The allure of quick profits in the cryptocurrency markets has attracted millions of investors to meme coins.

However, the reality is dire. Around 97% of meme coins fail within a short period of time. Understanding the factors that make these altcoins successful or fail is important for investors investing in this space.

Most memecoins fail

Meme coins often gain attention quickly by taking advantage of viral trends and social media buzz, but this approach generally lacks long-term viability.

In an exclusive interview with BeInCrypto, Bitget Wallet COO Alvin Khan says the main reason for meme coin failure is short-term thinking.

“Most meme coin developers launch tokens to generate short-term market interest, for a few weeks or months. Once the initial interest fades and investors’ FOMO dissipates, the token becomes virtually nonexistent in the crypto market,” Khan explained.

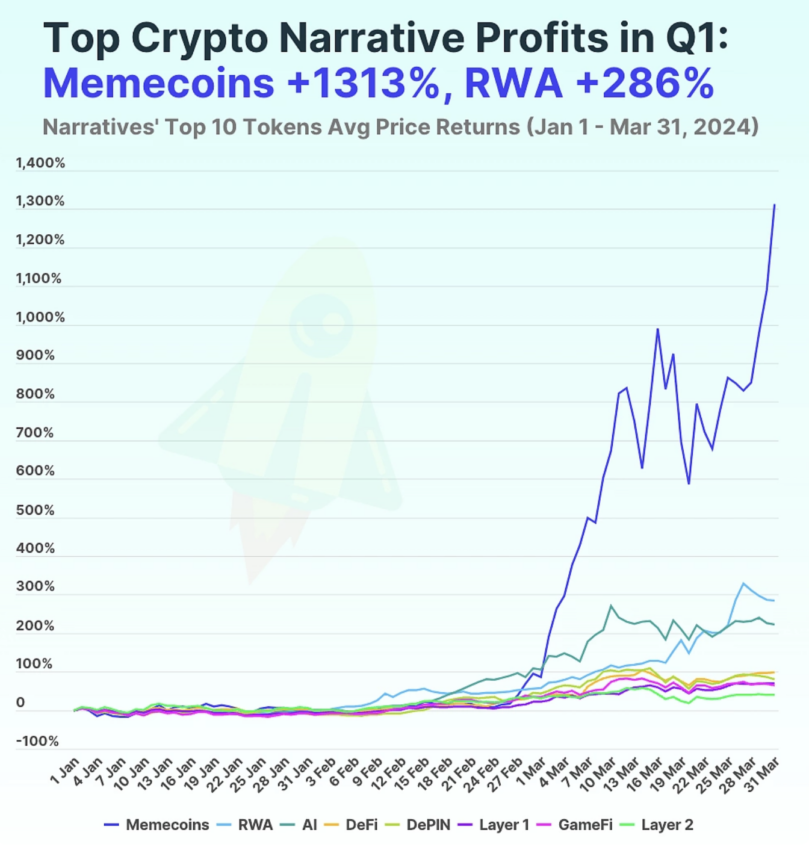

After a huge success in Q1 2024, most meme coins have crashed this year due to lack of prospects. In fact, many meme coins are purely based on buzz and have no inherent value or long-term strategy. After the initial enthusiasm fades, the lack of sustained engagement and utility leads to their downfall.

So when the buzz dies down, memecoins disappear from trading platforms and investor portfolios. As of 2024, 97% of memecoins have failed , reflecting the speculative and short-lived nature of these tokens. On average, memecoins only last about a year , compared to three years for other crypto projects.

Secret to Success

Despite the disappointing statistics, some meme coins thrive after their initial hype has faded. Khan believes successful meme coins share common characteristics: utility beyond buzz, innovative token economics, and strategic marketing.

For example, Shiba Inu (SHIB) started out as a simple Dogecoin (DOGE) competitor but has since evolved into a multifaceted project with DeFi integration, staking, and Web3 gaming capabilities. Other coins like BONK and FLOKI have also shown that meme coins can be more than just a mirage by offering real-world applications.

“If you look at the tokens that have performed well this year, BONK, FLOKI, SHIB, etc. all have large ecosystems that create broad utility for their tokens. For developers who value long-term success, Meme Coin has a strong distribution structure, engages with key opinion leaders, holds AMA sessions with developers, and promotes their projects through partnerships and collaborations,” Khan added.

The evolution from a simple meme to a useful token is essential to survival in the competitive and speculative cryptocurrency market.

