This week, the overall inflation rate CPI fell to 2.5%, close to the Fed's 2% target. As bets on a 50 basis point rate cut by the Fed next week rose, the Nasdaq index opened up 0.6%. Spot gold continued to rise on the basis of a nearly 2% surge overnight, hitting $2,580/ounce, setting a new record high. COMEX gold futures rose more than 1% during the day, standing above $2,600/ounce.

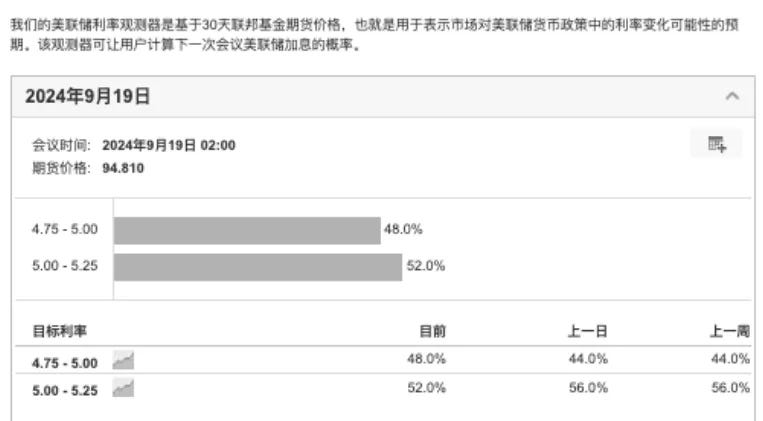

The Federal Reserve is expected to announce its first rate cut in four years after its meeting next week, with bets on a 50 basis point cut rising to 43% from 28% yesterday, and Bitcoin immediately broke through the 60,000 mark!

The Fed's rate cut expectations triggered market volatility: There were rumors in the market that the Fed might cut interest rates by 50 basis points, not just the 25 basis points that were widely expected before. Now the odds of a 25BP cut and a 50BP cut are evenly split.

1. Nick Timiraos, a journalist known as the "Federal Reserve's mouthpiece," published an article discussing the possibility of a 25 basis point and 50 basis point rate cut, indicating that a 50 basis point rate cut is still within the Fed's consideration range.

2. Financial Times: Following closely, the Financial Times published a similar article, citing former Fed officials and discussing the reasons for two rate cuts.

3. Views of former Fed officials: Former New York Fed President Dudley said there are strong reasons to cut interest rates by 50 basis points

It is not enough to just focus on the magnitude of the first rate cut. We need to have a deeper understanding of the Fed’s policy trends. The upcoming rate cut cycle may be very different from the previous rate hike cycle, and future market changes may exceed expectations.

The market is currently highly uncertain about the Fed’s final decision. It is expected that more information may be revealed through the media before the Fed meeting next Wednesday.

If the Fed decides to cut interest rates by 50 basis points, it will communicate more information through the media to reduce market panic; if it decides to cut interest rates by 25 basis points, it may disclose less information to avoid market disappointment.

