The US finally cut interest rates! The US Federal Reserve announced a 50 basis point rate cut at 2:00 am on September 19. The Fed is still bold in its actions. It raised interest rates aggressively at the beginning, and it is just as aggressive now. It did not hesitate by 25 basis points, but directly cut interest rates by 50 basis points.

The 50 basis point rate cut was implemented, which was also in line with market expectations. The policy statement last night had new adjustments in wording, with new commitments: in addition to the commitment to push the inflation rate back to 2%, the statement added that the committee will be "firmly committed to supporting full employment." Statement on inflation and employment: employment growth has slowed and inflation has "made further progress" but is still somewhat high.

However, what is puzzling is that there was no movement in the U.S. stock market. The U.S. stock market opened high and fell, and the currency market was basically the same. Market data showed that the three major U.S. stock indexes all turned to decline, completely erasing the gains since the Fed announced its interest rate decision. In addition, spot gold has also completely given up the gains since the Fed announced its interest rate decision. It is very disappointing, and it may be that the good news has turned into bad news. I was worried that the Asian stock market and currency market would follow the decline early, but I didn’t expect that Asia’s performance was shocking.

Japanese stocks opened sharply higher. On September 19, the US S&P 500 futures rose 0.85% in the Asian session, the Nasdaq futures rose 1.3%, and the Dow futures rose 0.51%. In addition, the Nikkei 225 index opened 1.6% higher and the Topix index opened 1.4% higher.

Following this, Asian cryptocurrency investors went crazy. Bitcoin rose vertically and broke through 62,000, Ethereum broke through 2,400, and other mainstream altcoins all surged! In the past 4 hours, the entire network liquidated 65.2839 million US dollars, mainly short orders.

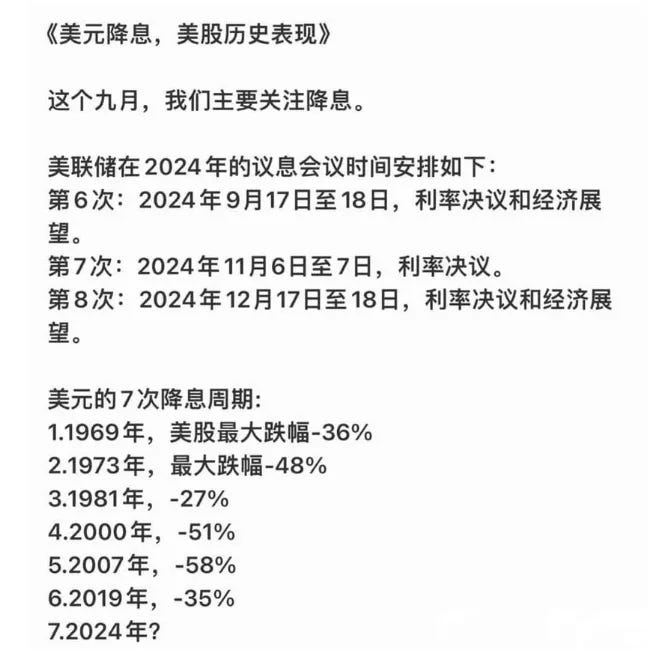

In the history of the United States, multiple interest rate cuts are often accompanied by market turmoil, especially sharp corrections in the stock market .

U.S. stocks have seen a significant decline in response to the current seventh rate cut.

The answer to this question is not absolute and depends on many factors, including but not limited to the global economic situation, investor sentiment, policy changes, and the inherent dynamics of the cryptocurrency market. Historically, there is indeed a certain degree of linkage between the cryptocurrency market and the traditional financial market, especially when risk appetite declines, cryptocurrencies are usually also affected.

However, the cryptocurrency market also has its own unique features, such as technological innovation, community-driven factors, etc., which may weaken the impact of the external economic environment to a certain extent. In addition, as the cryptocurrency market gradually matures, it sometimes shows a lack of synchronization with the traditional market.

In general, although the cryptocurrency market is likely to be affected by the decline of US stocks , it may also show different trends due to its own characteristics . Investors should pay close attention to market dynamics while considering their personal risk tolerance and investment strategy.

What can a rate cut bring?

Looking back at the previous upward trend

There is only one reason for the bull market in 2020, which is the liquidity brought by the interest rate cut . Brothers, don’t believe any stories. Only capital injection can drive the rise. Stories can only drive leeks to enter the market. The transmission of stories always lags behind the layout of capital.

The rise at the end of 2023 is because the Bitcoin ETF started to rise after it was approved. Let's look at the K-line. After the U.S. Securities and Exchange Commission (SEC) first approved it on January 10, 2024, local time, the price of Bitcoin was 41,000. With the approval of the ETF, traditional funds entered the crypto and funds were formed, starting to rise to 73,000. Large funds are lagging. After the interest rate cut, funds began to slowly flow from the United States to the financial markets of countries around the world, and then interest rates would begin to rise to absorb global assets.

Analysis of BTC and ETH market on September 19:

Today's highlights

BTC: 1-hour and 4-hour levels are above healthy levels, and the daily level has returned to a healthy level. It is expected to continue to rise during the day. It can be followed up slightly, but it needs to be reduced before 9:30 pm. There is a need for consolidation after the interest rate cut, and caution is still needed. The expectation of the big cycle has not weakened. The support below is 60800-61300, and the resistance above is 63500-64000.

ETH: 1-hour and 4-hour levels are above healthy levels, while the daily level is below healthy levels. Pay attention to the trend of BTC. The current trend is still not strong, but it is expected to rise synchronously with BTC. However, we still need to pay attention to the correction after the opening of the US stock market. The upper resistance during the day is 2480-2530, and the lower support during the day is 2330-2360.

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background