Public chains entering the Korean market are focusing on community building, education, and strategic partnerships to grow their ecosystems.

Original text: Is the Korean Market Still a Priority for Mainnets? (Tiger Research Reports)

Author: Leo Park & Yoon Lee , Tiger Research

Compiled by: Felix, PANews

Key points:

- Public chains that entered the Korean market earlier are still very active and position themselves on entertainment IP, especially in the gaming field.

- Public blockchain projects like Arbitrum, Monad, Story, and Scroll are rapidly expanding in South Korea this year, each adopting a unique strategy focusing on community building, education, and strategic partnerships to grow its ecosystem.

- While the Korean market is certainly attractive, a deep understanding of its language, culture and regulatory environment is essential. Working with a local partner from the outset is critical to a successful market entry.

1. Introduction

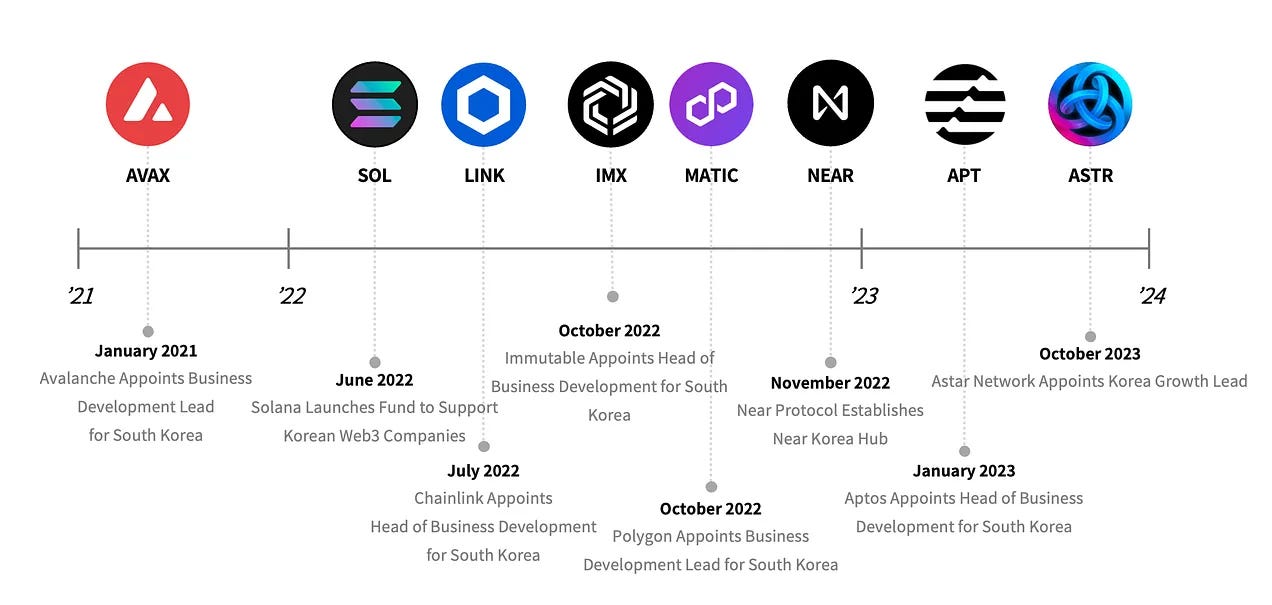

Since 2022, various public chains have been exploring the Korean market by appointing local representatives and establishing partnerships with Korean companies. Avalanche appointed a head of business development in 2021 and announced its official entry into the Korean market. Well-known public chains such as Solana, Polygon, Aptos, and Astar have also made a big push into the Korean market.

However, the rapidly developing Web3 industry has led to changes in some of these public chains’ strategies. This report aims to examine whether these public chains are still committed to the Korean market and identify any newly emerging public chains. Through this analysis, we seek to gain a deeper understanding of how these public chains seize opportunities and formulate strategies in the Korean market.

