BTC has briefly soared to the $68,000 level, sparking many bullish predictions, and traders are expecting prices to surpass the all-time high. While BTC has not yet set a new record, its open interest (OI) has reached a peak, signaling that interest in major cryptocurrencies has been at the highest level for a considerable time.

The surge in price up to $66,000 and the rise in OI indicate that traders' confidence in a potential breakout is growing. How high can BTC go?

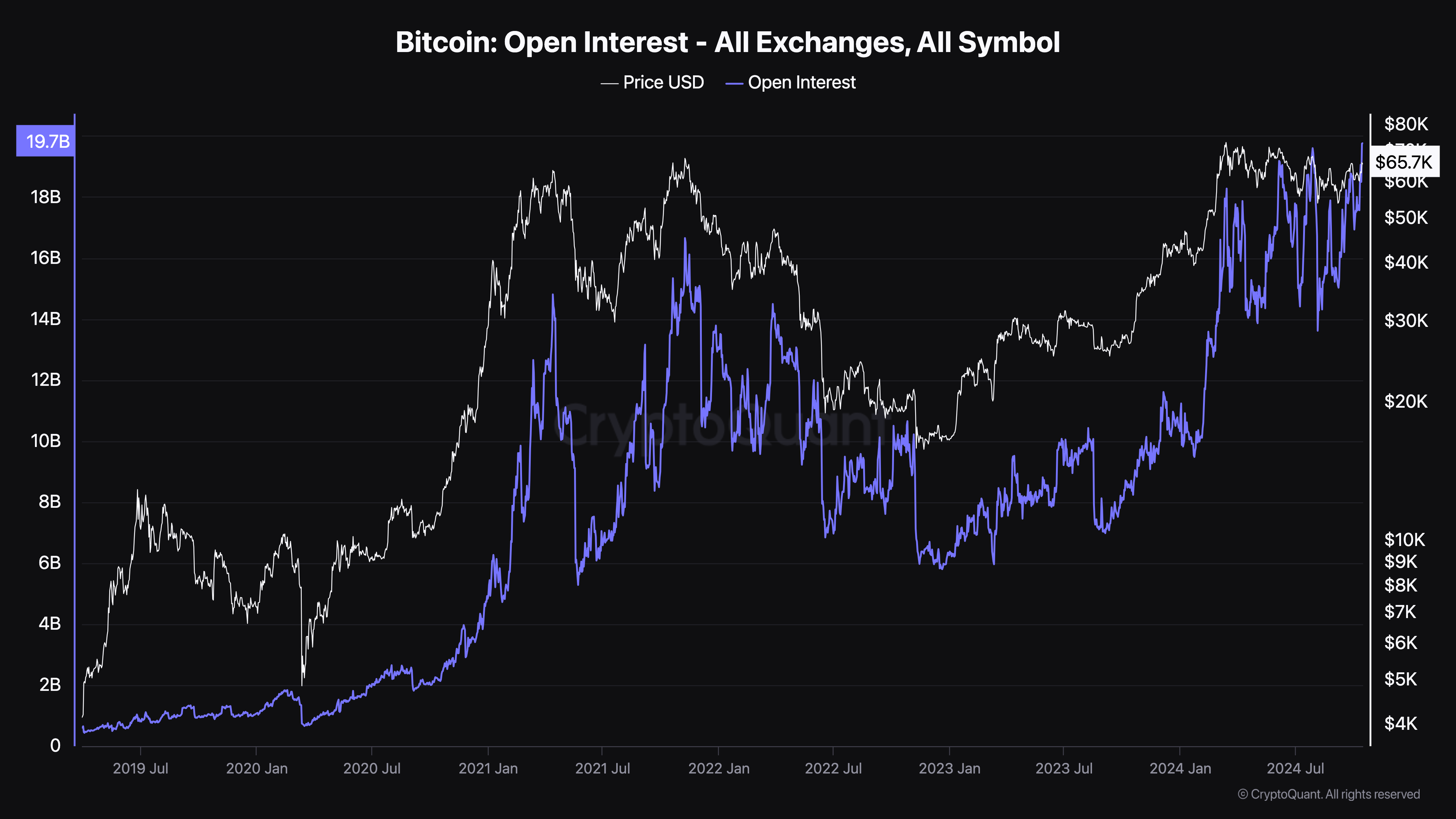

Bitcoin Open Interest Reaches New All-Time High

Generally, OI reflects the number of open contracts in the market. An increase indicates that traders are actively taking positions, expecting significant price movements. Conversely, a decrease suggests reduced exposure to the coin.

