a real-time price index with low slippage. However, this dynamic creates an adversarial environment between LPs and traders: LPs profit from traders' negative P&Ls, but when traders are profitable, LPs suffer losses from pool rebalancing.

Virtual AMM

Another design implementation that has emerged in the perp DEX space is the virtual AMM (vAMM) pioneered by Perpetual Protocol (famous). Similar to Peer-to-Pool, vAMM uses a two-party system consisting of LPs and traders. However, instead of using real tokens to provide liquidity, vAMM uses virtual synthetic assets (i.e. perps). In this model, there is no actual liquidity pool in the protocol; traders are able to leverage assets stored in the smart contract vault.

Perp DEX has come a long way since its inception, but its potential remains largely untapped due to being limited to trading crypto assets. Let’s dive into a specific protocol that aims to expand the utility of on-chain perps beyond crypto assets to enable on-chain trading of almost anything in an eToro account - the Ostium protocol.

Ostium Protocol In-depth Analysis

What is Ostium?

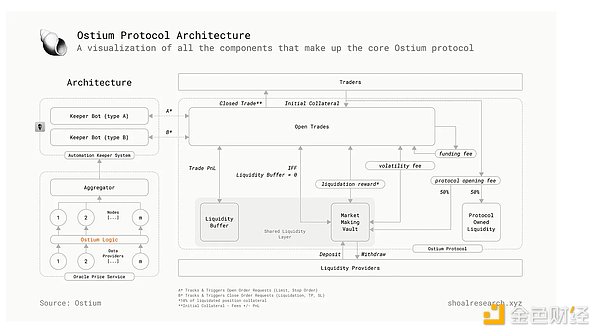

The Ostium Protocol is an open-source decentralized exchange for trading blue-chip crypto assets and RWAs in the form of on-chain perpetual contracts. At the heart of the protocol is a set of smart contracts that live on Arbitrum Layer 2, consisting of a trading engine and liquidity layer, as well as an internal oracle and automated custody system, which are key supporting infrastructure components. In summary, the protocol provides several key products: virtual exposure to off-chain assets (assets that do not exist on-chain); a shared liquidity layer consisting of two capital pools (liquidity buffer + market making vault) that settle trades and act as counterparties to traders; near-sub-second price information enabled by a dual oracle system; automation of key trading functions including liquidations, stop-loss and limit orders; and a strategic risk-adjusted fee structure to capture and minimize directional risk posed by open positions to the shared liquidity layer.

From a design perspective, Ostium has chosen to use a peer-to-pool model, but it also has its own unique twists, which are explained in more detail below. The choice of a peer-to-pool model makes sense because the market is not mature enough to make markets for long-tail assets such as soybeans or hog prices; instead, utilizing a shared liquidity layer for price discovery allows for a more scalable deterministic model.

Ostium’s Vision

Ostium believes that the best way to meet traders' demand for on-chain RWA leverage, short-term and medium-term price exposure is through oracle-based perpetual contracts. Its goal is also simple: to become the preferred destination for trading almost any asset in the form of oracle-based perpetual contracts.

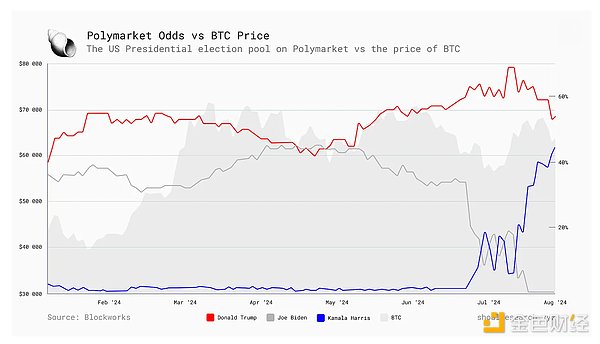

Crypto markets and macroeconomic environments are increasingly converging, with the post-pandemic macroeconomic landscape sparking a growing interest among macro-focused traders. Crypto’s reaction to the yen carry trade and Nikkei unwinding is a prime example; if someone went around telling Altcoin traders to keep an eye on the Bank of Japan’s moves because it would have a significant impact on their token’s performance, they would be laughed at. Last week, however, that theory was proven correct. Polymarket’s surprising rise in the US election year also demonstrates interest in speculating on the outcomes of real-world events; in fact, there is even a positive correlation between Bitcoin’s price and the odds of Donald Trump being elected president.