2. Current status of public chain expansion in South Korea

1. Shift the focus to project settlement

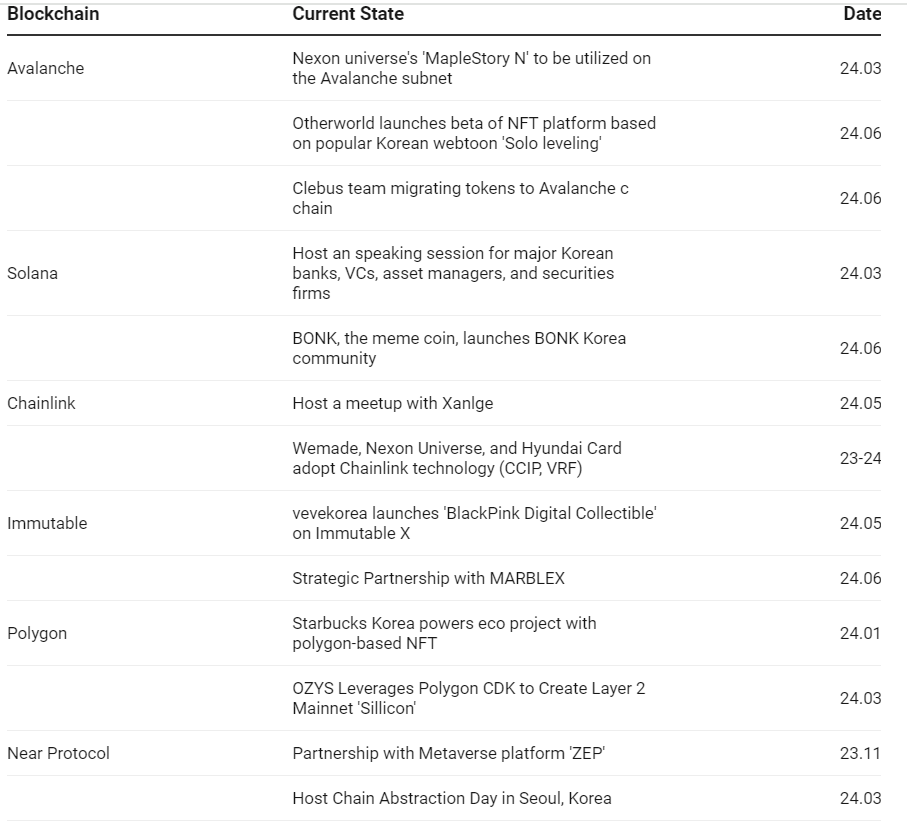

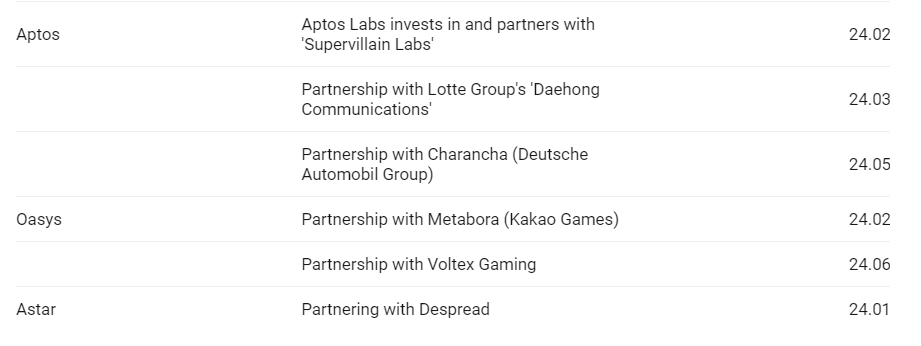

Public chains that entered the Korean market earlier are now beginning to reap the rewards. These public chains are no longer simply establishing partnerships with Korean companies, but are focusing on business development to attract high-quality projects to settle in.