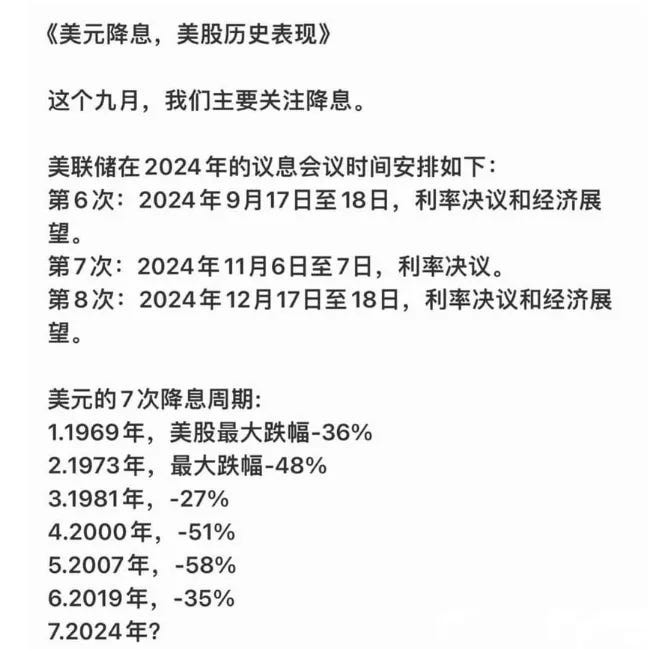

In the history of the United States, multiple interest rate cuts are often accompanied by market turmoil, especially a sharp correction in the stock market. Facing the current seventh interest rate cut, the US stock market has seen a significant decline. So, can the crypto remain immune this time?

The answer to this question is not absolute and depends on many factors, including but not limited to the global economic situation, investor sentiment, policy changes, and the inherent dynamics of the cryptocurrency market. Historically, there is indeed a certain degree of linkage between the cryptocurrency market and the traditional financial market, especially when risk appetite declines, cryptocurrencies are usually also affected.

However, the cryptocurrency market also has its own unique features, such as technological innovation, community-driven factors, etc., which may reduce the impact of the external economic environment to a certain extent. In addition, as the cryptocurrency market gradually matures, it sometimes shows a lack of synchronization with the traditional market.

In general, although the cryptocurrency market is likely to be affected by the decline of US stocks, it may also show different trends due to its own characteristics. Investors should pay close attention to market dynamics while considering their personal risk tolerance and investment strategy.

Market Analysis

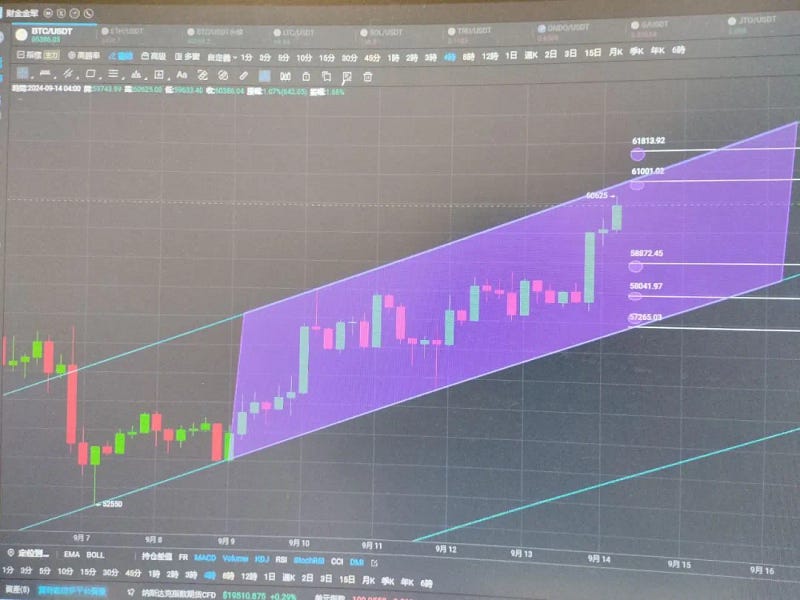

BTC 4-hour K-line trend:

Pressure level: around 61001~61813 Support level: around 558041~58872 ETH 4-hour K-line trend:

Pressure level: around 2494-2553 Support level: around 2309-2371 Bitcoin's 4-hour K-line cycle has increased in volume, and the KDJ indicators of the 30-minute, 1-hour, 2-hour, 3-hour, and 4-hour cycles are all in the overbought and blunted rising space area (the K-line is singing all the way in the price rising channel space), forming a multi-cycle multi-investment trend; the 4-hour MACD indicator forms an aerial refueling pattern above the 0 axis, and the 12-hour MACD indicator fast line crosses the 0 axis, showing a strong upward trend; BTC and Ethereum are the first to go into a top divergence pattern in the 15-minute small cycle. Once the price pulls back to the Bollinger middle track or other important support levels in the small cycle, it is the best opportunity to long! BTC is going through a strong multi-cycle resonance trend, and it is recommended not to go short.

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background