Author: Three Sigma, Blockchain Engineering and Audit Firm

Compiled by: Felix, PANews

The DeFi space is constantly evolving, and the options market has also made significant progress. New protocols, products, and strategies are emerging, reshaping decentralized options trading. It is crucial to re-examine this ever-changing landscape and assess the trends shaping the future of DeFi options. A year ago, the protocols were categorized into 4 main classes:

Order Book

AMM (Internal)

AMM (External)

Structured Products

Since then, the protocols in each category have undergone significant changes. Some protocols have expanded aggressively, while others have pivoted to new models or unfortunately shut down. The outlook is both challenging and hopeful, and survival in this fast-paced environment is not guaranteed.

As @DanDeFiEd (founder of rysk finance) mentioned in his derivatives talk at Politecnico di Milano last year, "Some of you are NGMI." (PANews note: NGMI stands for "Not gonna make it"). His words have proven to be prescient. 50% of the protocols mentioned in the original report have either abandoned their options business or ceased operations altogether. The DeFi ecosystem can be ruthless, and only the most adaptable will survive.

But why such a high attrition rate?

Over the past year, point systems and MEME coins have dominated, raising questions about sustainability and value creation. For many options protocols struggling to find product-market fit (PMF), the preference for perpetual contracts with leverage has been a key challenge.

Additionally, the rise of yield farming has diverted attention and liquidity away from more complex structural products like options.

Have the protocols that struggled last year successfully adapted, or have the increasing focus on perpetuals and short-term rewards sealed their fate? The answers are as diverse as the projects themselves, but one thing is certain: the path ahead will only get more difficult.

Overall Trends

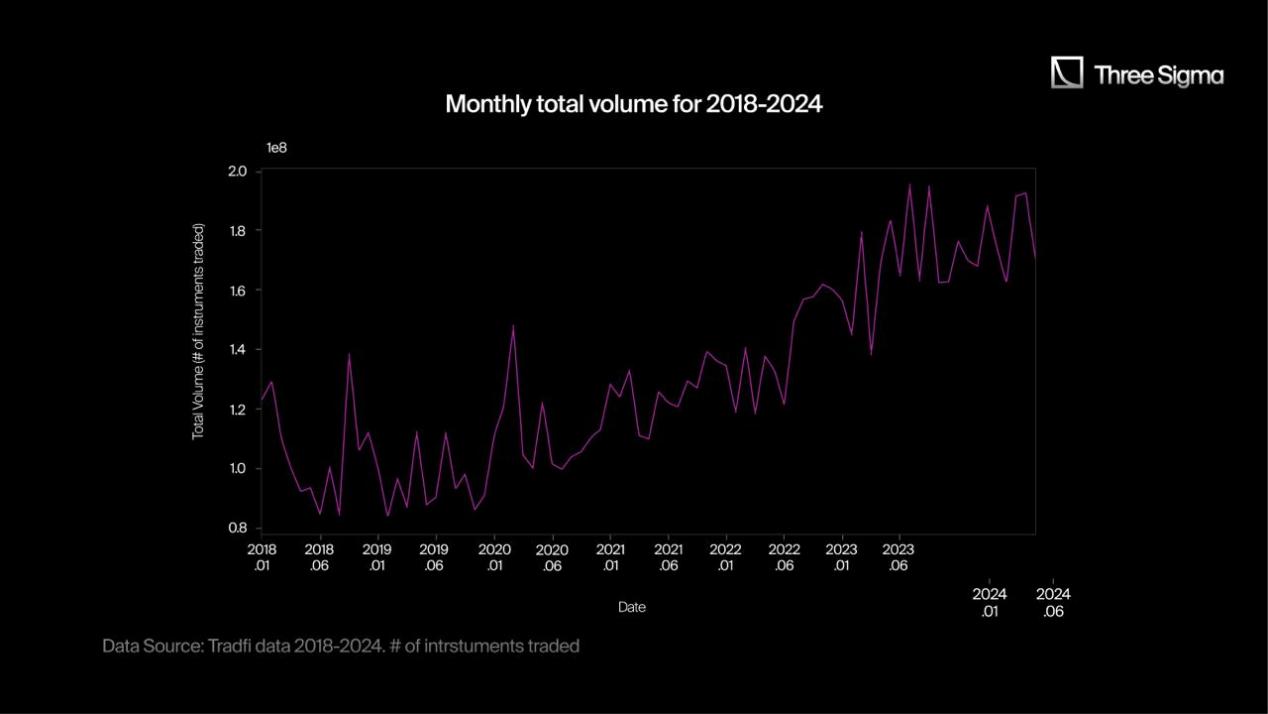

"[...] According to our estimates, the retail share of U.S. stock options trading volume is [...] 45%, [...]. The growth in retail options share was initially driven by the 2020 pandemic, as retail options traders seized on short-term options bets on market direction, and this share has continued to grow. The share of low-priced options trading volume has also been increasing, further driving overall options trading volume, especially among retail traders. These trends do not appear to be in danger of reversing."