In addition to utility, successful meme coins often have token economics that prioritize long-term value. For example, BONK has allocated 40% of its supply to community incentives, which encourages ongoing participation and support by providing clear rewards to holders.

Marketing is another area where success and failure are at stake. According to Khan, “pump and dump” meme coins tend to engage in marketing campaigns that are effective at getting the word out to the public, but feel superficial. These strategies often degenerate into repeated low-quality media exposure or bot-driven social media marketing. These projects get a brief moment of attention, but quickly fade into oblivion when no money is spent.

Double-edged sword

Platforms like X (formerly Twitter) play a huge role in driving the meme coin craze. Industry figures like Elon Musk can cause a meme coin price to skyrocket with a single tweet. In an unregulated social media environment, rumors and speculative enthusiasm can cause prices to spike or crash.

Recently, TikTok has emerged as a powerful platform for promoting meme coins. Viral challenges encouraging users to buy a particular token have resulted in short-term price spikes. While this strategy can generate significant interest in a coin, it often results in extreme volatility and can cause the token price to drop sharply.

Community-led efforts to increase coin popularity can be a double-edged sword: while these campaigns can result in price spikes, they also run the risk of market manipulation.

Retail investors are often at a disadvantage when a few large holders drive up prices and then exit the market, leaving behind assets that have fallen in value.

“The sense of belonging to the community and the fear of missing out on the ‘next big thing’ is what drives more investors to get involved. People who see posts and discussions about a coin’s value going up are jumping in to ride the wave. Investors need to be aware of this trend and understand that they are betting purely on the community’s ability to generate buzz. This makes these coins speculative and risky,” Khan told BeInCrypto.

In fact, one of the biggest risks is the prevalence of fraud and rug pulls. About 55.24% of meme coins are classified as malicious coins or malicious coins. In particular, the fraud rate is as high as 59.15% on blockchains such as Base . Of course, fraudulent meme coins created on traditional powerhouse Ethereum also account for 55.59% of the total. The probability of being scammed is slightly higher than the probability of landing on one side of a coin when flipping. In such a situation, it is recommended that investors develop the habit of thoroughly checking before investing.

Learn from past mistakes

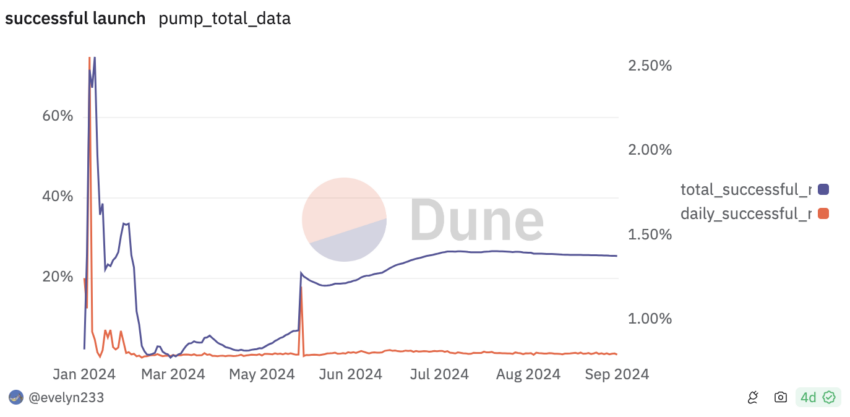

Another important statistic : 98.6% of memecoins on platforms like Solana’s Pump.fun never even successfully launched. This shows that while it is very easy to create a memecoin, it is also quite difficult to get it to market and maintain its value.

Investors should be aware of these risks and trends. In most cases, meme coins are speculative assets, and their value is largely dependent on the ability of the community to maintain interest. When interest wanes, the value of the coin can often collapse to near zero (0).

Read more: 11 Solana Meme Coins to Watch in September 2024

On the other hand, developers who aim for success need to prioritize transparency, build trust with their community, and adopt a mature marketing strategy.

“If you look at recent successful meme coins, there are a lot of DeFi components. Developers are creating ecosystems where these coins can be used for staking, gamification, and NFT integration. These efforts provide passive yield opportunities for token holders. So even in a bear market, there is continued utility and trading of the token,” Khan concluded.

Understanding the background of success and failure can make a big difference. Investors should be cautious and recognize that the meme coin market is highly speculative and prone to extreme volatility.

Meanwhile, new projects seeking to establish credibility amidst the skeptical eyes of the market must prioritize transparency. Third-party audits, industry partnerships, and consistent communication help build a trustworthy reputation.