As the renewal report for Virtual Asset Service Providers (VASP) is in progress, the effectiveness of exchange self-regulation is once again being questioned as domestic won exchanges are listing memecoins one after another. According to the common guidelines for listing review announced by the Digital Asset Exchange Association (DAXA), a virtual asset exchange self-regulatory council, and the Financial Supervisory Service in July in line with the enforcement of the Virtual Asset User Protection Act, many of the recently listed memecoins do not meet the listing requirements.

According to industry sources on the 27th, Upbit, the largest won exchange in Korea, has listed three meme coins in succession over the past two months. On August 20th, it listed Brett (BRETT) and Pepe (PEPE) simultaneously on the USDT market, and then on the 19th, it listed Cat in a Dog World (MEW) on the BTC and USDT markets.

Related Articles

- DAXA, Proposal and Revision of Self-Regulatory Proposal Ahead of Enforcement of User Protection Act

- [Decenter Small Talk] Will Coinone withdraw from DAXA? ‘War of nerves’ among the 5 major won exchanges

- Certik: “Blockchain security vulnerabilities still exist… We will close the Memecoin audit loopholes” [Decenter Interview]

- Financial Supervisory Service Chairman: “Unfair Virtual Asset Trading, Zero Tolerance Principle… 2nd Stage Bill Also Discussed”

Coinone, which supports the largest number of meme coin transactions among domestic KRW exchanges, has also started listing additional meme coins. Coinone announced the listing of Sundog (SUNDOG) on the KRW market on the 10th. Events are also being held to promote trading. Coinone held the 'Coinone Dog Festa' last week and plans to pay 28,000 SUNDOG in installments to users who trade three or more out of five types of dog-themed meme coins: SUNDOG, Dogecoin (DOGE), Shiba Inu (SHIB), Bonk (BONK), and Volt Inu (VOLT).

The problem is that many of these meme coins do not comply with the listing review guidelines that have been applied to all domestic exchanges in the form of self-regulation since last July. According to the listing review requirements disclosed by DAXA, exchanges must check the following when reviewing listings: △ credibility of the issuer △ presence of user protection devices △ technology and security level △ compliance with laws and regulations. Accordingly, exchanges must receive important information, such as virtual asset circulation volume plans, from virtual asset project teams seeking listing and conduct a review. It is pointed out that many meme coins issued by anonymous entities solely for fun do not meet these requirements.

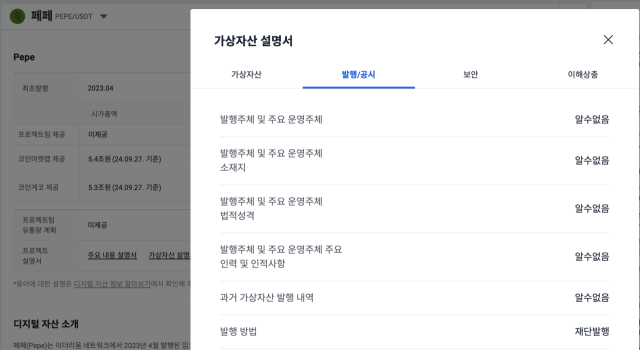

For example, PEPE, which Upbit listed last month, is a project for which even basic information such as who the issuer and main operator are and where it is located are unknown. The circulation plan has not yet been shared with the exchange. SUNDOG, which Coinone listed on the 10th, also has an unknown issuer and main operator. Although the listing guidelines include an exception clause that relaxes some screening requirements for virtual assets whose issuers are difficult to identify if they have been traded in an eligible overseas virtual asset market for more than two years, memcoins BRETT, PEPE, MEW, and SUNDOG, which were recently listed in Korea, are all new coins that have not even been on the market for two years.

The industry is expressing doubts about the successive listings of memecoins at a time when renewal applications for virtual asset business licenses are in progress. Unlike the previous listing review guidelines, which were voluntarily implemented by only five affiliated won exchanges under the leadership of DAXA, the new guidelines applied to exchanges with the enforcement of the Virtual Asset User Protection Act in July were established with the direct participation of financial authorities, so they were expected to have a certain degree of binding force. With the business renewal application season approaching, the Financial Supervisory Service and the Financial Intelligence Unit (FIU) of the Financial Services Commission have recently been conducting on-site inspections of exchanges, tightening their supervisory net. An industry insider said, “I thought the authorities were aware of these guidelines since they were created in cooperation with financial authorities, and that they would naturally refer to them in renewal reviews, but it is incomprehensible that the listing of memecoins that do not meet the listing requirements and related events are continuing.”

Exchanges, concerned that new listings would be difficult due to the listing guidelines, listed virtual assets en masse ahead of the implementation of the User Protection Act. However, skepticism about self-regulation is rising as the listing of virtual assets that do not meet the listing requirements continues without a problem even after the new guidelines are applied. Recently, Financial Supervisory Service Chairman Lee Bok-hyun called exchange representatives together and personally urged them to follow self-regulation such as the listing guidelines, but it is pointed out that due to the lack of enforcement power, it is still just a reckless regulation that is ineffective. Hwang Seok-jin, a professor at Dongguk University’s Graduate School of International Information Protection, said, “It is important to establish DAKSSA as a legal institution or to codify a separate self-regulatory institution in the second legislative process for virtual assets, and to establish an organization that takes charge of areas that the authorities cannot manage, like the Korea Financial Investment Association,” and “Even if DAKSSA is not yet a legal institution, it is necessary to strengthen cooperation with the authorities by distinguishing between ‘things that can be done with the law’ and ‘user protection measures that can be taken without the law. ’”

- Reporter Kim Jeong-woo

- woo@decenter.kr

< Copyright ⓒ Decenter, unauthorized reproduction and redistribution prohibited >