The price of Bitcoin has risen by over 20% in the past few days, breaking the $65,000 mark. Despite this huge gain, if further gains are not followed, the price of Bitcoin could fall again.

At this point, a group of major investors known to be taking profits could pose a potential threat to the ongoing uptrend. If selling pressure increases, Bitcoin’s uptrend could reverse.

Bitcoin investors can realize profits

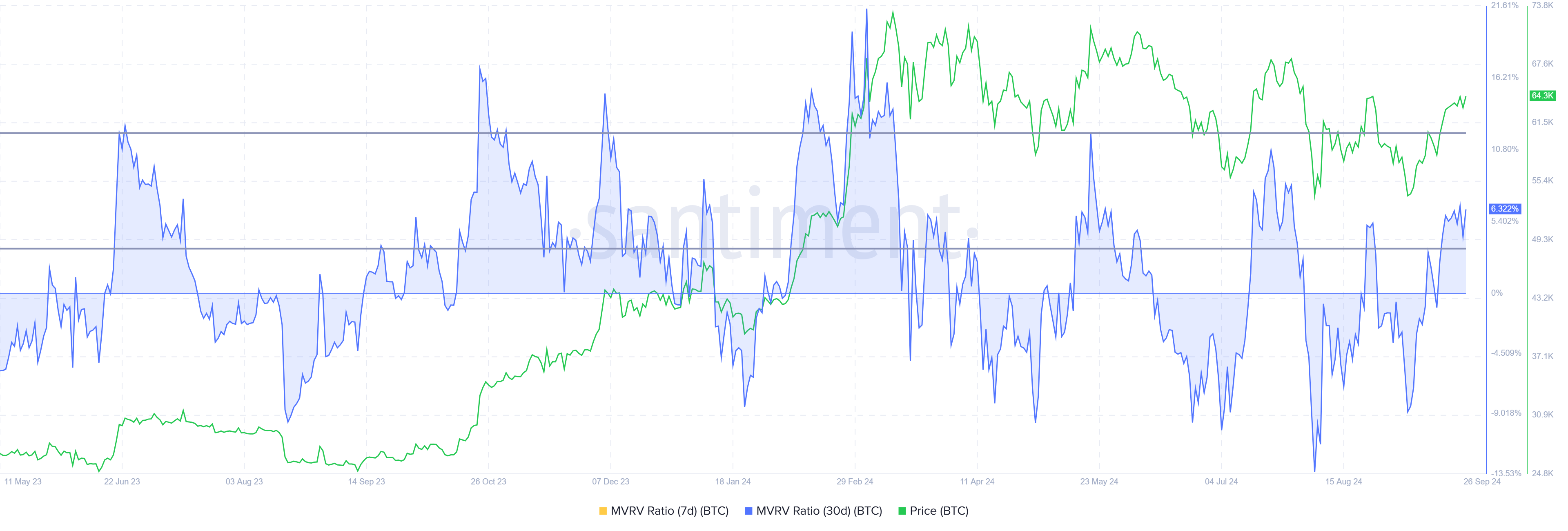

The price of Bitcoin is under threat of correction due to the possibility of selling. The same signs are observed in the Market Value to Realized Value (MVRV) ratio.

This metric, a key indicator of profitability, has entered the danger zone again after almost a month. Bitcoin’s 30-day MVRV is currently at 6.3%, indicating that investors are taking profits.

Historically, when the MVRV ratio is between 2% and 12%, it often triggers selling pressure, leading to a correction. When this threshold is reached, investors look to lock in profits, which can lead to a decline in the Bitcoin price.

