A quick overview of important events this week (9/29-10/5)

- Fed Trends : Powell said on Monday that if the economy meets expectations, interest rates will be cut by 50 basis points for the rest of the year, in line with market expectations.

- Middle East crisis heats up : Iran launches missile attack on Israel, U.S. port strikes increase economic turmoil

- The yen will not raise interest rates yet : the new Japanese Prime Minister expressed a dovish stance , the yen depreciated, and Japanese stocks rose

- Taiwan crypto ETF ban lifted : professional investors are allowed to purchase overseas Bitcoin spot ETFs on entrustment

- CZ News : CZ issued a long post after serving his sentence, saying that he will continue to invest in blockchain, AI, and biotechnology

- China’s bailout : Shanghai and Shenzhen lifted purchase restrictions , multiple policies stimulated the economy , and stocks rose sharply

Changes in trading market data this week

Sentiments and Sectors

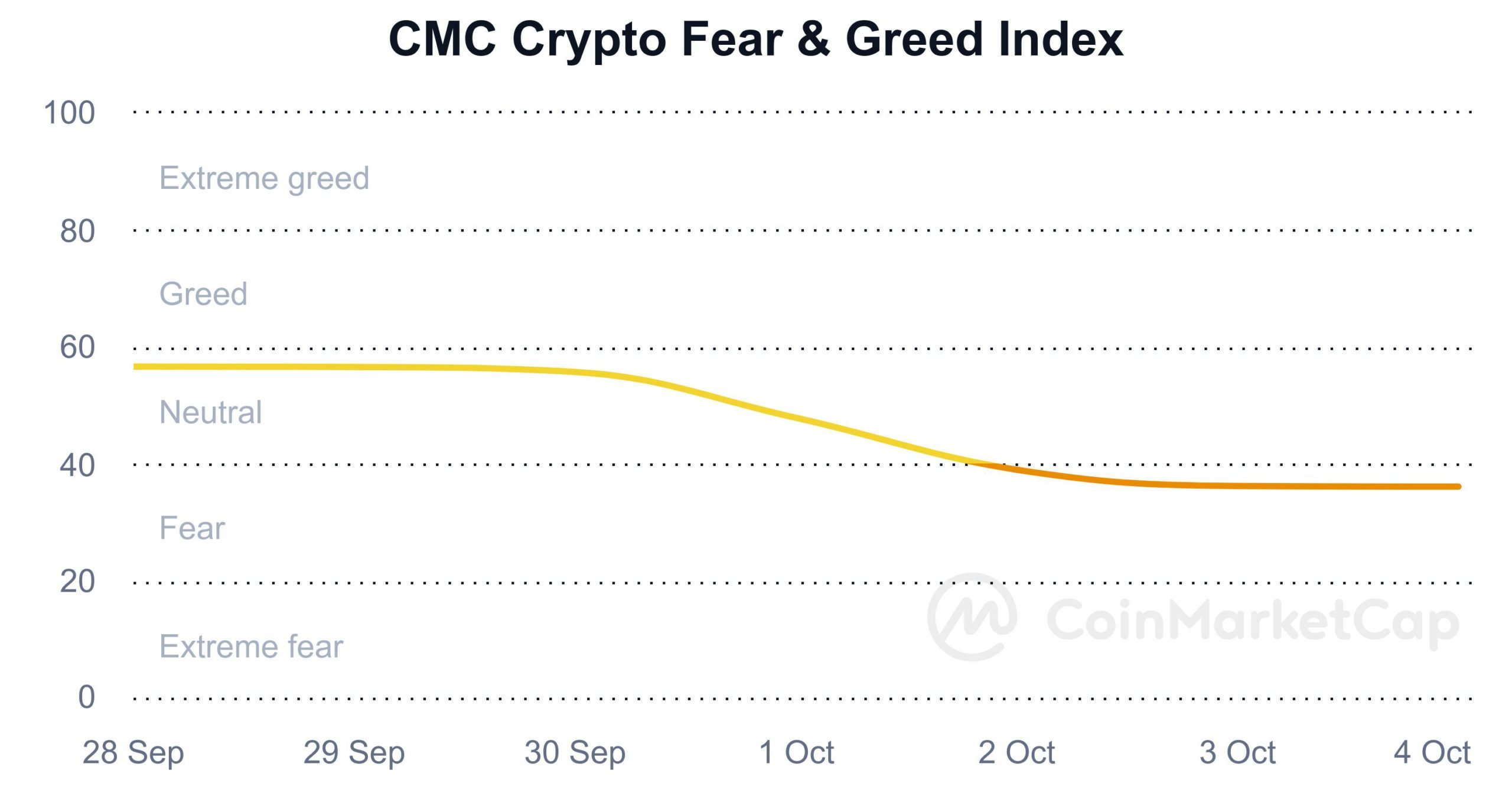

1. Fear and Greed Index

This week's market sentiment indicator fell from 56.67 (neutral) to 36.11 (fear).

