Author: Darshan Gandhi, Founder of FutureX Labs; Translation: Jinse Finance xiaozou

1. Introduction

In recent years, many Web3 startups have been struggling to scale while maintaining a stable user base. Although the initial publicity focused on decentralization, the core challenge remains how to build sustainable long-term business models in competitive fields such as games, entertainment, social media, and DeFi.

Understanding the underlying economics—such as whether the FDV is low or high, what the market cap is, etc.—will become increasingly important.

Unfortunately, many projects still prioritize short-term token performance over sustainable growth. After the 2021 cycle peak, many startups have not even reached their previous peaks, let alone set new highs (only BTC and BNB have managed to do this among the top tokens), and even fewer have survived the 2017-2018 cycles.

A major problem with past Web3 cycles has been the lack of a robust business model. Software development cycles typically take 5-7 years to reach maturity, with projects like Ethereum only having 8 years, and projects like Solana having launched less than 5 years ago. This is really hard. As a result, many projects have fallen into the trap of relying on token hype, which only generates short-term interest and doesn’t actually provide any strong long-term value other than governance.

The imbalance between token speculation and the actual value accumulation and token utility that can be obtained is an unresolved problem in the current crypto ecosystem.

I believe the true potential of Web3 lies in its integration with real-world industries such as energy, artificial intelligence, the Internet of Things, and supply chains. By focusing on these development applications, Web3 will ultimately deliver on its promise of ownership, transparency, and broader social impact—moving beyond speculation and creating lasting value.

2. Transformation

There is a clear shift towards creating tokens that are tied to real business models and tangible revenues. Instead of relying on hype and narrative to drive token prices, projects should focus on providing real value - driving long-term user engagement through mechanisms such as voting rights, access to services, or utility, and accumulating value for tokens through methods such as burning and staking.

Investors and users are now prioritizing projects that provide sustainable benefits. Concepts such as staking, token burning, and user rewards help to better position these projects and ensure their growth. For example, Uniswap recently decided to provide fee rewards to users who provide liquidity.

This shift suggests that in the future, tokens will not only be trading tools on the secondary market, but will truly become an integral part of the project.

3. Areas that perform well

So now let's try to really understand which areas or ecosystems are doing well, can generate sustained cash flow, and have real practicality.

While many projects are still in development or have just launched, most are turning their attention to discovering and justifying important business metrics (such as revenue, profit, and user base) rather than focusing solely on transaction volume.

Here are the industries that are doing really well and are considered cash-rich, which don't actually have too many speculative issues and are more about initial launch and distribution issues, and once those issues are resolved - these industries will become cash cows.

(1) DePIN

● DePIN is one of the hottest areas recently, and a lot of attention has shifted to it from industries that performed strongly at the beginning of the year, such as AI and games. This is thanks to some projects in this field, which have brought an increase in usage and indicators, led by Helium.

● Projects like Helium — a decentralized wireless network — show us the power of real-world applications. Helium’s HNT tokens are rewarded to users who set up hotspots to provide wireless coverage, and their value is driven by the usage of IoT devices (not speculation).

● Projects such as GEOD and Hivemapper also adopt a similar model, crowdsourcing physical data such as geolocation and dashcam footage and then monetizing it.

● All of these projects have done well in terms of revenue, can generate some healthy cash flow, and can truly realize the accumulation of token value.

(2) Social platforms

● Web3 social is fun and exciting for everyone. Consumer applications are one of the main ways this technology can truly reach millions of users around the world. But for a long time, consumer cryptocurrencies have struggled to take off.

● Recently, Alliance and other companies have been pushing this narrative hard, and chains such as Solana and Base are becoming more consumer-friendly, encouraging users to develop and build on them.

● Applications such as Farcaster, Lens Protocol, Fantasy top, etc. are trying to change the way people think about consumer cryptocurrencies. Some of them have actually generated some revenue and usage.

● It’s too early to tell though as the user base is still very small compared to the wider web2 world, but it’s a good start.

