On the eve of the Federal Reserve's September interest rate decision, market expectations for a 50 basis point rate cut have become increasingly strong.

VX:TTZS6308

According to data, trading volume in October federal funds futures, which bet on the Federal Reserve's interest rate decision this week, has risen to the highest level since records began in 1988, with most new contracts betting on a 50 basis point rate cut by the Fed, and one-third of the positions were created this week.

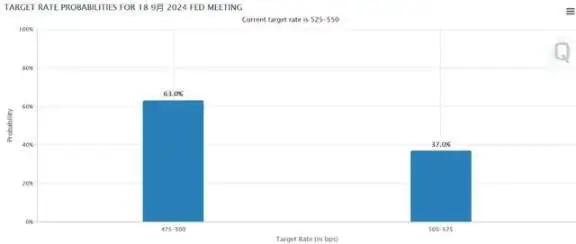

Currently, the market implied odds show that the probability of a 50 basis point rate cut before the Fed makes a decision is slightly higher than 50%. At the same time, U.S. Treasury yields have fallen sharply this week, with the 2-year Treasury yield hitting a two-year low of 3.52%.

The futures market is pricing in a 63% chance of a 50 basis point cut, far higher than the 30% a week ago, and a 37% chance of a "conventional" 25 basis point cut. The minority of voices that believed the Fed would not cut rates in September have disappeared.

As of the week ending September 10, hedge funds increased their net short positions in long-term and ultra-long bonds by approximately $6.4 million per basis point; as of September 16, although long positions were closed during the week, investor sentiment remained bullish.

If the Fed's rate cut is smaller and Powell hints that it will take a gradual approach to rate cuts, the market may face greater selling pressure.

If the Fed cuts rates by 25 basis points instead of 50 basis points, the market reaction will be much stronger. The current market positioning, optimism and loose financial conditions may be tested.

Tonight is the important FOMC. The market has already rallied on expectations, but there is a higher risk of losses ahead.

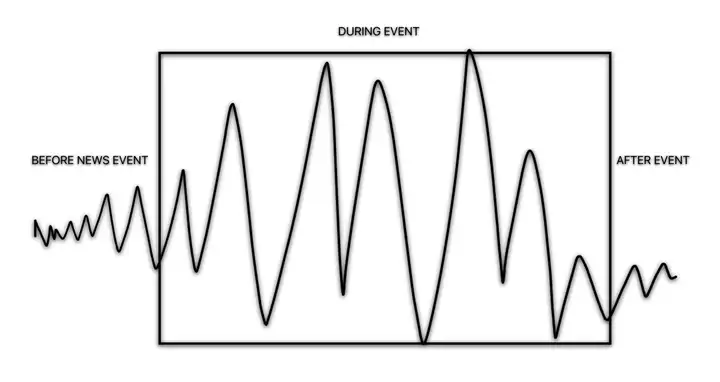

1. Short-term impact FOMC is an event trading day, which means it usually only affects the financial market in the short term. Don't expect it to bring a bull or bear market. Control your emotions and avoid being impulsive.

2. Expect price shocks. A price shock is a sudden and significant change in price caused by unexpected news or news releases. This is an unpredictable event and cannot be predicted. In most cases, a price shock will be fully retraced.

3. FOMC meeting days are noisy. It is not safe to trade on noisy, volatile meeting days. Even if you guess the result correctly, be careful! Mistaking luck for skill may lead to overconfidence bias and overinvestment, which can lead to losing money.

4. Exiting profiteering? Usually, after an FOMC decision, prices retrace to previous levels with little impact other than a spike in volatility. So if there is a profiteering, it is just a fluke, not a trading genius. Consider closing out your lucky profits before they disappear.

5. The gap means volatility. The magnitude of the price reaction depends on the gap between the expected and actual news. The larger the gap, the greater the volatility.

6. Don’t go against the Fed. The Fed’s decisions are speculative, but trading against its decisions is a losing bet. Trying to guess and predict what Powell calls almost unpredictable outcomes is one of them. However, it is unwise to continue trading against its decisions on monetary policy.

For traders who are generally risk-averse and loss-averse, consider staying on the sidelines. Sometimes, taking no action is the best action.

The market trends in the next few days will revolve around the FED's decision. Generally speaking, if the Federal Reserve (FED) decides to cut interest rates, whether it is 1 point or 2 points, it will be good news for risky assets such as US stocks and Bitcoin (BTC) in the long run.

However, Powell's remarks at the press conference will largely determine the Fed's policy direction in the next three months. If Powell and the FED choose to take a hawkish stance after this rate cut, it may still turn a positive into a negative.