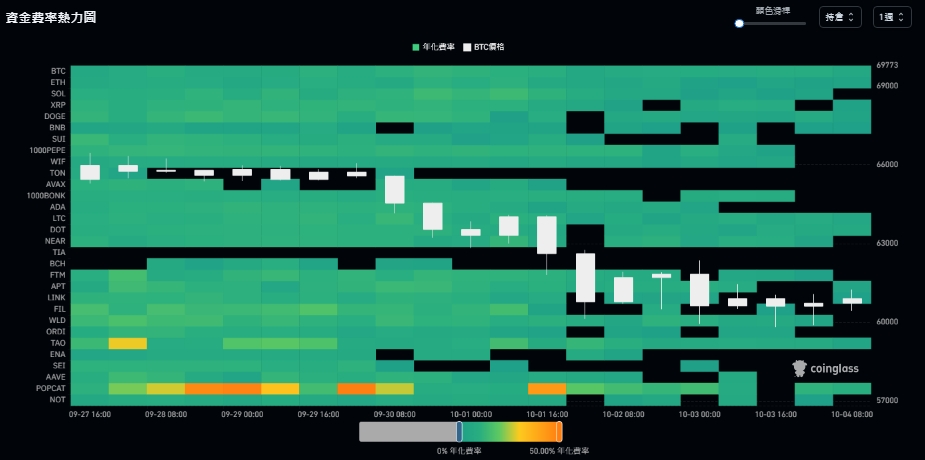

2. Funding rate heat map and long premium reduction

This week, the Bitcoin funding rate reached a maximum of 12.01% and a minimum of 5.37% . Overall activity has declined, funding rates have stabilized, and market sentiment has become calmer. Last week, the market activity was relatively high, funding rates fluctuated greatly, and trading volatility was also strong.

The funding rate heat map shows the changing trend of funding rates for different cryptocurrencies. The color ranges from green with zero rate to yellow with 50% positive rate. Black represents negative rate; the white K-line chart shows the price fluctuation of Bitcoin. , in contrast to the funding rate.

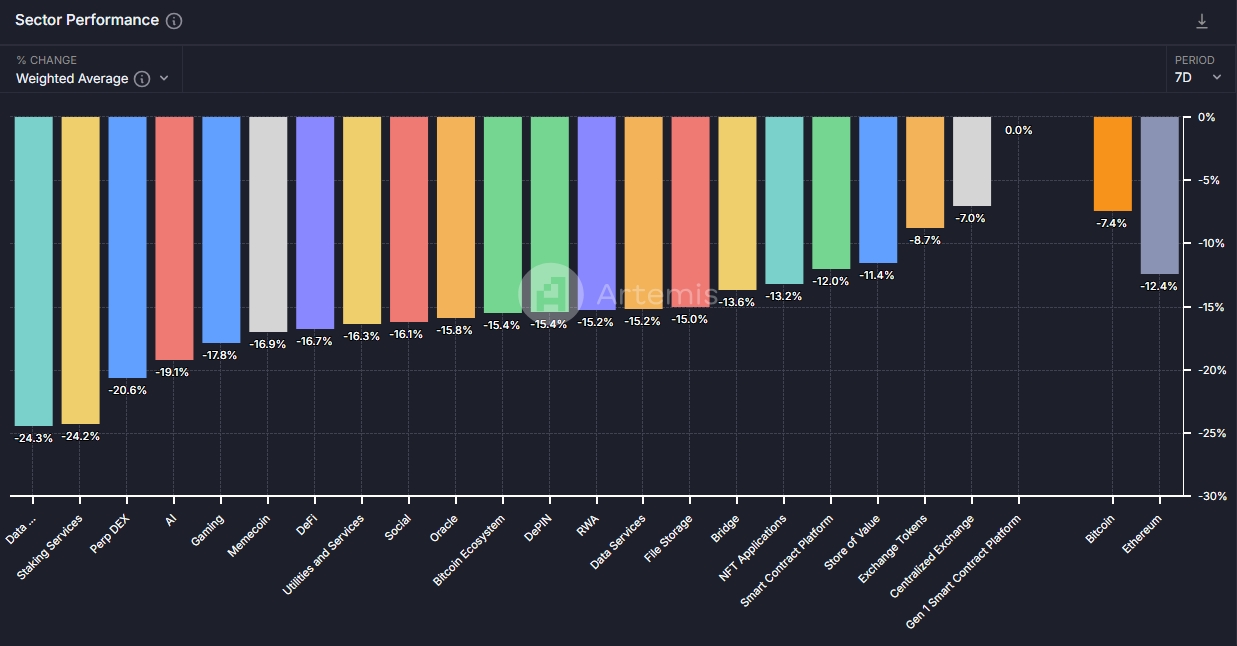

3. Sector performance generally fell

According to Artemis data, the average growth rate of the blockchain sector this week was ( -15.2%) , of which centralized exchanges, value storage, and smart contract platforms accounted for ( -8.7%, -11.4%, and -12%) respectively. Top three.

