In September, the cryptocurrency market experienced dramatic fluctuations, with both Bitcoin and Ethereum experiencing massive sell-offs at the beginning of the month. However, the Federal Reserve announced a 50 basis point interest rate cut last night, which became a turning point in the market and pushed the public chain sector to regain vitality.

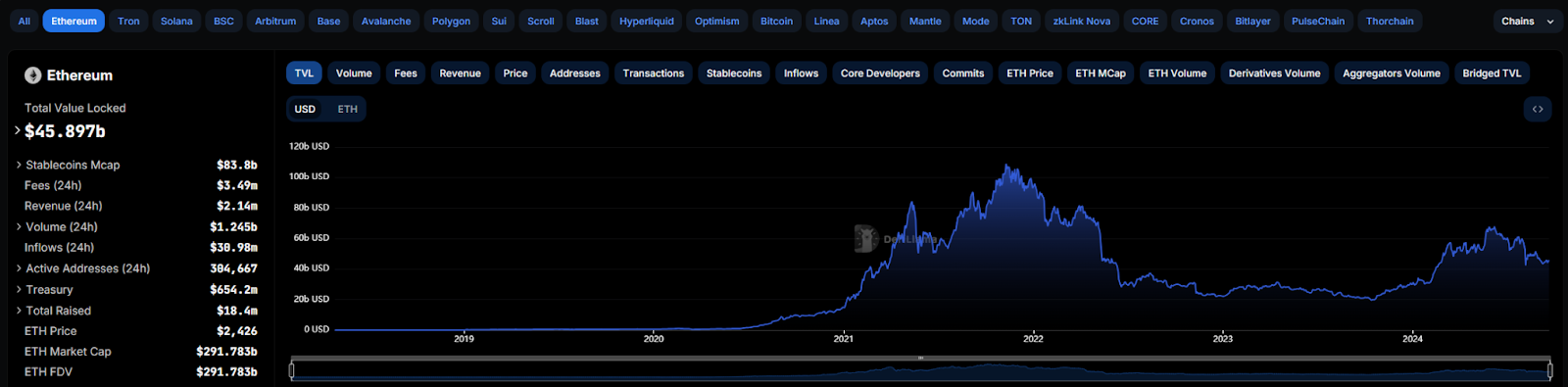

In the Layer 2 field of Bitcoin, the booming expansion plan is particularly significant, and the TVL (total locked value) has increased significantly, attracting widespread attention from investors. At the same time, Ethereum's Layer 2 network is under considerable pressure, and has fallen by about 30% since the TVL peak in June. Despite this, industry giants such as Sony have joined the Ethereum ecosystem, becoming a recent highlight.

Although the overall crypto market value has shrunk, as the Fed's policy tone of rate cuts becomes clearer, technological innovations in the Bitcoin and Ethereum Layer 2 fields will undoubtedly become the key driving force for the growth of cryptocurrency market value in the future.

