Some people believe that sorters always generate greater value than DAs, and that the plan to accumulate L1 value through DAs is a dead end.

Original text: This is good analysis and the most plausible bull case for DA. But I think the part that will definitely not come true is DA ever getting close to 50% of L2 fees. (X)

By Doug Colkitt , Founder of Ambient

Compiled by: Felix, PANews

Cover: Photo by Shubham Dhage on Unsplash

On August 31, Doug Colkitt, founder of the decentralized trading protocol Ambient Finance, wrote that the plan to accumulate L1 value through DA seems to be a "dead end" in the foreseeable future.

In response to this, Ethereum community member Ryan Berckmans wrote a post discussing Ethereum L2 revenue and Blob fees, assuming that DA costs would rise to approximately 50% of total L2 revenue.

Based on this assumption, Doug Colkitt published another article and refuted it, arguing that DA cannot be close to 50% of L2 fees. The following are the details:

Ryan Berckmans’ analysis is great and is the most compelling reason to be optimistic about DA. But I personally think that DA will never get close to 50% of L2 fees. For structural economic reasons, sorters will always generate greater value than DA.

Blockchain is fundamentally in the business of selling block space. Since block space is not easily interchangeable between chains, it is close to a monopoly.

But not all monopolies can earn excess profits. The key lies in price discrimination for consumers. Without price discrimination, monopoly profits will hardly be higher than commodity profits.

Think about how airlines differentiate between price-insensitive business travelers and consumers seeking cheap airfares. Or how the same SUV model is sold at very different prices under the Volkswagen, Audi and Lamborghini brands.

Priority fees are an amazing price discrimination mechanism in blockchain. The highest priority transactions pay fees that are actually orders of magnitude higher than the median.

Both L2s and Solana achieve high throughput and high revenue by using sorter priorities as a form of price discrimination.

Marginal transactions pay very low fees, thus achieving huge TPS. But price-insensitive transactions are squeezed out, paying the majority of network fees.

