Our country recorded the highest virtual asset adoption index in East Asia this year.

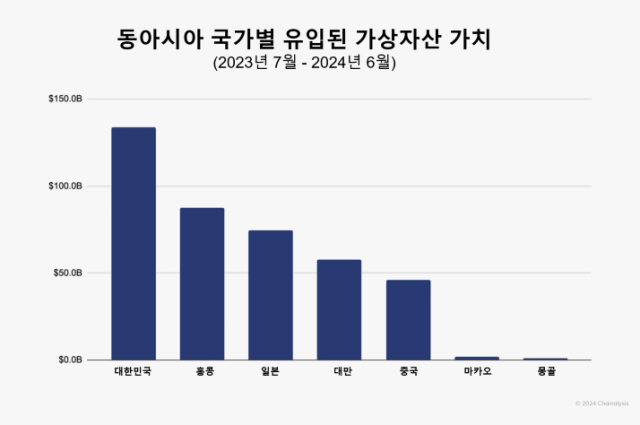

According to the '2024 Global Virtual Asset Adoption Index - East Asia Report' by blockchain data analysis company Chainalysis on the 23rd, Korea's virtual asset adoption index ranking from July 2023 to June 2024 rose 8 places from 27th last year to 19th. It recorded the highest ranking in the East Asia region, beating out China (20th), Japan (23rd), and Hong Kong (29th). During the same period, the value of virtual assets flowing into Korea was approximately 130 billion dollars (approximately 173 trillion won), the largest in East Asia.

Related Articles

- Chainalysis: "Korea is a strategic stronghold... We will continue to invest"

- Chainalysis CEO: “Blockchain Adoption Continues to Grow…Building New Financial Infrastructure”

- Chainalysis: Singapore to Boost Market Confidence by Introducing Stablecoin Regulations [Decenter Interview]

- Chainalysis: "Virtual Asset Ransomware Damage $1 Billion… Highest Ever"

It is analyzed that the advanced technology infrastructure that allows easy access to virtual asset transactions through mobile apps and PCs has promoted the introduction of virtual assets in Korea. A domestic exchange official said, “Large corporations such as Samsung have introduced blockchain to enhance operational transparency and efficiency, which has led to public trust.”

In Korea, there has been a noticeable increase in altcoin and stablecoin trading. Altcoins are mainly traded in Korean Won (KRW). Ripple (XRP) continues to gain popularity among Korean virtual asset investors due to its fast transaction speed and low unit price compared to Bitcoin (BTC) and Ethereum (ETH). Investors are moving funds from domestic exchanges to global platforms to take advantage of various assets and arbitrage opportunities, which is acting as a cause of the 'kimchi premium' phenomenon in which Korean virtual asset prices are higher than the global average.

Hong Kong, along with Korea, was cited as a country leading the growth of the East Asian virtual asset market. With new regulations on virtual asset trading platforms (VATPs) coming into effect in June 2023 and the introduction of Bitcoin and Ethereum spot exchange-traded funds (ETFs), institutional investors are turning their eyes to Hong Kong. Due to Hong Kong’s favorable regulatory environment, on-chain virtual asset trading volume increased by 85.6% year-on-year.

According to the report, the on-chain transaction volume in the entire East Asia region during this period exceeded 400 billion dollars (approximately 532 trillion won), accounting for 8.9% of global virtual asset activity. Compared to other regions, East Asia is characterized by large-scale transactions led by institutional and professional investors. Centralized exchanges (CEX) remain the most popular service in East Asia, accounting for 64.7% of total transaction volume. Professional investors mainly use centralized exchanges, while institutional investors use decentralized exchanges (DEX) and decentralized finance (DeFi) services.

- Reporter Kim Jeong-woo

- woo@decenter.kr

< Copyright ⓒ Decenter, unauthorized reproduction and redistribution prohibited >