DeFi Data

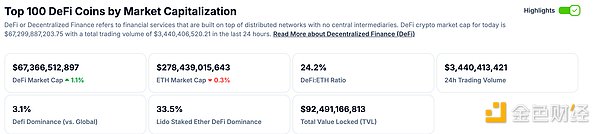

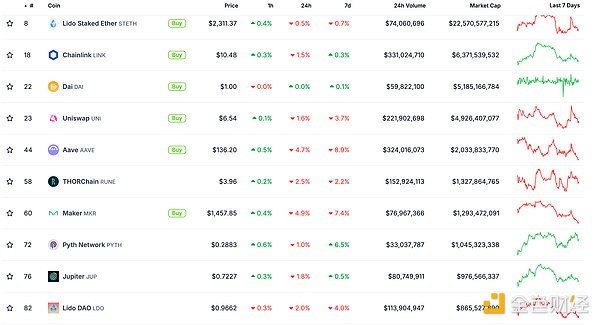

1. Total market value of DeFi tokens: $67.366 billion

DeFi total market value data source: coingecko

2. The transaction volume of decentralized exchanges in the past 24 hours was US$3.44 billion

Data source for decentralized exchange trading volume in the past 24 hours: coingecko

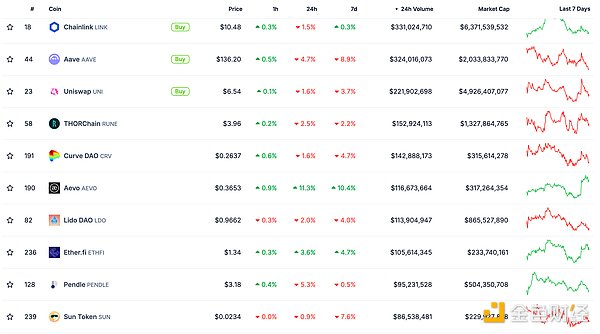

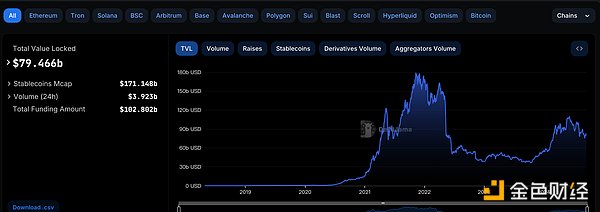

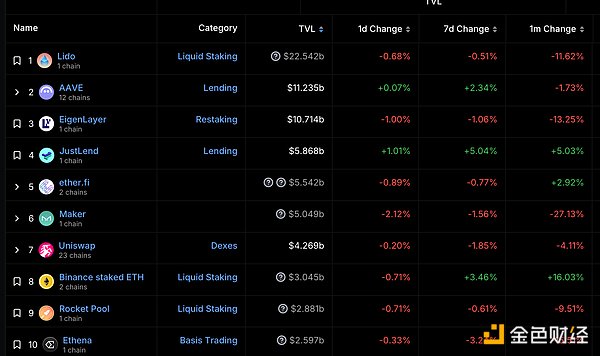

3. Assets locked in DeFi: $79.466 billion

The top ten rankings of DeFi projects’ locked assets and locked-in amounts. Data source: defillama

NFT Data

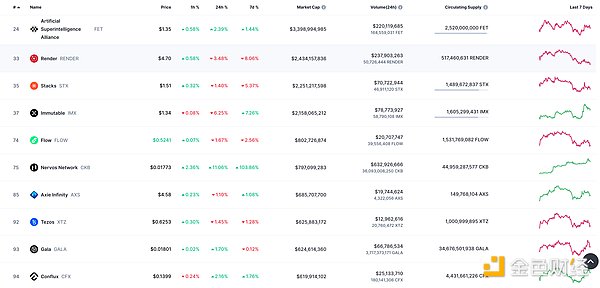

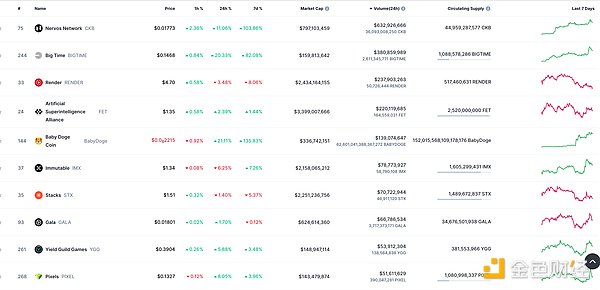

1. Total NFT market value: $25.772 billion

Data source of NFT total market value and top ten projects by market value: Coinmarketcap

2. 24-hour NFT trading volume: $ 3.022 billion

Data source of NFT total market value and top ten projects by market value: Coinmarketcap

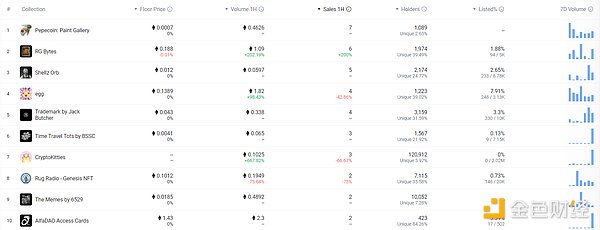

3. Top NFTs in 24 hours

Top 10 NFTs with the highest sales growth in 24 hours Data source: NFTGO

Headlines

MakerDAO has officially changed its name to Sky

Rune, the founder of Maker DAO, said on the X platform that Maker DAO has officially changed its name to Sky, and the token is expected to be upgraded to USDS and SKY on September 18. The Sky ecosystem has opened registration for the early bird reward program on its official website Sky.Money. Eligible users will receive double rewards in the first month after the project is launched.