New York Stock Exchange - Options Trading Trends, December 2023

In traditional finance (TradFi), retail traders' appetite for high-risk, short-term options is growing. This shift is evident in the data: weekly options trading volume has doubled, from around 100 million contracts per week in 2018 to 200 million contracts per week in 2024. This means a significant increase in the number of weekly openings and closings.

As retail traders outside the crypto space become heavily biased towards short-term, high-leverage opportunities, the question arises: Can DeFi options leverage the same momentum? Or will perpetual options continue to dominate the crypto leverage narrative?

DeFi Options Development

"We found the PMF" - a founder telling an unsuspecting VC

"Huuugeee TAM" - the same founder telling the same unsuspecting VC

Throughout 2022, options protocols like Ribbon were popular and garnered interest from the DeFi community. However, as the initial excitement waned, from the end of 2022 to 2023, the notional trading volume began to steadily decline. This slump reflects the broader challenges DeFi options protocols face in maintaining momentum.

However, by 2024, the situation begins to change. The introduction of new exchanges and products, such as AEVO, Derive (Lyra's application chain), and Stryke, helps reignite interest in the space and gradually regain market share. Here are the notional trading volume data:

September 2021: $392 million

September 2022: $411 million (1.05x year-over-year growth)

September 2023: $78 million (0.19x year-over-year, 81% decline in volume)

September 2024: $866 million (10.99% year-over-year growth)

In addition to the surge in notional trading volume, another key indicator of market health is the premium trading volume - the amount buyers pay to sellers for options. The robust recovery data from 2022 to 2024 is evidence of this:

September 2022: $3.8 million

September 2023: $3.3 million (0.87x year-over-year change)

September 2024: $10.3 million (3.11x year-over-year change)

The growth in premium trading volume highlights the new demand for DeFi options, as buyers are willing to pay significantly higher premiums in 2024 compared to previous years. This reflects a shift in the market, with new products and more sophisticated strategies driving increased participation and confidence in the options space.

While the notional trading volume has soared 18-fold from 2023 to 2024, the premium for liquidity providers (LPs) has only grown 3.7-fold. This disparity suggests that a large portion of the increased trading activity is driven by cheap options, likely out-of-the-money (OTM) options. The high trading volume may be impressive, but the relatively lower premium growth indicates that the market is still dominated by low-cost, high-risk options.

Options vs. Perpetuals: The Battle for Dominance

Despite the rapid growth of DeFi options, perpetual contracts still maintain a dominant position.

Although the gap between the two is still significant, it is gradually narrowing. In 2022 and 2023, the weekly on-chain trading volume of perpetual contracts was between $10 billion and $12 billion, growing to $41 billion by 2024. Meanwhile, the options trading volume remains around 1/100th of the perpetual contracts.

September 2022: Perpetual contracts were 85x the volume of options

September 2023: This gap widened to 400x

September 2024: The gap has narrowed to 160x

Although the DeFi options field has always struggled to match the scale of perpetual contracts, it is not without hope for development. When reviewing the research from a year ago, although the development was uneven, it was clear that the industry was growing. Most users still prefer perpetual contracts due to their simplicity, ease of use, and strong liquidity, putting options protocols in a more challenging position.

The options field has been severely overshadowed, with many projects continuing to struggle for product-market fit (PMF) in a market still dominated by perpetual contracts.

The key question remains: where will future demand for DeFi options come from? As traders seek more complex strategies, can DeFi options carve out their own niche market, or will perpetual contracts continue to dominate the on-chain derivatives space?

