The MiCA Act clarifies the scope of supervision, divides regulated crypto assets into three categories and provides detailed regulatory rules, and puts forward specific regulatory requirements for different crypto asset service providers such as exchanges and institutions.

Author: Chris Chuyan , web3 lawyer, former senior product manager of an exchange, on-chain data researcher

Cover: Photo by Christian Lue on Unsplash

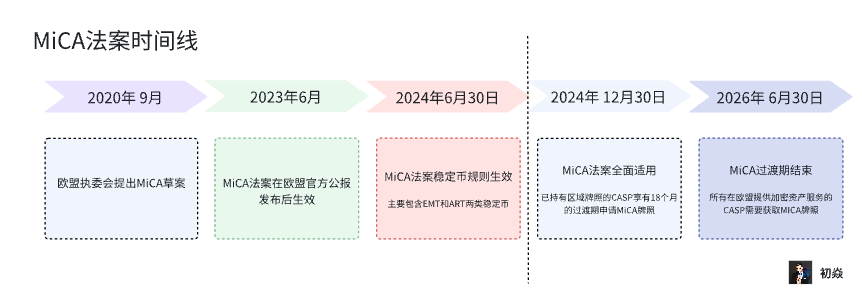

On June 9, 2023, the Markets in Crypto Assets regulation bill (MiCA) was published in the Official Journal of the European Union after nearly two and a half years of legislative review and officially became law. MiCA is the EU's first legislation on the regulatory framework for the crypto asset market.

MiCA's past and present

The European Banking Authority (EBA) released a report in 2019 that there are risks of insufficient consumer protection and money laundering in crypto asset transactions, and it recommended that the European Commission take action. In 2020, the EU Anti-Money Laundering Directive No. 5 led to inconsistent registration and licensing systems for cryptocurrencies in various countries, adding regulatory pressure and compliance costs to regulators and companies. Regulatory authorities in various countries and the crypto industry are calling on the EU to introduce relevant laws and regulations to assist in supervision. Subsequently, the MiCA draft was proposed in September of the same year and approved at the EU meeting on April 20, 2023.

Regulatory Scope of MiCA Act

The MiCA Act clarifies the scope of supervision, divides the regulated crypto assets into three categories and provides detailed regulatory rules, and puts forward specific regulatory requirements for different crypto asset service providers such as exchanges and institutions. In addition, it also includes the prevention and prohibition of insider trading, user protection rules, and collaborative investigation and punishment by regulatory authorities of various countries.

MiCA divides the crypto assets under its supervision into two stablecoins, ART and EMT, and other crypto asset tokens:

1. Asset-referenced token (ART) refers to a stablecoin that maintains a stable value by referring to one or more combinations of values and rights, such as a stablecoin issued with a combination of assets such as legal tender, precious metals, bonds, and funds.

USDT is a stablecoin issued with assets such as US short-term Treasury bonds, Bitcoin, and precious metals. The decentralized stablecoin Dai is also issued with virtual currencies voted by MKR holders as collateral. Recently, Dai's issuer MakerDao also announced that the decentralized stablecoin Dai will be upgraded and renamed USDS, and will support the freezing function after the upgrade.

For stablecoins such as ART, both issuers and crypto asset service providers are prohibited from paying interest to holders. And when the number of quarterly transactions exceeds 1 million and the average daily transaction volume exceeds 200 million euros, the issuer needs to temporarily stop issuing ART and submit a plan to the competent authorities to ensure that the number of ART transactions and transaction volume in circulation are lower than the above standards before continuing to issue.

2. Electronic money token (EMT) refers to a stablecoin issued by anchoring the value of an official legal currency.

When the holdings, market value, number of transactions and other indicators of the two stablecoins ART and EMT reach the standards stipulated in the MiCA Act, their issuers will be required to bear additional compliance obligations such as regular independent audits and liquidity stress tests. 3. Crypto assets other than ART and EMT are other crypto asset tokens stipulated in the MiCA Act. MiCA's supervision of other crypto asset tokens mainly lies in white papers and publicity and promotion.

MiCA requires that the white paper of a crypto asset project should include: ① information related to the issuer; ② information about the trading platform; ③ a detailed description of the project's vision and goals, implementation timetable, token application scenarios and other specific information; ④ the token economic model, issue price, and online trading platform; ⑤ information on the rights and obligations of token investors during the holding period; ⑥ the project's technical framework and detailed underlying technical information; ⑦ investment market risks, technical risks, compliance issues, energy utilization during project operation, and whether the consensus mechanism will have an adverse impact on the environment.

