People's expectations for a Republican victory are optimistic, believing that this is beneficial for Bitcoin. However, some say that Bitcoin will rise regardless due to the influence of various macroeconomic factors.

According to Bloomberg, cryptocurrency options traders are increasing their bets that Bitcoin will hit a new high by the end of November.

The open interest of options expiring on November 8 has a strike price as high as $75,000, indicating that this is a key market focus area during this period.

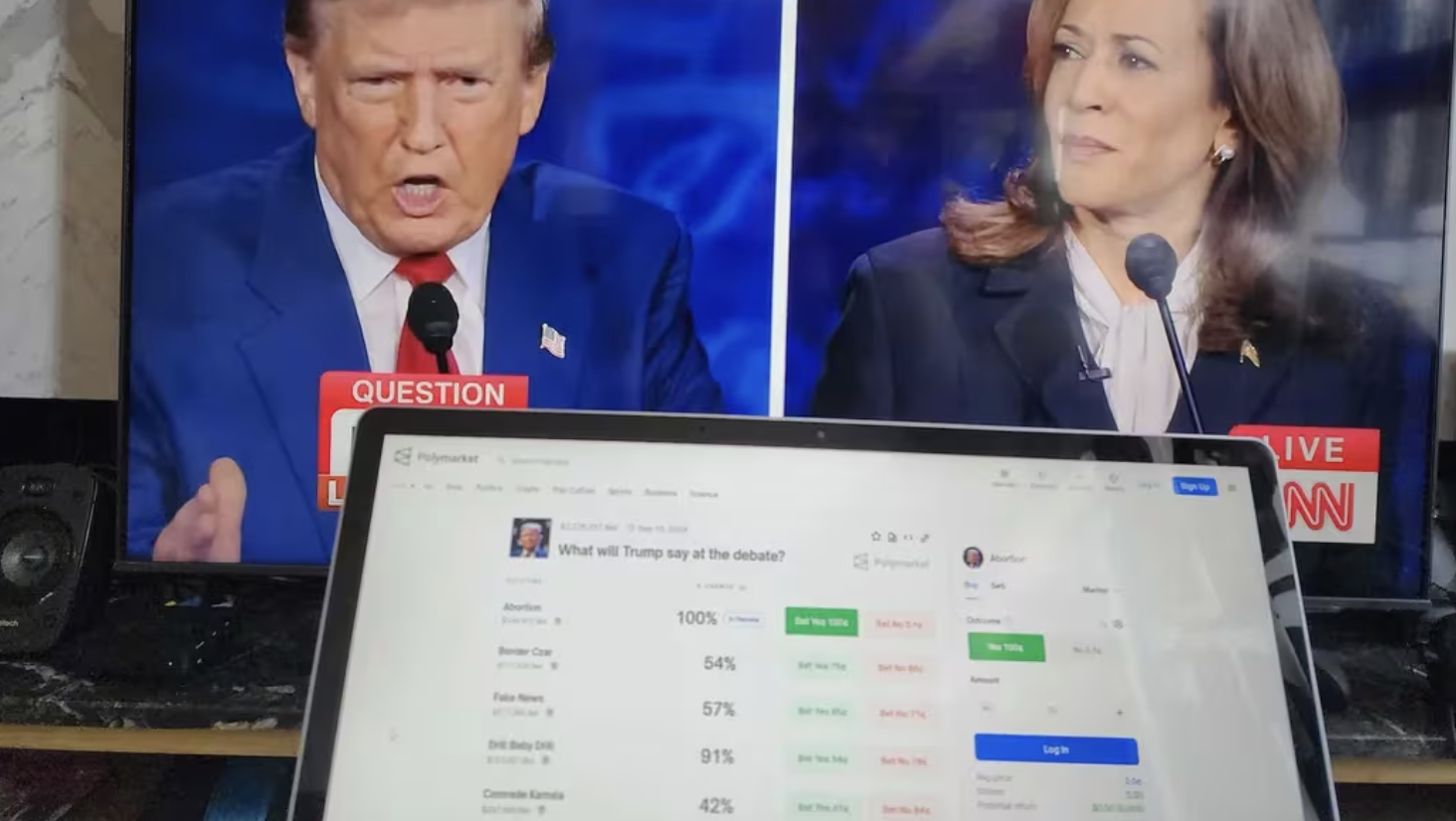

Trump and Harris debating on CNN. (Sam Reynolds/CoinDesk)

Some traders say that regardless of which candidate becomes the US president, Bitcoin (BTC) is likely to break its previous highs in the coming weeks, marking a shift in the pre-November election tone.

Traders have long believed that a victory for Republican Donald Trump would be a bullish catalyst for the industry, as he supports cryptocurrencies and has promised to make America a Bitcoin powerhouse. On the other hand, Democrat Kamala Harris has not made similar commitments, but has said she will introduce regulations to protect certain groups.

This distortion of expectations for a Republican victory being more favorable for Bitcoin. However, some say that the asset is likely to rise regardless due to several macroeconomic factors.

"Both presidential candidates have taken pro-crypto stances to attract voters, but it's hard to say whether any of their promises will materialize," Jeff Mei, chief operating officer of cryptocurrency exchange BTSE, told CoinDesk in a Telegram message. "However, it's clear that the market is reacting positively to the impending government and policy changes - whether it's Harris or Trump, traders and investors see any change as a good thing."

"This is in line with the fact that the Federal Reserve has cut interest rates for the first time in four years and recent stock price increases, which will further bolster the argument that Bitcoin could break its all-time high and reach $80,000," Mei added.

According to Bloomberg, options traders have already started increasing their bets that Bitcoin will hit a new high by the end of November. The implied volatility of Bitcoin options expiring around election day is elevated.

The open interest of call options expiring on November 29 is mainly concentrated at a strike price of $80,000, followed by $70,000. For call options expiring on December 27, the open interest is mainly concentrated around $100,000 and $80,000.

The open interest of options expiring on November 8 has a strike price as high as $75,000, indicating that this is a key market focus area during this period.

However, some have characterized the price behavior as an election hedge rather than a bullish outlook.

Augustine Fan, head of insights at SOFA, told CoinDesk in a Telegram message: "I wouldn't say people are buying $80K BTC call options to bet on higher prices, but more like a cheap option (implied volatility hasn't actually gone up that much) to hedge against a broader market bounce."

"BTC volatility is heavily skewed towards higher prices post-election, but as an 'election hedge' this has been going on for several weeks now," Fan added.

CoinGecko data shows that BTC has fallen 0.7% in the past 24 hours, outperforming the broader CoinDesk 20 (CD20) decline of 1.6%.