Current Status of Ethereum Layer2

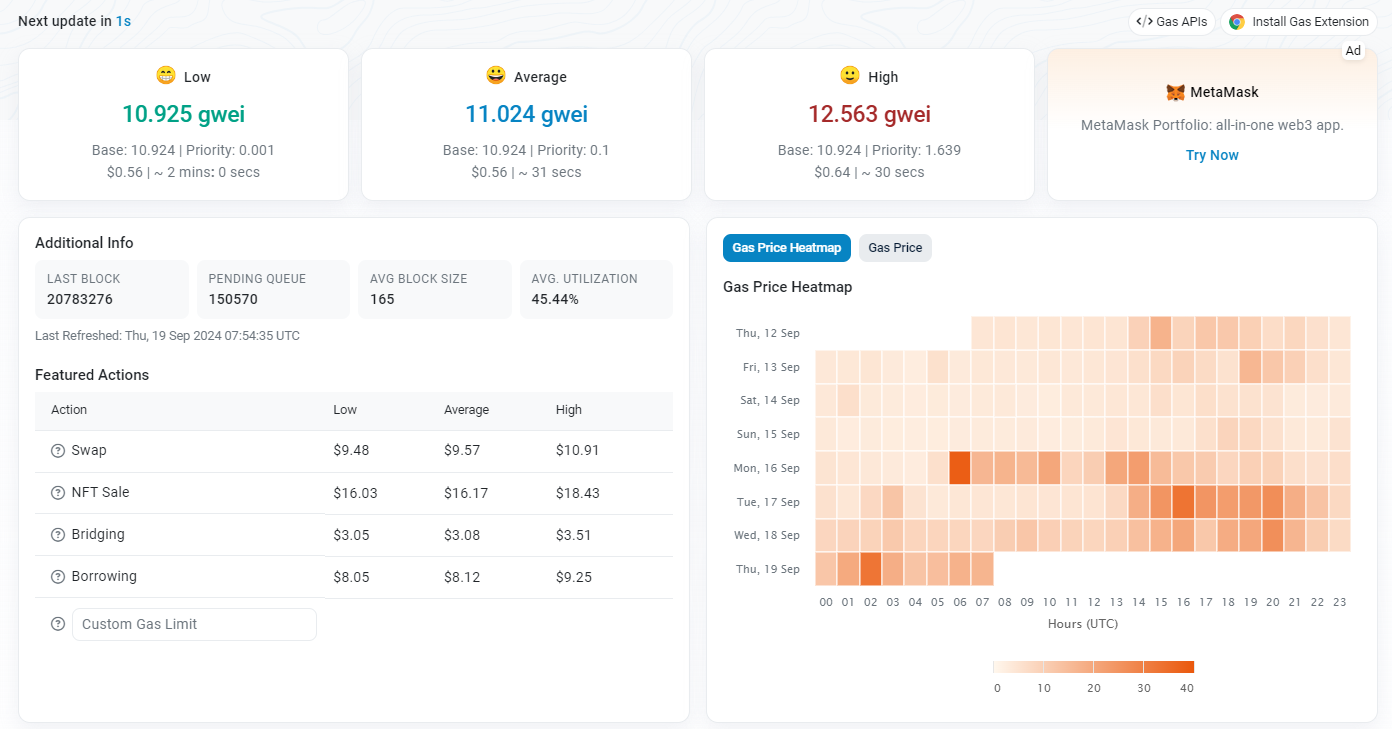

For many, Ethereum represents the primary settlement layer on the Internet of Value. The network remains front and center for Web3 development and innovation. But it has issues with scalability, throughput, and high gas costs that make it difficult to use.

Ethereum is currently unable to scale effectively because its network infrastructure is limited by its design, which prioritizes decentralization and security over scalability. The Ethereum mainnet processes all transactions on a single layer, leading to congestion during periods of high demand. This congestion results in slower transactions and increased fees.

According to Etherscan data, Ethereum's highest gas fee today reached 32 Gwei, a 7-day high.

While solutions like rollups, sidechains, and the upcoming Ethereum 2.0 upgrade aim to address these issues, they introduce tradeoffs and are still in the early stages of development or adoption. The network’s reliance on these complex and evolving solutions slows its ability to scale effectively in the short term.

Ethereum has been exploring various solutions to increase transaction speed and reduce fees, each with different tradeoffs. Here are the main solutions and the compromises they introduce:

Optimistic Rollups: Optimistic Rollups batch transactions and publish them to the Ethereum mainnet (L1) after being executed off-chain. The batches are considered valid unless someone challenges them within seven days. This approach reduces fees and increases speed, but comes with significant latency. Users must wait for the challenge period to end before transactions can be fully settled on the mainnet. In addition, the responsibility for detecting fraud also falls on the user. Today's Optimistic Rollups also rely on centralized sorters and proposers, which can lead to transparency and trust issues as the memory pool (the queue of pending transactions) is not fully transparent.

