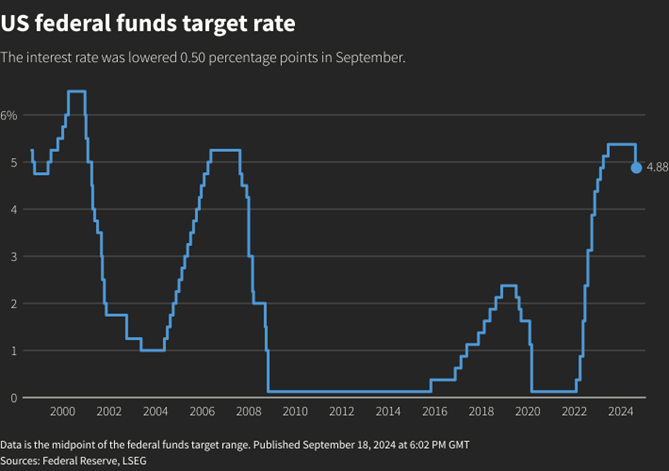

The U.S. Federal Reserve (Fed) announced on Wednesday that it would cut its benchmark interest rate by 50 basis points to a range of 4.75%-5%, the first rate cut since 2020. The move marks the end of the Fed's nearly two-year tightening cycle and a shift to a more relaxed monetary policy. This decision not only affects the traditional financial market, but also has a profound impact on the cryptocurrency market.

Fed Chairman Jerome Powell said at a press conference that the rate cut is aimed at maintaining the good shape of the U.S. economy. He stressed that the unemployment rate remained below 4%, indicating that the labor market is in good shape. At the same time, the Fed has increased its confidence that the inflation rate will continue to move toward the 2% target, and believes that the risks of achieving employment and inflation targets are roughly balanced. However, the rate cut decision also triggered market volatility. After the FOMC decision was announced, U.S. stocks erased early gains, and the tech-heavy Nasdaq 100 and S&P 500 closed down 0.3% and then recovered.

Image source: WSJ

Crypto Market Reactions and Correlations

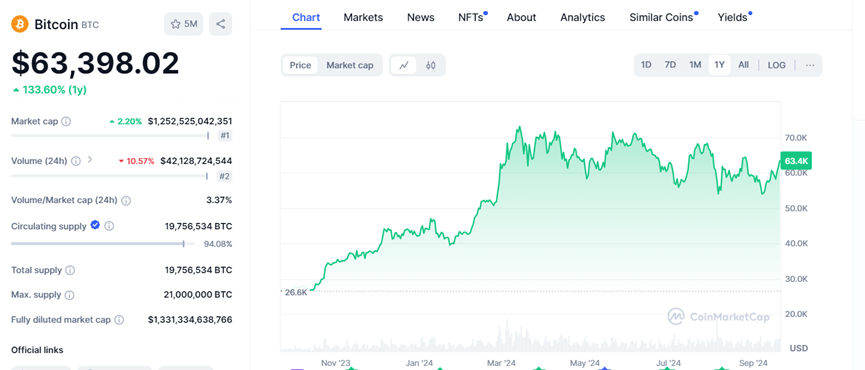

The price of Bitcoin (BTC) surged to $64,000 by Friday after the rate cut announcement, before falling back to around $63,000. This volatility is in line with Wintermute's forecast of 2% - 3%. In addition, on the 18th, the U.S. dollar index (DXY) fell to 100.3 after the rate cut decision, the lowest level since July 2023. A weaker dollar is generally seen as a favorable factor for risky assets, including cryptocurrencies. However, while the Fed has met the market's demand for a larger rate cut, there is still uncertainty as to whether the market can continue to have confidence in buying risky assets in the future.

Image source: CoinmarketCap

The Fed's quarterly economic forecasts show that the median benchmark interest rate may fall to 4.4% by the end of the year, suggesting that there may be two more rate cuts in the future. This is more radical than previously expected and reflects the Fed's judgment on the economic situation. For the crypto market, the Fed's policy shift brings both opportunities and challenges. On the one hand, loose monetary policy may increase demand for risky assets; on the other hand, market volatility may increase.

In general, the Fed’s decision to cut interest rates opens a new phase for the crypto market, in which macro factors and the intrinsic value of crypto assets will jointly shape the market direction.

Possibility of a soft landing

The Fed's decision to cut interest rates was the first since 2020, ending a nearly two-year cycle of rate hikes. The move is intended to ease borrowing costs for everything from mortgages to credit cards while maintaining economic growth momentum. However, the decision was not unanimous, reflecting different views of the Federal Open Market Committee (FOMC) members on the economic outlook.

Economists generally believe that the Fed's rate cut is a cautious response to economic data. According to the latest data, the US inflation rate has dropped significantly from the 40-year high in the summer of 2022, but is still higher than the Fed's long-term target of 2%. At the same time, the job market remains relatively strong and the unemployment rate remains low.