Ostium proposes that perpetual contracts will become an outstanding financial tool to promote the prosperity of blockchain capital markets.

Let’s take a closer look at the components that are working together to achieve this vision.

Key protocol components

Ostium Trading Engine

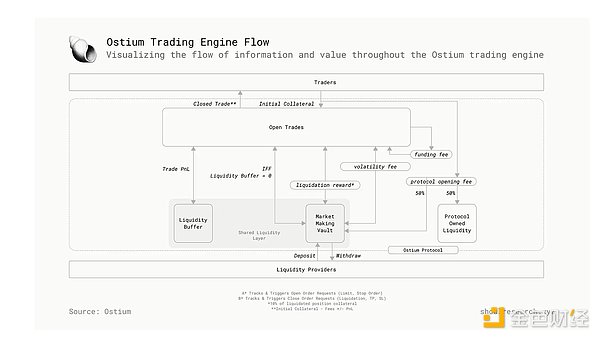

The Ostium Trading Engine is a key feature of the Ostium Protocol, facilitating the trading of assets supported by the protocol by coordinating interactions between traders and LPs.

After depositing collateral, traders can choose to long or short; place market, limit or stop orders, and customize leverage settings (Ostium offers up to 200x leverage). The Gelato function is used to continuously track price changes and determine whether orders need to be automatically executed (liquidation, stop loss, profit order), while calling prices on demand using a pull-based oracle mechanism. During the holding period, users can update their positions (update profit, update stop loss, or add collateral) at no additional cost. Positions can be closed manually or automatically; triggered by stop loss orders (negative P&L), profit (positive P&L) orders, or liquidation. If the value of a trader's collateral drops by 90%, the keeper triggers a liquidation event and the remaining collateral (10%) is transferred to the market making vault as a liquidation reward.

Opening price and price impact

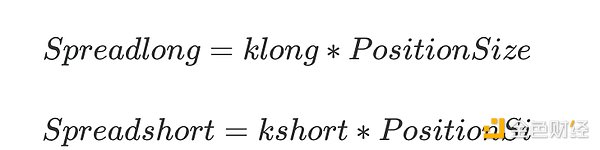

To protect LP capital from the risks associated with peer-to-pool based pricing models, Ostium has implemented a price discovery approach that incorporates real-time market liquidity conditions when determining the price at which traders open positions. While the mid-price is often used as a neutral valuation metric, relying solely on it can be misleading in situations where liquidity significantly impacts the quality of execution received by traders. Instead, Ostium employs a scaled bid-ask spread model that more accurately reflects real market conditions and the costs associated with different trade sizes.

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (the bid price) and the lowest price a seller is willing to accept (the ask price), and in Ostium's model, this spread is dynamically adjusted. Under this model, the spread is linearly related to the position size, which means that the larger the trading volume, the larger the spread. Therefore, traders will not always get the bid or ask price, but a scaled version of these prices, such as 0.1 times the middle bid spread or 2 times the middle ask spread, depending on the specific circumstances of the transaction.

When a trader opens a long position, the quote is a proportional ask price, and when a trader opens a short position, the quote is a proportional bid price. Similarly, when a trader closes a long position, the quote is a proportional bid price, and when a trader closes a short position, the quote is a proportional ask price.

