Author: Krisztian Sandor, James Van Straten, CoinDesk; Translator: Tao Zhu, Jinse Finance

Summary

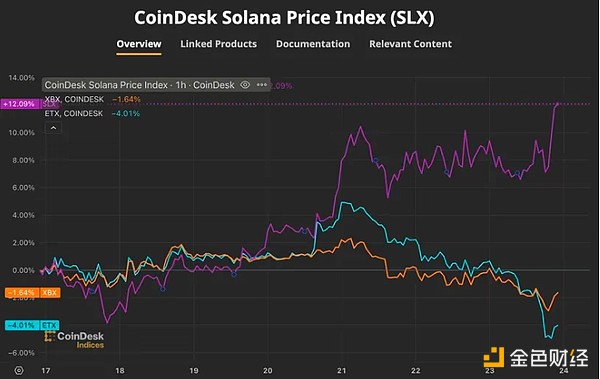

On Thursday, Solana's SOL outperformed Ethereum (ETH) and Bitcoin (BTC).

The latest meme coin trend driven by AI agents promoting and investing in tokens is primarily centered around Solana.

Over the past four days, open interest in Solana futures has increased by nearly 3 million SOL, or $506 million.

While the broader cryptocurrency market has been consolidating after a rapid rebound from early October lows, Solana (SOL) has continued to outperform the largest cryptocurrencies.

SOL was the best-performing asset in the CoinDesk 20 index over the past week, rising 11%, while nearly all other cryptocurrencies declined.

According to TradingView data, on Tuesday, SOL reached a new all-time high relative to the Layer 1 network Ethereum, surpassing the 0.064 level first reached in August.

At the same time, SOL has also shown relative strength against Bitcoin, reaching its highest price relative to BTC in over two months.

BTC and ETH price performance (CoinDesk index)

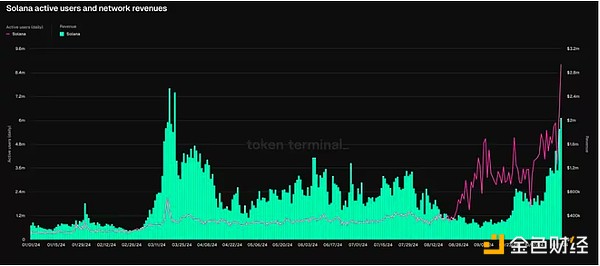

This price action coincides with a resurgence of meme coin speculation, a significant increase in network revenue, and a rise in bullish bets in the cryptocurrency derivatives market.

Solana activity thrives on meme coin frenzy

Solana has greatly benefited from the speculative frenzy around meme coins, with much of the activity centered around Solana-based decentralized finance (DeFi) protocols. The latest trend or fad of AI meme coins is also primarily based on the Solana network.

A key example is the Goatseus Maximus (GOAT) token, which saw its market cap surge from zero to over $600 million in just two weeks, with the AI bot called Truth Terminal, backed by Marc Andreessen, heavily promoting it on social media. The token was created by an anonymous developer on October 10 using Pump.fun and endorsed by Truth Terminal.

In a report on Wednesday, DeFi analyst David Zimmerman of K33 Research wrote, "This way, the convergence of AI, meme coins, and cryptocurrencies has birthed a complete narrative." "Over the past two weeks, AI meme coins have gained widespread attention, with many tokens reaching market caps over $100 million."

The meme coin frenzy has pushed Solana's blockchain activity to new highs. Token Terminal shows that network revenue from transaction fees exceeded $4 million per day on Tuesday, nearing a record set in March and up tenfold from the low in early September. Meanwhile, active users on the chain have reached an all-time high, surpassing 8 million.

Solana on-chain activity surges (Token Terminal)

According to Blockworks data, the higher revenue has also helped curb token inflation, with over 15% of new token issuance now being destroyed or burned.

Open interest soars

CoinGlass shows that open interest in the SOL futures market has climbed to over 18 million SOL, or $309 million, the highest nominal value since January 2023. In the past four days alone, open interest has increased by nearly 3 million SOL, worth $506 million.

Open interest refers to the total amount of funds allocated to unsettled futures bets or open futures contracts. It is one of the best ways to gauge whether new money is entering the market. It can be measured in native token terms, such as the nominal value of solana (SOL). Native tokens are the preferred denominator because the nominal value is affected by changes in the asset's price. A surge in leverage could lead to market volatility, and if prices start to move in one direction, we may see large-scale liquidations of short or long positions.

The annualized funding rate for perpetual contracts is 10%, which measures the price that longs must pay to shorts to maintain their perpetual futures positions, indicating that the majority of the bets are long, expecting prices to rise.