Zero-knowledge (zk) Rollups: Zk Rollups also package and verify transactions before publishing a cryptographic proof to L1 that the execution state is correct. This approach ensures that the state submitted to L1 is accurate without the need for a challenge period. However, similar to optimistic Rollups, zk Rollups currently rely on a centralized sorter with an opaque memory pool and centralized proposers. This centralization may be a concern for users who prioritize decentralization and transparency.

Validiums: Validiums operate similarly to zk rollups, but only publish the state root to L1. The network itself is responsible for ensuring that chain data is available to users in order to settle back to L1. This reduces the load on the Ethereum mainnet and improves scalability. However, the compromise here is that the burden of ensuring data availability falls on the network. If the network cannot maintain transparency, users may have difficulty verifying state or recovering assets.

Sidechains: Sidechains are independent blockchains connected to the Ethereum mainnet via a bridge. They maintain their own consensus mechanisms and process transactions independently of Ethereum. Sidechains can provide faster and cheaper transactions, but there are significant trade-offs in terms of security. Because they rely on a separate consensus mechanism, they may not be as secure as Ethereum's mainnet. Additionally, the bridges that connect sidechains to the mainnet may be vulnerable to attacks, putting cross-chain transactions at risk.

Related reading:

Each of these solutions improves transaction speed and cost, but they also introduce new challenges, particularly in terms of security, centralization, and user trust. Balancing these factors is key to the continued development of Ethereum scalability solutions.

We know that Bitcoin has won the trust of crypto enthusiasts around the world with its unparalleled security and rock-solid decentralization mechanism. Ethereum, on the other hand, has attracted the favor of countless developers with its powerful smart contracts and vibrant ecosystem. If we can perfectly combine the two and create a modular protocol that integrates the advantages of Bitcoin and Ethereum, users and developers will be able to enjoy the best security, scalability, and interoperability on one platform. Such an ambitious innovation is the protagonist we are going to unveil today - Hemi Network.

Introduction to Hemi Network

Hemi Network is a modular layer 2 network that facilitates Ethereum smart contract functionality secured by the Bitcoin network. The chain introduces the Hemi Virtual Machine (hVM), which integrates a full Bitcoin node within the Ethereum Virtual Machine (EVM), Ethereum's core smart contract engine. HVM allows developers to create smart contracts that interact with the Bitcoin state, unlocking Bitcoin-based DeFi applications including staking, lending markets, and a democratized MEV market .

Compared to other Layer 2 (L2) rollup solutions, the Hemi Network introduces a more decentralized approach to data publishing and verification, solving key issues that exist in current L2 setups:

Decentralized Roles: Introducing a decentralized approach where publishers handle key roles asynchronously, mitigating the risks associated with centralized control in other L2 networks.

Incentivized Participation: Allows public participation by staking tokens using Ethereum-side validation contracts, promoting consistent and incentivized data sharing even during periods of increased fee activity.

Fault tolerance and reward system: Implement a system to discourage malicious behavior, slashing the stake of publishers who submit invalid data while rewarding challengers who discover faults, thereby promoting network integrity.

Efficient Ethereum Fee Management: Rewards are managed through Ethereum-side validation contracts, ensuring that publishers receive consistent incentives despite fluctuations in Ethereum fees.

Hemi's core features include:

Easy to develop

The Hemi Virtual Machine (hVM) integrates a full Bitcoin node within the Ethereum Virtual Machine (EVM), providing developers with a familiar programming interface while leveraging the power of both Bitcoin and Ethereum.

Bitcoin’s Programmability

Building with the Hemi Bitcoin Kit (hBK) provides smart contracts with a highly granular, indexed view of the Bitcoin state, unlocking Bitcoin DeFi applications that were previously impractical or impossible to execute via the EVM.

Bitcoin’s Superfinality

Hemi’s Proof-of-Proof (PoP) consensus mechanism ensures transactions surpass Bitcoin’s security levels in just a few hours.

