Today, many friends have many opinions on the rise of BTC, including MSTR buying BTC, the 50 basis point interest rate cut and the SEC's explanation of Token securitization. In addition to the 50 basis point interest rate cut, they are indeed helpful to market sentiment, but in fact, the rise is most likely driven by the SEC's explanation of Token securitization . This is a big step forward compared to the previous all Tokens are securities attributes. It is just believed that some Tokens are sold by means of securities, so as long as the Token is not named by the SEC, it can be regarded as non-securities.

Although this is nothing for many friends, it is a relief for many projects in Europe and the United States. After all, no one wants to be the next target of the SEC, so the market has given a very positive feedback. Of course, the current market's main expectation is still that the Fed will cut interest rates by 25 basis points. The discussion and expectation of 50 basis points still needs Nick to add fuel to the fire

Will BTC rise or fall if the interest rate is cut by 25 or 50 in September?

Let me first state the conclusion. If we follow the current trend, Nick did not release the reason for the 50 basis point rate cut before the interest rate meeting, but announced a 50 basis point rate cut. Then it is highly likely that the risk market will fall more in the 40 minutes from the announcement of the rate cut to Powell's speech (30 minutes of waiting + 10 minutes of opening remarks). If the Fed cuts interest rates by 25 basis points in September, the market transition will be very smooth, and the probability of a small rise will be relatively high .

It is not difficult to see from the narrative cited by Nick that a 50% interest rate cut is likely to trigger market panic about economic recession, so it is said that "the Fed needs to use a lot of words to make the interest rate cut too large to cause panic and worry." Therefore, before Powell comes out to explain the 50 basis point interest rate cut, the probability of market panic is very high.

Analysis of BTC's future market trends

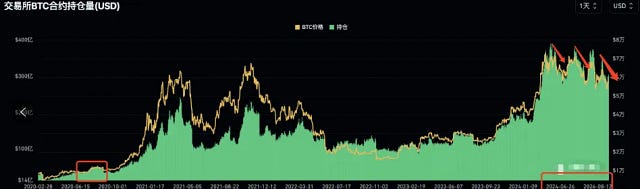

This year's market is basically the same as last year's market from April to October. Last year was a narrow level of shock, oscillating in the range of 25000u - 32000u. This year is a large-scale shock, doing deep back and forth washing in the range of 50000u - 73000u. The washing here is to wash more of the contract positions of the entire network. In the above picture, there is a long-short ratio of the large households in the entire network. You can see that it is a clear downward trend. At the same time, you can take a look at the BTC contract positions of the exchange

I think there are two possible outcomes for the next market situation :

First: BTC has formed a head-and-shoulders bottom structure in the current market . The market will still be dominated by fluctuations in the next 20 days. The 25 basis point interest rate cut in September has little impact on the overall market. The market will continue to fluctuate upward, and a major market will start after mid-October.

Second: After the rate cut is implemented, the economic recession is confirmed , and Japan starts to make trouble, there will be a wave of liquidation of deep contracts, and the bottom of 49,000 will be tested again to see if this price can hold up. But I think that once it falls below 52,000, the target will not be 49,000, but the range of 46,000 to 48,000, but it should not last for a long time. This price is mainly for liquidation of contracts.

What should we do now?

Is it a rebound or a reversal? It doesn’t matter. It is important to think about a few questions:

1. If it is a reversal, is the position large enough ? If it is not large enough or close to an empty position, how to get on board and at what position to intervene?

2. If it is just a rebound, in the market that is pulling back and forth , should you sell the chips in your hand that are at a relatively low level ?

3. The current market is very unfriendly to short-term players, so would it be a better choice to expand the space and time?

4. If you decide to start selling your stocks in the next year's crazy bull market , many high-quality underlying assets are very cost-effective. Don't easily consider whether they will fall or rise in the short term. Even if the cost-effectiveness is very high,

At this time next year, the price will definitely be higher than it is now. How much higher? How much can you earn? It depends on the underlying assets you select. For example, when the BTC price is $58,000 today, if you were at $26,000 or $28,000 last year, is it meaningful to enter the market? Do you still care?

5. You must have your own reasonable position management plan , and know clearly how much you want to earn in this round? How to roll positions? How to change positions? Instead of buying everything you see?

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background