The Fed's goal is to achieve a "soft landing" for the economy - that is, to avoid a recession while controlling inflation. Historically, this outcome has rarely occurred, with the most famous example being the mid-1990s. Ellen Zentner, chief economist at Morgan Stanley, recently said that the U.S. economy currently has a good chance of achieving a soft landing. She pointed out that the gradual cooling of the labor market, the continued decline in inflation and the Fed's flexible policy stance all increase the likelihood of a soft landing.

However, challenges remain. Global economic uncertainty, geopolitical risks, and potential supply chain disruptions could all have an impact on the U.S. economy.

Market reaction and future expectations

Financial markets fluctuated after the rate cut was announced. Some people in the market believe that the Fed's action came too late, while others worry that cutting interest rates too quickly may reignite inflationary pressures. Market participants generally expect the Fed to cut interest rates further in the coming months, but there is still uncertainty about the specific timing and magnitude.

The Fed's path of rate cuts will depend largely on future economic data, especially inflation and employment data. If the economy continues to remain resilient, the Fed may adopt a more gradual rate cut strategy.

Political pressure and central bank independence

Against the backdrop of the Federal Reserve's 50 basis point rate cut , the cryptocurrency market is facing new opportunities and challenges. The views of Arthur Hayes, co-founder of BitMEX, provide us with a unique perspective. Hayes boldly declared that "the era of central banks is over", a view that coincides with the predictions of Scottish market strategist Russell Napier. They believe that governments are gradually taking over control of the money supply and the importance of central banks is declining rapidly. This shift may lead to targeted liquidity creation measures by governments in specific economic sectors, such as manufacturing and re-industrialization.

This trend could have far-reaching implications for the cryptocurrency market. As the traditional financial system faces more government intervention and potential capital controls, the appeal of cryptocurrencies as a globally transferable asset that is not directly controlled by governments could increase significantly.

In a U.S. presidential election year, the Fed's decisions are inevitably influenced by politics. Fed Chairman Powell has repeatedly stressed the independence of the central bank and stressed that the Fed's decisions are based on economic data rather than political considerations. However, political pressure still exists. Former President Trump has publicly criticized Powell's policies and said he would consider replacing the Fed chairman if he is re-elected. In my opinion, maintaining the independence of the central bank is crucial to maintaining long-term economic stability. Political interference in monetary policy may lead to short-term interests overriding long-term economic health.

Changes in the interest rate environment and market impact

Suppose that the US interest rate will gradually drop from the current 5.25%-5.5% to a level close to 2 or even 1. This low interest rate environment may reignite the bull market of income-generating assets in the cryptocurrency market, especially products such as Ethereum (ETH) and BTC staking. For example, Ethereum: The annualized staking yield is 4%, which may be more attractive in a low interest rate environment. At the same time, the demand for interest-sensitive products such as tokenized treasury bonds may weaken as investors may turn to seek higher-yielding assets.

Image source: Reuters

Market volatility and investment strategies

In the months following the Fed’s rate cut, risk assets, including cryptocurrencies, may experience a significant correction. This potential market turmoil reminds investors to remain vigilant and develop corresponding risk management strategies.

Faced with this complex market environment, investors should:

Pay close attention to macroeconomic indicators, especially inflation rates and monetary policy changes.

Pay attention to changes in the Japanese yen exchange rate and its impact on global financial markets.

Consider a diversified portfolio that includes both traditional and crypto assets.

Assess the relative merits of different crypto products in a low interest rate environment.

Conclusion and Outlook

The Fed's half-point rate cut decision marks an important turning point in U.S. monetary policy. As we enter this new financial era, the cryptocurrency market may experience significant changes. Increased direct government intervention in the economy may increase the appeal of cryptocurrencies as assets independent of the traditional financial system. At the same time, the low interest rate environment may push investors to seek new sources of income, which may benefit certain crypto products.

The Fed is currently facing the complex challenge of finding a balance between achieving a soft landing for the economy and controlling inflation. Despite the volatility of the bond market, as long as real GDP remains stable, the economy is expected to achieve a soft landing. The current low unemployment rate of 3.4% also provides a buffer for the economy. However, the inflation rate is still far above the Fed's target, which may make it more difficult to achieve a soft landing for the economy. Recent remarks by Fed Chairman Powell show that the state of the job market has become one of the key factors affecting monetary policy, and its importance is no less than inflation control. The Fed's interest rate cut strategy is not a passive response, but a forward-looking risk management measure aimed at balancing market risks through moderate interest rate cuts. This defensive interest rate cut reflects the Fed's cautious attitude of taking preventive measures when there are no obvious problems in the economy. It is necessary to control inflation and maintain economic growth to achieve the goal of a soft landing for the economy. However, the realization of this goal is still faced with many uncertainties, and the Fed needs to continue to monitor economic indicators and flexibly adjust policies to respond to various economic risks that may arise.

Looking ahead, the Fed will continue to pay close attention to economic data, especially inflation and employment indicators, to determine the future policy path. Market participants and policymakers will pay close attention to every move of the Fed, because these decisions will not only affect the US economy, but also have a profound impact on global financial markets.