Security is a core priority for the Hemi Network. To address the shortcomings of existing cross-chain solutions, Hemi operates as an Ethereum Layer 2 and is secured by Bitcoin's Proof of Work (PoW) through a protocol called Proof of Proof (PoP). PoP allows Hemi to inherit Bitcoin's strong security while maintaining Ethereum's flexibility. Here's how it works: Hemi miners publish the network's consensus data to the Bitcoin blockchain. When these blocks are confirmed by Bitcoin, they reach finality and receive the same level of security as Bitcoin itself. In addition, the Hemi Virtual Machine (hVM) also plays a key role. The hVM is a full Bitcoin node encapsulated in the Ethereum Virtual Machine (EVM) and connected to the Bitcoin P2P network, which enables Hemi to track the state of Bitcoin in real time. This setup ensures that Hemi has full knowledge of Bitcoin's state without relying on third-party services for data relay, thereby reducing the risk from external validators or relayers.

Trustless cross-chain portability

hVM’s unique awareness of the state of Bitcoin and Ethereum enables secure and seamless asset transfers between Hemi and other chains through its “tunneling” functionality.

Hemi’s direct connection to the Bitcoin state enables secure and efficient cross-chain functionality that was previously difficult to achieve. Here’s how it solves some of the main challenges in cross-chain interoperability:

- Eliminate third-party risk: Hemi has built-in awareness of Bitcoin’s state, eliminating the need for third-party relayers, thereby reducing points of failure and increasing trustlessness. This makes it possible to develop secure Bitcoin-based decentralized applications (dApps) directly on Hemi without the need for additional intermediaries.

- Prevent consensus attacks: By publishing cross-chain transactions as proofs to the Bitcoin blockchain, Hemi ensures that these transactions inherit Bitcoin’s security. This greatly reduces the risk of decoupled assets in cross-chain transfers, a common vulnerability in many bridge protocols.

- Decentralized liquidity through the tunnel system: Hemi's tunnel system provides a secure and decentralized way to connect Bitcoin and Hemi without relying on overcollateralization or centralized parties. Instead, the tunnel system uses liquidity providers (LPs) who are rewarded for providing BTC and HEMI tokens, making the process more decentralized and efficient. This eliminates the need to lock funds with a third-party custodian, enhancing trustlessness while maintaining the scalability of the system.

Using the Hemi Bitcoin Kit (hBK), developers can create custom tunnels based on their specific needs for security, cost, and speed. This flexibility enables developers to build a range of solutions within Hemi's secure framework, opening up new opportunities for innovation.

Scalability

Hemi allows external projects to create their own chains secured by Hemi technology, promoting Bitcoin security as a service and enhancing dual-chain interoperability.

Excellent asset handling capabilities

With Hemi, advanced on-chain functions including routing, time locks, and password protection can be achieved, thereby improving asset management and security.

While Hemi’s Tunnel system provides a more secure and decentralized way to transfer assets, it does much more than that. With real-time visibility into the state of Bitcoin, developers can build trustless dApps that leverage both the programmability of Ethereum and the security of Bitcoin. This makes Hemi a powerful platform for building more complex decentralized applications that leverage the best of both ecosystems. Ethereum was designed to be a world computer, but Hemi takes that vision a step further by integrating Bitcoin at the protocol level. Hemi’s unique architecture makes the blockchain ecosystem more secure, trustless, and scalable, while simplifying the development of Bitcoin-based technologies. By bringing the Ethereum and Bitcoin ecosystems together, it also makes the blockchain ecosystem less fragmented. Hemi Network combines the security of Bitcoin with the flexibility of Ethereum, marking a major leap forward in cross-chain interoperability. By leveraging Bitcoin’s PoW security (through its Proof-of-Proof consensus), and using innovative tools like hVM and the Tunnel system, Hemi reduces trust assumptions and enhances the decentralized nature of blockchain technology. Whether used to transfer assets or build complex dApps, Hemi provides a secure, efficient, and trustless environment for Bitcoin and Ethereum to thrive together.

Team Background

Hemi was founded by Jeff Garzik, a renowned early Bitcoin developer, and Max Sanchez, a blockchain security pioneer.

