Original: Liu Jiaolian

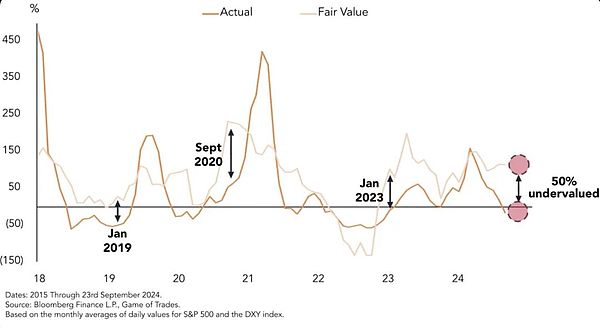

Overnight, BTC continued to stand at 65k, aiming at 66k. After the recent Fed rate cut, gold, US stocks, and A-shares have all been in high spirits, which makes BTC seem a little behind. Someone (Game of Trades) studied the divergence between BTC and S&P 500 in the past six months, as well as the negative correlation between BTC and the US dollar index, and came to a conclusion: BTC's current market price is underestimated by 50%, and the actual price may exceed $120,000 to $140,000.

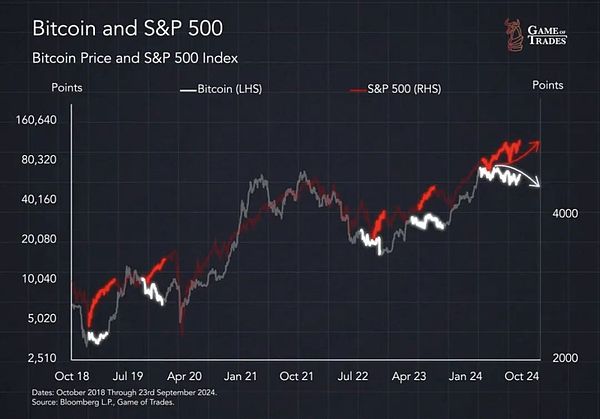

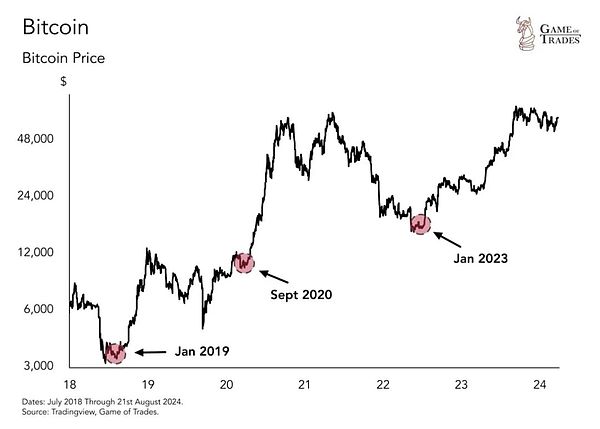

Generally speaking, the rising phase of BTC will resonate with the US stock market. For example, as shown in the figure below, the bottom recovery from the end of 2018 to the middle of 2019, the early fast bull market from April 2020 to the beginning of 2021, and the exit from the bear market from the end of 2022 to the beginning of 2024, etc.

However, at some point, we will also see the trend of BTC and US stocks diverge. For example, as shown in the figure below, at the end of 2018, BTC fluctuated sideways at the bottom of the bear market, and the S&P 500 rose. In the second half of 2019, BTC fluctuated and fell, and the S&P 500 rose. In the second half of 2022, BTC bottomed out in the bear market, and the S&P 500 rose. In early 2023, BTC adjusted and adjusted, and the S&P 500 rose. The most recent long-term divergence was since March 2024, when BTC fluctuated sideways and fell, and the S&P 500 rose.

Therefore, many people have an illusion that if BTC rises, the US stock market will definitely rise; if the US stock market rises, BTC may not rise; but if the US stock market falls, BTC will definitely fall. From this point of view, the US stock market should rise more often than BTC. But the final result is that the increase of BTC far outperforms the US stock market.

It's like a father running with his son. When the son starts running, the father sometimes speeds up, and sometimes walks slowly. When the son can't run anymore, the father will stop and wait for him. But as long as the father speeds up, he can always easily surpass his son. Don't just see that the son runs much longer than the father. In fact, the father always runs faster and farther than his son in less time. BTC is the father, and the US stock market is the son.

So this time from March to September now, the son is still running, but the father stopped and walked slowly. This is waiting.

The 6-month consolidation provides ample time for those who entered the market in March to increase their positions and establish positions when the market falls. The average cost of establishing a position is about $60,000. This is the starting point for the next stage of the market.

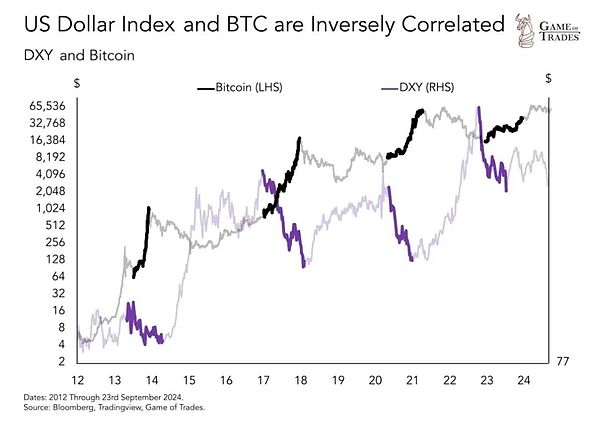

BTC is a sensitive indicator of a weakening U.S. dollar. It has a negative correlation with the U.S. dollar index DXY. As shown in the figure below, DXY fell in 2013 and BTC soared, DXY fell in 2017 and BTC soared, DXY fell in 2020 and BTC soared, and DXY fell in 2023 and BTC recovered rapidly.

Why? Because the so-called rise and fall of BTC is the nominal price denominated in US dollars. When the US dollar is weak, the nominal price remains unchanged, which is equivalent to a discount. This will induce non-US buyers to rush to buy, and demand will surge. This is precisely due to the unique advantages of BTC as a world currency and global asset.

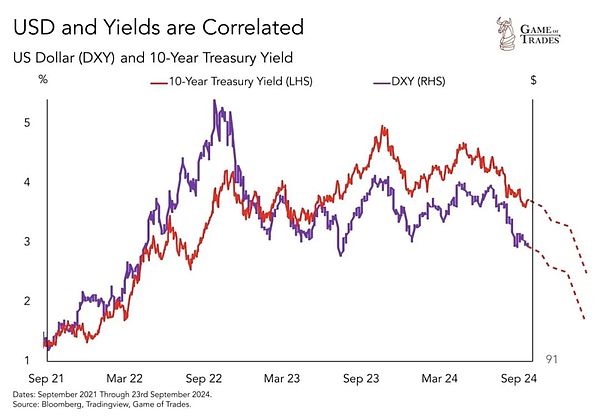

Now, the Federal Reserve has officially started to cut interest rates. This means that the US dollar will start a new round of decline along with the US Treasury yields.

This will hopefully drive a new round of BTC surge.

According to researchers’ estimates, the current market price of BTC is underestimated by about 50%. In the past, such a significant underestimation occurred in January 2019, September 2020, and January 2023.

The three times such a significant underestimation occurred in the past were all the eve of a major BTC explosion.

Sit tight, fasten your seat belts, and don’t be thrown out of the car. The fun, exciting and thrilling journey is about to begin!