CPI growth is expected to slow further

This is good news for risk assets like Bitcoin and Ethereum, says Scott Garliss.

Inflation growth is rapidly approaching the Federal Reserve's 2% target.

One of my favorite parts of the day is drinking coffee in the morning. After my espresso machine preheats, I look forward to making two lattes, each with a shot of espresso. This has become a part of my daily routine, to the point where I often feel like my day can't start without it.

Before COVID, my daily routine was a bit different. Back then, I still looked forward to my daily coffee, but I didn't make it myself. Instead, I enjoyed going out to buy coffee. I would come into the office, get my morning work done, and then run out to see my favorite barista and enjoy a hot cup of coffee.

When I first returned to the office, everything had changed. You see, before the pandemic, I would spend around $10 a day, or $5 per cup. But when I first got my coffee, I noticed the price had gone up to $7.50. While the previous $5 per cup didn't bother me, as that price had held for many years, this increase was noticeable.

It wasn't long before I started cutting back on my trips to buy coffee, only getting one cup. Soon after, I was only getting a few cups per week. Facing the savings from making my own coffee, a 50% price increase per cup felt like a gut punch. I no longer felt it was worth it.

Recently, I've been pressed for time and unable to make my own coffee. So, I've stopped to buy a latte. When I paid for it, I found the price hadn't changed. I believe many people, like me, are experiencing similar situations. After the post-pandemic price spikes on all sorts of goods, you're less willing to spend your hard-earned money on purchasing them.

Later this week, the Bureau of Labor Statistics will release the September inflation growth indicator. When this data is released, it will show that price pressures have reached their lowest level since February 2021. This change will support our central bank in further rate cuts, providing a tailwind for the stabilization and rebound of risk assets like Bitcoin.

But don't just take my word for it, let's look at what the data is telling us.

Each month, the Federal Reserve Banks of Dallas, Kansas City, New York, and Philadelphia survey manufacturers in their respective regions about the state of activity. The questionnaire asks these companies about new orders, delivery times, employment, and production, among other things. It also asks if costs are rising, falling, or staying the same.

But we need to focus on the "prices of goods." This number indicates the prices customers are paying for the manufacturers' finished products. This is similar to the Consumer Price Index (CPI). So, the direction of the prices received is an indicator of whether inflation is rising or falling.

Now, the states where these four bank headquarters are located - Texas, Missouri, New York, and Pennsylvania - account for about 25% of U.S. domestic economic output. So, we can get a pretty good sense of national demand. And these results are published ahead of the CPI, so it's like getting a sneak peek at the data.

And the latest readings show that the prices received have been declining...

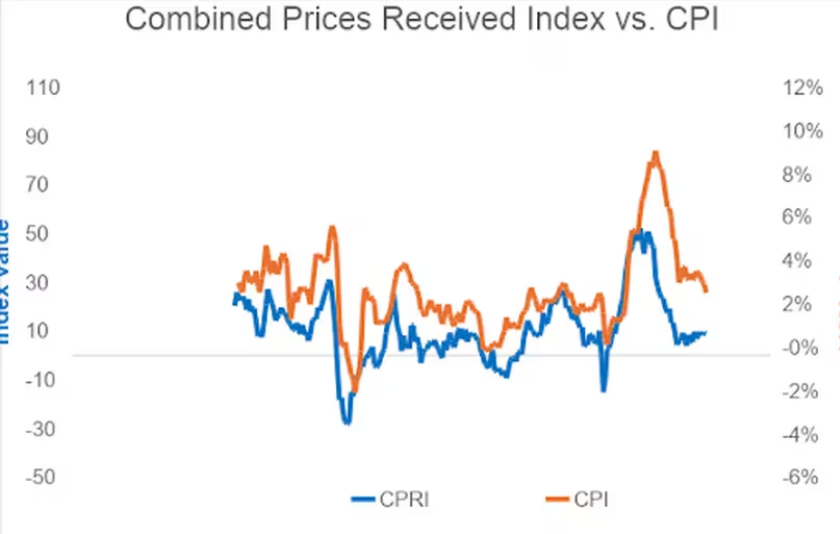

In the chart above, I've combined the readings from the four central banks into a composite indicator. This indicator is called the Composite Price Received Index (CPRI), and it's shown by the blue line. I've compared it to the Consumer Price Index (CPI, orange line). As you can see, the CPRI tends to be a leading indicator. It peaked in October 2021. However, it wasn't until June 2022 that the CPI finally reached its highest level in over 40 years, and then started to decline.

As you can see in the chart above, my index maintained a stable trend in 2019 and early 2020. Inflation growth also followed suit, staying below 2% the whole time. But when businesses sent their employees home in the early stages of the pandemic, the CPRI index declined. As the economy reopened, the index started to rise again. In each case, we can see the CPI performance is similar, but lagging.

Now, the CPRI trend appears to be stabilizing. You can see this by looking at the right side of the chart. This change is happening against the backdrop of us seeing consumers' excess COVID savings gradually disappear and consumption slowing. This means people's sensitivity to prices is increasing, and they are more inclined to hold onto their own funds.

In December 2023, the index reading was 8.4. Last month's reading was 8.8. In fact, so far this year, the index has been holding steady between 5 and 10. This is important because the longer it stays stable, the more likely it is that inflation growth will slow. This is because the annualized readings will bring down the earlier higher numbers, helping to bring CPI back below the 2% target.

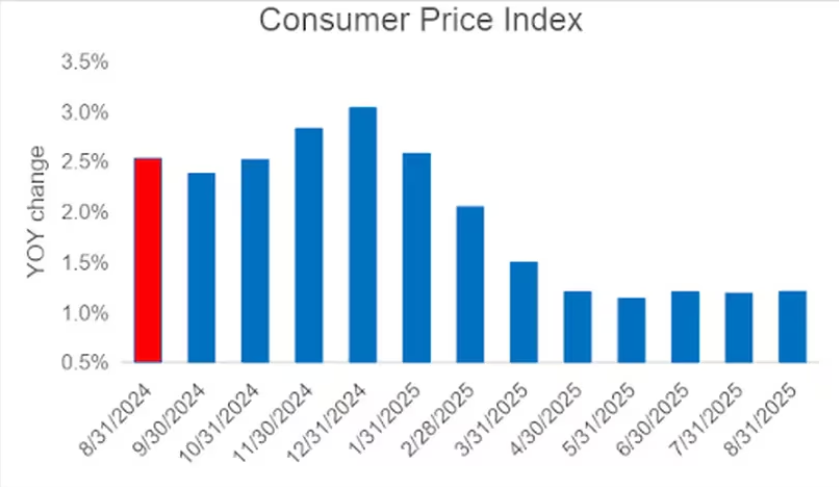

Over the past three months, inflation has been growing at a 0.1% monthly pace. If this pace continues, we may see annualized growth down to 1.5% by March 2025.

As you can see, the regional central bank economic teams expect overall CPI to decline from 2.5% in August to 2.3% in September. This will be the lowest reading since March 2021, when inflation data started to surge significantly.

As I said at the beginning, price growth is slowing. Manufacturers tell us they are finding it increasingly difficult to pass on price increase pressures to consumers. And if my model is correct, we'll soon see inflation growth return to 2%.

So, don't be surprised when the report later this week confirms what my indicator has been showing. The easing of price pressures should bolster the Fed's confidence in the slowing of inflation growth. This will provide room for the central bank to further lower interest rates. This change will be a tailwind for the long-term stable rise of risk assets denominated in dollars, including Bitcoin and Ethereum.