On Thursday, the total revenue of Bitcoin (BTC) network miners reached a new high in 2 months. This increase coincided with the first day in the past month that miners did not sell their holdings.

As Bitcoin approaches its all-time high of $73,764, the decrease in miner sales indicates an upward trend. This suggests that these milestones could be achieved in the near future.

Bitcoin Miners Maintain Holdings

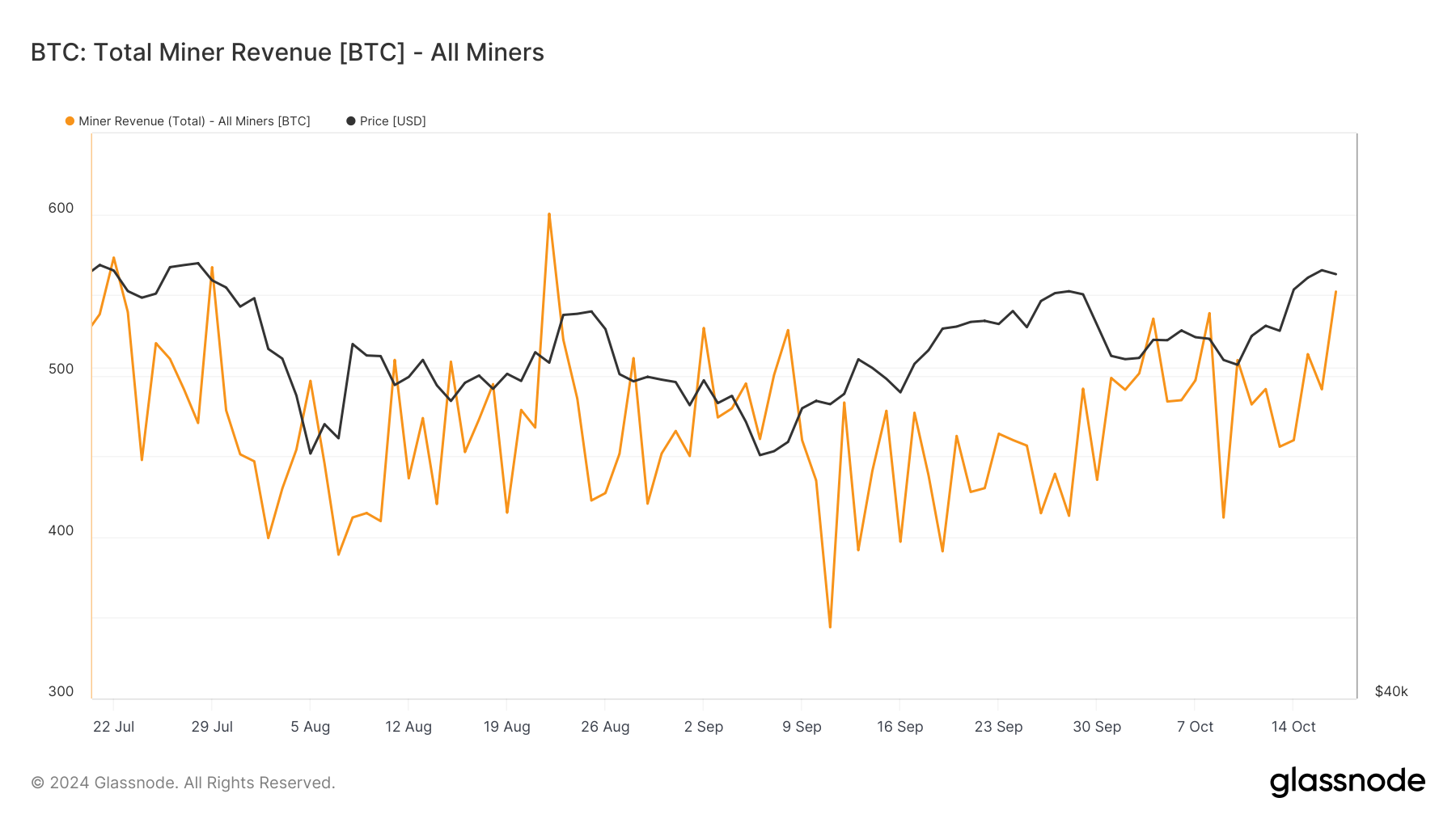

Yesterday, the revenue of the Bitcoin network miners reached 552 BTC, worth over $37 million at the current market price. According to Glassnode's data, this is the highest since August 22nd, a 12% increase from the $491 BTC total revenue recorded on Wednesday.

Read more: What Happened During the Last Bitcoin Halvings? 2024 Prediction

The recent surge in BTC miner revenue is directly linked to a sharp increase in average transaction fees on the network. According to Messari, the average fee has increased by 166% in the past 7 days and is currently $5.31.

As Bitcoin network transaction fees have risen, miners have earned more revenue per block processed, contributing to the sustained increase in total revenue.

