As the activity of the Ethereum network continues to increase, ETH has not only shown strong price trends, but also surpassed Bitcoin in key market data. With the increase in open interest and funding rates, the strengthening of the meme wealth effect on Ethereum, and clear signs of network growth, the market demand for Ethereum is rapidly soaring. Faced with this series of positive factors, many investors are beginning to look forward to whether ETH can rise further, break through the $3,000 mark, and become the protagonist of the next bull market.

According to Binance data, ETH rose 18.7% between September 17 and September 23, outperforming Bitcoin, which rose 1.8% to $63,000 during the same period. The overall cryptocurrency market capitalization rose 2% to $2.3 trillion.

ETH/BTC strengthens

ETH/BTC ratio. Source: Binance

ETH has risen 17.5% over the past seven days, significantly outperforming Bitcoin's 9.8% gain over the same period. Previously, the ETH/BTC trading pair had fallen to a three-year low of 0.0384, but rebounded about 7.5% over the past week and hit a three-week high of 0.0424 on September 23. This reversal in the ETH/BTC ratio reflects the significant increase in market demand for ETH.

Ethereum ETF fund inflows turned from negative to positive

According to Farside Investor data, the inflow of funds into the US spot Ethereum ETF turned from negative to positive last week, with inflows of $5.2 million and $2.9 million recorded on September 19 and September 20, respectively. However, data from CoinShares shows that the inflow of funds into Ethereum investment products still lags behind Bitcoin, and ETH has experienced net outflows for the fifth consecutive week, with a total outflow of $29 million from September 16 to September 20. This phenomenon is mainly attributed to the continued outflow of funds from the Grayscale Trust Fund and the failure of the newly issued ETF to attract sufficient funds.

ETH’s outstanding performance is also reflected in the decline of BTC’s market dominance. The chart below shows that Bitcoin’s dominance has dropped from a high of 58.7% on September 19 to 57.4% on September 23. This shows that the top cryptocurrency is weakening relative to Altcoin such as ETH.

Bitcoin market dominance chart. Source: TradingView

ETH's strong performance is also reflected in the decline of Bitcoin's market dominance. Data shows that Bitcoin's market dominance fell from 58.7% on September 19 to 57.4% on September 23, indicating that Bitcoin's performance relative to Altcoin such as ETH is weakening.

As Bitcoin's dominance gradually declines, the market expects the ETH/BTC ratio to rise further, reflecting investors' increasing bullish sentiment on ETH and potentially driving more funds into Ethereum-related investment products.

