This week, after completing the second bottoming out, Bitcoin gradually stabilized and rebounded. Although the rebound process is still very tortuous, the market's money-making effect has improved significantly, which is mainly reflected in two aspects: First, although the price of Bitcoin is still hovering around $58,000, 30% of the top 100 currencies by market value have recovered to the price level of $65,000; Second, from September 5 to September 12, the market share of Altcoin increased from 9.13% to 9.8%, and the daily trading volume accounted for from 20.3% to 33.5%, showing a trend of continued fermentation. In addition, unlike the previous rebounds that were mainly led by MEME coins, this rebound has benefited a wider range of people. For example, BIGTIME, PENDLE, AAVE, SUI, FEI and other currencies from various fields have also frequently appeared on Binance's gain list recently. Historical experience shows that when funds shift from focusing on absolute value to taking into account price elasticity, this often indicates that market risk appetite is in an upward stage.

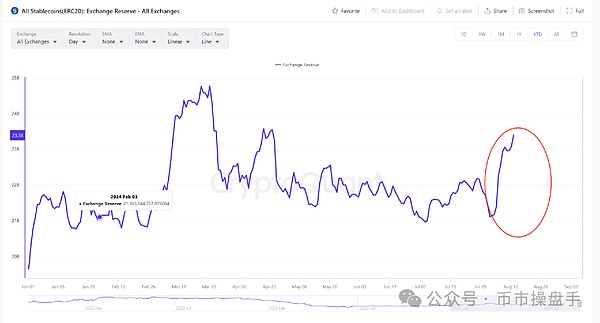

From a trading perspective, the increase in risk appetite for funds is closely related to the marginal improvement in global liquidity. As the Federal Reserve is about to enter a rate cut cycle, the 10-year U.S. Treasury yield, the anchor for global asset pricing, has fallen rapidly since the end of July. At the same time, the balance of stablecoins on exchanges has also increased significantly during this period, indicating that some investors who are foresighted have begun to arrange interest rate cut transactions in advance. According to CryptoQuant data, the last large-scale growth in the balance of stablecoins on exchanges was in March 2024, when Altcoin also saw a strong rise, which is quite similar to the current situation. As of September 12, the yield on the 10-year U.S. Treasury bond has fallen to 3.662%, a new low since June 2023. According to the pricing of federal funds rate futures, the market expects the magnitude of this round of rate cuts to be 225 basis points, so the yield on the 10-year U.S. Treasury bond still has room to fall in the future.

At present, the rebound of Altcoin is still in the stage of being equally shared, and almost all sectors that have been severely oversold in the past have the opportunity to rebound. For example, the NFT (blue chip) sector, which has been falling for two years, has generally seen a 15%-25% increase in floor prices in the past month. APECOIN, which is considered to be chronically dead by the market, has also seen a nearly doubled increase in this round of rebound. However, the author believes that this general rise may not last too long, and the limited funds in the market will eventually flow to those sectors where the fundamentals have improved or the industry is still expanding rapidly, such as the old leader of DeFi, DePIN, RWA, etc.

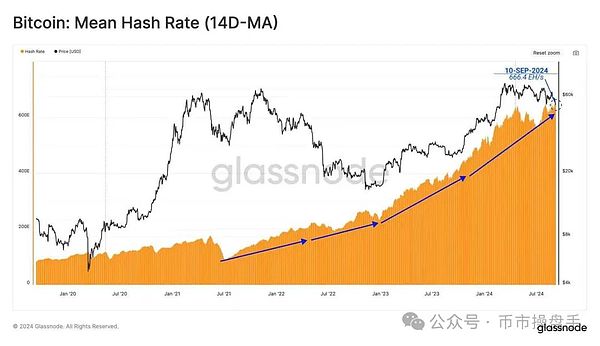

Since August, despite the continued volatility and weakening of Bitcoin prices, even approaching the miners' shutdown price, the hash rate of the Bitcoin network has continued to maintain a record level, indicating that miners continue to increase their investment in hardware and remain confident in the long-term trend of Bitcoin. For example, Marathon Digital, one of the world's largest mining companies, has stopped selling Bitcoin since June and has continuously increased its holdings of Bitcoin worth $249 million in July and August. Fred Thiel, chairman and CEO of Marathon, said that the company's comprehensive HODL strategy is based on a firm belief in the long-term value of Bitcoin and aims to provide a safety cushion for unforeseen market fluctuations by optimizing the balance sheet. Judging from the fact that Marathon completed $300 million in convertible notes in just one month, shareholders and creditors are basically supportive of the company's strategic transformation. If Marathon wants to follow MicroStrategy and anchor the value of the company's stock to Bitcoin, it will surely conduct multiple rounds of financing next.

Although miners are often seen as "forced sellers" in the market, fluctuations in their income can significantly affect their willingness to sell Bitcoin. Generally speaking, if miners believe that the price of Bitcoin is overvalued during a certain period of time, they will tend to sell more Bitcoin to obtain higher profits. When the price of Bitcoin is undervalued, miners may choose to reduce sales or temporarily "hold on" and wait for the price to rise. Therefore, the Puell Multiple, an indicator calculated by dividing the daily issuance value of Bitcoin (in US dollars) by the moving average of the past 365 days, is often used to analyze the cyclical changes of Bitcoin. When the Puell Multiple is lower than 0.5 (green area), it indicates that the price may be undervalued and suitable for investment; when the multiple is higher than 4 (red area), it indicates that the price may be overvalued and it is an ideal time to make a profit. At present, the Puell Multiple of Bitcoin is 0.51, which is at the critical value of undervaluation, indicating that the market may be about to enter a new accumulation period.

In terms of operation, as the mid-term bottom is completed, the market gradually enters a stage of mild recovery. Although the rebound did not show a sudden rise, it is precisely this slow-heating state that verifies the sustainability of the rising market. After all, under the pattern of stock, every concentrated outbreak of bullish sentiment is often a signal that the market has reached its peak. Therefore, repeated washing and steady progress are the most ideal performance of the bottom rebound. Only by being patient can we wait for the main rising wave.