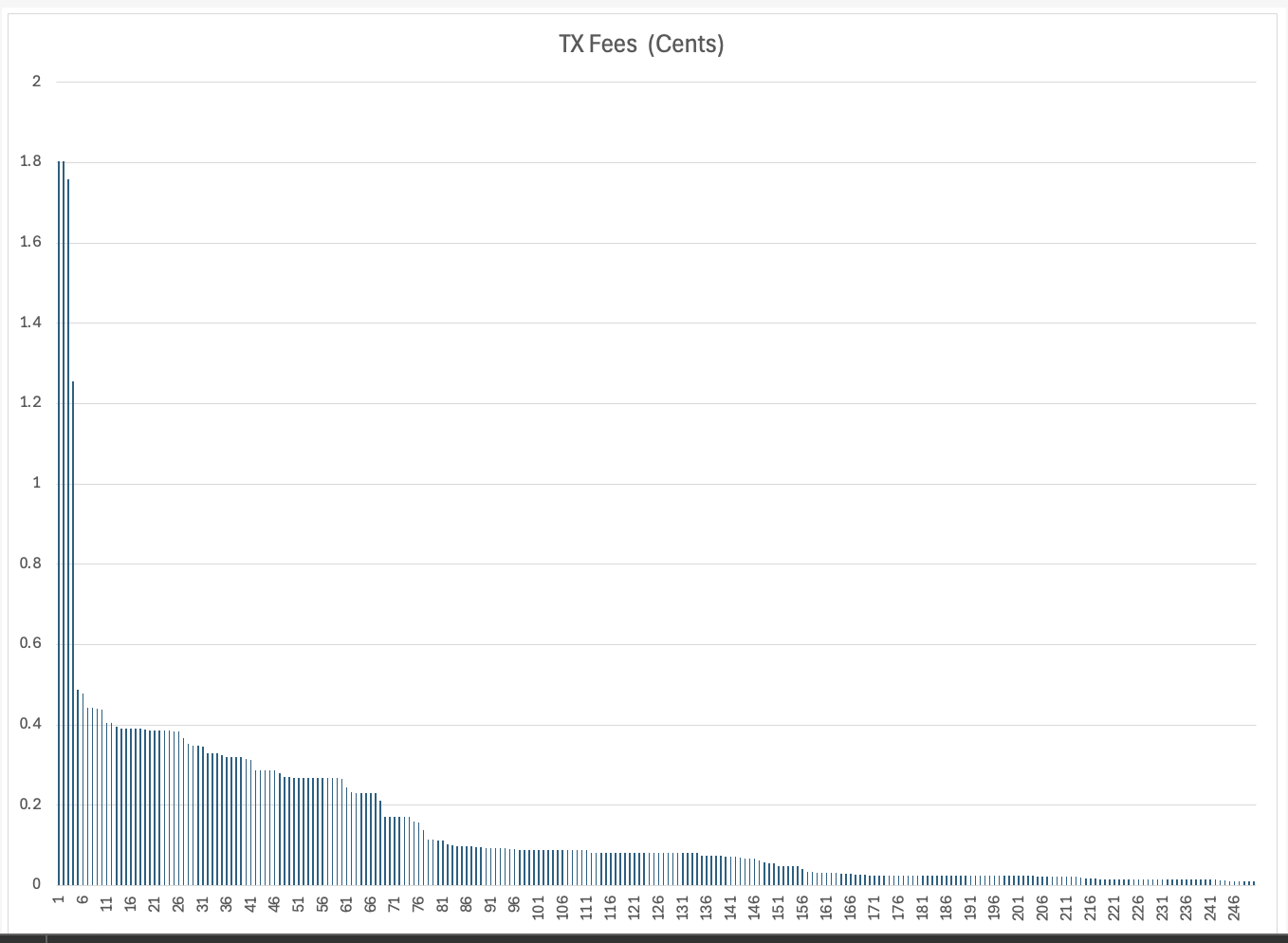

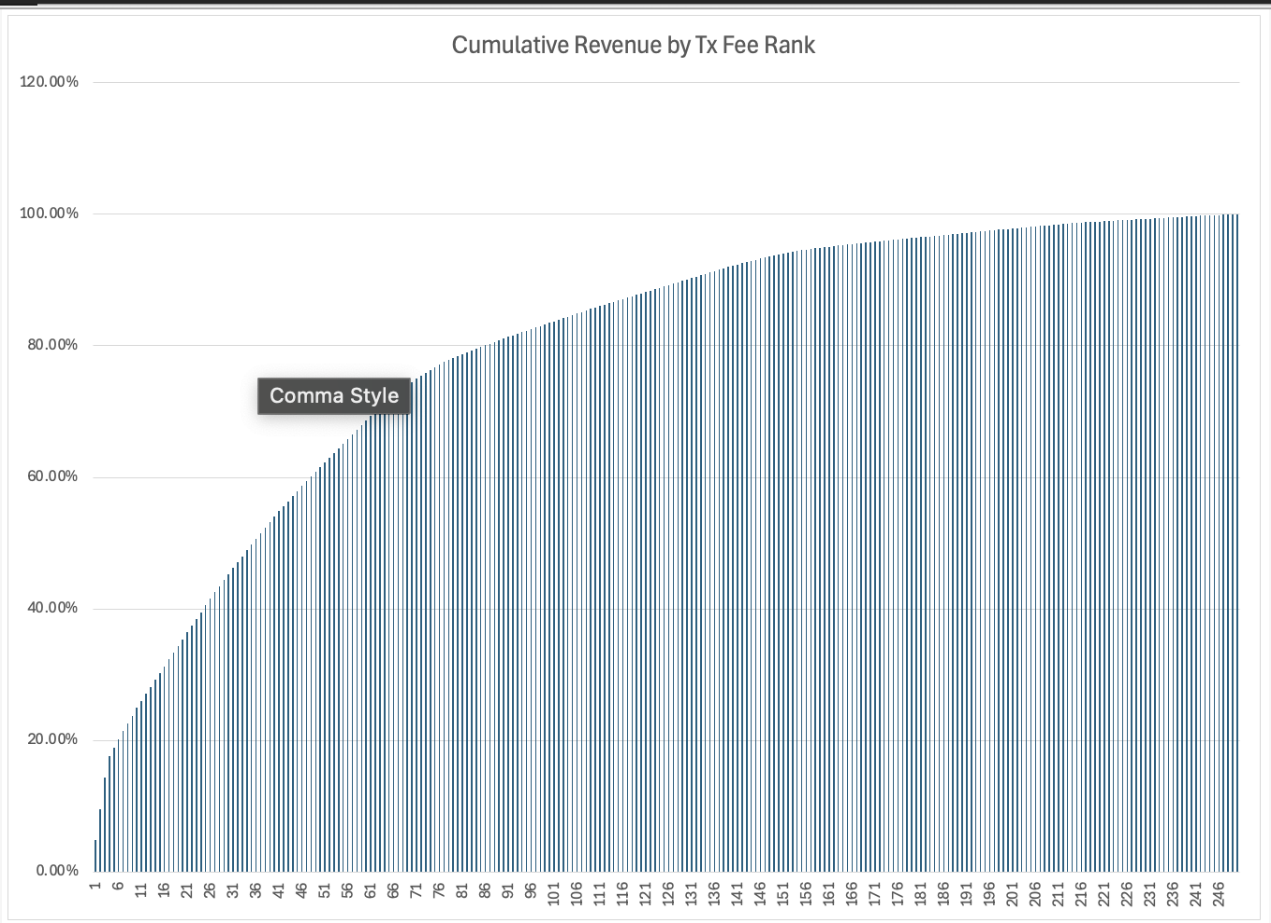

Below is the distribution of 5 randomly drawn blocks from Base L2. This is a clear Pareto distribution, which makes price discrimination very effective.

PANews Note: Pareto distribution means that through market transactions, 20% of people will own 80% of social wealth. If the transactions can continue, then " there is generally an unbalanced relationship between cause and effect, effort and gain. The typical situation is: 80% of the gain comes from 20% of the effort; the other 80% of the effort only brings 20% of the results . "

The top 10% of transactions paid 30% of fees. The bottom 10% paid less than 1%.

The problem is that while the sorter makes a lot of money from this, the DA layer cannot do the same because it has no ability to price discriminate.

This ultra-high value arbitrage pays the same fee for Ethereum DA as the 1 Wei junk transaction because they are settled in the same batch.

Since the value of marginal transactions is very low, high TPS can only be achieved if the cost of the median transaction is close to zero. But with DA, basically every transaction has the same payment. The DA layer can have both high throughput and high revenue. But it cannot have both.

This makes rollups virtually impossible to scale without collapsing Ethereum network revenue.

The rollup-centric roadmap is fundamentally flawed because it gives up the valuable part of the network (ranking) in the belief that it can be earned back with the worthless part (DA).

The author initially favored a rollup-centric roadmap because the author believed that any rational person would recognize the economic principles of price discrimination and that it would run in parallel with L1 expansion.

High-value users who are not price-sensitive will use L1 for its traceability, security, and reliability. L2s, on the other hand, focus on marginalizing low-income users. Therefore, Ethereum will still receive considerable sorter rent.

But Ethereum leadership has repeatedly stressed that L1 as an application layer is effectively dead and will never scale. As a result, users and developers have responded very rationally, and the L1 application ecosystem is now dying, and Ethereum network revenue is dying with it.

If you believe that the long-term value proposition of ETH is as a monetary asset, then it is possible. Getting more people to own ETH makes it a form of money. Subsidizing L2s that add zero value to the base layer should help achieve this.

But if you believe that ETH’s long-term value proposition is network equity in a widely used protocol, then you need value accrual.

Clearly, there are structural problems with Ethereum’s development due to poor economic assumptions.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and the guest, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group