Source: Grayscale; Compiled by Wuzhu, Jinse Finance

Summary

The outcome of the US election could have a significant impact on the digital asset industry. The next president and Congress may enact legislation targeting cryptocurrencies and may modify tax and spending policies that could affect broader financial markets.

Current polling data and implied odds from prediction markets like Polymarket indicate this is a close race. [1] However, as of October 15, these data suggest the Republicans appear likely to control the Senate. Grayscale Research believes that given the Senate's role in confirming presidential appointments to key regulatory bodies like the SEC and CFTC, a change in Senate control could be particularly relevant for the cryptocurrency industry.

At the voter level, data shows cryptocurrencies are a bipartisan issue, with Democrats having slightly higher Bitcoin ownership rates than Republicans. Additionally, the specific candidates from both parties have expressed support for crypto innovation.

Regardless of which party controls, Grayscale Research believes comprehensive bipartisan legislation may be the best long-term solution for the US digital asset industry.

Despite the many issues surrounding the 2024 US presidential election, the digital asset industry has managed to attract some attention and time from candidates. This can be partly attributed to the evolving preferences of voters: in a nationwide survey conducted by Harris Poll on behalf of Grayscale, we found that about half of potential US voters would be more likely to vote for a candidate interested in cryptocurrencies rather than one uninterested. The growing focus on cryptocurrencies also reflects the fact that US rulemaking has lagged behind other countries, even as the industry continues to evolve and innovate, making comprehensive legislation increasingly urgent.

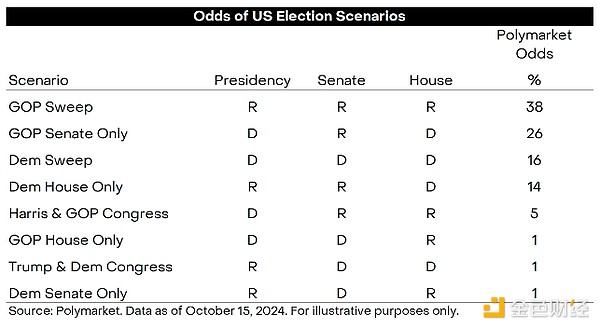

Below, we consider potential election scenarios for the White House and Congress and their possible impacts on the crypto market. For each outcome, we report the implied odds from Polymarket, a blockchain-based prediction market that has seen a sharp increase in adoption this year.

Most outcomes have a high degree of uncertainty: poll data and prediction markets indicate a wide divergence in electoral forecasts. However, these data suggest the control of the Senate appears likely to shift (from Democrats to Republicans), which, given the Senate's role in confirming presidential appointments, could be a particularly relevant change with direct implications for the cryptocurrency industry.

The White House

Polymarket Odds: Trump 57% / Harris 43% (as of October 15, 2024)

The result is: A Trump victory could mean more supportive regulators and larger budget deficits, both of which could provide tailwinds for Bitcoin and cryptocurrencies. But Trump's fiscal policy plans would require Congressional support, and tariffs could introduce market uncertainty.

The next president will set the crypto policy agenda, nominate key regulatory bodies, and drive broader economic policy decisions on taxation, spending, and tariffs. Former President Trump has enthusiastically embraced the digital asset industry, stating a desire to make America the "world crypto capital and Bitcoin capital"[2]. He has also announced plans to launch a crypto lending platform called World Liberty Financial, though details on this project remain limited.[3]

Vice President Harris has recently made more supportive comments about digital assets, explaining that her administration would "encourage innovative technologies like artificial intelligence and digital assets, while protecting our consumers and investors".[4] Her campaign team is also reportedly set to announce plans to "safeguard" crypto assets and develop "a plan to establish rules for cryptocurrencies and other digital assets".[5]

However, Harris' campaign has provided fewer specifics, and notably, as some market participants and commentators in the crypto industry have observed, the current Biden/Harris administration has taken a confrontational approach to regulating the industry, including through a series of lawsuits, restricting access to traditional banking services, and vetoing bipartisan legislation.[6] Therefore, Grayscale Research believes a Trump administration would be more likely to nominate regulators interested in supporting crypto industry innovation.[7]

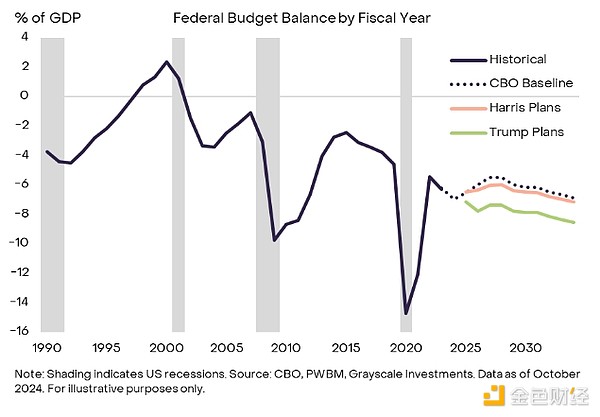

Specifically, the outlook for Bitcoin may also depend on the macroeconomic policy choices of the next administration. Independent research suggests that both Trump and Harris's fiscal policy proposals would lead to larger budget deficits - already quite substantial.[8] Prior to incorporating campaign pledges, the Congressional Budget Office (CBO) projected the federal deficit to average 6.2% of GDP over the next 10 years. According to the Penn Wharton Budget Model (PWBM), Vice President Harris's proposals to expand the child tax credit and other reforms would bring the 10-year average deficit to 6.5% of GDP, though she plans to raise the corporate tax rate to 28%.[9] Meanwhile, PWBM analysis indicates that former President Trump's plan to extend the 2017 tax cuts and lower other rates would bring the 10-year average deficit to 7.8% of GDP (Chart 1).[10]