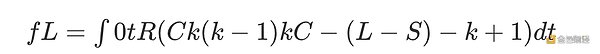

This can be expressed as follows (assuming K is a constant):

Please note that Ostium charges users a one-time fee during the position opening process, as well as compounding fees over the life of the position. These fees are further detailed in the "Fee Structure" section below.

Oral fluid layer

Rather than using a central limit order book (CLOB) model, Ostium operates as a liquidity pool-based DEX, similar to well-known perp DEXs such as GMX. This model enables the protocol to maintain an imbalance of open interest, but there is a key difference between the Ostium model and traditional perpetual contracts, where liquidity providers directly benefit from traders' losses, creating an adversarial relationship between two sets of market participants that are equally important to the protocol.

Ostium's Shared Liquidity Layer (SLL) consists of two capital pools - the Liquidity Buffer , which serves as the first layer of settlement for positive PnL trades, and the Market Making Vault , which acts as a fallback when the Liquidity Buffer is exhausted. Note that the capital in the Liquidity Buffer comes from accumulated traders' PnL, while the Market Making Vault is open to LPs for deposits to receive liquidation rewards and 50% of the opening fee. The core idea is that by creating two isolated pools with strategically defined fee structures, LPs primarily benefit from increased trading volume and OI growth. The LB is designed to absorb traders' PnL, thereby stabilizing LPs' APY while traders continuously earn positive PnL, which means that traders and LPs should benefit from protocol growth at the same time.

Liquidity Buffer

LB is the primary settlement layer for trades on Ostium, which means that trades are executed without the need for a direct counterparty. Given that LPs cannot deposit or withdraw funds from LB, this ensures that the value accumulated by LB reflects organic trading activity on Ostium.

When a position is closed, LB funds positive P&L trades while capturing any value from negative P&L trades. When one side is unbalanced, OI deviates from 0, LB absorbs volatility in trader returns and helps stabilize APY LP's earnings.

Consider the following possible states of delta exposure in the agreement based on market conditions;

Perfect Balance — When traders’ long and short positions are equal, the protocol’s delta exposure is 0, and the market is stable as positions naturally cancel each other out.

Unbalanced OI - When trader positions are unbalanced, i.e. there are more longs than shorts or vice versa, the shared liquidity layer will step in to compensate for the imbalance and regain delta exposure.

Extremely Unbalanced OI – When no trader takes one side of the market (all long or all short positions are closed), the liquidity buffer bears all the delta risk.

If a series of large trades with positive profit and loss are closed consecutively, the liquidity buffer may be exhausted due to settlements that must be paid. If this happens, the protocol will turn to the Market Making Vault (MMV) for trade settlement.

Market Making Vault

Ostium's MMV is a smart contract that is structured as a liquidity pool where LPs deposit funds to earn an APY defined by liquidation rewards and 50% of trader opening fees to compensate for the delta exposure risk they take. This will play a particularly important role in the early stages of the protocol, as ongoing trader profits and losses may take some time to accumulate to LB, so incentivizing LPs to deposit MMV is critical to the Ostium protocol.

Upon depositing capital into MMV, LPs receive an Ostium Liquidity Provider (OLP) token, which can be used as a standard deposit receipt. OLP tokens are minted upon deposit, destroyed upon withdrawal, and LP rewards are distributed according to a rebasing model where they directly compound to increase the value of the OLP token (if Alice starts with 100 OLP and earns a 10% reward, she will have 110 OLP upon withdrawal). As a means of incentivizing stickier capital among LPs, Ostium will enable annual lock-up boosts to support longer-term lockers in earning larger rewards.