This week’s gains for Bitcoin and Ethereum were ( -7.4%, -12.4%) .

The three worst performing areas are: AI (-19.1%), Bitcoin ecosystem (-15.4%) and cross-chain bridges (-13.6%) .

market liquidity

1. Total cryptocurrency market capitalization and stablecoin supply

Data on the total market capitalization of cryptocurrency this week showed that it rose from US$ 2.29 trillion to US$ 2.11 trillion , a decrease of US$180 billion, and the total market value increased by approximately -7.86%.

The total stablecoin supply, an important indicator of market health and liquidity, fell from $ 160.38 billion to $ 159.69 billion this week, a decrease of $690 million, an increase of approximately -0.43%.

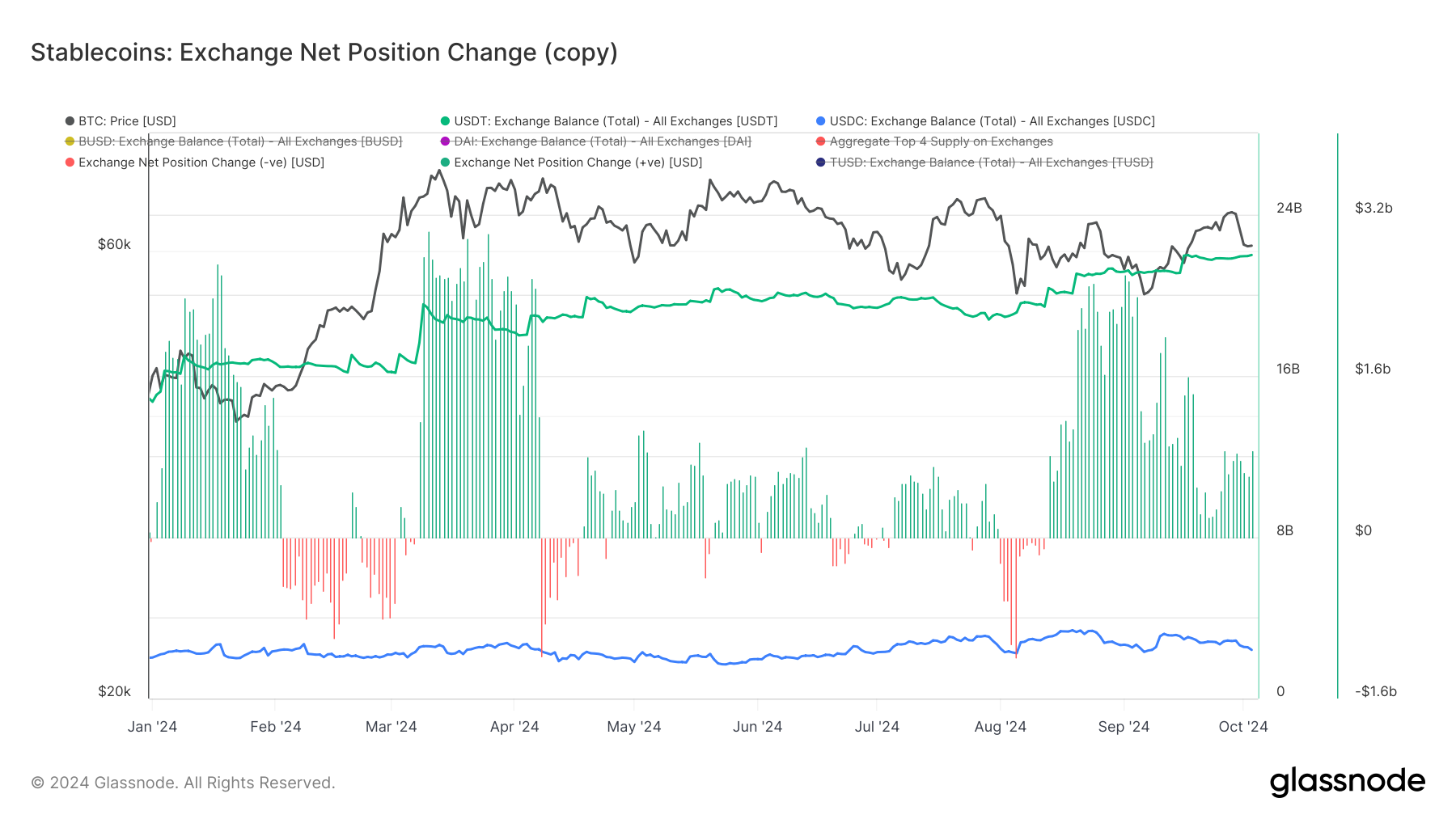

2. Potential purchasing power within the exchange

This week's data shows that the exchange's net position change is positive, USDT continues to increase but USDC shows a decreasing trend this week.