According to the on-chain analytics platform CryptoQuant, Bitcoin's open interest has reached a new all-time high of $19.8 billion. The last time this metric was this high was in July, when the coin's price nearly retested $68,000.

Considering the current market sentiment, it is not unreasonable to think that BTC can reach its all-time high of $73,750, but this is only possible if the asset's interest is sustained.

Read more: Where to Trade Bitcoin Futures: A Comprehensive Guide

On this development, crypto analyst EgyHashX expressed the view that the rising liquidity could have a positive short-term impact on BTC's price.

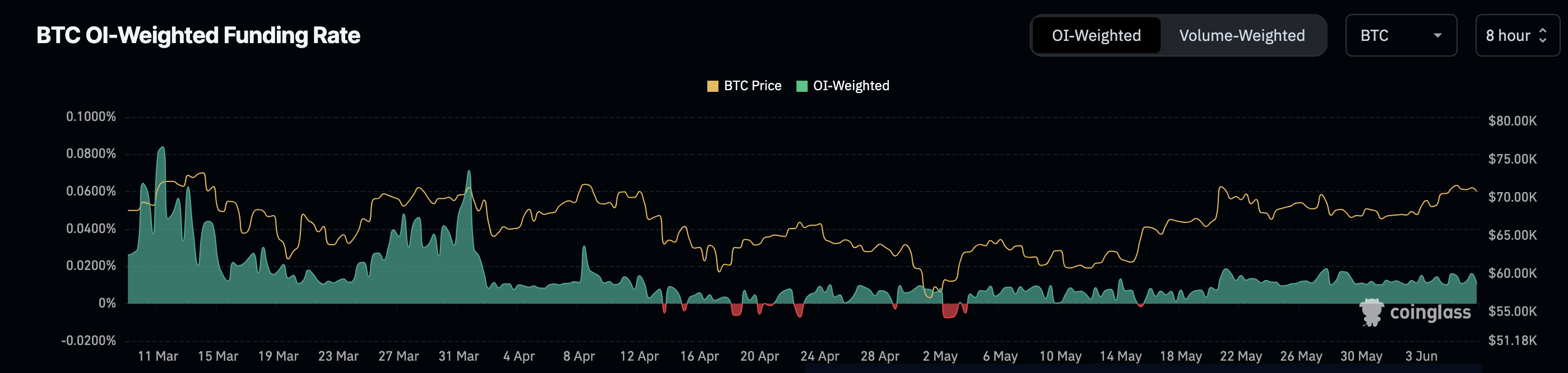

"The bullish trend in the derivatives market indicates increased liquidity and heightened interest in the crypto space. The rise in funding rates further accentuates the bullish sentiment among traders," EgyHashX emphasized through CryptoQuant.

Additionally, the recent sharp rise in Bitcoin's funding rates strengthens the bullish sentiment in the market. Funding rates measure the cost of maintaining long and short positions in futures contracts. When positive, more traders tend to take long positions, expecting upward price movements.

Negative funding rates indicate a bearish outlook, with more traders preferring short positions. As the funding rates have remained at their highest levels since August and stayed in positive territory, traders are expecting BTC's price to rise, and the data suggests expectations towards $75,000.

BTC Price Prediction: 14% Upside to Start

Over the past few months, BTC's price has been trading within a descending channel, making it difficult for the coin to break out and maintain a range.

However, on October 14th, BTC finally broke above its resistance level of $65,234. On the 15th, it approached the $68,000 level before retreating, but it did not re-enter the descending channel, indicating that the bullish hypothesis may still be strong.

If this situation persists, BTC could break through the $70,738 upper resistance level. In that case, the coin could rise to $75,002 by the end of this quarter.

Read more: The 4 Best Cryptocurrency Brokers for Buying and Selling Bitcoin in 2024

However, if it fails to break above $66,009 again, the bullish bias could be invalidated. In that scenario, BTC could drop to $60,272. Santiment's senior analyst Brian Quinlivan cautioned that the coin may have reached a local top, suggesting some caution.

"The bullishness of the crowd in the current BTC rally is still a bit concerning. The positive to negative comment ratio over the past 2 days has been at its highest level this year, and this can often coincide with short-term top signals," Quinlivan told BeInCrypto.