Support infrastructure

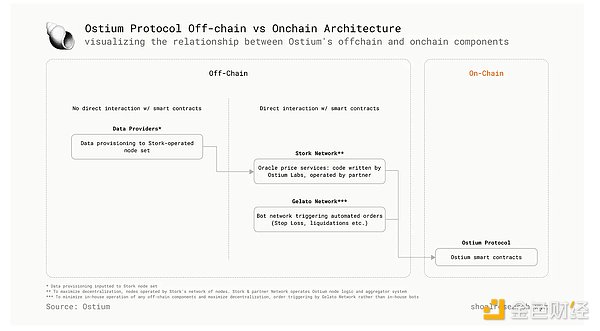

Ostium leverages two key off-chain infrastructure components, an oracle and an automated custody system, designed to support operations on the trading engine and SLL as efficiently as possible.

RWA Oracle

To address the complexities of RWA (i.e. OTC trading hours, futures contract rollovers, opening price gaps), especially when dealing with a variety of less traded, long-tail assets with lower volume and higher volatility, Ostium Labs developed an in-house oracle service configured to its unique needs. However, operating a fully in-house oracle service places significant trust assumptions on protocol users, as their trading outcomes and liquidity provision depend on the functionality of this oracle. To ensure disintermediation and mitigate the risks associated with operating an in-house oracle, the node infrastructure is operated and managed by Stork Network, an open data marketplace comprised of a decentralized network of data publishers. Note that this model operates on a pull-based oracle system, meaning that prices are only communicated on-chain when there is an explicit need to execute a trade, saving costs associated with constantly publishing data on-chain.

In short, Ostium’s RWA oracle is customized by Ostium Labs, while its nodes are operated and managed by Stork Network.

Crypto Oracle

In addition to RWA, Ostium also offers leveraged trading for BTC and ETH. For these assets, prices are pulled via Chainlink data streams, which are purpose-built to provide applications with on-demand access to high-frequency market data.

Automatic feeding system

To execute and manage conditional trades (i.e. “long HOG at $80, take profit at $100”), perp DEXs use specialized agents called Keepers. Protocols typically run Keepers first and then gradually decentralize over time, although there is never a guarantee that they actually will be decentralized. Under this approach, the experience of traders and LPs remains more dependent on the underlying protocol. As a result, Ostium has outsourced the responsibility of running its Keeper network to the Gelato Network; from day one, Gelato Functions will be used to monitor market order price requests routed on-chain, as well as existing open trades, to understand the necessary conditions to trigger RWA automated orders. Automated orders include limit orders, stop-limit orders, take profit, stop loss, and liquidation.

Fee Structure

Ostium seeks to ensure that every source of risk in the protocol is mitigated by strategically implementing fees - open interest deviation, high pool utilization, and high asset volatility. Ostium charges a fixed fee when a position is opened, and a compounding fee while the open position is maintained. The fixed fee is used to cover the associated infrastructure costs, while the variable fee is designed to mitigate the various protocol risks mentioned above.

Account opening fee

Fee ProtocolOpen = makerCharge + takerCharge + utilizationCharge

When opening a position, Ostium charges an opening fee, which is composed of five variables that account for external factors that affect a particular trade. Three of these variables depend on the trader's asset, leverage, and position size, while the remaining two depend on the protocol's OI deviation and exploitation conditions. The size of the opening fee depends on its impact on the protocol's conditions; trades that increase OI deviation (i.e., short positions increase the short OI of an asset) create greater delta exposure for the LB and therefore incur a higher base fee. In addition, exploitation fees are charged if trades push OI above a certain threshold during periods of high utilization. As a means of encouraging arbitrage on Ostium, which is critical to maintaining price stability and balance, traders are charged a "taker" fee if leverage exceeds 10x or OI deviation increases with a trade. Conversely, if leverage is less than 10x and OI deviation decreases with a trade, traders are charged a "maker" fee.

Maintenance Fee

Throughout the trading period (while the position is open), the compounded fees will be used to a) help guide the protocol OI towards equilibrium through funding fees; and b) mitigate LPs' directional risk exposure through volatility fees .