Bitcoin Technical Indicators

1. Bitcoin spot ETF net inflow of funds

Bitcoin ETF funds inflowed US$170.4 million this week, showing continued inflows of market funds.

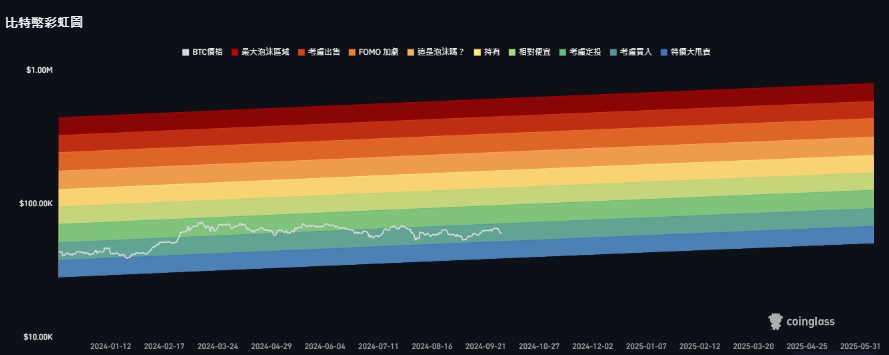

2. Bitcoin Rainbow Chart

The Bitcoin rainbow chart shows that the current price of Bitcoin is in the " consider buying " range ( $61,000 ), between the " considering fixed investment " stage ($70,000) and the " special sale " stage ($52,000).