NFT Hot Spots

1. Pudgy Penguins CEO: Not worried about the SEC’s recent actions against the NFT industry

Pudgy Penguins CEO Luca Schnetzler said he is not concerned about the recent actions taken by the U.S. Securities and Exchange Commission (SEC) against the NFT industry. On August 28, NFT marketplace OpenSea revealed that it had received a Wells Notice from the SEC. The company claimed that the SEC claimed that NFTs on the trading platform may qualify as securities. Then, on September 17, the SEC fined the Flyfish Club restaurant $750,000 for offering NFTs. Schnetzler added that if the SEC takes action against OpenSea, they will have to go up against a lot of large organizations that are already involved in the NFT space. Schnetzler believes that OpenSea is not selling on false promises. "OpenSea, in particular, I think it has its own unique parts, like not selling people false promises or dreams. So for that reason, I am not worried."

2. BAYC: Dookey Dash: Unclogged is scheduled to be launched on September 19, with a prize pool of $1 million in the first season

On September 18, "BAYC" BAYC announced on the X platform that Dookey Dash: Unclogged will be launched on Thursday, September 19, and will support iOS and Android mobile versions. According to Yuga Labs co-founder Garga.eth (Greg Solano), the prize pool for the first season of Dookey Dash: Unclogged is $1 million, and it has been pre-installed on iOS and Android Google Play today.

DeFi Hotspot

1. Liquid staking protocol Amnis Finance completes $2 million in financing

Amnis Finance , a liquid staking protocol on the Aptos blockchain, has completed a $2 million financing, led by Borderless Capital and OKX Ventures. Aptos Labs, Arkgrow Pte Ltd, Ambush Capital, Gate Ventures, Sky Vision Capital, Old Fashion Research, Chorus One Venture, Re7 and Flowdesk participated in the investment. The new funds will enable Amnis Finance to accelerate the integration of its innovative liquidity pledge solution in the Aptos DeFi ecosystem. The platform will continue to focus on enhancing its services within Aptos while expanding its influence through strategic partnerships.

2. Bitwise: Ethereum may reverse its weak trend before the end of the year

Bitwise CIO Matt Hougan said that ETH seems to be on the shelf now, but its poor price performance may be reversed as the year draws to a close. The report believes that ETH's recent poor performance stems from risks related to the November US presidential election, increased competition from Solana and other blockchains, challenges facing token economics, and mixed reactions to the launch of spot trading platform exchange-traded funds (ETFs) in the United States. Hougan pointed out that the market may re-evaluate Ethereum as the November election approaches and regulation becomes clear. At present, Ethereum seems to be a potential contrarian investment option by the end of this year.

3. TON: Catizen is the first consumer Web3 application with more than 1 million paying users

TON officials posted on social media that Catizen is the first consumer-grade Web3 application with more than 1 million paying users. Its token CATI will be officially launched on September 20. Prior to this, it has achieved significant growth, with a total of more than 39 million users and more than 18 million monthly active users.

4. Framework Ventures co-founded: Berachain mainnet will be launched before the end of the year

On September 18, Vance Spencer, co-founder of Framework Ventures, said at Token2049 in Singapore that the Berachain mainnet and tokens are scheduled to be launched by the end of 2024. Berachain's POL consensus mechanism can introduce a fully consistent blockchain ecosystem by transferring part of the profits back to ecosystem participants: when users stake BERA, they must direct the liquidity they obtain to these primitives. In this way, all fees remain in the ecosystem. They all flow to BGT and BERA holders, which is what the market desires. It is worth noting that on April 12, the new public chain Berachain announced the completion of a $100 million Series B financing, which is about 45% higher than the previously reported amount. This round of financing was jointly led by Brevan Howard Digital's Abu Dhabi branch and Framework Ventures, with participation from Polychain Capital, Hack VC and Tribe Capital.

5. Gate.io officially launched the Telegram applet

According to the official announcement, on September 14, the cryptocurrency trading platform Gate.io officially launched the Telegram applet, where users can directly complete account registration and KYC certification in Telegram. To celebrate the launch of the applet, the platform has launched a limited-time $10,000 reward event. After completing the task, you can receive $100 in cash and share the contract recharge experience coupons with the number of gold diamonds.

Game Hotspot

1. Blockchain game developer Ambrus Studio completes multi-million dollar financing, led by The Spartan Group

On September 18, Ambrus Studio, the developer of the MOBA game E4C: Final Salvation, announced that it had completed a multi-million dollar financing round, with the specific amount not disclosed. The financing was led by The Spartan Group, with participation from IVC, Sui Foundation, Knight Capital, Goodwater Capital and ZeePrime Capital.

Disclaimer: As a blockchain information platform, Jinse Finance publishes articles for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to raise your risk awareness.