(3) Launchpads

● Projects are usually hardest during the initial launch phase – they lack the things that are most important to them: relevance and distribution.

● This is where launchpads can really help change the game by providing these projects with an ecosystem and platform of users/investors/supporters.

● Publishing platforms like Pump Fun and Multiplier were able to generate millions of dollars in a short period of time thanks to the publicity and adoption of meme coins.

● Although I personally believe that this is not a sustainable model in the long run as it will only bring more harm to the field without adding any value, we should realize that there are various verticals that are already doing well, and we should draw inspiration from them and apply them to other fields to create more lasting value.

(4) DeFi products

● Defi remains an evergreen category and the only category that can continue to bring a good share of revenue to web3. Of course, leading companies such as Uniswap, Aave, Maker, Curve, etc. contribute most of it.

● I think these businesses, although “boring”, are sustainable and will exist for a long time. One thing I find very interesting is to observe whether apps can leverage the first principles of DeFi and combine them with other areas such as prediction markets and games to test whether they can open up new markets and new perspectives.

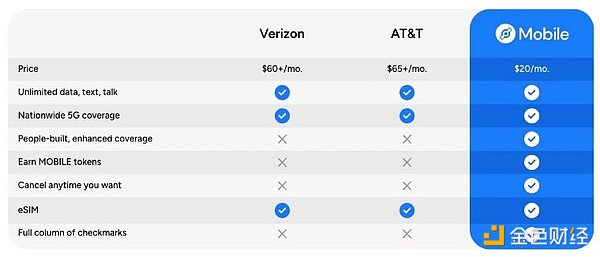

4. Web3 and Web2 Models

The core difference between Web3 and Web2 companies is how they generate revenue and how they operate. Web2 relies on centralized models such as subscriptions, advertising, and enterprise sales. Web3, on the other hand, uses decentralized models such as token economics, transaction fees, staking, and DeFi earnings to create value for the platform and users.

Web2 derives value through:

● Control user data

● Monetize high-quality content

● Provide platform services

Web3 transfers control to the community by:

● Token Ownership

● DAO and governance

● Voting and participation incentives

While this decentralized model offers new opportunities, it also introduces several barriers such as complex user experience, regulatory challenges, and scaling issues (e.g., blockchain congestion, high gas fees).

Web3 startups benefit from the use of smart contracts to quickly release products, but they face the following problems:

● Lack of easy ways to attract users

● Limited retention mechanism

● Product utility beyond speculative value

To achieve long-term success, the focus must shift to building sustainable revenue models and translating them into real token utility rather than relying on hype.

Here are a few different types of models and their applications in different industries:

● Token-based model:

--Tokens drive platform operations and usually have a governance role.

--As the platform develops, the value of the token also grows through mechanisms such as burning.

--Example: MakerDAO burns MKR tokens when debt is paid off, which reduces the supply and increases value over time.

● Subscription model

Web3 platforms such as Audius offer advanced features or premium content for a recurring fee, eliminating the need for middlemen.

--Artists and creators earn money directly from their audiences, similar to traditional Web2 subscription models.

● Platform fees

Platforms like Zora earn revenue by taking a small cut of each transaction.

--User activity directly drives revenue growth.

● DePIN Network

--These projects in this space reward users for contributing real-world resources, such as bandwidth or wireless coverage or location data.

Helium allows users to earn tokens by providing wireless hotspots that support IoT devices.

● Social Tokens

--Creators mint their own tokens for fans to buy or trade.

--Revenue driven by token sales and fan engagement.

--Rally enables creators to build stronger connections with their communities through token ownership.

● Market

--Platforms such as Blur, Opensea, and Rariable earn revenue by taking a certain percentage of NFT/asset sales.

--As trading activity grows, platform revenue also grows, and profitability is directly linked to user engagement.

● Web3 Games/Entertainment — Freemium

--Web3 games’ revenue comes from in-game purchases, marketplace fees, or play-to-earn models.