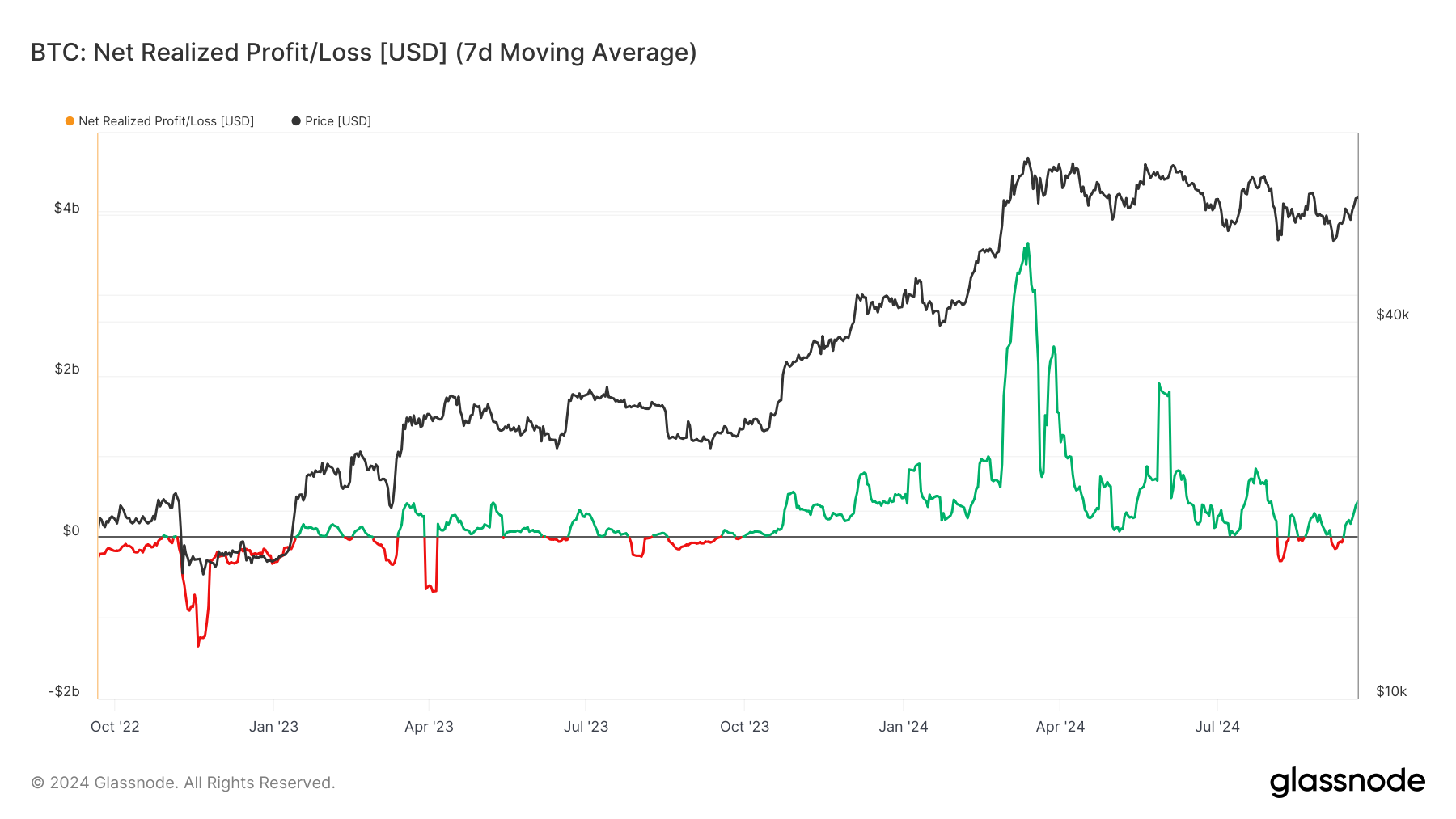

3. Bitcoin net profit and loss performance

Bitcoin's realized net profit and loss indicator shows that the current market conditions have recovered, and the proportion of profits and losses is generally similar to last October .

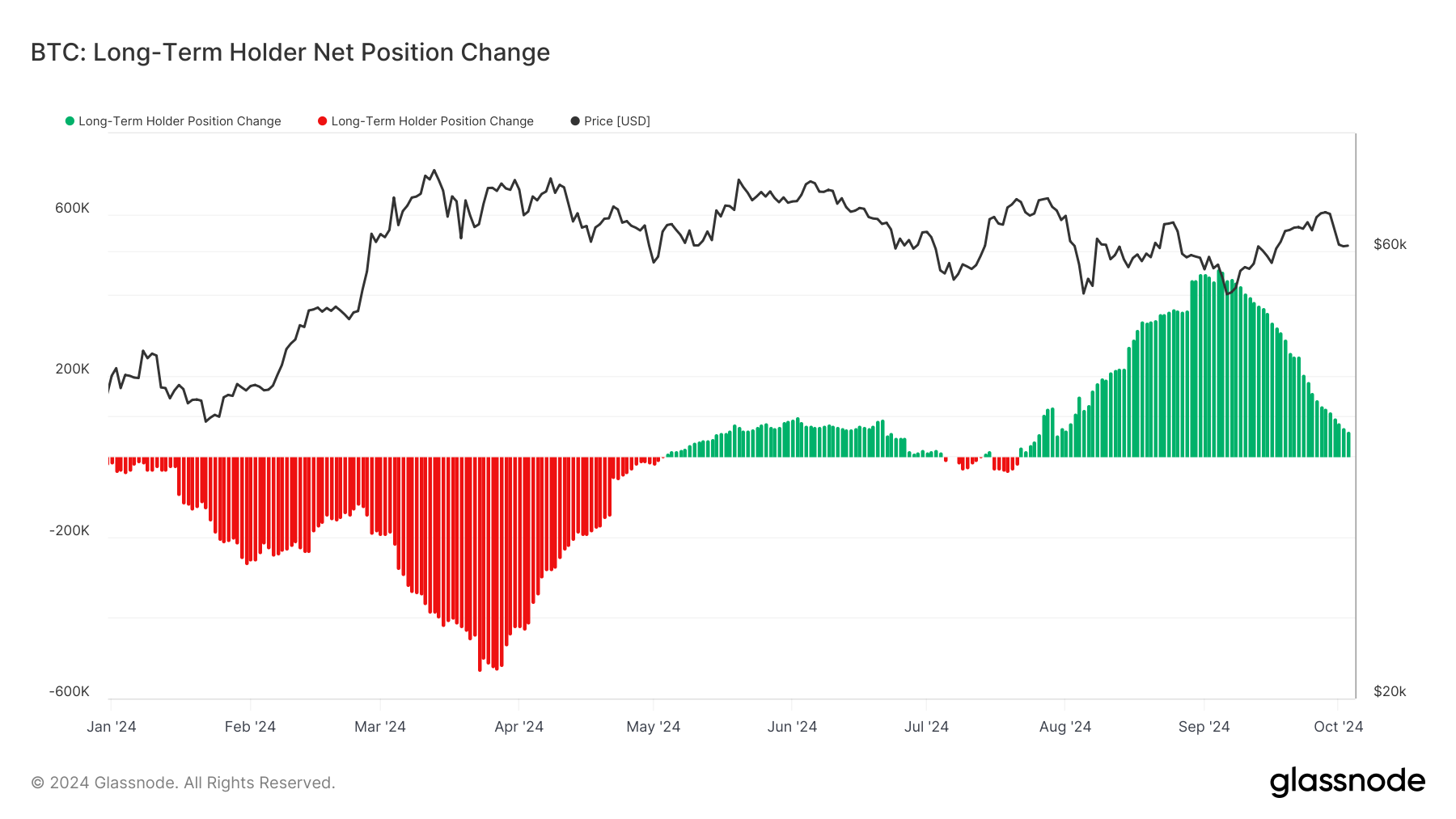

4. The continued decline in the number of long-term Bitcoin holders

According to on-chain data , the net positions of long-term holders (LTH) have maintained a decreasing increase over the past seven days, showing that the market’s long-term confidence in Bitcoin has not been broken and long-term holders are continuing to accumulate Bitcoin positions.