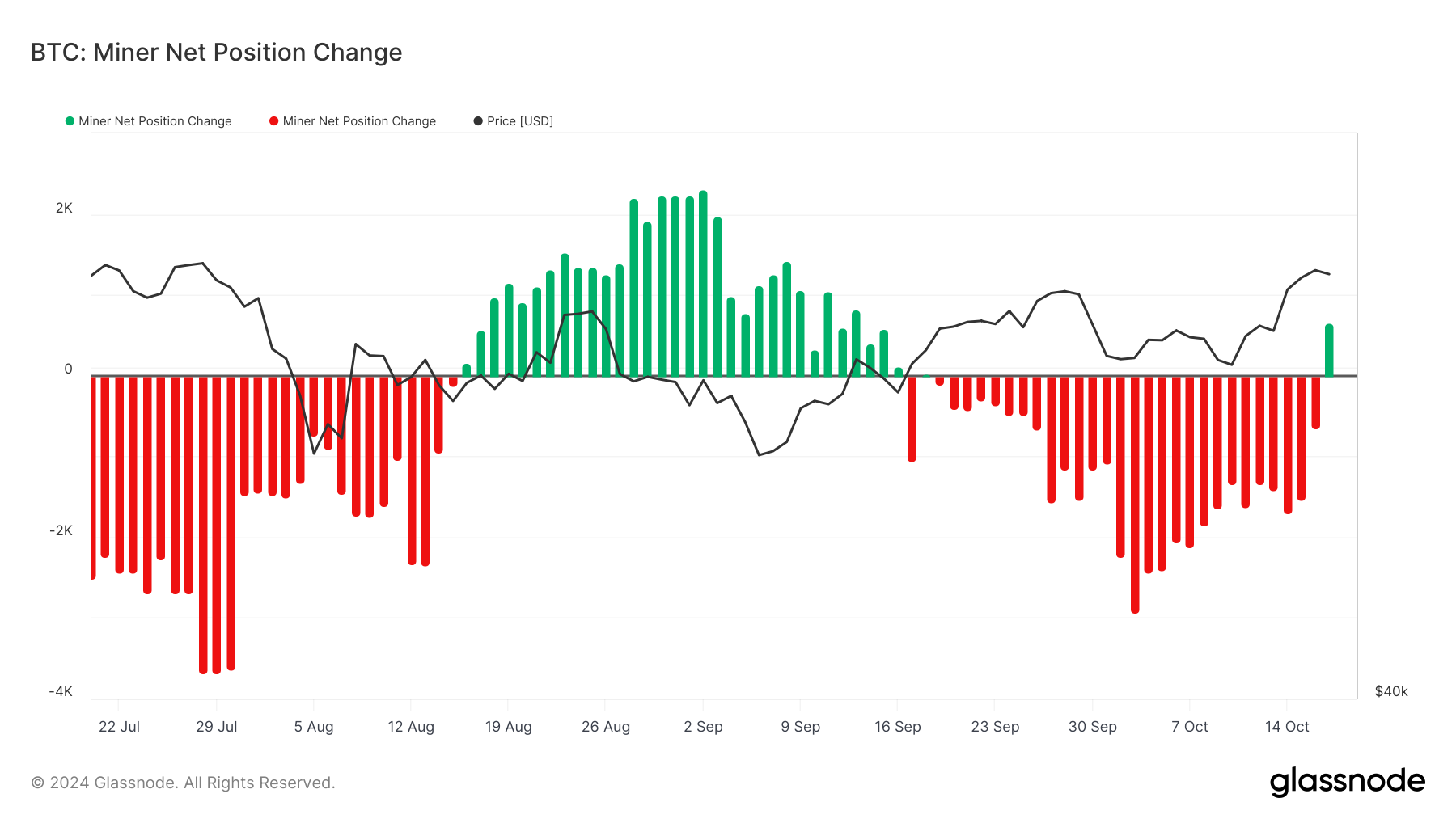

Interestingly, Thursday's 2-month high revenue coincided with a notable change in miner behavior. It was the first day in the past month that miners chose not to sell their coins. BeInCrypto's assessment of BTC miner net position change confirms this.

On that day, miners held a total of 658 BTC, the first time since September 16th that the majority of Bitcoin network miners did not sell their holdings.

BTC Price Prediction: All-Time High in Sight

Bitcoin is currently trading at $67,738, just below the next resistance level of $68,464. Demand for the coin has surged in the past few days, as evidenced by the Relative Strength Index (RSI) reaching 67.57 currently.

RSI measures the overbought and oversold conditions of an asset. Ranging from 0 to 100, readings above 70 indicate the asset is overbought and may be due for a correction, while readings below 30 indicate the asset is oversold and may be due for a rebound.

The current BTC RSI of 67.57 indicates a strong bullish momentum in the market, with buying activity exceeding selling. If this trend continues, Bitcoin's price is likely to break through the $68,464 resistance and retest the all-time high of $73,764.

Read more: Bitcoin Halving History: Everything You Need to Know

However, this bullish outlook can be invalidated if profit-taking activity increases even slightly, which could lead to a downward trend. In that case, Bitcoin's price could retreat to a support level of $64,304 or lower.