Today (18th), $1.62 billion worth of Bitcoin and Ethereum options contracts are set to expire. The expiration of such options can lead to short-term price volatility and significantly impact traders' profitability.

Specifically, the expiring Bitcoin (BTC) options are worth $1.25 billion, while the Ethereum (ETH) options are valued at $367 million.

Bitcoin and Ethereum holders brace for volatility

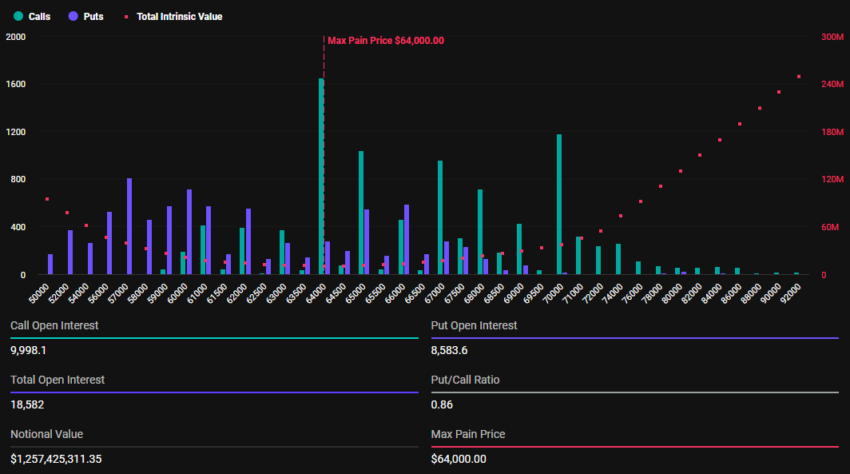

According to Deribit, the Bitcoin options expiring today total 18,583, slightly higher than the 18,271 contracts that expired last week. The options contracts expiring today have a put-to-call ratio of 0.86, and the 'Max Pain' point where participants suffer the most losses is $64,000.

Read more: Introduction to Cryptocurrency Options Trading.

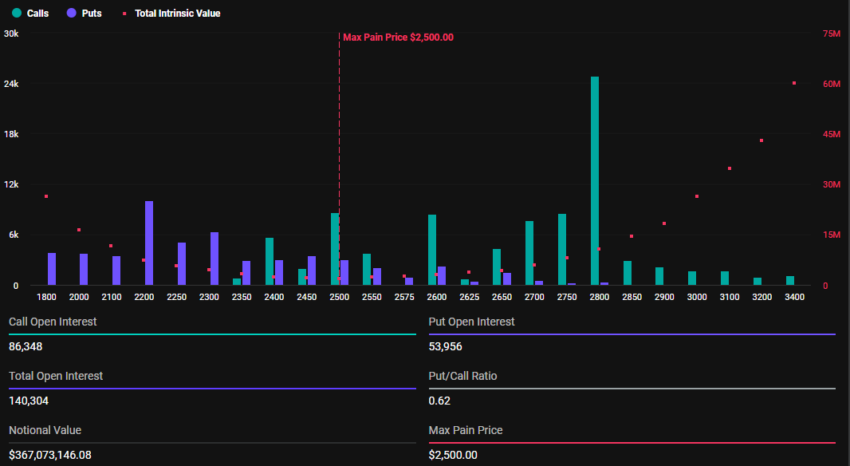

Meanwhile, the Ethereum options contracts expiring today total 140,320, significantly lower than the previous week. They have a put-to-call ratio of 0.62, and the Max Pain point is $2,500.

This data generally indicates a bearish sentiment for both contracts. Currently trading at $67,661, Bitcoin is above the Max Pain point. Similarly, Ethereum is trading at $2,617, also above its Max Pain point.

As the options contracts approach expiration, the prices of Bitcoin and Ethereum are expected to approach their respective Max Pain points. This suggests that the values of BTC and ETH could be pushed down to the Max Pain levels by smart money trying to force the prices there.

Read more: Top 9 Cryptocurrency Options Trading Platforms.

Meanwhile, analysts say Bitcoin and the overall market are finding strong momentum. With some luck, Bitcoin could even surpass its all-time high of $73,700. Researchers at CoinShares say the US elections are the main driver of the current market sentiment. From a macroeconomic perspective, there are no positive catalysts in sight.

"...investor decisions were more heavily influenced by the upcoming US elections than by monetary policy expectations. This is evident from the fact that the immediate inflows and price increases were driven by the recent US vice presidential debate and a shift in polling towards the more crypto-friendly Republican party, despite stronger-than-expected economic data failing to stem the outflows," as mentioned in a recent report.