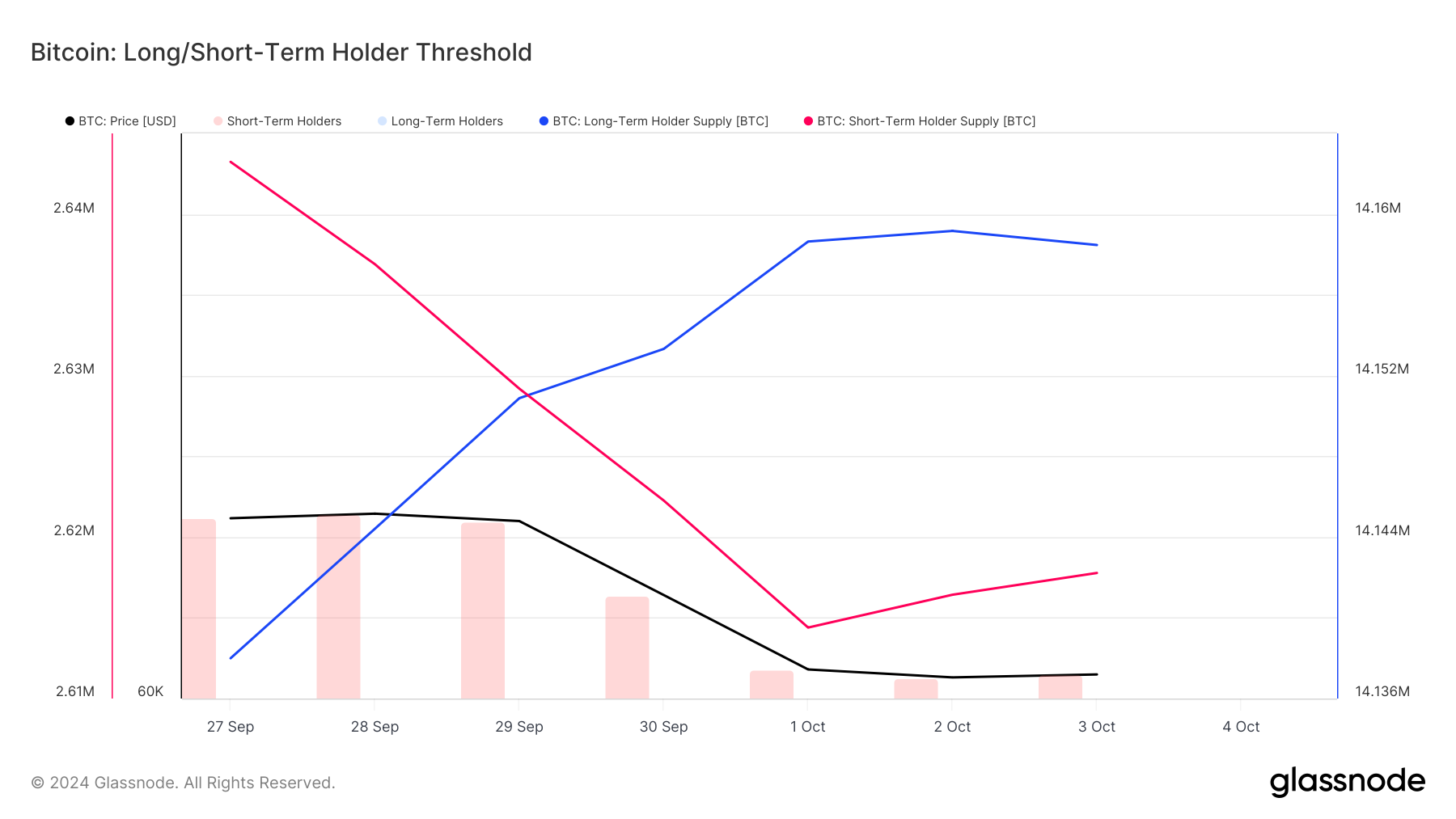

5. Short-term selling of purchasing power on the Bitcoin chain

According to on-chain data , the BTC market this week showed heavy selling by short-term holders, causing supply to drop and triggering price declines. At the same time, long-term holders have chosen to increase their holdings when the price falls, indicating that they have stronger confidence in the long-term value of BTC.