For example, Avalanche successfully incorporated South Korean gaming giant Nexon’s “MapleStory N” into its subnet, creating a noteworthy integration case. In addition, Avalanche continues to strengthen its ecosystem by integrating SK Planet’s NFT membership platform “Road to Rich”, further expanding its influence in South Korea.

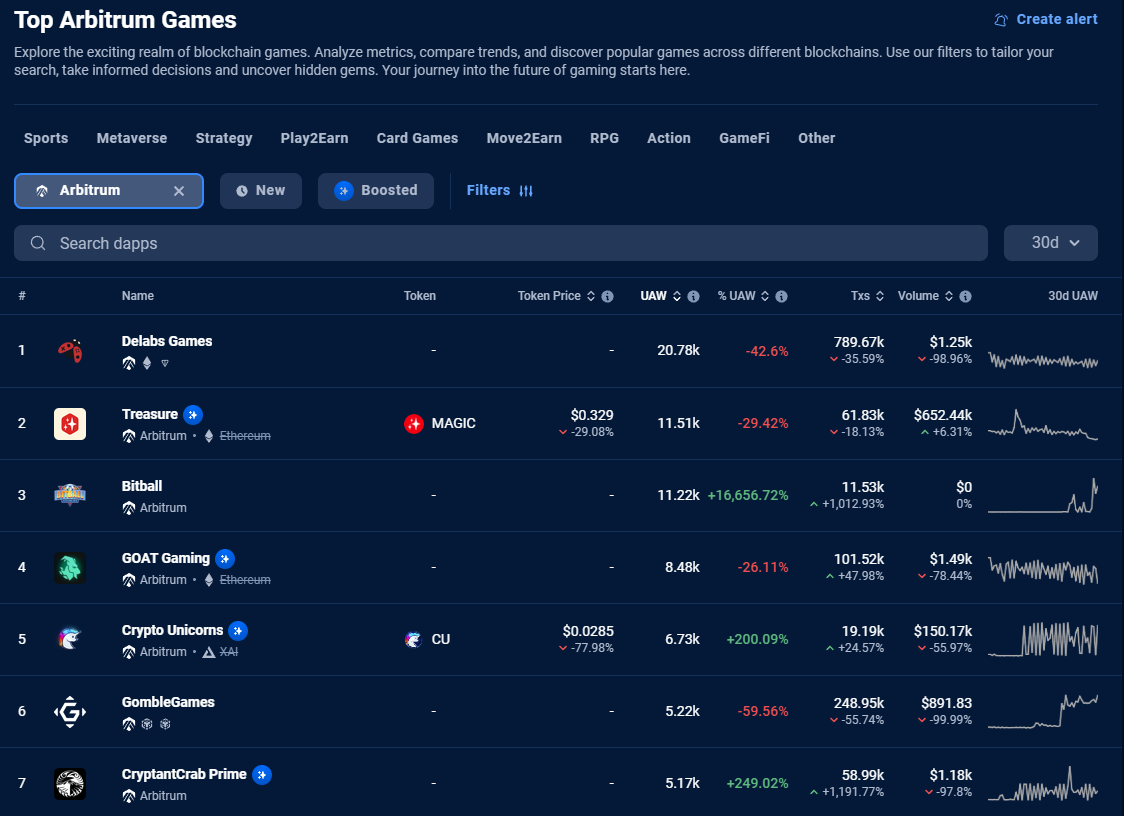

Arbitrum, which hired a Korean head in 2023, recently established the "Arbitrum Korea Community" to consolidate the ecological foundation. The public chain has cooperated with Delabs to implant its Web3 games into Arbitrum and integrated Lotte Group's metaverse platform Caliverse, which shows that the company is committed to injecting vitality into the Korean ecosystem.