Leverage Demand and Market Expectations

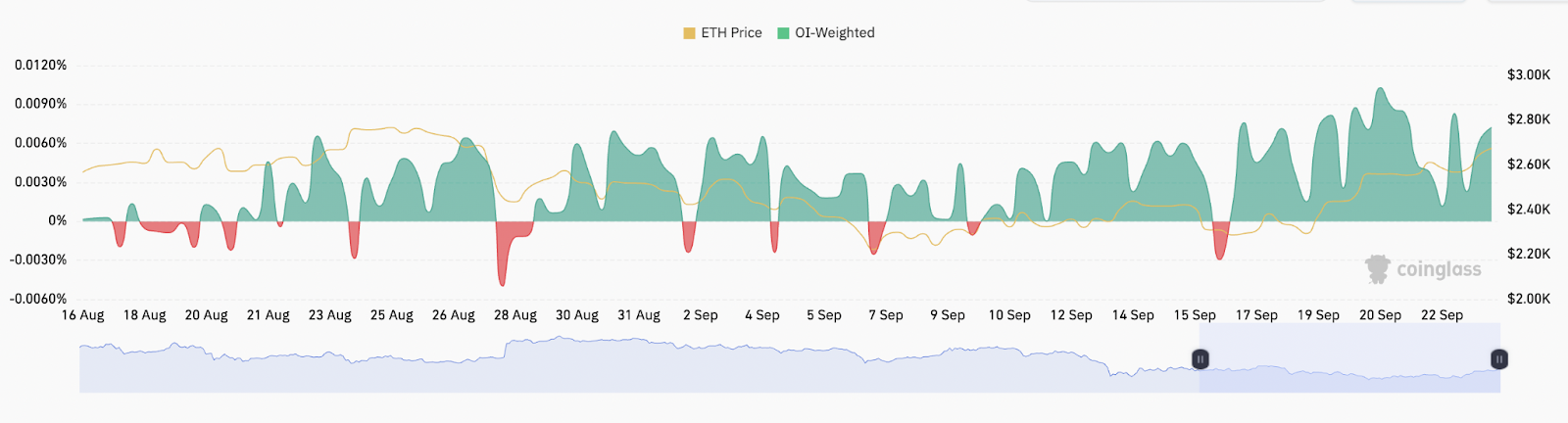

ETH OI weighted funding rate. Source: Coinglass

According to Coinglass data, the 8-hour Ethereum open interest weighted funding rate has turned positive since September 16 and is currently 0.0072%.

Meanwhile, open interest in Ethereum futures has reached a 20-month high, even as leverage demand remains relatively balanced. This price action is complemented by an increase in open interest in Ethereum futures, which has also reached a 20-month high.

Ethereum’s positive funding rate and rising open interest reflect a significant increase in demand for leveraged long positions, signaling a bullish market outlook.

MEME wealth effect on Ethereum is enhanced

Recently, the uppercase $NEIRO and lowercase $Neiro were launched on Binance, which seems to have ignited a new round of Ethereum's rise, and the gas fee on the Ethereum chain also ended the slump of several months. At the same time, this wave of enthusiasm has also stimulated the discussion and participation enthusiasm of other MEME projects on the Ethereum chain.

NEIRO

According to Binance data, lowercase $Neiro has broken through $0.0013, up more than 60% in 24 hours, and its current total market value has exceeded $550 million, setting a record high.

Related reading: NEIRO: who is better, reviewing the journey of Binance’s new coin NEIRO, which increased 600 times in one month!

TERMINUS

The contract for this project was first created 39 days ago, and its token ID comes from the name of "the first city on Mars" that Musk once mentioned SpaceX would build on Mars in the future. Community members pointed out that Musk quoted this concept from the famous science fiction writer Asimov in the "Foundation" series as early as February 2020, and regarded TERMINUS as "a new highland for mankind." On September 21, DogeDesigner (a UX/UI designer of Dogecoin, retweeted by Musk) tweeted: "The first city on Mars may be named 'Terminus'-Elon Musk", and then the price of MEME coin TERMINUS soared by more than 10,000%.

As of press time, the current price of TERMINUS is $0.44, with a circulating market value of $44 million and a 24-hour trading volume of more than 10 million US dollars. In the past four days, the token has increased by 500 times. According to Lookonchain's monitoring, a trader bought 3.46 million TERMINUS at $135 on September 8, and now the market value has exceeded $1.4 million, with a return rate of an astonishing 10,000 times.