● Decentralized AI

--Decentralized cloud service providers (such as Akash Network) rent out computing power.

--Users pay for these resources using tokens, competing directly with traditional cloud providers.

--There are also projects specifically addressing decentralized training, workflow, and data capture/collection.

● Publishing platform

--Platforms like DAO Maker help projects raise funds through token sales, taking a percentage or additional fees.

5. Income-generating projects

Over the long term, projects with real-world utility have consistently outperformed those that rely on speculative token economics.

Revenue-driven models are slowly becoming the foundation for the most successful web3 businesses, proving their value through sustainable business models that can attract users and investors.

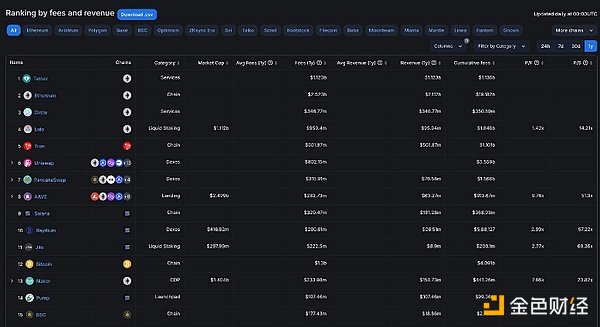

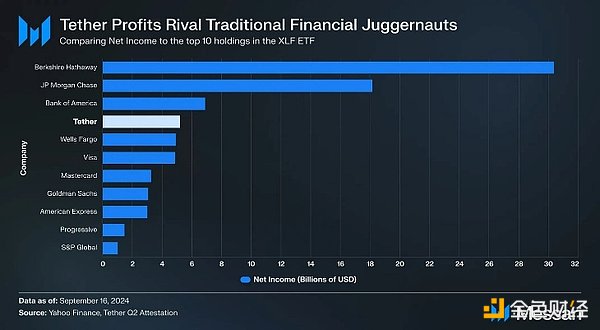

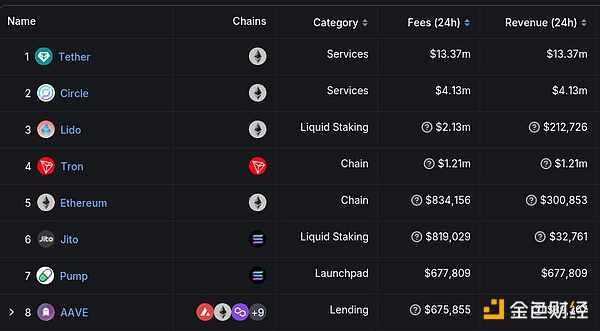

The following figure provides an overview of the crypto projects with the highest revenue generation.

It is great to see projects like Tether, Tron, ETH dominating the space, which are chains or cryptocurrencies themselves and form the base layer of Web3.