Funding fees function similarly to standard funding rates on perpetual exchanges, designed to close the gap between long and short OIs, thereby bringing the protocol into balance and minimizing delta risk for LPs in MMV. However, unlike CEXs, which can charge funding rates, Ostium automatically charges the value of the position on the "hot" side and injects that value into the PnL on the "unhot" side, with the proceeds realized in the trader's PnL when the position is closed. Additionally, this fee is velocity-based, meaning it is an integral of the length and magnitude of the previous imbalance. This design feature is intended to incentivize arbitrageurs to completely eliminate OI imbalances, compensating arbitrage behavior to a greater extent if the negative externalities of the previous state were large.

The formula is expressed as a percentage per day and can be expressed mathematically as:

At the same time, the volatility fee is designed to capture the external impact of market volatility on LPs. The fee is automatically deducted from the trader's position size and is deducted from the position's profit or loss when the position is closed. From the LP's perspective, a 10x long position on a relatively stable asset (such as the Euro) carries much less risk than a 10x long position on an asset that is more volatile intraday (such as oil). LPs must be appropriately compensated for the additional volatility risk they may be taking. However, it is also important to ensure that this fee does not deter traders from trading volatile assets, thereby affecting funding rates. Therefore, the volatility fee is strategically designed to be 10 times lower than the funding fee. The fee is automatically deducted from the trader's position size and is deducted from the position's profit or loss when the position is closed, and can be mathematically expressed as:

fr(v)=F(Vs(s−1)Vs−v−s+1)

LP Rewards

It is worth mentioning that LPs who deposit funds into MMV will receive a) 50% account opening fee, and b) 100% liquidation reward.

To summarize, here is the capital flow at each stage of the Ostium transaction;

Opening a trade : A percentage of the initial collateral is reserved as the protocol opening fee and is evenly (50/50) split between the market making vault (where LPs deposit money) and protocol revenue.

Holding Trades : Volatility fees are accumulated period by period on open positions and go directly into the liquidity buffer.

Closing a trade

Liquidity buffer > 0 : Liquidity buffer settlement transaction;

Liquidity Buffer = 0 : The LP MM Vault will settle the trade if and only if the liquidity buffer is depleted (see here for more details):

In case of positive profit or loss:

In case of negative profit or loss:

Unliquidated : Liquidity buffer receives losses of traders;

Liquidation : 90% of the initial collateral (trader loss) goes to the liquidity buffer, and the remaining 10% goes to the LP MM vault (liquidation reward)

Risks and considerations

The primary risk of trading perpetual contracts on any exchange comes down to liquidation risk. When opening a position, traders deposit collateral; through leverage, they can take on position sizes that are far greater than the value of their collateral (up to 20x on Ostium). However, the flip side is that losses are magnified just as gains are, which can lead to rapid liquidations if the market suddenly moves against the trader. When a trader’s losses equal the initial collateral used to open the position, the position must be liquidated to avoid the protocol incurring a bad debt (a deficit that must be covered). On Ostium, liquidations must occur before the value of the collateral drops to zero; therefore, liquidations occur when the value of the collateral drops to 10% of the original deposited collateral. While Ostium has developed many built-in mechanisms to mitigate the directional risk that affects liquidations, traders who open positions using leverage must still be familiar with these associated risks and implied losses.

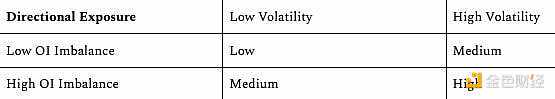

On the other hand, the biggest risk for LPs depositing with MMV is directional exposure risk; this occurs when LPs are exposed to sudden changes in underlying market prices, which is caused by the simultaneous occurrence of high OI imbalances and high volatility. The following matrix illustrates how directional exposure risk changes accordingly:

Ostium has partnered with Chaos Labs to develop the “Imbalance Score,” a metric used to assess a protocol’s current overall directional risk exposure. The Imbalance Score takes into account not only the imbalance in open interest (OI), but also volatility and correlations between different assets. In short, asset imbalance indicates the extent to which the market favors long or short positions on certain assets, with assets with higher volatility contributing more to the risk score, and positively correlated assets being riskier than negatively correlated assets. According to Ostium, the team plans to continue working with Chaos Labs to actively monitor metrics that impact the protocol’s variable directional risk exposure and make parameter recommendations as needed to manage risks accordingly.