New Faces

As DeFi options continue to evolve, some new protocols have emerged. Here is a brief analysis of these new entrants:

Order Book/Request for Quote (RFQ)

Arrow Markets — Using an RFQ system and launching on Avalanche

Ithaca — Featuring an off-chain order book and on-chain settlement

Predy V 6 — Expected to launch intent-based options soon

Valorem — Using an off-chain streaming RFQ system. Unfortunately, it is now outdated.

External AMM

Limitless — A platform without oracles and liquidations, where Uniswap LPs can earn yield by lending their positions to traders/borrowers, even if their liquidity positions go out of range.

Structured Products

3 Jane — A Ribbon fork, where early depositors can earn higher yields.

Strands — Structured products based on Lyra and CME, allowing traders to tokenize their covered call options.

SuperHedge — Allows users to deploy assets on platforms like AAVE or Ethena, stake the yield tokens on Pendle, and use a portion of the yield to purchase options.

Other Protocols

ClearDAO — Providing an options SDK.

Jasper Vault — Offering 0 DTE and 2-hour options with permissioned liquidity and an internal pricing oracle.

Sharwa (Dedelend) — Initially an aggregator for Ryks, Hegic, Premia, and others, the upcoming version will introduce 10x leverage, using WBTC, WETH, and USDC as collateral, backed by Hegic.

tealfinance — A comparator aggregator that allows users to compare prices across different platforms (like bitbit).

Umoja — Creating synthetic options by adjusting the positions in their token and perpetual contract portfolio based on market trends.

Order Books

The order book landscape within the DeFi options space can be divided into two main categories: protocols that provide order books as infrastructure for others to build on, and protocols that act as trading platforms. The reality is harsh, with 3 out of 6 protocols being eliminated. Let's dive deeper into what happened:

Still Evolving:

AEVO — As a top contender in the on-chain options market, its rise is simple: yield farming. AEVO provides traders the ability to long a single Bitcoin with up to 10x leverage under the right collateral, or the ability to purchase deeply out-of-the-money (OTM) options for pennies, if the seller is willing to underwrite them.

(PANews note: OTM options are options whose strike price makes them have no intrinsic value. For call options, the strike price is higher than the current market price; for put options, the strike price is lower than the market price.)

This has driven AEVO's monthly trading volume to reach tens of billions of dollars, setting a new record for the protocol and the entire on-chain options market.

While the notional trading volume has skyrocketed, the premiums remain very low due to the massive number of far OTM options. Considering that the trading volume was $16 billion in March and $2 billion in April - an 8x increase in volume, but only a 50% increase in premiums ($8.2 million vs $5.3 million). Even without the yield farming program, AEVO remains one of the protocols with the highest notional trading volume.

Derive (fka Lyra) — After transitioning from the Synthetix ecosystem, Derive now runs its application chain Derive Chain on the Optimism (OP) Stack. By shifting to an order book model, Derive provides a more efficient trading experience, with monthly settlement volumes between $200-300 million.

Opium — Once a base layer infrastructure provider, Opium has now pivoted to focus on zero-day-to-expiry (0 DTE) options, reflecting the growing retail market's interest in short-term TradFi instruments.

Exiting Options Business or Failed

Opyn — Despite its early success with its options suite, Opyn never managed to generate any revenue from it. Since then, the team has shifted towards perpetual contracts.

Psyoptions — Has ceased operations, with no clear direction for the future.

Zeta — Has abandoned options and is now fully committed to perpetual contracts, which proved to be more sustainable for them.

AMM (Internal)

Protocols that use internal AMMs for options pricing. Some protocols have adopted complex liquidity provision strategies, while others are simpler and more reliant on the risk of their LPs. Today, 3 out of 10 protocols have either pivoted or shut down.

Still Evolving:

Deri — With the launch of its V4 protocol, Deri has attracted significant capital on Linea, now offering perpetual contracts and perpetual derivatives, with its liquidity pool acting as the counterparty for all trades.

Hegic — Launched 0 DTE options in the summer of 2024, but its core one-click strategy product has remained unchanged for years.

IVX — Offering 0 DTE on Berachain.

Premia — V3 adopts a hybrid model, combining CLAMM on Arbitrum One and on-chain order books on Arbitrum Nova. Monthly trading volumes range from $6 million to $15 million, and the team plans to launch Premium V4, improving collateralization and introducing perpetual contracts.

Rysk — After the success of V1, Rysk is now focused on building Rysk V2, which will create insurance vaults for a decentralized order book DEX, allowing market makers to sign orders from these vaults.