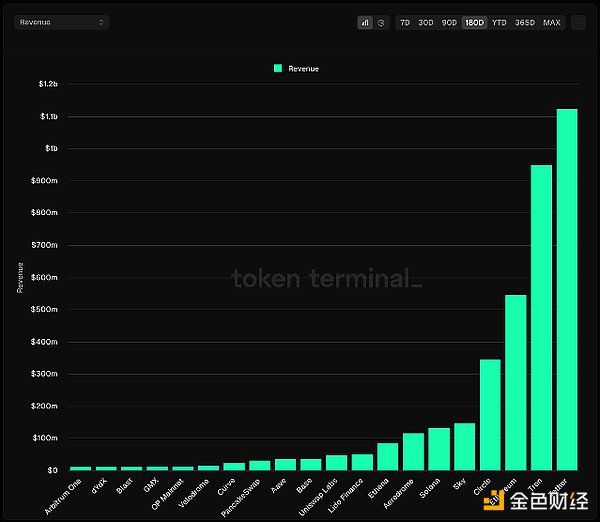

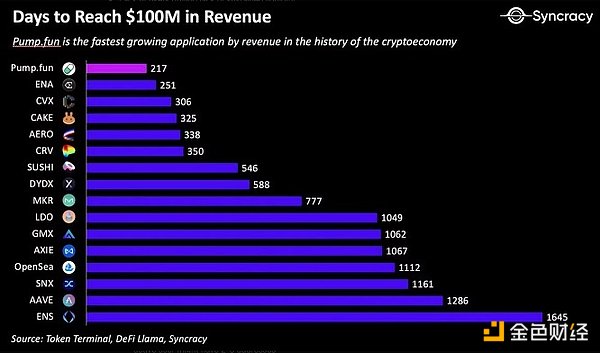

When we looked at the apps that reached $100 million in revenue the fastest, we noticed a strong correlation between the actual utility of the projects and their financial performance.

● Projects focused on real-world applications, such as decentralized exchanges and DeFi platforms, tend to grow faster.

● Their ability to generate steady income from transaction fees, staking rewards, and reward pools are some of the methods that have helped them quickly grow to nearly $100 million in revenue in such a short period of time.

Let’s take a look at some of the most interesting projects at the moment.

(1) Helium

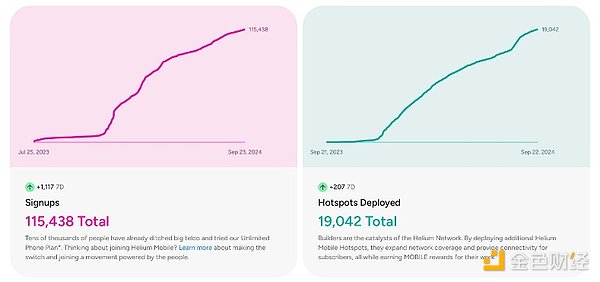

Helium is one of the best performing projects in 2024. Helium focuses on mobile operator services and is an alternative to traditional providers. It focuses on attracting users, expanding consumer scale, and using Solana for settlement.

The value of its tokens is tied to network usage, not hype.

Since June, the network has attracted 756,000 users and transferred more than 19.1 TB of data. The best part is that most users don’t even realize they are interacting with the blockchain. The surge in registrations over the past year reflects Helium’s steady progress towards mainstream adoption.

According to depin.ninja, Helium is the most profitable project recently. They have been performing well and it will be interesting to see how their earnings grow after the 2025 halving.

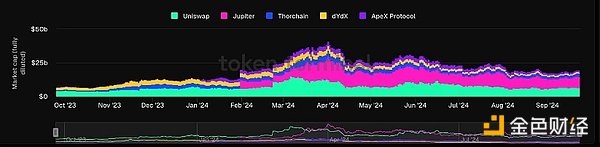

(2) Decentralized exchanges (Uniswap, Jupiter)

Uniswap remains the largest DEX (decentralized exchange) with continued strong trading volumes. However, with the recent surge in Solana’s popularity, Solana-native DEXs like Jupiter have begun to take significant market share from Uniswap.

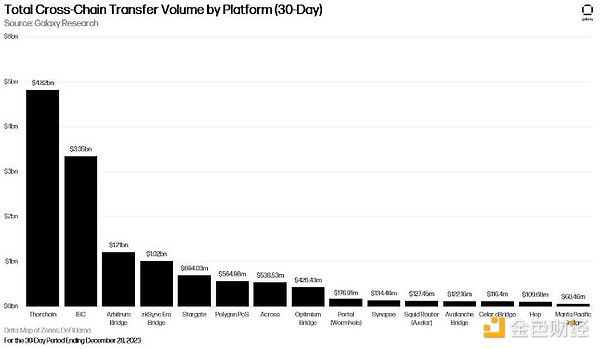

Overall, the future of DEX looks bright, as platforms incur fees for every trade and handle a large volume of transactions. The top five exchanges alone handle nearly $45 billion in volume, which is quite staggering when compared to the volume of all other sectors.