To mitigate LPs’ directional risk, Ostium employs a) LB as a priority resolution layer, and b) a strategic fee structure to reward LPs for putting their capital at risk in service of protocol liquidity and help drive the protocol towards balance by eliminating OI imbalances or charging higher fees during periods of high volatility.

Competitive Landscape

Perpetual contract trading is largely dominated by centralized exchanges (CEX), which can be explained by the lack of sufficient decentralized exchange infrastructure in the early stages of blockchain and cryptocurrency development (Uniswap V1 was launched in 2018), as well as the lack of sufficient blockchain infrastructure to achieve low fees and high performance. With high-performance Layer 1 (i.e. Solana) and rollups (i.e. Arbitrum, Base) hosting more and more on-chain activities, blockchain is not only a resilient and secure ledger for storing information, but also a high-performance network that can achieve near-instant settlement and transmission of information and value.

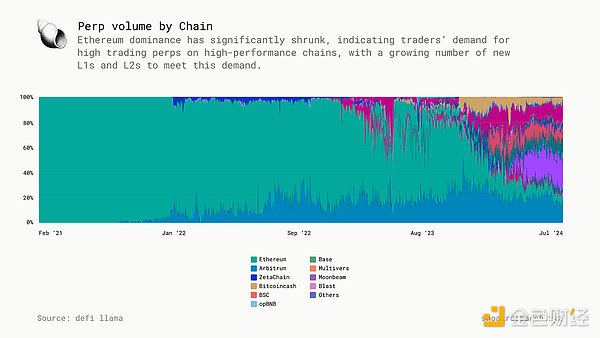

Ethereum’s dominance in perpetual swap volume has shrunk significantly, indicating traders’ demand for high-transaction perpetual swaps on high-performance chains, which can be met by an increasing number of new L1 and L2 protocols.

Ostium 's Advantages

Currently, there aren’t many teams building exchanges to facilitate trading of RWAs as on-chain perps. As such, Ostium has an opportunity to gain a first-mover advantage here and build a moat around its product. That said, if Ostium open-sources its code, one can expect many forks to be launched, in addition to the various protocols that could be built on top of Ostium. Forks aren’t a bad thing — sometimes imitation is indeed flattery, and a large number of forks can often be indicative of a good idea and a strong core product. That being said, vampire attacks could be a cause for concern — a perps DEX could decide to offer similar markets to Ostium, but provide greater incentives to traders and LPs through inflationary token issuance (as of yet — Ostium has no token). However, Uniswap is still ahead of Sushiswap in most metrics today, and it’s likely that Ostium will do the same if it acts and launches in a timely manner.

Ostium open-sourcing its code also raises some questions - what can be built on top of the RWA perps exchange? Will these developments benefit Ostium, and if so, how? Can Ostium gain enough momentum and adoption initially so that potential competitors have more incentive to build or integrate on top of Ostium, rather than trying to build competing products more directly (i.e. something similar to the Curve/Convex ecosystem)?

Protocol KPIs and Roadmap

Given that Ostium is currently in the public testnet phase, protocol data must be treated with caution as the numbers may change with the mainnet launch. That being said, looking at the testnet leaderboard, the numbers for the latest competition look quite impressive;

Total traders 15.9k || Total trade volume 88.9k || Total trade volume $13.54 billion

Looking ahead, we are excited about several things at Shoal; firstly, Ostium has just recently completed its first smart contract audit with Zellic, and is expected to release details of another audit with Three Sigma in the near future; the mainnet is about to launch and is apparently 95% complete; it seems that the Ostium mobile app is also in the works. In addition, we have posed several questions to the Ostium team below that can serve as a guiding framework for future research.

