Although there was recent controversy over Tesla's sale of Bit, the third-quarter earnings report shows that Tesla still holds Bit.

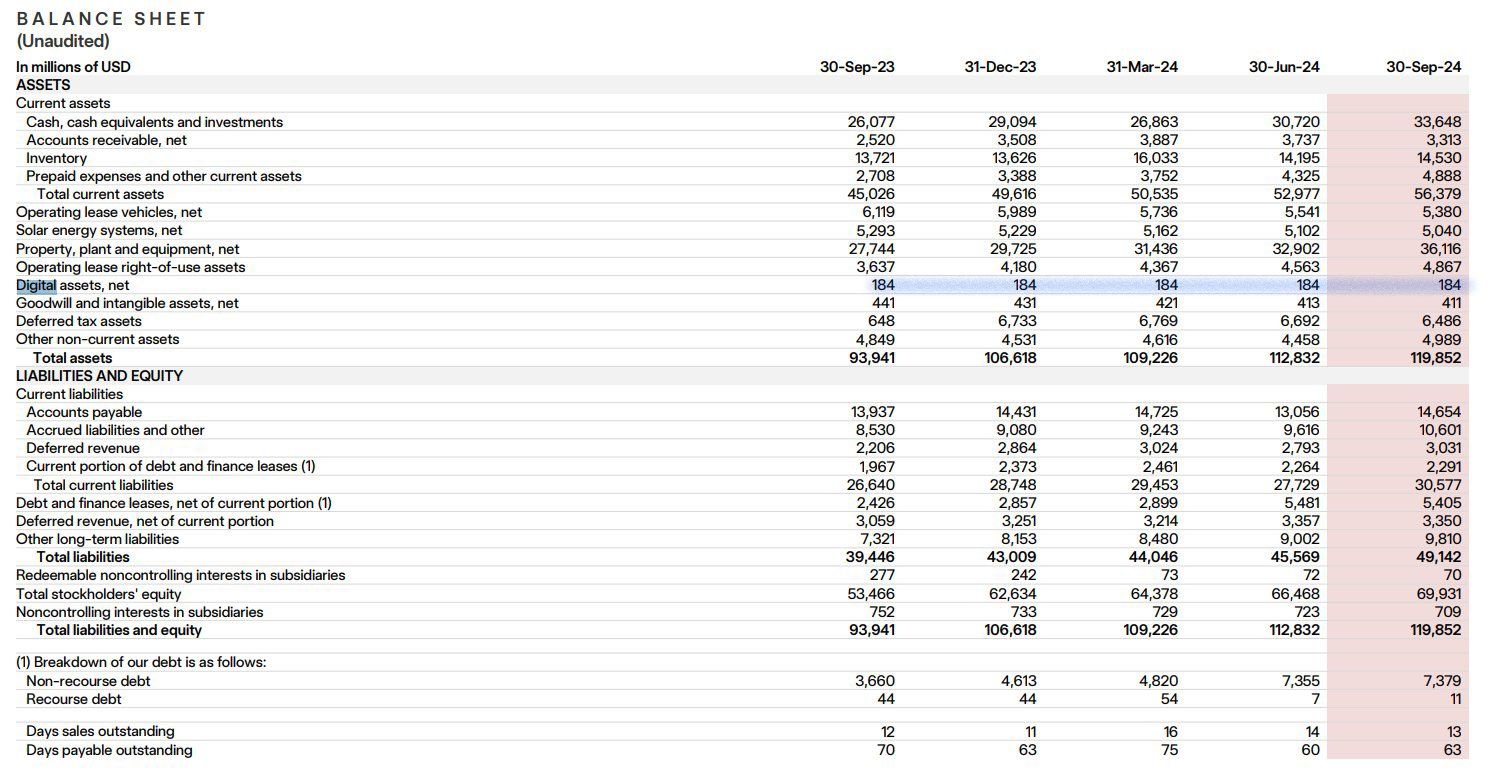

The company continues to hold 11,509 BTC, valued at approximately $765 million. This means that Tesla is the fourth-largest corporate holder of Bit in the United States. The top three are MicroStrategy, Marathon Digital Holdings, and Riot Platforms.

Over 11,500 Bit Moved Suddenly - 'Just for Security Purposes'

The reason for the sudden controversy over Tesla's sale of Bit was that there had been a large-scale movement of Bit from Tesla's Bit wallets. Typically, Bit movements are often for the purpose of selling. However, the third-quarter earnings report confirms that no such action was taken. Arkham Intelligence also confirmed that this movement was likely for security purposes.

Read more: Who Will Own the Most Bit by 2024?

"The Bit wallet movements we reported last week were just a wallet rotation to confirm that Bit remains in Tesla's possession. The Bit is now held in 7 wallets, with holdings ranging from 1,100 to 2,200 BTC." Arkham Intelligence posted on X (formerly Twitter)

Tesla's third-quarter earnings report surprised many analysts and exceeded expectations in some areas. The company recorded a total margin of 19.8%, up from 18.0% in the second quarter.

However, revenue came in slightly lower than expected at $25.1 billion, compared to the expected $25.4 billion. This figure still represents an 8% increase year-over-year, indicating strong global sales growth.

Tesla CEO Elon Musk had previously mentioned the company's profit issues, stating that they had dropped by nearly 50% at the end of the second quarter due to competition from cheaper electric vehicles. He assured investors that this decline would be temporary.

One Bearish Factor for Bit Has Disappeared

Tesla's earnings report provides some reassurance to the Bit community. The fact that the company's holdings did not change during the quarter suggests the market may be more optimistic.

Read more: Top 5 Platforms to Buy Bit Mining Stocks After the 2024 Halving

Another of Elon Musk's ventures, SpaceX, also holds 8,285 BTC worth $560 million, making it the seventh-largest corporate holder of Bit.

Tesla's relationship with Bit dates back to 2021 when it briefly accepted the cryptocurrency for vehicle purchases.

This policy was later revoked due to concerns over the environmental impact of Bit mining. Musk hinted that he may consider re-accepting Bit if mining practices become more sustainable.

Bit prices are currently around $66,500 and stable. It will be interesting to see what impact the post-earnings optimism may have on the market in the coming days.