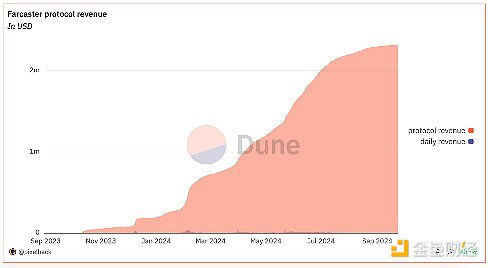

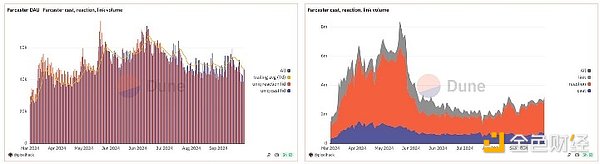

(3) Farcaster

Farcaster is probably the largest crypto social media platform focused on user-owned content and user engagement. Rather than relying on token speculation, users pay for permanent storage of their account content, which helps the platform generate some serious revenue.

Farcaster has also gained traction due to the support of the meme coin community and the participation of degens. Although Farcaster's revenue is low compared to other fields, it is still a leading protocol in the crypto social field. I can watch how they achieve the goal of 10 million users in the next few years.

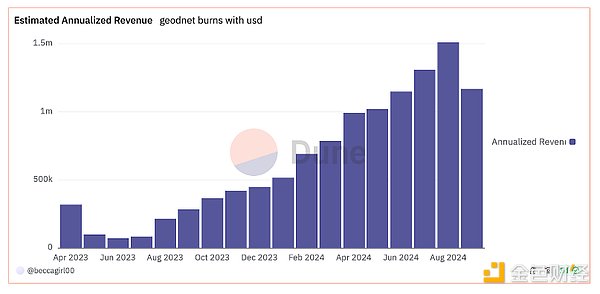

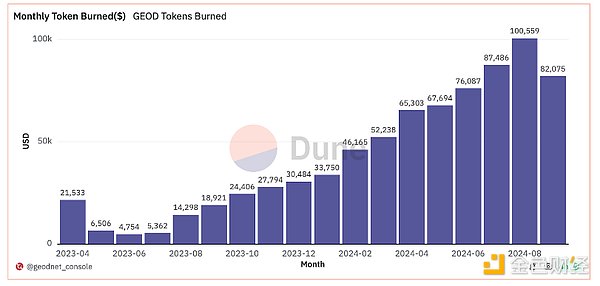

(4) GEOD

GEODNET is the world's largest Web3 RTK network, providing highly accurate positioning services for artificial intelligence, IoT, and autonomous systems. By using RTK real-time dynamic positioning technology, GEODNET aims to increase positioning accuracy to 100 times that of traditional GPS.

This high level of accuracy is critical for applications that rely on device sensors, such as:

● Camera

● LiDAR

● IMUs

This makes it a key player in driving AI autonomous systems.

● The network is rapidly expanding, with more than 9,000 miners worldwide, and monthly revenue has maintained a sustained growth of 10-15% since the beginning of this year.

● GEODNET is expected to achieve $2-3 million ARR by the end of the year, making it one of the largest high-margin DePIN projects with strong potential for further growth.

● Not only is their technology more accurate, it’s also 90% cheaper than the competition and offers wider global coverage.

● Through cooperation with the U.S. Department of Agriculture and others, GEODNET has demonstrated that long-term, stable growth can produce significant results. The company's monthly revenue has grown 20 times from US$5,000 to more than US$100,000.

