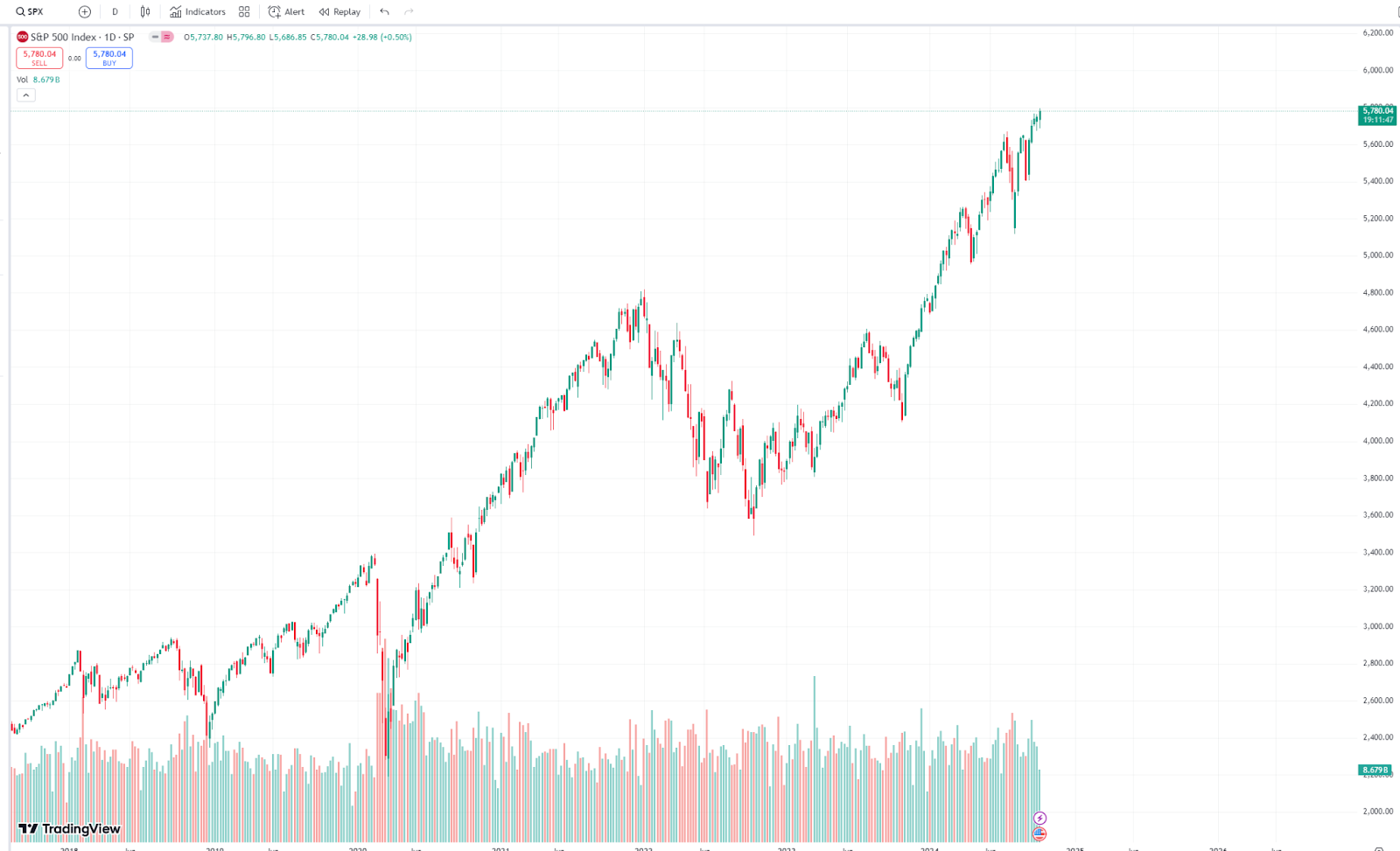

In the past few months, the performance of the S&P 500 has been enviable. Tech stocks have been marching forward steadily, pushing the index to new highs time and again.Especially this past Tuesday, with the strong support of earnings reports from AI and big tech companies, the S&P 500 index soared to 5,796.80 points, setting a new record high. The market is filled with optimism, and investors' joy is almost overflowing.

However, in stark contrast to the stock market's revelry is Bitcoin's fatigue. As the "king" of the crypto world, Bitcoin's performance has been lackluster. The price has been fluctuating between $50,000 and $65,000, far from the dizzying heights of the bull market. Especially after the release of the CPI data by the Federal Reserve last night, Bitcoin experienced significant volatility. The data showed that the unadjusted CPI year-on-year in the US in September recorded 2.4%, the sixth consecutive month of decline, reaching a new low since February 2021.After the release of this data, the S&P 500 dipped slightly during the session but then quickly rebounded, with the index barely affected. However, the Bitcoin price briefly fell below $59,000.

Macro market liquidity remains ample, and economic data is also bright, boosting investor confidence, but Bitcoin prices have failed to rebound in sync. It was not long ago that Bitcoin and the S&P 500 were almost in sync, rising and falling together. But now, the S&P 500 has left Bitcoin far behind, while Bitcoin is stuck in a wide range of fluctuations. What has happened behind the scenes? Today, let's take a closer look at the reasons.

