On Sunday, BTC continued to fluctuate around 63k. The day before yesterday [“ 9.20 Teaching Chain Insider: In the US dollar interest rate cut cycle, will the RMB exchange rate rise or fall? ”] reported a piece of information in the macroeconomic situation section. After the 2024.9.19 “The Fed’s interest rate cut has landed, and half of the people are wrong” , other central banks unexpectedly kept their hands off the ball - “ The People’s Bank of China unexpectedly kept its benchmark lending rate unchanged, and the Bank of England and the Bank of Japan also kept their policy rates stable. ”

The Fed has stopped cutting interest rates for now, and has stopped raising interest rates for now. It seems that everyone is waiting to see the sincerity of the Fed's unexpectedly large interest rate cut and the data on whether the US economy has avoided a recession.

Needless to say, this is an extremely difficult thing to judge.

Is it difficult to trade stocks and cryptocurrencies in the secondary market? Anyway, 98% of people lose more and more money the more they trade. Do you think it is difficult? Then, the difficulty of macroeconomic judgment is 10,000 times more difficult than trading stocks and cryptocurrencies.

The price data of the secondary market is formed by the market and is extremely transparent. The macroeconomic indicator data is manually counted and mixed with various corrections, which is full of manipulation.

The impact of individual judgments and actions on the secondary market is minimal, while the impact of countries' judgments and actions on the macro-economy is large or even huge. Therefore, the " observer effect " will be extremely significant, so that it is impossible to use bystander thinking to understand the entire market and macro-situation.

Because of the existence of the observer effect, we cannot use speculators' thinking to understand the judgments and actions of various entities in the macro-economy, but should use game players' thinking to understand and analyze. Otherwise, we will definitely talk endlessly and make a thousand miles of mistakes.

The speculative thinking here, from a higher macro level, not only covers the so-called speculators who engage in short-term speculation, but also covers investors who engage in so-called long-term investments.

There is an interesting saying: Both speculators and investors are gambling, but they are gambling on different things. Speculators gamble on the present, while investors gamble on the future.

For example, if Zhang San buys 1 BTC at 63k today and expects to sell it at 65k tomorrow to make 2k, this is called speculation. If Li Si buys 1 BTC at 63k today and expects to sell it for 1 million US dollars in 10 years, this is called investment?

Therefore, Jiao Lian said that no matter whether Zhang San or Li Si is called a speculator or an investor, there is not much difference between them in essence, and they all have the mindset of a speculator.

Game players think completely differently.

Game player thinking requires the thinker to clearly realize that he is not a bystander, but a player in the game, or even an important player.

Game player thinking is about how I participate in the market, how my actions will affect the overall balance of power, how the other party will react to my actions, how I will respond,... how I should plan and arrange to achieve my strategic goals, and so on.

To put it bluntly, most of the so-called investment institutions, large and small, active in the capital market today have speculative mindsets.

The purpose of the teaching chain is not to evaluate whether their way of thinking is good or bad, but to point out that the fundamental reason for their formation and fixation in this way of thinking is determined by their own class status and class attributes in the social stratification: they are a small group of people who are high above and detached from the bottom, with fine clothes and delicious food, and they do not know the difference between grains. They hold a bystander mentality towards the hard work of the people and the development of the country, and thus inevitably breed a speculative mentality.

From the perspective of the interests, speculative thinking and class standpoint of this small group of people, it can really be called an "accident" that the central bank did not enthusiastically follow the Fed's pace of interest rate cuts and quickly make a gesture to open the floodgates to release water, allowing the financial property owners who were almost dying of thirst in the "dry season" to "get a rain after a long drought", further widening the already huge wealth gap between them and ordinary people at the bottom.

However, for the real economy and even farmers who are far from the "tap", they are the last to benefit or even suffer when the water is released, and they are also the last to be affected when the water is withdrawn. This is the well-known "Cantillon Effect " - the central bank's quantitative easing policy may first benefit financial institutions and the wealthy, while ordinary workers and consumers may feel the impact only after asset prices rise, which may lead to increased social inequality.