Grayscale Research believes that, all else equal, large budget deficits should be viewed as dollar-negative and Bitcoin-positive in the medium term.

Chart 1: Both candidates lack plans to reduce the federal deficit

However, the practical market impact remains uncertain. First, changes in fiscal policy would need to be approved by Congress, and it is unclear which campaign proposals could actually become law - especially under a divided government. Second, former President Trump also signaled plans for significant tariff increases. Tariff hikes often strengthen the dollar and could put pressure on risk assets, especially if other countries retaliate.[11] While tariffs would not directly impact Bitcoin, crypto asset valuations are correlated with broader markets, so tariff increases could pose downside risks to prices.

The Senate

Polymarket Odds: Republican Control 78% / Democratic Control 22%

The result is: While members of both parties have shown support for certain aspects of crypto policy, given the Senate's critical role in confirming regulatory appointments, Republican control could be viewed as a net positive outcome for cryptocurrencies.

The Senate, along with the House, is responsible for passing any changes to fiscal policy[12] as well as any crypto-specific legislation. The Senate also has the duty of confirming presidential appointments, including to the key regulatory bodies of the SEC, CFTC, and Federal Reserve. As the regulatory status of many crypto assets remains uncertain, the Senate's oversight of agency appointments could be crucial for the industry.

Crypto legislation passed in the current Congress has been bipartisan, including the Digital Commodities bill from the Senate Agriculture Committee and stablecoin legislation from the Senate Banking Committee.[13] At the same time, Republican Senators have been more steadfast in their support for the digital asset industry. For example, the crypto industry lobbying group Stand With Crypto[14] gave "A" grades on crypto issues to 39 out of 49 Republican Senators, but only 6 out of 51 Democratic Senators.[15] Additionally, voting patterns indicate more Republican support: on the Senate vote to overturn SEC Staff Accounting Bulletin (SAB) 121,[16] 48 Republicans voted in favor, compared to 12 Democrats.

The Democrats currently control the Senate, thus chairing key committees, setting legislative priorities, and ultimately having decisive voting power on some presidential appointments. Given that Republicans are generally more supportive of digital asset innovation, Grayscale Research believes a change in Senate control could be a positive outcome for the crypto market - arguably the most important electoral result for the industry, given the critical role of regulatory bodies.

The House of Representatives

Polymarket Odds: Republican Control 44% / Democratic Control 56%

The control of the House of Representatives is crucial in determining whether the government will be unified or divided, which will to a certain extent determine whether the next president can achieve his established fiscal policy goals, and thus determine the impact of the election on the broader financial market.

Like the Senate, the House of Representatives requires support for any changes to fiscal policy or specific cryptocurrency legislation. The legislation being considered by this Congress is being reviewed on a bipartisan basis, but has received more support from Republicans. For example, on the House Financial Services Committee's FIT21[17] bill, 208 Republicans voted in favor, as did 71 Democrats, including former Speaker Pelosi and Democratic Whip Clark.

Control of the House of Representatives will determine the committee assignments and legislative priorities of the House, which could impact cryptocurrency policy. But perhaps the most important impact will be whether one party controls both the White House and both chambers of Congress - a "unified government" - or control is divided between the parties - a "divided government". Under a divided government, changes to fiscal policy may be particularly difficult to achieve.

Eight Possible Scenarios

For the upcoming U.S. election, there are three institutions in play (the White House, the Senate, and the House of Representatives), each with two possible outcomes (controlled by Republicans or Democrats). Therefore, there are eight different possible scenarios, each with different implications for the digital asset industry. Figure 2 provides the implied payouts for each scenario from Polymarket.

Figure 2: According to market forecasts, the election has a high degree of uncertainty

Grayscale Research will highlight a few key points. First, among the four more likely scenarios, none clearly dominates - in other words, the post-election power balance remains highly uncertain. Second, observers are divided on whether we will have a unified government or a divided government: the overall odds of a Democratic or Republican sweep are still close to 50%. Third, according to Polymarket, the only specific outcome with relatively high odds is a Republican-controlled Senate. As long as this scenario persists, given the Senate's critical role in confirming presidential appointments, we believe the election outcome will trend in a direction favorable to the cryptocurrency market.