Jeff Garzik is an entrepreneur and software engineer. Jeff is the co-founder and CEO of Bloq. Jeff is a board member of Coin Center and an advisory board member of BitFury, Bitpay, Chain.com, Netki, and WayPaver Labs. Jeff has spoken on Bitcoin and blockchain at TEDx, State of Digital Money, and numerous Bitcoin conferences, and has given private briefings to corporations, governments, central banks, and hedge funds. Jeff Garzik received his degree in computer science from Georgia Tech in 1996.

Jeff has extensive experience in early Internet technology adoption. After helping to create CNN.com on the Internet in the early 1990s, he worked for several Internet startups and service providers. At the same time, he has continued to work on open source software engineering projects for more than 20 years.

His involvement in one of the most famous open source projects, the Linux kernel, led to a long tenure at Linux leader Red Hat during open source's most mature years. Today, Jeff's work can be found in every Android phone and Linux installation in the data center.

In July 2010, Jeff stumbled upon a post introducing Bitcoin. He immediately realized the potential of a concept that had previously been thought impossible - decentralized digital currency - and did the natural thing: develop Bitcoin open source software. This gave birth to a micro-enterprise based on Bitcoin. Almost by accident, Jeff found himself at the heart of Bitcoin, a revolutionary global technological phenomenon.

“The passion we have for the projects we build is reflected in the quality and enthusiasm of our investors and ecosystem partners, who understand the uniqueness and value of Hemi’s approach to scaling and integrating two leading blockchain networks, adding to the incredible growth and vitality of this particular space,” said Jeff Garzik.

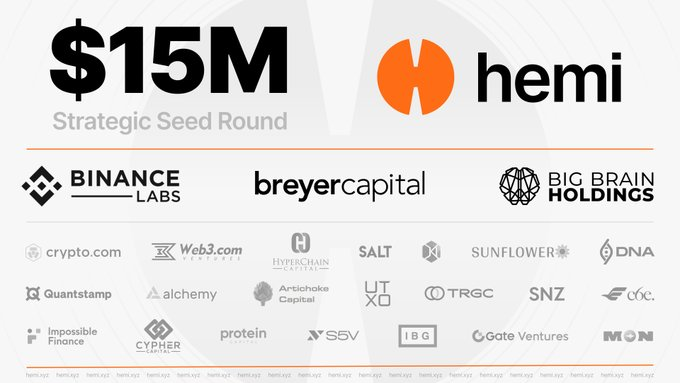

Investment Background

Modular blockchain developer Hemi Labs completes $15 million in financing

- Binance Labs, Breyer Capital, and Big Brain Holdings led the investment round.

- Binance Labs continues to demonstrate its commitment to supporting dedicated teams in building technological innovations that have the potential to advance the cryptocurrency industry.

- Breyer Capital is an early investor in Facebook, Circle, and Spotify. Big Brain Holdings is a leading Web3 fund that has invested in Solana, The Graph, and Arweave.

- Participants in this round of financing include Crypto.com, Web3 Ventures, HyperChain Capital, Alchemy, SALT Fund, Kelly Investments, Sunflower Capital, DNA Fund, Gate Ventures, Quantstamp, TRGC, BTC INC, Artichoke Capital, Cypher Capital, SNZ Holding, C6E, IBG Capital, Protein Capital, MON Ventures, SV5, Impossible Finance, Jihan Wu (Bitdeer), George Burke (Portal), Sonny Singh (Beluga), etc.

Hemi Labs will use the funds to develop and launch the Hemi Network. The Hemi Network incentivized testnet is now live, and the company plans to launch the mainnet in the fourth quarter.

“We look forward to supporting Hemi Labs as they work on important infrastructure that connects Bitcoin and Ethereum in a modular and scalable manner. Hemi’s approach aligns with our commitment to supporting projects focused on building practical, decentralized solutions with long-term potential,” said Alex Odagiu, Investment Director at Binance Labs .

