Original: Liu Jielian

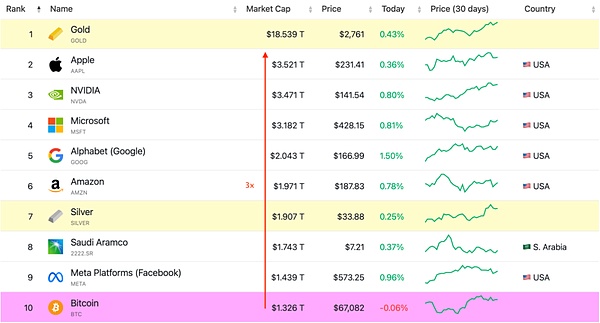

This weekend, BTC withstood the challenges of various external events and successfully defended the 67k position. Jielian suddenly discovered an interesting arithmetic, that is, when BTC is at the 67k line, its market value is 1.3 trillion US dollars. If the BTC price is multiplied by 3, the market value will reach 3.9 trillion US dollars. This is a "tipping point" moment: because 3.9 trillion US dollars just exceeds the current market value of the world's largest company, Apple, which is 3.5 trillion US dollars.

BTC becomes the company with the highest global market value, a company without a boss, without employees, without an office, an immortal and evergreen company, a company with huge cash flow but zero profit.

$67,000, multiplied by 3 is about $200,000.

Satoshi Nakamoto is estimated to have mined and held 1.1 million BTC. If BTC triples from the current base, that is, reaches $200,000, then Satoshi Nakamoto's wealth will reach $220 billion, surpassing the world's second richest person, Tesla CEO Elon Musk ($210 billion), and on par with the world's richest person, Bernard Arnault ($220 billion).

It can be said that Satoshi Nakamoto will become the new world's richest person, and also the first world's richest person from the cryptocurrency industry.

The symbolic significance of this is huge. The fact that an industry can produce the world's richest person shows that this industry is a sunrise industry that will attract a large influx of talent.

However, it is highly likely that Satoshi Nakamoto will not care about this nominal title at all.

If BTC triples again to reach $200,000, based on an exchange rate of USD:RMB = 7:1, one only needs to own a little more than 7 BTC to achieve RMB-denominated A8 (multi-millionaire) status.

In other words, an A8 only needs to hold a single-digit number of BTC to easily achieve this.

This is called "ten coins can be called a marquis".

According to 2023 data, the number of multi-millionaires (individuals with 10 million RMB or more) in China is around 2 million. 2 million out of 1.4 billion, a ratio of 1.4 per thousand, can be called "one in a thousand".

And A9 (billionaires) will only require less than 100 BTC.

The number of billionaires in China is around 150,000. 150,000 out of 1.4 billion, a ratio of 1 in 10,000, "one in ten thousand".

If BTC triples again to reach $200,000, owning just 5 BTC will make your net worth reach $1 million, joining the ranks of global millionaires.

As of 2023, the global number of millionaires (individuals with $1 million or more) is only around 60 million.

If these millionaires each want to own 1 BTC - note that it is only 1 BTC - the vast majority of them will not be able to realize this wish: because the total supply of BTC is only 21 million, which is only one-third of the 60 million millionaires! That is to say, even if they divide it equally, each person can only get about 1/3 of a BTC.

But if BTC triples again to reach $200,000, is that already very high and enough? No, not at all.

Suppose Trump, according to his publicly discussed national BTC strategic reserve plan, has the US government reserve 1 million BTC. Then when BTC reaches $200,000, the value of these strategic reserves will be about $200 billion. Compared to the $35 trillion US debt scale, it is still a drop in the bucket: $200 billion, only enough to repay 0.57% of the $35 trillion. This is still very, very far from being able to "pay off debt with BTC" as Trump said.

The above 3 times and $200,000 are not an unreachable figure.

Of course, this is a static assumption, and in reality, other US stock companies are also changing, so it may be other multiples and prices that can surpass the US stock market.

This surpassing will most likely become the "tipping point" for BTC to enter the "early mass market", and thus become the turning point for BTC to enter a new stage of growth.

In this bull market cycle, we will most likely witness the arrival of this "tipping point" that is destined to attract global attention.