The market suddenly changed direction last night, and all asset classes rose across the board. Next, we will focus on whether the market can stabilize around 6w. At present, the market is almost going to move sideways, and will change again next week.

Much of the current market rally is due to investor expectations that the Federal Reserve may announce a 50 basis point rate cut after the Federal Open Market Committee meeting next Wednesday. Bill Dudley, former president of the New York Fed, said there are strong reasons for further rate cuts.

The CME FedWatch tool currently shows a 49% chance of a 50 basis point rate cut, up from 28% on Thursday.

Currently, at the 4-hour level, Bitcoin has broken through and stood above 58,000, which means that the short-term adjustment is about to end, but this weekend it will definitely be a gamble at 60,000, and it is expected that there will be upward adjustments in the future.

The real resistance above is around 62,800. When this position is broken and stabilized, it will truly start a major counterattack at the daily level and lead the crypto market to rise again. At that time, a large-cycle rebound will occur.

How will the current interest rate cuts and elections, which everyone is paying attention to, affect the crypto market?

The US presidential election has a significant impact on the short-term trend of US stocks. Historically, there are often large fluctuations in the months before the election. Therefore, the market often chooses to wait and see, waiting for the results to be announced before making major decisions. However, US stocks often perform better in the year after the election.

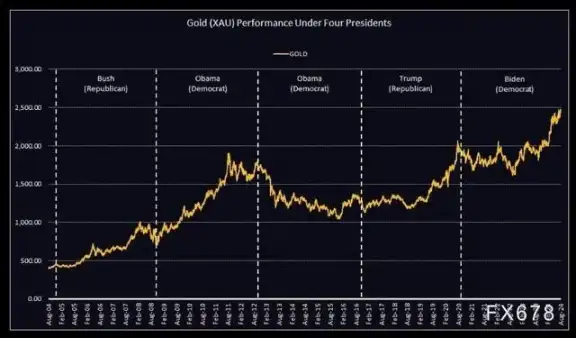

The election also has a certain impact on the short-term trend of gold. As a hedge against capital, gold is also in high demand during the election, so it will continue to rise in the months before the election.

Although the election will have a significant impact on U.S. stocks and gold in the short term, it will have little impact on their price performance in the long run and will not cause any abnormalities in the financial market. In fact, in the short term, the election will have little impact on the trend of the U.S. dollar and the macro economy.

This is because the medium- and long-term performance of financial markets is often affected by economic parameters such as inflation trends. Who is elected president is not a big factor.

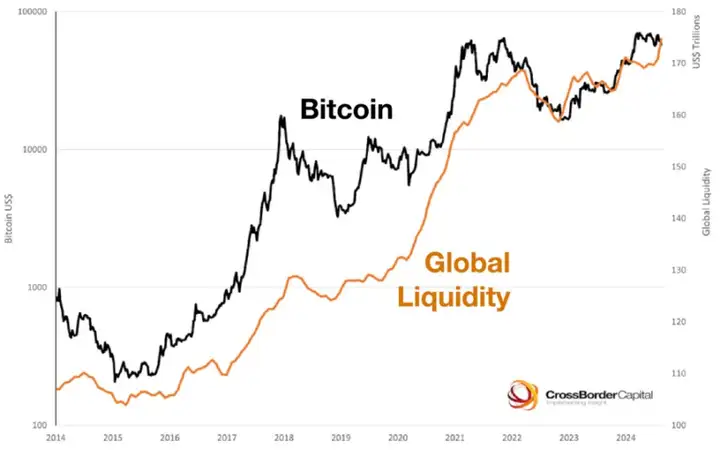

At present, the crypto market, led by Bitcoin, has risen to trillions of dollars. It has entered the mainstream vision from the so-called alternative assets and is no longer on the edge. Bitcoin is also increasingly affected by macro factors, including market liquidity, interest rate cuts and increases by the Federal Reserve, and the US election.

When the Federal Reserve cuts interest rates and global capital liquidity increases significantly, BTC prices continue to rise. Macro liquidity still plays a decisive role in the crypto market.

In addition, in recent months, the non-farm payrolls and CPI data, which are of great reference value to the Fed’s interest rate cut decision, often bring considerable volatility to the crypto market in the short term once released. BTC is currently increasingly linked to the macro-financial market, and the influence of macro factors can no longer be ignored.

Market volatility is expected to increase further in the near term

Bitcoin finally ended the week in bullish mode. This price action is consistent with the recent pattern of increased volatility on the low timeframes, moving within a six-month descending channel. If this trend continues, we could easily see BTC testing the $62,000 to $64,000 range next week.

While rate cuts are good news for risk assets, it is unlikely that asset prices will continue to rise from here, so be prepared for continued volatility.

Given the current uncertainty in the markets, the remainder of the month is likely to be quite volatile as markets react to broader economic indicators, although short-term volatility is to be expected as traders react to economic indicators.

The drivers behind Bitcoin’s recent price action are largely driven by expectations of an upcoming rate cut and speculation about a new rate cut cycle. These macroeconomic factors, coupled with changes in investor sentiment, are driving market dynamics.

Currently, BTC’s key support and resistance levels are around $50,000, an area that is crucial for traders as it could determine the next direction of BTC’s price action. That being said, with increased institutional participation and mainstream adoption, we may see these levels shift in the coming months.

I think there are two possible outcomes for the next market:

First: BTC has formed a head-and-shoulders bottom structure in the current market. The market will still be dominated by fluctuations in the next 20 days. The 25 basis point interest rate cut in September has little impact on the overall market. The market will continue to fluctuate upward, and a major market will start after mid-October.

Second: After the interest rate cut is implemented, the economic recession is confirmed, and Japan starts to make trouble, there will be a wave of liquidation of deep contracts, and the bottom of 49,000 will be tested again to see if this price can hold. But I think that once it falls below 52,000, the target will not be 49,000, but the range of 46,000 to 48,000. But it should not last for a long time, and this price is mainly for liquidating contracts.

Has the bull market started? How can we escape the peak?

Started 163 days after the 2016 halving

The breakthrough started 163 days after the 2020 halving

It has been 145 days since the halving, and there are still 18 days to go until the 163rd day. Generally speaking, the peak of a bull market is often 500 days after the Bitcoin halving.

This was the case with the last two bull markets. Will this one be the same?

At least let it be one of the references. The 500 days after this round of Bitcoin halving should be September to October of 25 years.

The current copycat track is worth laying out

SUPER: SuperVerse is a decentralized ecosystem that unites multiple products under one governance token, SUPER. SuperVerse's products have two core verticals: NFT market and games. This week, SuperVerse launched Super Champs Chain, a game-optimized L3 chain based on the Base chain, which attracted investment from institutions such as Coinbase Ventures.

SUI: Sui chain’s gaming consoles started pre-sale this week, similar to Solana’s mobile phone airdrop, and it can be clearly seen this week that funds began to flow into the Sui ecosystem. The BLUB and LIQ on its chain rose very rapidly this week, creating a wealth-creating effect on the Sui chain. This week, Grayscale Fund announced that Sui Trust has been opened to qualified investors who invest in SUI, increasing purchases of SUI tokens.

FET: The Super Artificial Intelligence Alliance ASI, formed by the merger of FET, AGIX and OCEAN, proposed to add the distributed artificial intelligence computing project Cudos to its collective and convert Cudos' token cudos into FET at a ratio of 112.427:1, with a price difference of 15 points, which caused FET to rise rapidly this week.