Ted Breyer of Breyer Capital said: "The Hemi team has a clear and compelling vision to unleash the programmability, portability, and potential of Web3. With an outstanding track record, they are uniquely positioned to achieve this goal." Sam Kim of Big Brain Holdings said: "Hemi is changing the way Bitcoin and Ethereum interact, not only building a bridge between the two largest networks in the blockchain ecosystem, but also building a super network that most elegantly combines the capabilities of both."

How to participate in the testnet and get airdrops

Season 1: Testnet

Goal: Build a solid foundation for the Hemi Network by engaging and incentivizing users, developers, and creators during the testnet phase.

Incentive Structure

- 🔗 On-chain participation: Points are allocated for transactions and other on-chain activities.

- 💬 Off-chain Participation: Points are also awarded for contributions to social platforms and community engagement that support network growth.

Reward Focus

- Network Utilization and User Onboarding: Prioritize actions that enhance network usage and effectively integrate new participants.

- Active Community Contribution: Recognizes significant participation and impactful contributions from the off-chain community.

Strategic Initiatives

- Customized Financial Support: Develop grants and investments specifically designed to align with the strategic goals of the Hemi ecosystem.

- Open innovation applications: Simplify the process for developers to propose and deploy on-chain solutions, encourage broad participation, and lower the entry barrier.

Hemi’s current first quarter incentivized testnet program (called the Hemi pilot program) was launched in late July, and the mainnet will be launched in the fourth quarter. Participants can earn miles (points) and gain leaderboard status by completing tasks that support Hemi’s development and marketing efforts, and it has been made clear that there will be airdrops.

Points Tasks

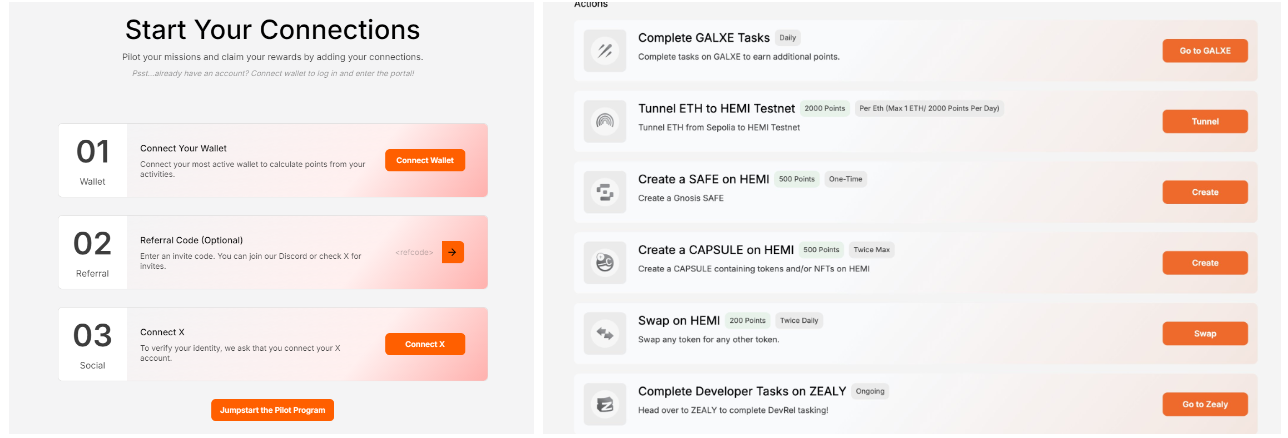

1. Enter the website

After activating the Twitter binding, enter the page and complete the tasks and daily tasks