2020-2022: The Honeymoon Period of Bitcoin and the S&P 500

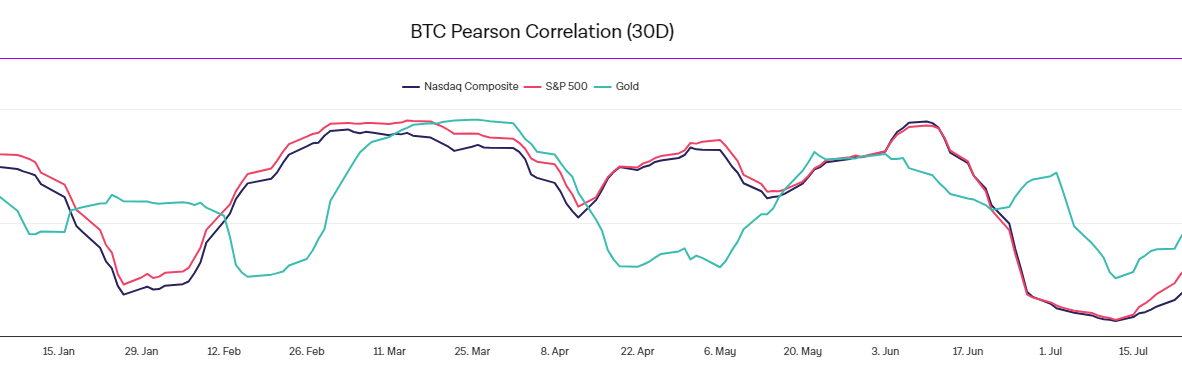

According to newhedge's data, during the period from 2020 to 2022, the 30-day rolling correlation coefficient between Bitcoin and the S&P 500 index exceeded 0.6 multiple times, showing significant positive correlation. Everyone was dancing to the same beat.

Aftermath of the Pandemic: Risk Assets Soar Together

To talk about the honeymoon period of Bitcoin and the S&P 500, we have to trace back to the period after the pandemic.In 2020, the global pandemic broke out, the economy came to a standstill, and the capital market was in a state of panic. As a result, central banks around the world opened the floodgates, with the Federal Reserve directly lowering interest rates to near zero, implementing a loose monetary policy on one hand and large-scale bond purchases on the other, resulting in a "surging" amount of funds in the market.

When liquidity is abundant, risk assets benefit the most. Under the "bull" policy of the Federal Reserve, the S&P 500 rebounded from the low point of the stock market crash in March 2020, reaching new highs repeatedly in 2021. On the other side, Bitcoin also rose with the capital tide, from a low of $3,800 to $64,000, even touching a historical high of $69,000 by the end of the year. At that time, Bitcoin and the S&P 500 were like a pair of brothers, dancing to the same rhythm, whether it was the Federal Reserve's decisions or changes in investor sentiment.

Investor Sentiment and Market Risk Appetite: Risk Appetite Rises Together

During that period, the expectation of global economic recovery was strong, and investors' risk appetite also soared. The market was full of people shouting "buy", whether it was the stock market, the real estate market, or the cryptocurrency market, they were all hot commodities. Everyone was looking for high-yield targets, and both Bitcoin and the S&P 500 became the sweet cakes of capital. The more the Federal Reserve's "printing press" ran, the higher the prices of risk assets soared.

In this market atmosphere, the S&P 500 and Bitcoin both enjoyed the nourishment of this capital tide. Whether it was the Wall Street whales or the retail investors, they all had some money, and they all wanted to take a gamble in the risk assets.

Institutional Capital Boost: From Wall Street to Bitcoin, Capital Blooms in Two Places

During 2020 and 2021, institutional investors also began to venture into the Bitcoin market. At that time, Grayscale Trust (Grayscale) had almost become synonymous with institutional Bitcoin purchases, and MicroStrategy even went "all in", treating Bitcoin as a corporate asset. Tesla also bought Bitcoin for a time, sparking a wave of corporate Bitcoin purchases.

These institutional funds not only are the main players in the traditional stock market, but also after entering the Bitcoin market, have provided the basis for the synchronization of Bitcoin prices and the S&P 500 index. The dual deployment of capital has driven the linkage effect between the two.

2023-2024: Why Have They Become "Fire and Ice" Now?

Especially in the past half year, Bitcoin has been fluctuating widely between $50,000 and $70,000, while the S&P index has been rising for six consecutive months.

Block data shows that in June-August, the 30-day Pearson correlation between Bitcoin and the S&P 500 index fell to -0.84 and -0.82 respectively, the lowest since November 2023. The former "Siamese twins" are now going their separate ways.

Federal Reserve Rate Hikes, Liquidity Tightening: Who's Skinny-Dipping When the Tide Goes Out?

Time has moved on to 2022, and the story of the market has taken a turn.To fight inflation, the Federal Reserve began to raise interest rates gradually from March 2022, and market liquidity has changed from "flooding" to "dripping". At this point, everyone realized that when the tide goes out, the S&P 500 can still swim, but Bitcoin seems to be struggling.

