From Bitcoin poised for a new bull run to Ripple receiving regulatory approval from the Dubai Financial Services Authority (DFSA), here are some of the top stories in the crypto space.

A crypto strategist who predicted a Bitcoin Dip in 2022 says time is running out for BTC bulls to show their strength.

Anonymous analyst DonAlt told his 62,300 YouTube subscribers that technical conditions are ripe for Bitcoin to start a new bull run.

According to a top trader, the deep correction in August that took BTC below $50,000 was the push Bitcoin needed to move higher. The analyst stressed that any signs of weakness now could put the flagship asset in a position to see a prolonged bear market.

“If BTC fails to rally and returns below the $58,000 support, the bear market will continue. But the leading asset is in a breakout position and will only go up from here…”

Source: DonAlt

DonAlt also pointed out a key level for the bulls, saying that BTC will explode if it moves above this price zone.

“If we return to $68,000 on the daily chart, there is nothing stopping BTC from continuing to grow… This is the most important level for the bulls to achieve in the coming time.”

Ripple, a leading digital asset infrastructure provider, has received regulatory approval from the Dubai Financial Services Authority (DFSA) to expand its services from the Dubai International Financial Centre (DIFC).

This milestone strengthens Ripple’s global footprint as a regulated entity and enables the introduction of seamless cross-border payment services, including Ripple Payments Direct (RPD), in the United Arab Emirates (UAE).

With the DFSA’s approval, Ripple will roll out its enterprise-grade digital asset infrastructure to a broad customer base in the UAE. This expansion is in line with Ripple’s mission to provide faster, more cost-effective, and more efficient cross-border payments solutions for businesses, by combining strict regulatory compliance with ongoing investments in critical infrastructure such as liquidation, best-in-class custody services, and fiat-to-digital asset on/off-ramps.

Winklevoss-founded exchange Gemini will close all Canadian customer accounts by the end of 2024.

In a September 30 email to Canadian users, Gemini said the exchange would close all Canadian accounts on December 31 and informed users that they have 90 days to withdraw assets from the platform.

“Starting December 31, 2024, Gemini will close all Canadian customer accounts with limited exceptions,” the exchange wrote in an email announcement.

Gemini ’s move comes months after Canadian financial regulators introduced regulations for crypto exchange and trading platforms operating in the country.

According to data from defillama, Chainlink (LINK) and oracles Pyth Network (PYTH), WINkLink (WIN), Chronicle (XNL), RedStone, and Switchboard have taken on the task of securing over $50 billion in Cryptoasset on blockchains.

Most of the Token associated with these oracles, which provide price feeds to smart contracts and blockchains, saw growth on Tuesday.

According to defillama, LINK's network has helped secure $23.33 billion across 405 blockchains.

Source: defillama

Chainlink powers a number of DeFi projects by providing price feeds and securing value for applications across the entire crypto ecosystem. Chainlink ecosystem assets LINK and PYTH rose between 2% and 3% on Tuesday, WIN gained 1% while XNL fell 7%.

RedStone and Switchboard secure assets worth $5.72 billion and $2.14 billion on more than 50 blockchains. Market participants are awaiting the launch of the RedStone Token , although there is no official announcement on the expected launch date yet.