For crypto asset projects, MiCA requires that: ① the marketing materials for promotion should clearly mark the marketing nature so that investors can identify it; ② the information in the marketing materials should be accurate, complete and clear, and should not mislead investors; ③ the information used in the promotion should be consistent with the content in the white paper; ④ in the promotion process, it should be clearly stated that the white paper has been published, and the issuer, trading platform website and contact information should be clearly stated; ⑤ it is necessary to prominently state in the marketing materials: "This crypto asset marketing communication has not been reviewed or approved by any competent authority of any EU member state. The crypto asset issuer is fully responsible for the content of the marketing communication materials."

Before the project goes online, the issuer needs to submit a white paper to the competent authority for review and publish it publicly on its official website. During the continuous operation of the project and the investors holding the project tokens, the white paper and marketing materials need to be continuously updated and published on the official website.

If there are major changes, major errors or uncertainties that may affect the valuation of the project tokens, the issuer needs to promptly revise the white paper and published marketing materials, submit them to the competent authority for review, and explain the reasons for the revisions.

The author believes that from the provisions of the above-mentioned MiCA Act, it can be seen that the white paper is crucial for the issuance of crypto asset projects. After the project is launched, if the project token economic model, future project planning and other white paper contents need to be modified, they need to be approved by the competent authorities. It is no longer like a few years ago when Taobao could write white papers for you and find celebrities to endorse you to start the project.

MiCA's requirements for white papers are very detailed and specific, the regulatory approval process is clear, and investor protection is becoming increasingly complete. It requires project parties to perform their duties diligently from launch to operation, prevent project parties from arbitrarily issuing, destroying project tokens and using them, and publish project information in a timely manner to achieve true transparency and compliance.

Other crypto assets and projects not regulated by MiCA

1. NFT

The MiCA Act clearly states in Article 2 (4) that this regulation does not apply to crypto assets that are unique and not interchangeable with other crypto assets. This provision does not simply stipulate that all NFTs are not subject to the MiCA Act, but excludes non-fungible tokens with general NFT characteristics such as unique, unique, and non-fungible from the scope of regulation of the MiCA Act.

If, as the industry develops, in order to solve the liquidity and practicality of NFT, a token swap protocol such as ERC404 appears, which allows the token to have the characteristics or uses of both FT and NFT, then this form of token may also be included in the regulatory scope of MiCA. From this, we can see the foresight and predictive nature of the MiCA Act in regulating the rapidly changing crypto industry.

2. Free crypto asset tokens

The MiCA Act clearly stipulates in Article 4 (3) that MiCA does not apply to crypto assets that meet the following conditions: 1. Crypto assets are provided free of charge; 2. Automatically generated crypto assets are used as rewards for maintaining a distributed network and verifying transactions; 3. Utility tokens provide the right to use existing or in-use goods or services; 4. Crypto asset holders only have the right to use the crypto assets to redeem goods and services within a limited network;

The free tokens here are not the same as the airdrops of project tokens obtained for free by requiring participants to complete some tasks during the early cold start or operation of many projects. MiCA clearly stipulates that crypto assets obtained at the cost of providing or promising to provide personal data information or paying any fees, commissions or non-monetary benefits do not belong to free crypto asset tokens. In other words, Depin projects where users provide map data and network bandwidth resources to projects in exchange for airdropped tokens, and public chain projects that require users to spend a lot of GAS to interact and require crypto asset pledges may not be considered free, and thus need to be regulated by the MiCA Act.

3. Decentralized projects such as DeFi

For decentralized projects such as DeFi, smart contracts are used on the chain to achieve decentralization, but the front-end web pages and servers open to ordinary C-end users of such decentralized projects are basically centralized service providers. MiCA only excludes projects that provide crypto asset services in a completely decentralized manner without intermediaries from the scope of supervision. Therefore, DeFi and other projects that are not completely decentralized may be subject to regulatory pressure from MiCA in the future.

In addition, the MiAC Act does not apply to crypto assets that meet the standards of financial instruments, deposits (including structured deposits), funds that do not meet EMT standards, and securitization positions in the context of securitization.