Read more: Bitcoin Halving History: Everything You Need to Know

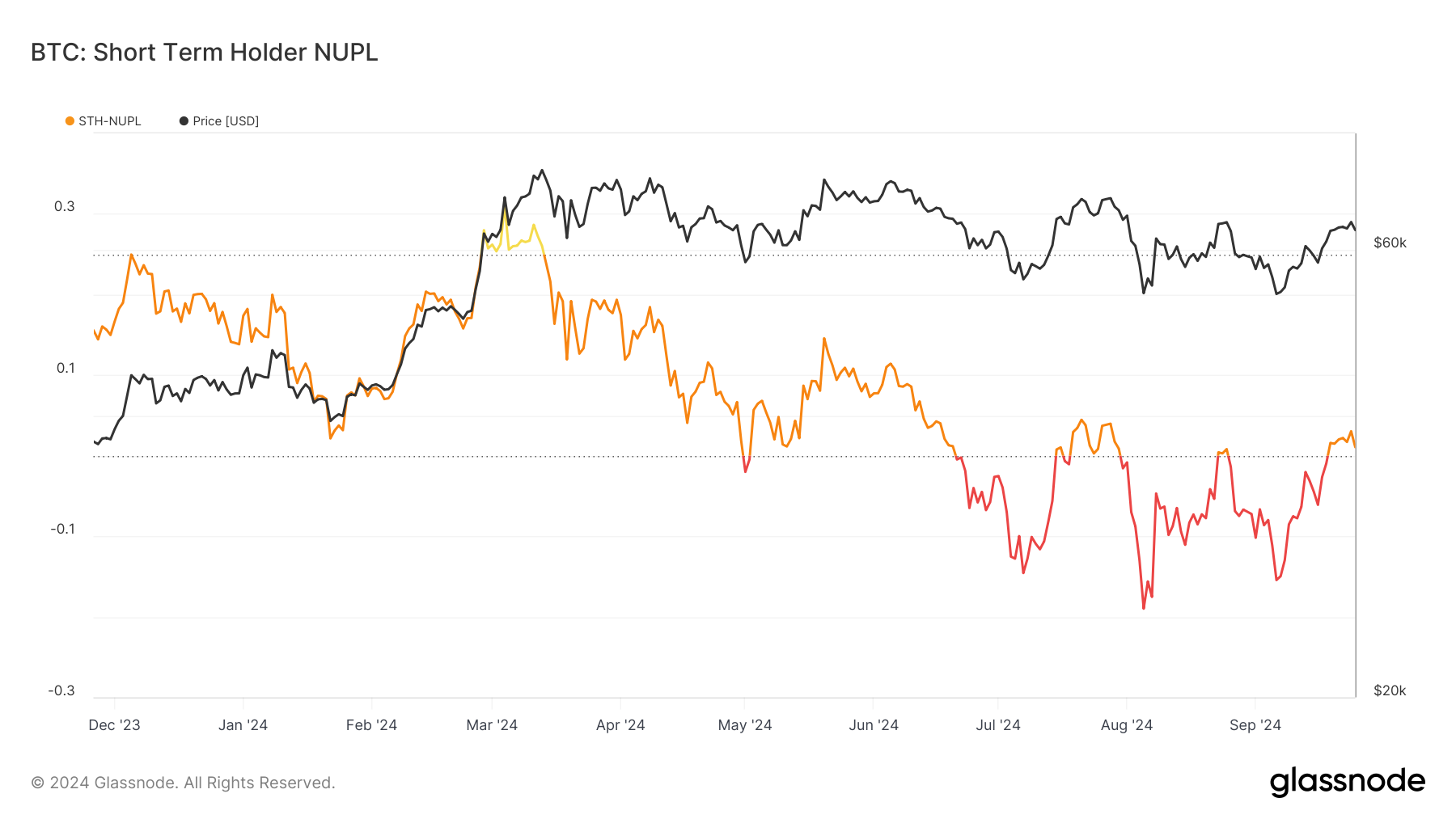

Another important indicator, short term net gain/loss (NUPL), suggests that short term holders are experiencing huge unrealized profits. This group of investors, known to hold assets for less than a month, tend to sell quickly when profits accumulate. NUPL shows that short term holders are likely to start selling at a high level, increasing the risk of a price decline.

Short-term holders are expected to start liquidating positions as bullish sentiment surpasses the current level. Historically, short-term holders have taken profits and sold assets when the level is surpassed, putting downward pressure on the Bitcoin price . If this trend continues, a price decline is very possible.

BTC Price Prediction: Bearish Outlook

Bitcoin’s recent 20%+ rally has taken the price to $65,500, with $63,068 acting as a key support level. This level has established itself as a key area where Bitcoin can find stability if selling pressure increases.

If profit taking strengthens, Bitcoin could fall below the $63,068 support level and the next important support level of $59,666. This price floor could act as a point where Bitcoin could bounce if selling pressure weakens. However, if this support level is not maintained, further declines are likely.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Conversely, if the market’s optimistic outlook for October continues, Bitcoin may have a chance to break above the $67,500 resistance level. A sustained break above this level could invalidate the current bearish outlook, leading to price gains and a continuation of the uptrend.