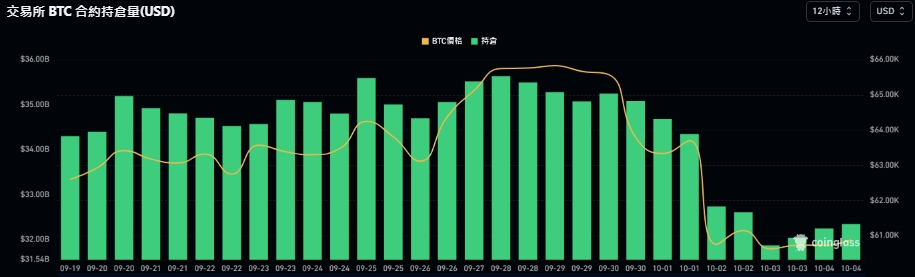

6. Bitcoin contract positions record short-term decline

According to data , contract positions on Bitcoin exchanges showed a steady downward trend this week, falling from US$3.55 billion to US$3.23 billion . This may be related to the fact that the market quickly fell to US$60,000 and long positions were liquidated.

Important technical indicators of Ethereum

1. Ethereum spot ETF funds continue to see net inflows

Ethereum ETF saw a net inflow of US$13.8 million this week.

2. Bitcoin Relevance

Data this week shows that the correlations between BTC, ETH, and SOL are 0.9 and 0.92 respectively. Compared with last week, the correlation between BTC and ETH has increased significantly. The correlation between ETH and BNB remains at a high level of 0.91. The market trends this week have become consistent, especially the recovery of linkage between BNB and SOL and other mainstream currencies.

3. Total Locked Volume (TVL)

Data this week shows that the DeFi market is relatively stable, with the total locked-up volume remaining at around US$81.7 billion.

Market analysis news this week

1. Bitcoin clings to US$60,000》CMC: The peak of this round of BTC is expected to be in May or June next year, and the bull market will end sooner than imagined

CMC Research said that this round of bull market is affected by many factors and is about 100 days ahead of previous bull market progress. Bitcoin is expected to reach its peak from mid-May to mid-June 2025. ( continue reading )

2. Not surprising? TON ecological tokens DOGS, CATI, HMSTR... have been falling since their launch!

After DOGS, Catizen, and Hamster Kombat of the TON ecosystem were listed on exchanges one after another, except for DOGS, which saw a brief rise after the opening of trading, Catizen and Hamster Kombat all fell all the way. ( continue reading )

3. China’s bailout sucks away hot money from the crypto? 10x Research: Speculators may have switched from Bitcoin to mainland A-shares

Driven by China's large-scale economic stimulus measures, China's stock market has continued to rise sharply in recent days. According to 10x Research analysis, the current short-term technical indicators of Bitcoin appear to be in an overbought state, and speculative traders may have switched from Bitcoin to Chinese stocks to obtain gains. Higher exposure to high volatility. ( continue reading )

4. Chinese experts shout: Expand borrowing 10 trillion yuan to stimulate the economy, but don’t be afraid if you are still in the safe zone

The People's Bank of China has recently launched a new round of economic stimulus policies, which has stimulated a surge in China's stock market. Jia Kang, former director of the Fiscal Science Institute of the Ministry of Finance and founding director of the China New Supply-side Economics Research Institute, recently suggested that fiscal policy should step up to keep up. , the government can issue up to 10 trillion yuan (approximately NT$46 trillion) of additional national debt and significantly increase investment in public projects to boost economic confidence. ( continue reading )

5. Taiwan’s “recommended” ban on buying Bitcoin ETFs has been lifted. Can you estimate how much new funds it can bring to BTC?

Taiwan is gradually opening up entrusted investment in overseas virtual asset spot ETFs, providing more choices for cryptocurrency investors. This article uses a simple method to roughly estimate how much potential funds Taiwanese investors may bring to Bitcoin? ( continue reading )

Cryptocurrency regulatory status in various countries

1. The world's first country to recognize the legality of Bitcoin transactions, a quick look at the "Germany" encryption tax and regulatory system

Germany is open to cryptocurrencies, providing friendly tax policies and regulatory frameworks to promote the healthy development of the cryptocurrency market. ( continue reading )

2. Taiwan opens overseas Bitcoin spot ETF! Take a look at the key purchase conditions and specifications at once

The Financial Supervisory Commission has opened up professional investors to invest in overseas virtual asset spot ETFs through multiple entrustment, which not only provides investors with more investment options, but is also a big step for Taiwan's financial innovation. ( continue reading )

3. Binance completed VASP registration in Argentina, achieving the world’s 20th regulatory milestone

Binance announced that it has completed registration in Argentina and has become a virtual asset service provider (VASP) under the regulatory compliance of the Argentine National Securities Commission (CNV). ( continue reading )