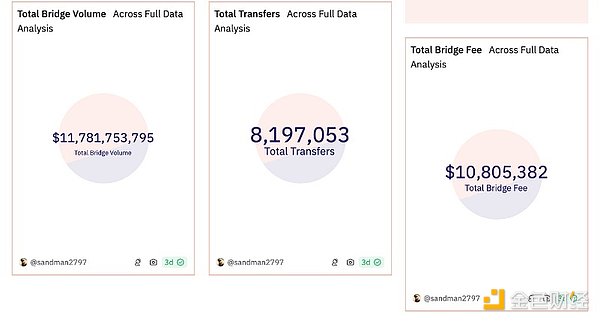

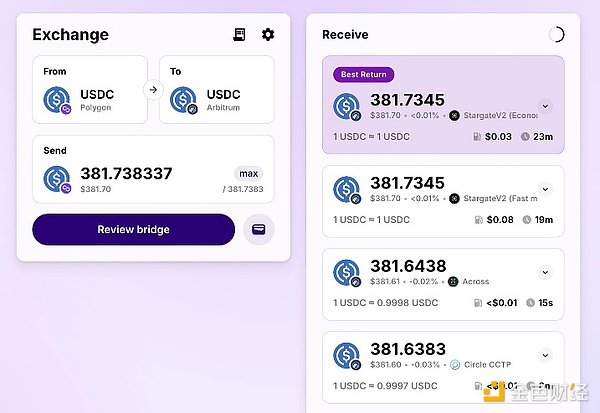

(5) Across Protocol

Across Protocol is a cross-chain bridge that enables seamless asset transfers between different blockchains. It earns revenue by charging fees for these asset transfers, which makes its success directly related to the demand for fast and secure cross-chain liquidity. As more and more assets are transferred across chains, especially with the growing popularity of multi-chain ecosystems, Across has positioned itself as a key player in this field.

Over the past month, the Across protocol has dominated Ethereum chain transactions through JumperExchange, handling more than 60% of Ethereum's bridge demand. This strong performance shows its growing influence in cross-chain operations. Powered by "intents", a new cross-chain interoperability method, Across sets the standard for a smooth and efficient user experience when transferring assets across chains.

Compared to other bridges, its waiting time is extremely low, measured in seconds, while other bridges take minutes.

It is also slowly climbing up the competitive rankings among cross-chain transfer provider networks.

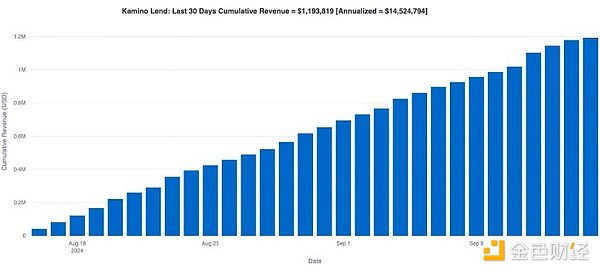

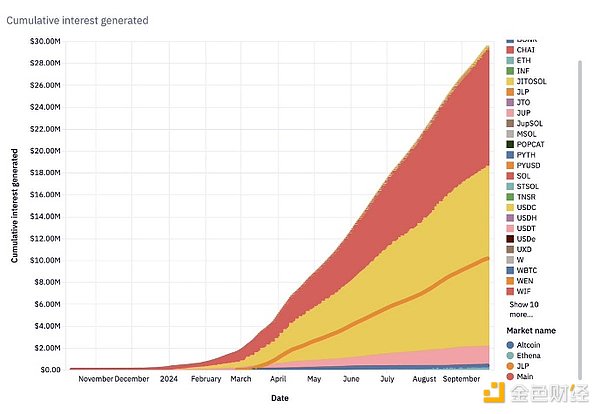

(6) Kamino Finance

Kamino focuses on optimizing liquidity management and provides users with a set of tools such as lending instruments and leverage strategies.

The platform has achieved impressive growth, with annual recurring revenue (ARR) approaching $14 million.

Over the past year, Kamino has generated approximately $30 million in earnings for its users, highlighting its ability to provide sustained returns through DeFi products.