Cryptocurrency is a Bipartisan Concern

At the voter level, cryptocurrency is a bipartisan concern. A national survey conducted by The Harris Poll on behalf of Grayscale found that self-identified Democrats have higher Bitcoin ownership and familiarity with cryptocurrencies than Republicans, and Democrats are generally more interested in cryptocurrencies this year. [18] Furthermore, any new cryptocurrency legislation would require an absolute majority in the Senate, and thus would almost certainly require bipartisan support.

That said, given the Senate's critical role in confirming regulatory agency appointees of the president, Grayscale Research believes Republican control of the Senate is a meaningful positive factor for the digital asset industry. Therefore, current polling and the implied payouts from prediction markets currently suggest a favorable outcome for the cryptocurrency market.

However, the prospects for any cryptocurrency-specific legislation and/or potential fiscal policy changes by the next administration remain more uncertain. Grayscale Research believes the best outcome for the healthy development of the digital asset industry is for the two parties to continue to drive comprehensive legislation.

Harris Poll Methodology

The survey was conducted online within the United States by The Harris Poll on behalf of Grayscale through its Harris On Demand omnibus product from September 4-6, 2024 among 1,841 U.S. adults (aged 18 and older) who plan to vote in the 2024 presidential election. Data were weighted as necessary, based on age, gender, race/ethnicity, region, education level, marital status, household size, household income, employment status and internet tendency, to be representative of their actual proportions in the population. Respondents for this survey were selected from among those who have agreed to participate in our surveys. The Harris Online Survey sampling precision is measured using Bayesian credible intervals. For this study, using a 95% confidence level, the sample data's accuracy is within +/- 2.8 percentage points. This credible interval will be wider for subsets of the surveyed population. All sample surveys and polls, regardless of whether they use probability sampling, are subject to multiple sources of error which are not possible to quantify or estimate, including but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.

Notes

[1] Grayscale takes no position on the accuracy or reliability of the poll data or the implied payouts from prediction markets like Polymarket. In this piece, Grayscale is using Polymarket data to illustrate the overall directional trends of potential election outcomes.

[2] Source: Barron's.

[3] Source: The New York Times.

[4] Source: Bloomberg.

[5] Source: National Public Radio.

[6] For example, see The Wall Street Journal, Unchained Crypto, Reuters, TechCrunch, Axios, Reuters.

[7] On regulation, former President Trump once said, "The rules will be written by people who love your industry, not hate your industry." Source: CNBC.

[8] This statement from the Congressional Budget Office summarizes the current budget situation: "Over the 10-year projection period, CBO's baseline primary deficit averages 2.5% of GDP. For the 62 years from 1947 to 2008, the primary deficit exceeded 2.5% of GDP in only two years. However, over the past 15 years, that ratio has exceeded 10 times, partly due to legislation enacted to respond to the 2007-2009 financial crisis and the pandemic that began in early 2020." Source: Congressional Budget Office.

[9] PWBM estimates based on primary (interest-before) deficits; prior to campaign proposals quantifying total deficit impacts, Grayscale has included CBO's estimates of interest expenditures. Estimates of budget impacts of campaign proposals vary by source, and the numbers provided here should be viewed as illustrative. For other estimates, please refer to organizations like the Committee for a Responsible Federal Budget.

[10] PWBM's estimates of the Trump proposals do not include the potential impact of tariffs on customs revenue. However, forecasts that do include tariff revenue, such as those from the Committee for a Responsible Federal Budget, find the net impact on the deficit to be roughly comparable. If the Trump tariff plan were to remain in place, the estimated impact on revenue over the decade is approximately $2 trillion to $5 trillion. Sources: Committee for a Responsible Federal Budget, Tax Policy Center, Tax Foundation.

[11] Various studies have explored the impact of tariff increases on the dollar. For example, see The Multifaceted Impact of U.S. Trade Policy on Financial Markets and To What Extent Are Tariffs Offset by Exchange Rates. For the impact on risk assets, see The Impact of the U.S.-China Trade War on U.S. Investment.

[12] Changes to tariffs typically do not require Congressional approval.

[13] Specific bills include the Digital Commodities Consumer Protection Act of 2022 (S.4760) and the Lummis-Gillibrand Responsible Financial Innovation Act (S.4155).

[14] The Stand With Crypto Alliance is a 501(c)(4) non-profit organization funded by donations. Grayscale takes no position on the accuracy or reliability of data from the Stand With Crypto Alliance. In this piece, Grayscale is using data from the crypto alliance to illustrate the overall directional trends of Congressional members' positions on cryptocurrency policy.

[15] Calculated with the independent senators caucusing with the Democratic party.

[16] SAB 121 is an accounting guidance that requires companies to report customer-held cryptocurrencies as assets and liabilities, impacting how they manage cryptocurrency custody services.

[17] The 21st Century Financial Innovation and Technology Act (H.R.4763).

In three rounds of public opinion polls, 18% of Democrats reported owning Bitcoin, compared to 15% of Republicans. Similarly, 51% of Democrats said they were "very familiar" or "somewhat familiar" with cryptocurrencies, compared to 45% of Republicans. Finally, in the third wave of the poll (September 4-6, 2024), 37% of Democrats said they were more open to learning more about cryptocurrency investments this year, compared to 30% of Republicans. Source: Harris Poll.