Stryke (fka DoPeX) — Successfully transformed by introducing CLAMM and managed to turn things around. Over the past year, their monthly trading volumes have ranged from $20 million to $50 million. During the rebranding process, Stryke also migrated from their dual-token model (DPX/rDPX) to SYK, abandoning the rDPX token. Now, xSYK represents the staked version of the SYK token.

Thales — Providing support for trading binary options and on-chain derivatives on the Ethereum network. Although the protocol caters to a niche market, its monthly trading volume has consistently remained around $5 million. However, as of the second half of 2024, the trading volume has dropped to around $1 million per month, lower than the higher levels earlier this year.

Exiting Options Business or Failed:

Ntropika — They seem to have never successfully launched. Despite raising $3.2 million from Tier 1 VCs in August 2020 and an additional $12 million from NFT sales in 2022, there has been virtually no activity since then. Rug pull? Development issues? The community is in the dark.

Oddz — Initially an options-AMM protocol, Oddz later pivoted to become a perpetual options aggregator.

Siren — Previously based on AMM, has now shifted to an oracle/RFQ system, with off-chain pricing managed by a curated whitelist of providers (known as Siren Guardians).

External AMM

What does "external AMM" mean? These protocols leverage third-party spot AMMs (like Uniswap or Balancer) as the underlying layer, allowing others to trade options seamlessly. Currently, 3 are in operation.

GammaSwap — Launched on Arbitrum, GammaSwap offers over 20 assets. A key development is that they now use an internal spot AMM (Delta Swap) to provide support for the platform, instead of Balancer or Uniswap. Since launching in January 2024, the protocol has facilitated around $130 million in notional trading volume, averaging $13 million per month.

Panoptic — After several alpha tests on L2s and alt-L1s, is preparing for its mainnet launch, expected before the end of 2024.

Smilee — Launched on Arbitrum, Smilee offers options on wETH, wBTC, GMX, and ARB. Since launching in March 2024, the protocol has seen around $71 million in notional trading volume, averaging $10 million per month.

Structured Products

This area once dominated the DeFi options TVL, but its luster has clearly faded — 9 out of 13 protocols have either adjusted or discontinued their products.

Still Evolving:

Cega — Continues to offer knock-in and knock-out vaults, expanding beyond Solana and integrating Pendle YT tokens to earn additional yield.

PODS — Remains active, using yield-bearing assets (stETH, aUSDC) to purchase options, offering a unique approach compared to other structured products.

Ribbon — Although TVL has declined, the team's focus has shifted to AEVO, but Ribbon continues to operate.

Thetanuts — Continues to operate, with recent vaults focused on Pendle's PT tokens.

Distancing from Options or Failed:

Cally and Putty Finance — As the NFT market cooled, these two protocols are struggling to find products suitable for the market.

JonesDAO — Abandoned their options vaults, signaling their exit from the options space.

Katana — Acquired by PsyFi through a merger transaction on April 4, 2023.

Knox Vaults — Integrated into the Premia V3 ecosystem as part of a broader strategic shift.

Polynomial — Pivoted to become a derivatives L2, now focusing on perpetual contracts.

Polysynth (now Olive) — Closed their options vaults, transitioning to become a cross-L1 and L2 general aggregator liquidity layer.

Primitive — Failed to gain significant traction. The team is now focused on building Pluto (Pluto Labs).

PsyOptions — Despite acquiring Katana, PsyOptions shut down its vaults and other products in June 2024.

StakeDAO — No longer offers options vaults.

Will History Repeat Itself?

The resurgence of on-chain options trading volume led by the likes of AEVO and Derive order books suggests a positive trend, but it raises important questions about decentralization. Just like the perpetuals market, fully on-chain and decentralized may no longer be as appealing as it once was. Instead, protocols are shifting towards centralized L2s or application chains to better control the critical parameters required to build efficient order books.

New protocols like GammaSwap and Smilee offer hope for attracting new users to options trading, but the market remains ruthless. As the saying goes, history may not repeat itself, but it often rhymes. It is highly likely that within a year, several of the protocols listed here will no longer be operational, demonstrating the merciless and rapidly evolving nature of the DeFi market.

However, despite the challenges, the increase in options trading activity is undeniable. With the perpetuals market still around 100 times larger than the options market, the challenge for options protocols is to make their products accessible to users with less experience.

Related Reading: All Set, Just Waiting for the Wind: Exploring Decentralized Options