The U.S. Securities and Exchange Commission (SEC) announced today that Gurbir S. Grewal, director of its Enforcement Division, will resign on October 11. Grewal took a tough stance on the cryptocurrency industry during his tenure and sued many crypto giants such as Binance and Coinbase. His Will leaving represent a shift in attitude at the SEC? ( continue reading )

The new president of Japan's Liberal Democratic Party, Shigeru Ishiba, was appointed as the 102nd Prime Minister today. Not only did he appoint Japan's Web3 promoter Masaki Taira as a digital minister, but also the use of blockchain and NFT technology as a digital minister appeared in Ishiba Shigeru's official policy documents. Strategies to revitalize local economies. ( continue reading )

With the passage of Uruguay’s cryptocurrency bill, the country becomes the fifth country in Central and South America to provide a clear legal framework for crypto service providers. ( continue reading )

Market focus next week

10/4 (Friday)

- United States: Average hourly wages in September (compared to previous period), forecast 0.3%, previous value 0.4%

- United States: September non-farm payrolls, forecast 148K, previous value 142K

- United States: Unemployment rate in September, forecast 4.2%, previous value 4.2%

10/9 (Wednesday)

- New Zealand: Interest rate decision, last value 5.25%

- United States: Crude oil inventories, previous value 3.889M

10/10 (Thursday)

- United States: FOMC meeting minutes

- United States: Core Consumer Price Index CPI in September (compared to previous month), previous value 0.3%

- United States: Consumer Price Index CPI in September (compared to the same period last year), previous value 2.5%

- United States: Consumer Price Index CPI in September (compared to the previous month), the previous value was 0.2%

- United States: Initial Jobless Claims

10/11 (Friday)

- UK: August GDP (compared to previous month), previous value 0.0%

- Germany: Consumer Price Index CPI in September (compared to the previous month), forecast 0.0%, previous value 2.6%

- United States: Producer Price Index PPI in September (compared to previous month), previous value 0.2%

Recommended activities

Moving block gathering #150

After Tornado Cash developer and Telegram founder Durov was criminally charged, look at the dilemma faced by open source developers!

When: Wednesday, October 9

Recommended interview videos

1. Scott Moore, the founder of Gitcoin, made a shocking statement: Ethereum is a consensus system that transcends voting and praised Taiwan as the best bridge between reality and Web3 governance.

( Video link )

Top 5 popular articles this week

1. Black Swan Fund warns: U.S. stocks, cryptocurrencies, and gold will “flash crash before the end of the year.” Is a major market change coming?

Benefiting from the wave of interest rate cuts by the world's major central banks, U.S. stocks continue to hit record highs. U.S. stocks, currency markets, and gold have all performed well recently. However, Mark Spitznagel, founder of the well-known black swan fund Universa, warned on Thursday that due to the economic slowdown, U.S. stocks and cryptocurrency , gold may crash before the end of the year. ( continue reading )

2. Comrade Satoshi Nakamoto” The late Bitcoin developer “Hal Finney” transferred 46 BTC from his wallet this month. What happened?

Hal finney, an early Bitcoin developer, has transferred dozens of Bitcoins to the Kraken exchange since his wallet woke up in early September. This article will take you to review his great contribution to the cryptocurrency world. contribute. ( continue reading )

3. When rich dad threw away his survival rules during the "worst financial crisis in history", Bitcoin was not his first choice?

Robert Kiyosaki, the author of Rich Dad, tweeted yesterday that before the worst financial crisis in history, investors can deposit cash equivalent to 2 months of living expenses in advance and purchase silver coins for storage, and reminded not to store cash in banks. ( continue reading )

If you have enough cash and silver coins, like American Silver Eagles, for two months of expenses, then buying more Bitcoin might make you stand out in the world.

4. Ball "smashed expectations of a major interest rate cut": the Fed cut a total of 50 basis points at the end of the year, and the US stocks Dow Jones and S&P continued to hit new highs

Federal Reserve (Fed) Chairman Jerome Powell said last night that if the U.S. economy performs as expected, it will cut interest rates by a total of 50 basis points, which is considered a hawkish statement. However, U.S. stocks fell briefly and then turned red. The Dow Jones and S&P indexes continued to hit new closing highs. Except for the Federal Reserve, the other three major indexes all closed slightly higher. ( continue reading )

If the U.S. economy performs as expected, it means there will be more rate cuts this year, totaling another 50 basis points.

5. Bitcoin plummeted while gold and oil surged. Why is it difficult for BTC to be used as a safe haven in war?

The intensification of conflicts in the Middle East has caused turbulence in global markets, and prices of gold and crude oil have risen in response. However, as a possible safe-haven asset, Bitcoin's performance failed to meet the expectations of a safe-haven asset and instead suffered a heavy setback. Why? ( continue reading )