Table of Contents

ToggleBitwise XRP ETF application emerges

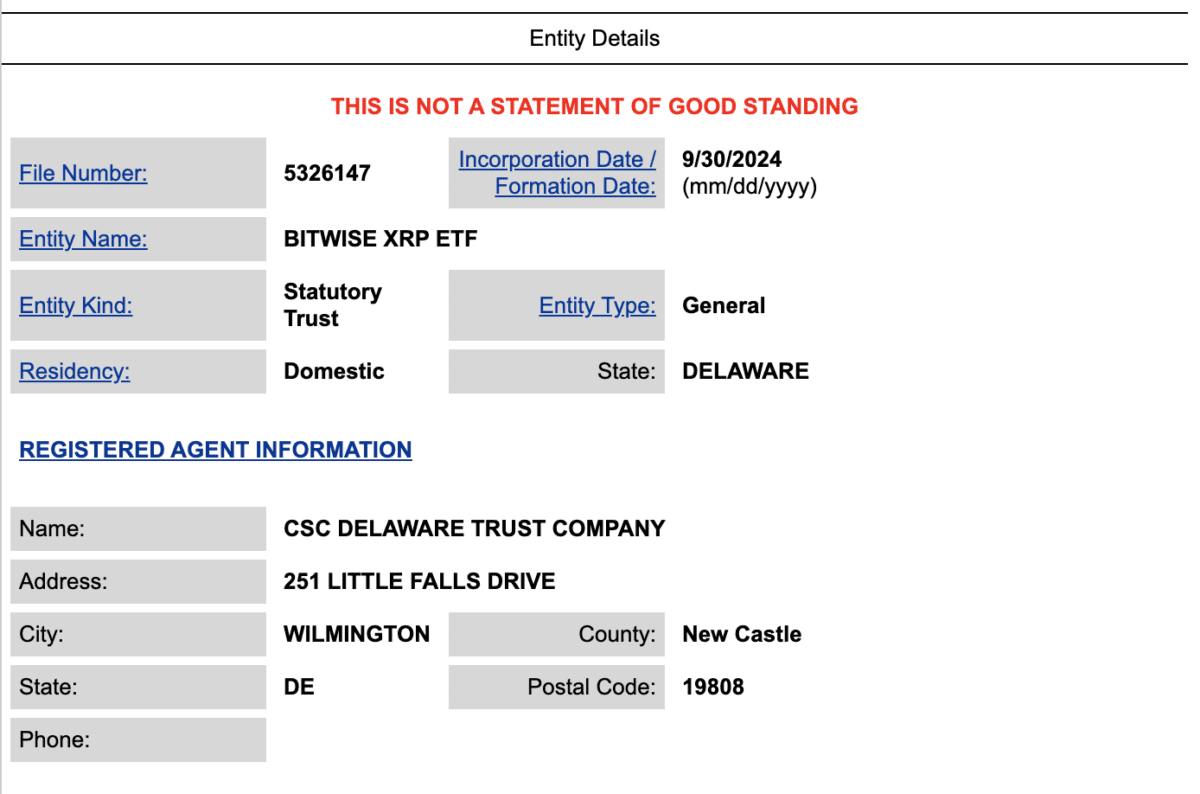

According to Cointelegraph, an application for a Bitwise XRP exchange-traded fund (ETF) recently appeared on the website of the Delaware Division of Corporations. According to the documents , Bitwise XRP ETF was incorporated on September 30, 2024, and the registered agent is CSC Delaware Trust Company in Wilmington, Delaware.

It should be noted that the filing of this application in Delaware does not mean that a registration application has been filed with the U.S. Securities and Exchange Commission (SEC). This may just be an early preparation for future ETF launches, and it may be closer to the formal filing of an SEC application. It will take several months.

Ripple CEO hints at XRP ETF launch

The submission of this application coincides with Ripple CEO Brad Garlinghouse’s earlier prediction of the XRP ETF. After the launch of Bitcoin and Ethereum ETFs in the United States, he said that an XRP ETF was “inevitable.” If the XRP ETF is ultimately approved, it would allow institutional investors to participate in the XRP market through a regulated investment vehicle and potentially increase liquidity and adoption of the token.

XRP ETF Rumors and Implications

In recent months, there have been rumors about the listing of an XRP ETF. In November 2023, a fake "BlackRock iShares XRP Trust" application appeared in Delaware, which caused market speculation about the imminent launch of the XRP ETF and pushed the price of XRP up by 12%. However, the application was ultimately denied by BlackRock, and the Delaware State Prosecutor's Office is currently investigating the truth of this false application.

SEC’s long-running dispute with Ripple

Bitwise’s Delaware filing comes amid a years-long legal dispute between the SEC and Ripple Labs. The SEC sued Ripple in 2020, charging that its sale of XRP constituted an unregistered securities offering. However, in July 2023, Judge Analisa Torres won a partial victory for Ripple by ruling that XRP does not qualify as a security when sold on a public exchange, but XRP sold by institutions may still be considered a security offering.

In September 2024, the case ushered in the latest development. The SEC and Ripple jointly applied to suspend the final judgment of the case pending the outcome of the SEC's appeal. If the application is granted, the court will stay further proceedings pending the outcome of the appeal.