Immutable is strengthening its cooperation with Web3 game company Marblex, Aptos is joining Supervillain labs, and Polygon has successfully cooperated with Starbucks Korea to complete an environmental protection project based on NFT. These cases show that public chains are not only forming partnerships, but also creating a large number of real-world use cases in the Korean market.

2. Wait for the opportunity or fall behind in the competition?

While some public chains are gradually introducing projects in their respective fields, others have taken a more passive attitude. For example, since the establishment of Near Korea, Near Protocol has not seen any noteworthy activities besides cooperation and hosting events. Similarly, other public chains have largely maintained surface-level partnerships without deeper involvement. In addition, public chains like Oasys have lost momentum in the Korean market, partly due to the departure of key business developers.

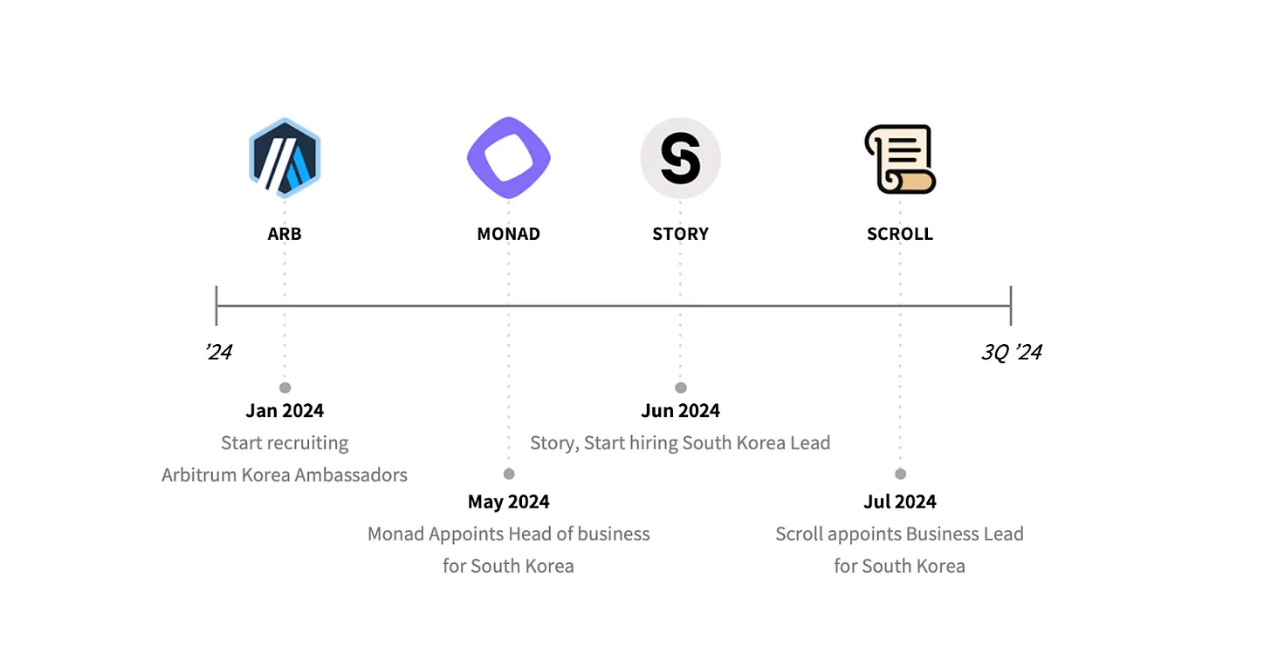

3. Multiple public chains will enter the Korean market in 2024

In 2024, multiple public chains continue to make their mark in the Korean market in their own ways. This includes building strong communities, conducting training courses, organizing events, and raising awareness, while seeking ecosystem partners. The following article will explore the major public chains that have recently begun to expand their ecosystems in Korea and take a deep dive into their ongoing activities.

1. Web3 starts with the community

Community is the cornerstone of any Web3 project, and the entry of public chains into the Korean market is no exception.