Questions about Ostium

Why build on Arbitrum/L2 instead of L1 like Solana, which is optimized for the speed and performance required by the Perps market?

Why build on Arbitrum specifically?

How do you imagine the MEV landscape in commodity markets? How does this differ from cryptocurrency markets, if at all?

With its open-source code, does Ostium envision any products or services being built on top of the exchange?

Conclusion

The case for bringing capital markets on-chain

To quote Larry Fink’s grand vision of tokenization again; imagine a globally accessible distributed ledger with hard-coded immutable evidence of who is buying, who is selling, and who owns how much of an asset at any given time, and everything is settled nearly instantly. This scenario describes a fairly egalitarian financial services industry, but it also illustrates the ultimate purpose of blockchain - to achieve transparency, immutability, and faster settlement than existing services and markets.

Meanwhile, Grayscale's Zach Pandl believes that many types of assets (such as stocks) are relatively well served by their current digital infrastructure, and it is not obvious whether public blockchains are a better solution. Instead, he believes that the potential key advantage of tokenization is greater network effects . By implementing a common platform to host all assets in the world, we can create a financial system that is more powerful, more accessible, and less expensive than existing solutions.

Ostium: Perpetual Contracts Are Better Than Tokenization

Ostium believes that perps will eventually preempt trading of tokenized RWAs as the primary means of bringing non-crypto assets to on-chain trading. The reason why perps are so popular and successful in the crypto space is largely because they "allow simple directional bets and abstract away the complexity of expiring futures and options". Where tokenization is plagued by operational management and regulatory hurdles, perps offer significant efficiency and listing advantages. All that is really needed to build a perps market on-chain is sufficient liquidity and a strong supporting data feed. This becomes especially easy for protocols whose pricing feed infrastructure is deeply integrated with existing traditional financial data service providers. Unlike tokenization and its associated complexities (i.e. composable KYC-enforced token standards), perpetual contracts do not require the underlying asset to exist on-chain - traders only trade derivative contracts here. To build a liquid perps market on-chain, there is no need to bring the underlying spot market on-chain or integrate directly into cryptocurrencies.

This is not to say that tokenized markets will not exist – one day everything will be settled on-chain . Capital markets will likely gravitate toward blockchain networks for enforcement and verifiability, and this will happen in two ways, as eloquently described in An Unreal Primer ; first, by recognizing RWA tokens as bearer assets across jurisdictions, thereby enforcing the legal protections of the owner; and second, by integrating collateral and other forms of lender protection directly into smart contracts to provide stronger guarantees than the existing legal system.

However, the reality is that it will take a long time for every liquid open market to be issued and settled on the blockchain, as it will take a long time for blockchain to become the ultimate record book and source of truth for financial institutions. Until then, perpetual contracts ultimately provide a better option for traders because they provide more flexibility, leverage, and segmentation than spot markets. Going forward, Ostium is betting that perpetual contracts will become the default listing engine for RWAs and be able to support market liquidity and depth to incentivize participation from traders of all backgrounds and interests.

One could argue that a potential barrier to wider adoption of perpetual swaps by retail investors is the complexity of these financial instruments. Perpetual swaps require many additional factors to be considered compared to spot markets, such as the relationship between collateral and leverage, how the funding rate works and how it affects P&L, and the difference between the price of the underlying asset and the price of the perpetual swap. That being said, Robinhood made options interesting and accessible to retail investors, generating $154 million in revenue for them in Q1 2024 alone, and options are likely more complex than perpetual swaps. Perpetual swaps are also the most successful product developed around crypto assets. So, perhaps all we’re missing is a user-friendly perpetual swap DEX to trade nearly any asset on-chain.

Where else can people bet on the price of hogs, soybeans, oil, foreign exchange, etc. through an on-chain platform?