Ethereum network activity shows increased demand for ETH

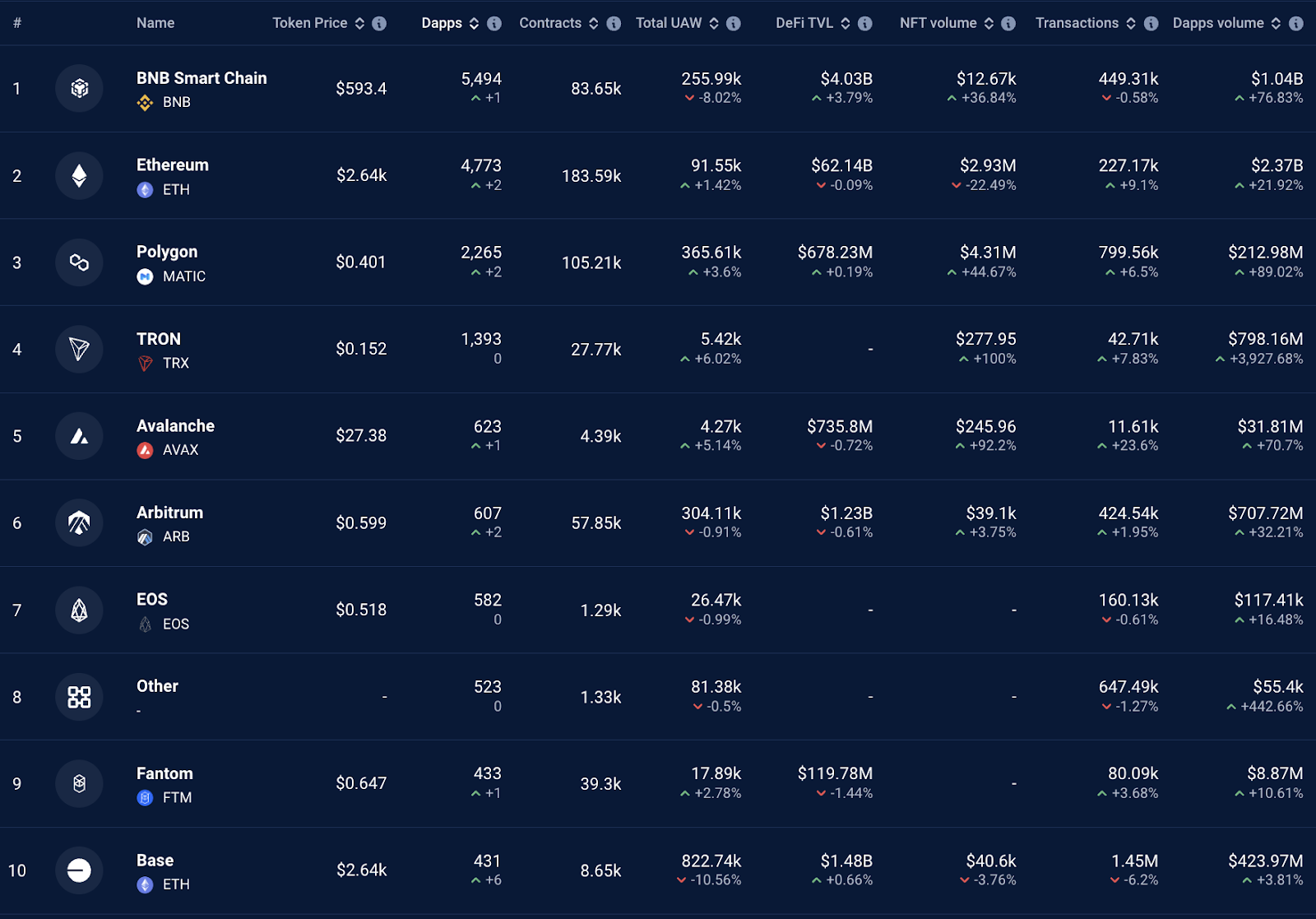

Analyzing Ethereum’s network activity and its scaling solutions is an important factor in maintaining the $2,600 support level. As the core of the Ethereum ecosystem, an increase in transaction volume for decentralized applications (DApps) generally reflects an increase in demand for ETH.

Blockchains ranked by 24-hour DApp count. Source: DappRadar

According to DappRadar, while the number of unique active wallets for the top Ethereum DApps decreased slightly by 1.42% in the past 24 hours, transaction volume surged by 21.92%, showing a significant increase in activity on DApps despite a decline in the number of users.

Total value locked in Ethereum. Source: DefiLlama

In addition, driven by the growth of DeFi platforms such as Uniswap, Balancer, ParaSwap, and Aave, the total number of DApp transactions on the Ethereum network increased by 6.5% during the same period. Data from DefiLlama further shows that Ethereum's total locked value (TVL) also increased from $44.1 billion on September 18 to $49.65 billion on September 23, showing that more users are interacting with the blockchain.

The continued growth of the Ethereum network, increased transaction activity, and increased DApp usage are all key drivers that keep ETH prices firmly above $2,600.