2. Complete the Galaxy Mission:

ETH Sepolia cross-chain to Hemi

Creating SAFE on HEMI

CREATE CAPSULE ON HEMI

Swapping on HEMI

Complete developer tasks on ZEALY

Participate in testnet mining

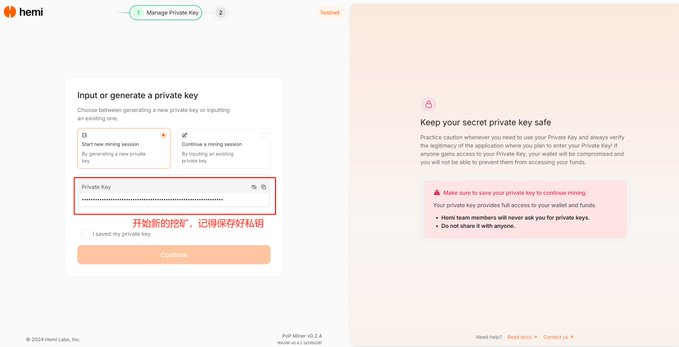

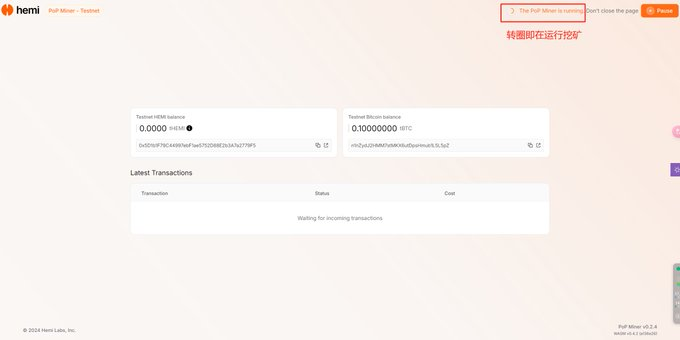

1. Open the link to enter the web mining https://pop-miner.hemi.xyz/manage

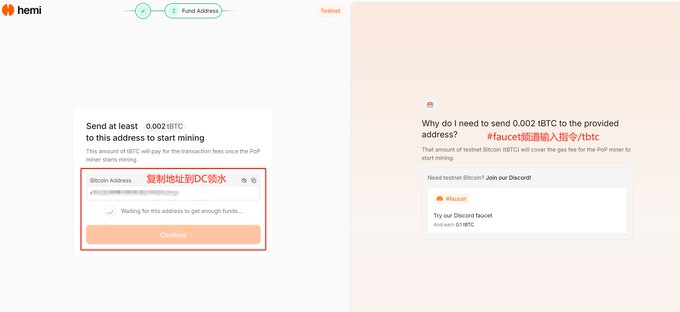

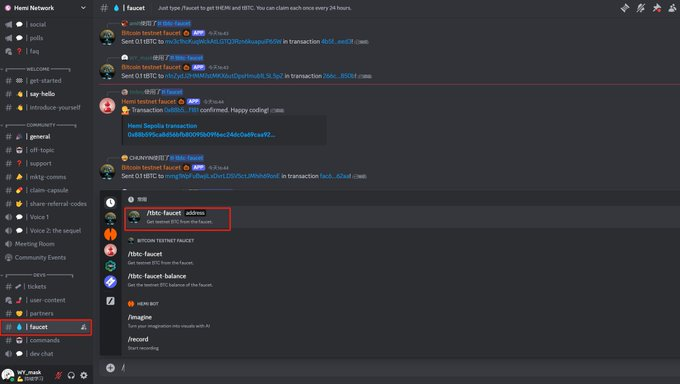

2. Copy the generated address to the DC channel discord.gg/hemixyz

3. Enter the command "/tbtc-faucet" in the DC channel #faucet and paste the address you just copied.

4. After receiving the water successfully, click to continue to enter the web mining. You will find that the mining is running in the upper right corner

https://pop-miner.hemi.xyz/explorer

Conclusion

As can be seen from Hemi's architecture, it combines the advantages of Bitcoin and Ethereum, while excelling in interoperability. Hemi's vision is to eliminate the boundaries between Bitcoin and Ethereum, and between blockchain and the Internet, just as today's "Web" is almost equivalent to "Internet."

Through this seamless integration, Hemi will not only unlock the true potential of Bitcoin and Ethereum, but will also drive innovation in decentralized applications, creating a more open, efficient, and powerful digital ecosystem for all users. This future may be closer than we think.