China is considering injecting 1 trillion yuan (about $142 billion ) into its biggest banks to help shore up its slowing economy. The capital injection is intended to bolster banks’ lending capacity and boost growth, which the country is struggling with as its economic performance weakens.

These discussions came shortly after the U.S. Federal Reserve cut interest rates by 50 basis points.

China plans to inject 1 trillion yuan of capital into banks

Bloomberg reports on the discussions, citing people familiar with the matter. According to the report, China will raise funds through new sovereign bonds . It would be the first time Beijing has injected such a large amount into a major bank since the 2008 global crisis.

The plan comes as China's economy continues to struggle, with banks already implementing measures such as lowering mortgage rates and cutting key policy rates.

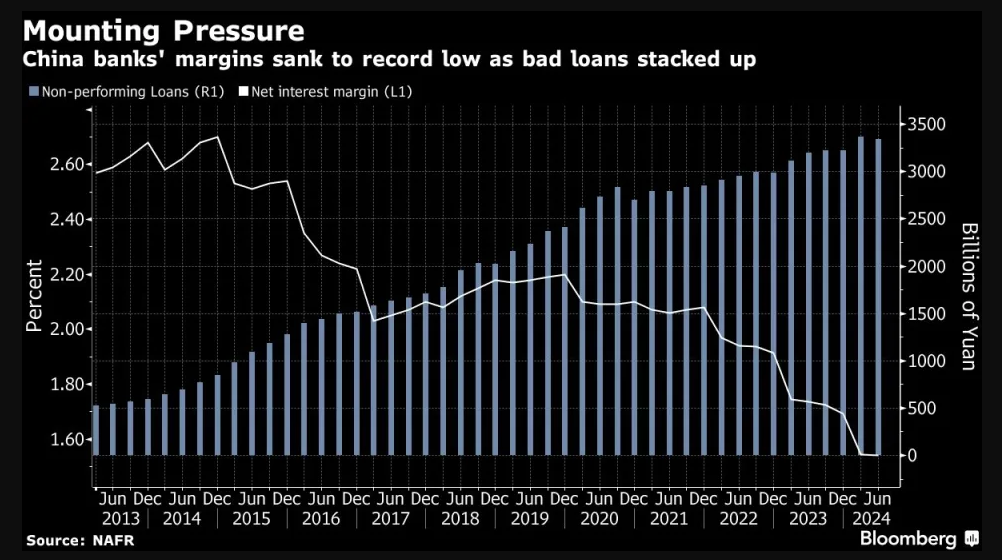

These measures have allowed the top six banks to build up capital above their required levels, but the Industrial and Commercial Bank of China and Bank of China, which were introduced to support the economy, are suffering record-low margins, shrinking profits and rising bad debts.

Read more: How to Protect Yourself Against Inflation Using Cryptocurrencies

Therefore, the general perception is that the 1 trillion yuan capital infusion will greatly enhance the banks' ability to support the national economy.

“This is a different type of stimulus. If it is done through special bond issuance, it can be a fiscal stimulus and it can stabilize banks as property prices continue to fall. It will ensure that banks’ ability to lend is not affected,” Bloomberg reported, citing Hao Hong, chief economist at Growth Investment Group.

Chinese regulators are also urging the country’s big banks to help shore up the struggling economy. They are demanding cheap loans to risky borrowers, which could be a good fit for risky assets like Bitcoin (BTC).

In fact, cheaper and therefore easier borrowing, i.e. lower interest rates , can stimulate spending and investment. This increased liquidity can help risky assets like Bitcoin and stocks, which often benefit when borrowing costs fall.

Su Zhu, founder of the now defunct Three Arrows Capital, has addressed the possible impact of the financial support. He hinted that crypto prices could benefit from the capital injection.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

These comments and optimism come as Bitcoin’s price has a track record of being closely tied to global liquidity, suggesting that China’s stimulus could spark a rally in the cryptocurrency’s value, according to economist Lynn Alden.

Meanwhile, China’s 2021 cryptocurrency ban was inevitable after a hostile stance toward digital assets that had been in place since 2013. The reasons for the ban included financial crime, economic instability, and capital outflow from the market as users circumvented existing restrictions. Given this backdrop, some question whether a $1 billion financial support could have any impact on cryptocurrencies.

“What does China putting money in banks have to do with Bitcoin? I know you can’t buy Bitcoin with that money,” one X user said .

However, there have been reports of a push to counter this ban. Chainalysis, a cryptocurrency on-chain analytics firm, reported that Chinese traders have invested $75.4 billion in Bitcoin. Over-the-counter crypto brokers in China continue to see increasing inflows, with a total of $75.4 billion in the past nine months.