MiCA Act regulates crypto asset service providers

A legal person or other legal enterprise that provides one or more of the following crypto-asset services to clients in a professional manner and has been formally authorized and approved by MiCA is a licensed crypto-asset service provider (CASP), which can provide crypto-asset services across borders throughout the EU jurisdiction.

- MiCA’s definition of crypto asset services:

① Provide custody and management of crypto assets on behalf of clients (platform custody services);

② Operate a crypto asset trading platform (exchange services);

③ Use crypto assets to exchange funds (the platform provides deposit and withdrawal services);

④ Use crypto assets to exchange for other crypto assets (coin-to-coin spot, flash exchange transactions);

⑤ Execute trading orders of crypto assets on behalf of clients (trading matching services);

⑥ Promote and publicize crypto assets to investors;

⑦ Receive and transmit crypto asset orders on behalf of clients (order placing and order routing services);

⑧ Provide customers with personalized crypto asset advice;

⑨ Provide portfolio management of crypto assets (crypto asset management services);

⑩ Provide customers with crypto asset transfer services (platform deposit and withdrawal services).

It basically covers common business scenarios such as crypto exchanges, wallets, institutional custody, asset management, investment advice, and publicity and promotion.

- CASP application document requirements:

① Applicant’s name, legal entity identifier, website operated, phone and email contact information, and physical address;

② The legal form and articles of association of the applicant;

③ An operational plan including the types of crypto asset services, marketing methods and locations;

④ Documents proving that the applicant meets the prudent safeguard requirements;

⑤ Description of the applicant’s governance structure, the industry skills and experience of the management team, the identity and shareholding of shareholders, and materials proving their good reputation;

⑥ A description of the applicant’s internal control mechanisms and risk control procedures, including anti-money laundering, terrorist financing, and business continuity plans;

⑦ Technical documentation of the applicant’s information and communication technology and security systems, which should be in non-technical languages;

⑧ The applicant’s description of the procedures for segregating client assets from its own assets;

⑨ The applicant’s description of the customer complaint handling procedure.

In addition, there are additional requirements for different crypto asset service businesses:

① Platforms that conduct custody business need to provide a description of custody rules;

② Exchange operators need to provide platform operating rules and procedures and system descriptions for detecting market abuse;

③ The pricing method needs to be provided for conducting deposit and withdrawal or currency-to-currency exchange transactions;

④ To carry out transaction matching services, a description of the matching rules needs to be provided;

⑤ To provide crypto asset consulting or portfolio management services, it is necessary to provide evidence that the relevant personnel have the knowledge and professional skills required to perform their obligations;

⑥ Operate wallets, exchanges, etc. to assist customers in on-chain asset transfer services, and provide description information of the transfer service.

From this we can see that MiCA's requirements for CASP's license application are very detailed and comprehensive, ranging from user wallet deposits and withdrawals, trading systems, asset isolation and security, customer complaint handling to cooperation with supervision on anti-money laundering and terrorist financing.

However, in practical experience, in addition to the provisions of MiCA, the regulatory authorities of each member state will also have additional material and procedural requirements for CASP in accordance with the corresponding laws and regulations of their own country. In this regard, practitioners are advised to conduct in-depth research on the laws and regulations of each member state and consult professional lawyers.

- Reasons for the competent authority to refuse authorization

If the management or shareholders of a CASP applying for a license have been convicted of money laundering or terrorist financing or other crimes that affect its good reputation, the competent authorities should refuse to authorize it to become a crypto asset service provider. CZ was previously sentenced to four months in prison by the U.S. Seattle Federal Court for violating U.S. anti-money laundering regulations, which may affect Binance's application for a MiCA license in the EU.

How MiCA protects investors

1. Establish a complete customer complaint handling procedure

CASP is explicitly required to establish and maintain effective and transparent procedures for handling customer complaints, and to clearly inform users that they can file complaints, provide them with complaint templates, and record all customer complaints. CASP will inform users of the investigation results within a reasonable time after a timely and fair investigation procedure.

2. Ensure safe custody of investors’ encrypted assets

CASPs that provide crypto asset custody services need to develop internal rules and procedures to ensure the safe custody and control of users' crypto assets, so as to minimize the risk of losing crypto assets due to fraud, network failure, etc. At least every three months, they should provide customers with a statement of their crypto asset holdings recorded in their name, which should include the type of crypto assets, balance, value and asset transfer.