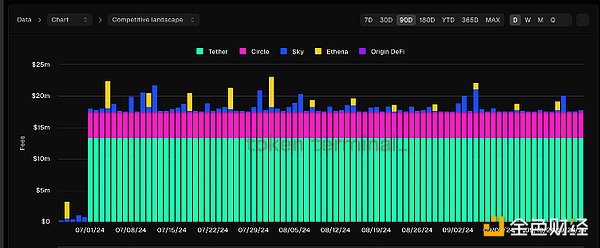

(7) Stablecoins (Tether & Circle)

Stablecoins have become essential in the Web3 space, with Tether (USDT) and Circle (USDC) at the forefront. These two giants dominate the market as the preferred stablecoins for traders, developers, and users. Their widespread adoption and liquidity have made them the backbone of many decentralized finance (DeFi) platforms.

Tether, in particular, is often compared to major Web2 financial players such as JPMorgan Chase, Visa, and Mastercard due to its rapid rise to become the dominant stablecoin. In a short period of time, it has surpassed many traditional giants in terms of market coverage and integration in the crypto market.

Tether and Circle have consistently outperformed other stablecoin providers and blockchain protocols, capturing the largest market share in Web3. Their stability, liquidity, and integration across various chains and dApps have made them stand out as key forces in the space.

summary:

● Each of these projects demonstrates the increasing importance of real-world utility in driving crypto gains.

● Whether through infrastructure, social, gaming, or DeFi, the future of Web3 will be shaped by projects that successfully combine their token economics with real-world utility and sustainable yield dynamics.

6. Lessons Learned

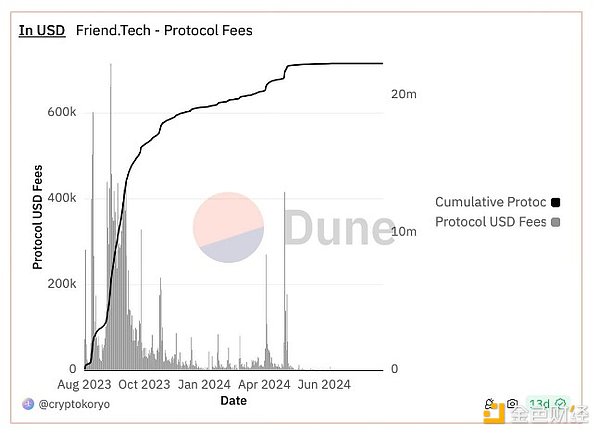

Friend.tech is a great example of a project that can generate quick buzz and revenue but fail to establish long-term sustainability. It shows us that not all startups that make money will eventually succeed.

The rise of these applications is driven by users purchasing other users’ “shares” in the hope that as they gain popularity and more users join, their value will rise. However, with no real use other than speculative trading, users quickly lost interest after the initial excitement faded. In addition, the initial excitement can also be attributed to the team’s airdrop to early participants - but since the airdrop, the platform has had little practicality and substantive application.

Speculation-driven economies are inherently fragile — users seek quick gains and walk away without substantial value. In contrast, platforms like Uniswap and Helium maintain long-term user engagement by providing real-world utility, proving that continued success comes from creating lasting value, not hype.

Friend.tech lacks such a foundation, and once the speculative enthusiasm subsides, there is nothing to maintain user stickiness.

It’s clear: for Web3 platforms to thrive, they must provide real value beyond speculation.

7. Why are projects that rely heavily on tokens not optimistic in the long run?

Projects that rely too heavily on tokens may achieve rapid success, but have difficulty maintaining that momentum. The prices of tokens in these ecosystems are often driven by hype and speculation, but without a solid foundation of utility, users will quickly lose interest. Once the hype fades and users realize there is no deep value, the token price will collapse and users will exit, leading to a downward spiral in prices.

This problem is evident in the example of Axie Infinity, which relied on a dual token system to support its growing user base. As more and more users joined, the economy became overinflated and the token rewards could no longer sustain the growth of users. Eventually, the entire system collapsed because the token economy could not cope with the influx of users.

Similar problems occurred with the fitness app STEPN, which initially attracted users by offering token rewards for physical activity. However, as the token supply increased and the token price fell, user engagement declined, revealing the fundamental flaws of relying solely on token incentives to drive long-term engagement.