For example, Arbitrum has established a local community called Arbitrum Korea to promote its expansion in South Korea. Arbitrum Korea actively works with ambassadors and local partners to strengthen its influence. These ambassadors play a vital role by translating Arbitrum's ecological progress into Korean and distributing it through major channels. They also organize events such as Twitter Spaces with Korean celebrities to increase awareness and engagement in the Korean market.

In addition, Arbitrum has launched a Telegram channel specifically for South Korea to spread ecosystem news and interact with community members. The channel not only attracts blockchain developers, but also investors eager to learn about the development of public chains. These initiatives are aimed at overcoming the barriers brought by language differences, cultural differences, and different search engine platforms, thereby promoting more people to participate in the ecosystem.

2. Expand the ecosystem through education and activities

There are many different types of blockchain technologies in the Web3 industry, all with different structures. The extent of the differences varies, but in many cases the dynamics are completely different due to the structure of the infrastructure or the programming language used. This leads to a fragmented ecosystem for developers, which is not conducive to the overall development of the ecosystem and the inclusion of companies and projects into the ecosystem.

Public chains are increasingly recognizing the critical role of education in developing a strong blockchain ecosystem. In this context, Near Protocol has established strategic partnerships with 12 blockchain associations in South Korea to promote educational programs and hackathons. Similarly, Arbitrum Korea has also partnered with the blockchain associations at Seoul National University and Yonsei University to host workshops aimed at increasing students' understanding of Arbitrum technology. These efforts reflect the strategic importance of the Korean market, beyond its potential as a retail investment sector. The focus on cultivating and attracting high-quality talent highlights South Korea's key role in the broader blockchain ecosystem. By investing in education and community-building activities, these public chains are effectively laying the foundation for ecosystem growth and innovation.

3. Ecosystem partners

Public chains are not only focusing on training their own developers, but also strategically expanding their ecosystems through partnerships with local companies. For example, Monad has partnered with Neowiz's Intellar X to strengthen its presence in the Asia-Pacific market, including South Korea. Similarly, Arbitrum has also partnered with Korean Web3 gaming company Delabs to promote the launch of gaming projects and further strengthen its ecosystem. These partnerships demonstrate a targeted approach to market expansion by leveraging local expertise and industry-specific collaborations.

Therefore, public chains are leveraging strong local partners to expand their markets. In the Korean market in particular, they are focusing on building partnerships with promising gaming companies. In addition, they are also expanding the ecosystem by partnering with infrastructure providers such as local wallets and validators. These partnerships help mitigate cultural and social barriers, allowing public chains to enter the market more quickly and efficiently.

IV. Conclusion

As of 2024, the development of the Korean Web3 industry is hampered by the implementation of the Korean Virtual Asset User Protection Act and the stagnation of security token issuance (STO) regulations. Despite these regulatory challenges, South Korea remains an attractive market due to its large liquidity and highly skilled developers. The major public chains still maintain a stable market share and seek various ways to enter the Korean market.

1. Steps to successful market entry

Public chains usually start by hiring Korean representatives and raising awareness through events and educational programs. Then, based on the accumulation of market influence, they create real-life cases through cooperation with major local partners. Another key feature is that they focus on content-oriented projects and cooperation. This seems to be a feature of the Korean market, which has a well-developed intellectual property (IP) industry, including games, comics, novels, and idols.

2. The key to successfully entering the Korean market

To effectively expand their business in Korea, most public chains usually hire local representatives. However, challenges arise if the representative is responsible for the wider Asian market or is unfamiliar with the Korean language and culture. Korea’s rapid economic development and unique market characteristics require representatives who have a deep understanding of local culture and are fluent in Korean.

Additionally, it is important to navigate the evolving crypto regulatory landscape and the associated political and social dynamics. In order to successfully enter and establish the market, it is highly recommended to partner early with a knowledgeable local partner who is well versed in Korean culture, industry peculiarities, and regulatory framework.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and the guest, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group