Ensure that user crypto assets are kept separately from CASP's own crypto assets to prevent creditors from pursuing user crypto assets held by CASP in the event of CASP bankruptcy. If user crypto assets are lost due to its own reasons, the upper limit of the compensation liability that CASP needs to bear shall be based on the value at the time of the loss.

3. Conduct suitability assessment for investors and inform them of risks

CASPs that provide crypto asset investment advice or asset management must obtain basic information from investors, including investors' experience with crypto asset investments, risk tolerance, their own financial status, and their understanding of crypto asset investment risks, and establish relevant procedures to collect this information and re-evaluate users at least every two years.

Investors should be clearly informed of the risks of price volatility of crypto assets, possible illiquidity, possible partial or total loss, and not being protected by investor compensation and deposit guarantee schemes.

4. Prevention and prohibition of insider trading and market manipulation

- MiCA defines insider trading information as:

① Precise information that is not yet publicly available and is directly or indirectly related to one or more issuers or crypto assets, which, if disclosed, may have a significant impact on the price of the crypto asset;

② Personnel responsible for executing crypto-asset trading orders on behalf of clients have access to pending order information, which, if made public, could have a significant impact on the price of crypto-assets.

The author believes that the insider information referred to by MiCA is mainly the undisclosed favorable information held by the crypto asset project parties, as well as the transaction order information of whale and market makers held by internal staff of CASP such as exchanges, institutions, and asset management that is sufficient to influence future prices.

Issuers should inform the public of insider information as soon as possible and cannot combine the disclosed insider information with their marketing and promotion activities. Information disclosed on the official website needs to be retained for at least five years.

Insider trading refers to the use of insider information to directly or indirectly obtain crypto assets related to the information for oneself or a third party. Insider trading also refers to the use of the information to cancel or modify previous trading orders.

- MiCA defines market manipulation as follows:

① Giving false and misleading signals about the supply, demand and price of crypto assets without justifiable reasons, causing the price of crypto assets to be at abnormal levels;

② Using fake equipment, accounts, etc. to place trading orders to influence the price of encrypted assets;

③ Spreading false and misleading information about the supply, demand and price of crypto assets through Internet media, causing the price of crypto assets to be at abnormal levels;

④ Taking advantage of the dominant position in the supply and demand of crypto assets to directly or indirectly fix the buying and selling prices, or create other unfair trading conditions;

⑤ Make it difficult for other investors to identify the real orders of the platform by frequently canceling, placing and modifying orders, disrupt the operation of the platform, and start or intensify false market trading trends;

⑥ Frequently express opinions on crypto assets through media channels without disclosing conflicts of interest to the public, and profit from the impact of such behavior on the price of crypto assets.

CASP needs to establish effective rules, systems, and procedures to prevent and detect market manipulation and other market abuses, and report relevant situations to the competent authorities in a timely manner. For cross-border market manipulation, relevant competent authorities need to establish a cooperation mechanism to discover and sanction.

Regulatory agencies involved in MiCA enforcement

EU member states need to designate the competent authorities of each country and notify these competent authorities to the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA). The European Banking Authority (EBA) is mainly responsible for promoting effective and consistent supervision of banks in EU countries and is responsible for formulating technical standards and guidelines for supervision throughout the EU; the European Securities and Markets Authority (ESMA) is the regulator of the EU financial market, mainly responsible for protecting the interests of investors, ensuring the orderly operation of the market, and ensuring financial stability and the ability to resist financial shocks.

During the implementation of the MiCA Act, EBA and ESMA are responsible for formulating technical implementation standards, coordinating the timely exchange of information between competent authorities of various countries in accordance with the templates and procedures in the technical standards, and cooperating in investigations, supervision and law enforcement.

Summary and Outlook

After years of unregulated and unregulated wild growth, crypto assets have brought a lot of financial and technological innovations to the real world, but have also spawned and encouraged a lot of money laundering, fraud and other criminal activities, becoming a tool for transferring and laundering illegal and criminal proceeds. Many grassroots have completed their counterattacks with the rapid development of the crypto industry and the discovery of the value of crypto assets, while some have gone astray in order to seek personal gain and satisfy their own ever-expanding desires.

With the implementation of the EU MiCA Act, regulatory rules are gradually becoming more complete and clearer, and the crypto industry will continue to move forward under the compliance review of regulators. Perhaps in the near future, industry participants will no longer be troubled by deposit and withdrawal risk control card freezing, and developers can focus on research and innovation, integrating crypto technology with the real world and bringing more applications to the market.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group