So they have to come out and shoot short videos, post marketing articles, and publicly express their surprise and even criticism.

From the perspective of the people at the bottom of society, from the standpoint of workers all over the world, and from the side of the vast majority of poor people, the more they criticize, the more we should strive to do well.

Some readers may wonder: Aren’t you also an investor, Jiaolian? Why don’t you stand on their side, but on the side of the people?

The answer is clear. Because Jiaolian has truly thought through the nature and value foundation of BTC. Jiaolian believes that every BTC investor and holder, if they truly understand BTC, will stand on the side of the people.

BTC is not a currency asset that is empowered by power, but a currency asset that is empowered by consensus. The more people own it, the greater the breadth and scope of consensus, and the greater its value. On the contrary, if it is monopolized by a few oligarchs, it will be abandoned by the people and its value will be very small.

And because the only way to own BTC is to earn money to buy it. Therefore, regardless of willingness and cognition, we must first support any policy that allows more people at the bottom to earn more money, so that more people can have the ability and possibility to own it. After all, if there is no purchasing power, talking about willingness and cognition is just nonsense, isn’t it?

So we can draw a definite conclusion: the greater the gap between the rich and the poor in society, the less conducive it is to the increase in the value of BTC; the closer the society is to common prosperity, the greater the value of BTC will be.

Based on this, the sincere wish of Jiaolian is that all readers and friends who recognize BTC and are willing to hoard BTC will become richer and richer - it does not mean that your BTC position will appreciate in value, but that your off-market income will increase, and the money you can use to increase your position will increase!

It is also based on this starting point that Jiaolian recognizes the central bank's macro-prudential policy.

In the article "Consumption Downgrade, Savings Upgrade" on September 13, 2024, Jiao Lian quoted the overall monetary policy policy publicly stated by the central bank, one of which is "strengthening counter-cyclical regulation."

If you understand this, you will understand why the central bank is sitting on its hands.

What is "countercyclical regulation"? Simply put, it means that if the Fed raises interest rates, I lower interest rates, and if the Fed lowers interest rates, I raise interest rates.

Now we need liquidity, commonly known as "water", but if the central bank releases this water, it will put pressure on the RMB exchange rate. If the Federal Reserve releases it, the effect will be different: it can solve the problem of water shortage and keep the RMB exchange rate against the USD.

The exchange rate is the anchor of all RMB assets. When the exchange rate appreciates, all RMB assets appreciate; when the exchange rate depreciates, all RMB assets depreciate.

Let the Federal Reserve do the loosening of monetary policy, which will raise the value of RMB assets and suppress the value of US dollar assets.

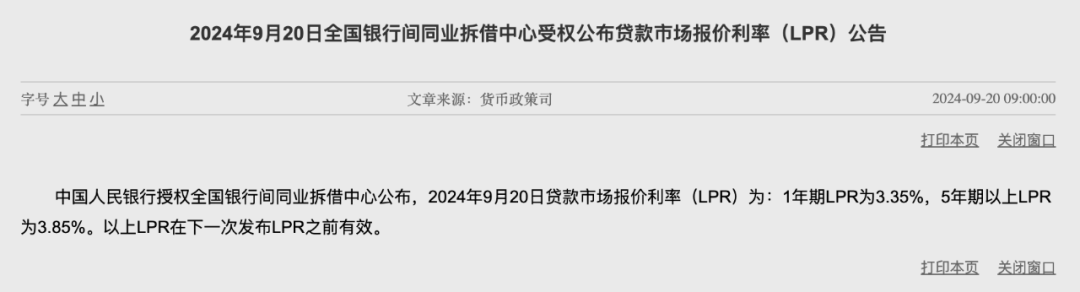

No matter how the Federal Reserve manipulates interest rates, up and down, the depreciation of the anchor of US dollar assets is clearly visible in front of zero-interest assets such as gold and BTC. (The figure below shows the changes in the Federal Reserve's federal interest rate and the price curve of BTC)