The Federal Reserve's rate hike policy has directly pushed up US dollar interest rates, raising the cost of capital, and the "faucet" of the capital market has been tightened. For the large companies in the stock market, especially the tech giants in the S&P 500, this environment has actually become a "blessing", as they have stable cash flows and profit support. The tech stock boom has been reignited, with good news constantly coming from sectors like AI and cloud computing, boosting market confidence.

But what about Bitcoin? As a highly volatile asset, facing the rate hike cycle, market funds have become more cautious, and the buying momentum is clearly insufficient. With less liquidity and less hot money, Bitcoin can no longer "take off" as easily as before.

Regulatory Crackdown and Policy Trends: Regulatory Thunders Undermine Market Confidence

Let's also look at the regulatory card. In recent years, the intensity of cryptocurrency regulation has been increasing globally, with policies in various countries like the Damocles' sword hanging over the market, constantly threatening its stability.Major economic powers such as the US, Europe, and Asia have all increased regulatory efforts on the cryptocurrency market, trying to curb the disorderly expansion of the market and potential financial risks.

China had already banned cryptocurrency mining and ICOs as early as 2018, and in 2021 it even expelled exchanges. The US SEC has repeatedly put the brakes on Bitcoin ETF approvals. In 2023, the SEC issued huge fines to Binance, totaling $4.3 billion, and Binance's founder CZ was even arrested and jailed, though he has since been released.

At the same time, Europe's MiCA regulation (Crypto Asset Markets Regulation) has also been officially implemented, regulating the issuance and trading of cryptocurrencies, significantly increasing the compliance costs of cryptocurrency companies.

Faced with this regulatory storm, many investors who were once optimistic about the crypto market have had to re-evaluate the risks. The hot money that originally flowed into cryptocurrencies has begun to flow back to the stock market, where regulations are more transparent. In comparison, the large tech stocks in the S&P 500, with their clearer legal framework and profitability models, have become a safe haven for capital.

AI and tech stocks take the spotlight: A crypto winter

In 2023 and 2024, AI became the "new darling" of the capital market. Generative AI exploded, and tech giants continuously launched new AI technologies, products, and applications, driving high expectations for future technology, and capital flooded into the tech track. Under such circumstances, the S&P 500 once again saw an upward trend, hitting new highs.

On the Bitcoin side, although there have been developments in technologies like Layer 2 and the Lightning Network, it has not attracted as much market attention as the AI track. Investors are more willing to bet their funds on tech companies that can bring faster commercial returns, rather than relatively mature but lacking explosive growth opportunities like Bitcoin.

Bitcoin ETF approved, whales and institutions dominate the market, but Altcoins are neglected

According to TradingView data, the current Bitcoin market dominance (BTC Dominance) has risen to over 57%, while the total market cap of Altcoins has declined significantly. In comparison, during the 2021 bull market peak, the market share of Altcoins once approached 70%.

In January 2024, the Bitcoin ETF was finally approved by the US regulatory authorities, undoubtedly injecting new blood into the market. The launch of the ETF opened the door for traditional financial institutions to enter the Bitcoin market, and whales and institutions became the main drivers of market fluctuations.

However, the capital preference of institutions is very clear: they favor Bitcoin, which has a larger market cap and better liquidity, rather than the riskier and less liquid Altcoins in the market. This has directly led to a significant increase in Bitcoin's market dominance, while the liquidity of Altcoins has plummeted. Market interest in Altcoins has gradually dissipated, and the daily trading volume of many small cryptocurrencies has fallen into a slump.

The rise of Bitcoin's dominance, while seemingly positive for Bitcoin, has actually limited the diversified development of the entire cryptocurrency market. The once thriving crypto landscape, where many contenders emerged, has now been reduced to Bitcoin as the "giant" dominating the field, while the fate of other Altcoins has been significantly weakened. The decline in liquidity has made the market prospects for Altcoins even more gloomy, and Bitcoin's sole strength is also unable to drive the entire market out of the doldrums.

Whenever there is a slight market movement, Bitcoin's price fluctuates dramatically. This volatility is actually at odds with the stable upward trend of the S&P 500. As a result, we have seen that the performance of Bitcoin and the S&P 500 in market fluctuations is becoming increasingly inconsistent.

The future path: Will Bitcoin and the S&P 500 join hands again?

The financial market is like an endless chess game, and the rules of the past may not apply to the future.The changing correlation between Bitcoin and the S&P 500 reflects the changes in capital flows, the evolution of the regulatory environment, and the shift in market preferences. Behind the S&P 500's frenzy is the tech giants leading the AI wave; while Bitcoin, after seeing the dawn of the ETF, faces the loneliness of walking alone.

In the future, Bitcoin may once again be seen as a "digital gold" for hedging in a turbulent world, becoming a safe haven for capital; or it may continue to waver between high volatility and regulatory challenges. Whether it can walk alongside the traditional market again or continue on an independent path depends on the attitude of capital, the pace of innovation, and the choices we make in the ever-changing market.