Although Axie generated significant revenue from marketplace fees and in-game sales, the project’s reliance on token growth and user expansion ultimately failed as growth slowed.

Similarly, fitness app STEPN initially attracted users with token rewards, but failed to maintain user stickiness after the token price fell due to oversupply.

Although Axie made money through sales and marketing fees, its model was too dependent on user growth and token rewards, and ultimately failed when growth slowed.

8. Web3 Games vs Web2 Games

The challenges faced by projects like Friend.tech and Axie Infinity highlight a general problem in the Web3 gaming space. Compared to traditional Web2 games, Web3 games have a hard time generating the same scale of revenue. For example, one Web2 game recently made $600 million in its first week alone, while Web3 games are lagging far behind. This is not because the Web3 game concept is bad, but because the Web technology has not been fully utilized to its potential and the timing is not right.

A major problem is that many Web3 games are still overly focused on token systems, where players are motivated by monetary rewards rather than the actual gaming experience. This over-reliance on token economics creates unrealistic expectations, and players are disappointed when the gameplay doesn't live up to the hype. To truly compete with Web2 games, Web3 projects need to shift their focus to making games more interesting and engaging. Technology should be used to optimize gameplay, not be the focus.

To succeed, Web3 games must shift to a gameplay-first model. Blockchain technology has the potential to deliver innovative experiences, but it should be a tool to enhance immersion, not the driving force behind the entire economy. Web3 games can only truly reach their potential when the focus shifts from token economics to creating truly fun and engaging player experiences.

9. What should be changed?

(1) Financial indicators for measuring success

● Web3 projects must go beyond an excessive focus on token prices. Traditional technology companies track key metrics such as yield, profit margins, and active users. Web3 projects should also measure real user activity and value creation.

● The focus of the project should be on identifying and defining a suitable set of metrics that may be applicable to a specific business in a specific area - this can only be done through more specific benchmarking against Web2 peers and active communication with customers.

(2) User-centered design

● Another important shift is the focus on user experience – that is, on interface usability and technical interactivity.

● Web3 platforms require intuitive, user-friendly designs to ensure long-term growth. Currently, most user experiences are quite complex, such as complex wallet management and steep learning curves, which drive away many new users early on.

● Simplifying the customer acquisition process and improving wallet usability are key measures. Companies such as Privy, Dynamic, Turnkey, etc. are excellent projects dedicated to solving this problem.

● Long-term engagement is also important. Platforms must provide real value to attract users, not just speculative rewards. For example, Audius enables artists to connect with fans in a meaningful way, adding other value beyond token incentives.

(3) Utility Challenge

● One of the biggest challenges to achieving utility is scalability. Blockchains often struggle to process large volumes of transactions at low cost. For example, Ethereum’s high gas fees have hindered wider adoption, and developers are turning to other chains such as Sui and Solana.

● Interoperability is also an ongoing issue as many platforms operate in isolation. Cross-chain solutions like Polkadot and Cosmos are making progress, but they have yet to truly become market leaders.

● Finally, regulation has always been a major challenge. This has eased somewhat with the approval of ETFs, but there are still concerns and gray areas that we need to address.

10. Conclusion

Web3 has tremendous potential, but lasting success will require moving beyond token speculation. Projects like Friend.tech and Axie Infinity have shown that while hype can lead to quick success, it doesn’t translate into sustainable long-term growth.

To thrive, Web3 platforms must focus on creating real value — starting with:

● Build products based on real utility

● Track meaningful metrics like active users and transaction volume, not just token price

● User-oriented development and construction

● Create an engaging and seamless experience for users

● It is not based solely on speculation, but is based on utility first.

● Simplifying the user experience and solving real-world needs will drive lasting user stickiness. Overcoming technical challenges such as scalability, interoperability, and navigating rules is critical to broader adoption. The future of Web3 lies in projects that combine innovative technologies with practical, user-centric solutions, relying on creating lasting impacts that go beyond token economics.