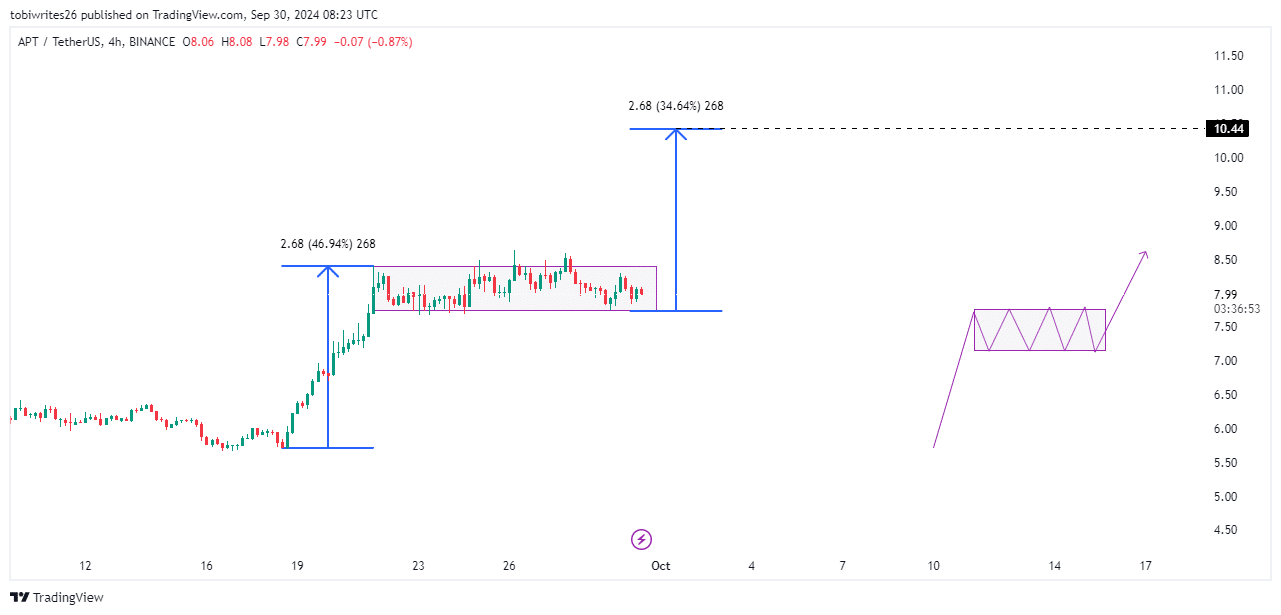

Aptos (APT) price spiked 17.84% before entering a consolidation phase at the moment. Over the past seven days, APT has only seen a slight increase of 0.33%.

APT is currently in a consolidation phase, a precursor to a strong rally. During this phase, traders often accumulate positions, buying more APT in the belief of a bullish move.

In the current scenario, APT is expected to surge to $10.44, marking a 34.64% increase.

Source: TradingView

However, a change in market direction could cause APT price to fall. This would be confirmed if APT suddenly drops sharply below the current consolidation channel.

Stellar Lumens (XLM) has reached a key resistance level after recording an 8.2% gain over the past four days. This is in line with the overall market trend as many altcoins have surged and bounced off short-term resistance levels.

Despite the bullish trend, the move has yet to clear resistance zones that have been in place since August or July.

Source: TradingView

The $0.103 resistance level has been in place since August. This is the third time since then that XLM bulls have attempted to break above this level. The market is likely to continue to face rejections, especially as the bullish momentum from BTC wanes, unless XLM succeeds in flipping this level into support.

Technical indicators paint a bullish picture. OBV has broken above the local high, which could be an early sign of a bounce from the $0.103 resistance. The daily RSI reflects solid bullish momentum. However, there are still warning signs of a pullback in price action.

Jesse Pollak, creator of the Layer-2 Base blockchain, said he has received an offer to lead the Coinbase development team, responsible for the exchange's wallet.

“I am really excited to take on this new role and accelerate our mission of bringing one billion users and one million builders on-chain. Coinbase Wallet will continue to operate across the entire on-chain economy and will begin the work of realizing Base’s other values in a variety of ways.”

Coinbase first launched its self-custody wallet in 2017 for mobile, then in 2021 for desktop as an extension for Google's Chrome browser.

Pollak was named one of CoinDesk's most influential people of 2023 for his work on Base, a blockchain that recently surpassed $2.2 billion in total value locked (TVL), and launched a version of Wrapped Bitcoin on the protocol in mid-August.

Crypto research organization Coin Center is making changes to its senior leadership.

CEO Jerry Brito said in a post on X that Brito and Robin Weisman, senior policy adviser at the nonprofit, will step down at the end of the year. However, both will remain on the board.

Peter Van Valkenburgh, Coin Center's current director of research, will take over as CEO on January 1, 2025. Landon Zinda, currently a policy adviser, will become the advocacy group's policy director, Brito added.

You can XEM coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine