CoinGecko data shows that BTC has risen 5% in the past 24 hours, breaking through the key resistance level of $70,000, with trading volume reaching $48 billion, nearly double the Monday trading volume.

Bitcoin broke through $71,000 during the Asian trading session, rising 5% in 24 hours, leading to a significant increase in trading volume, with over $143 million in short positions being liquidated.

This rise is partly due to whale activity on Binance and large inflows into Bitcoin ETFs, with a net increase of 47,000 BTC in Bitcoin ETFs over the past two weeks.

This rise is influenced by the upcoming US election, and traders are betting on a bullish market condition regardless of the outcome.

In early Asian trading on Tuesday, Bitcoin surged above $71,000, leading a broader market trend, with the US election less than a week away, and traders generally believe that regardless of who wins, this is a bullish catalyst for the market.

CoinGecko data shows that BTC has risen 5% in the past 24 hours, breaking through the key resistance level of $70,000, with trading volume reaching $48 billion, nearly double the Monday trading volume.

This has led to the liquidation of over $143 million in short or bearish bets on the price rise in the past 12 hours, which may be the reason for the price surge as traders close their losing short positions. CoinGlass data shows that BTC shorts lost $73 million, followed by ETH shorts losing $39 million.

Darius Sit, co-founder of QCP Capital, told CoinDesk in a Telegram message: "We're seeing some shorts around $70,000 getting liquidated as the market seems to be pricing in an increasing certainty of a Trump win."

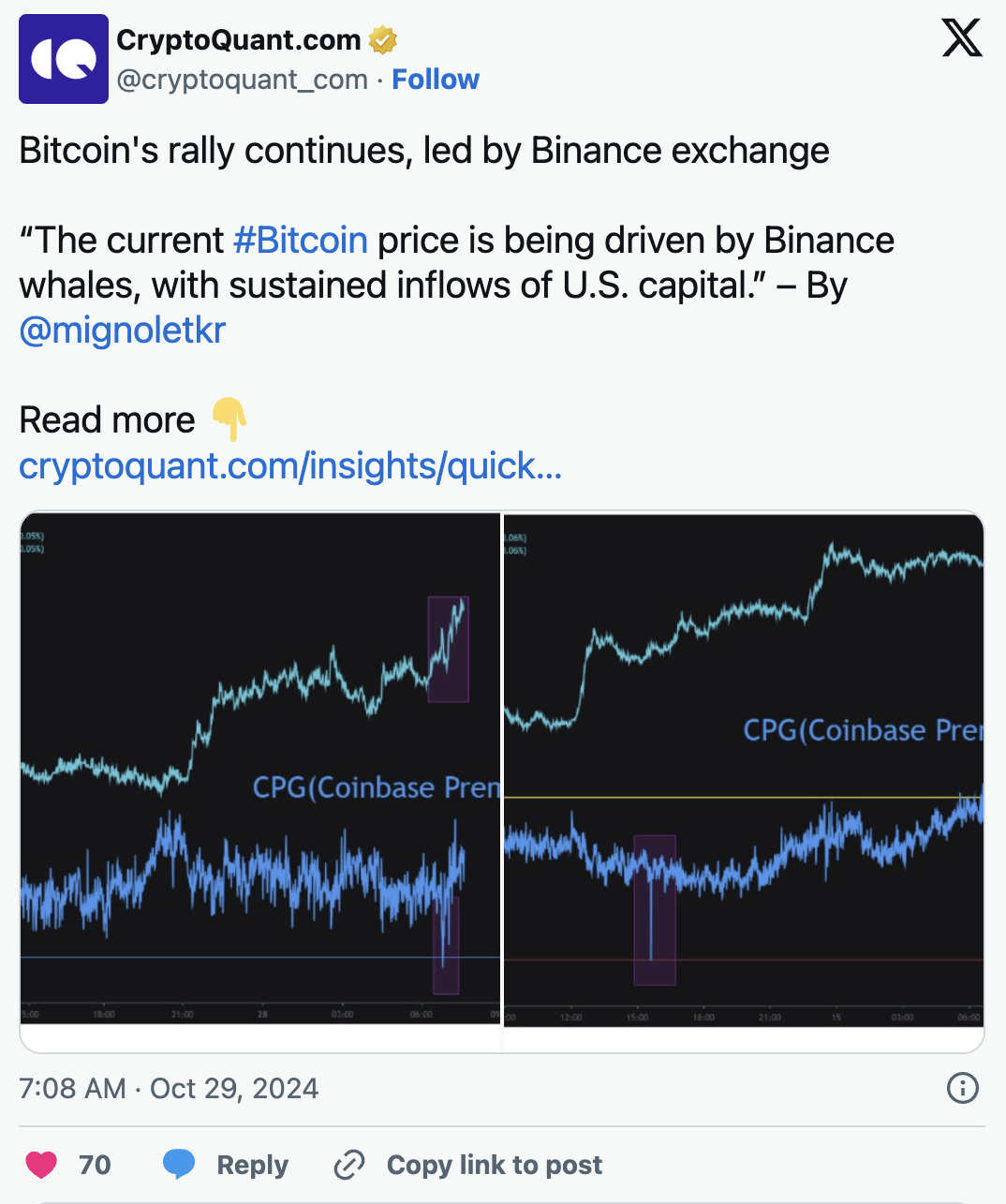

CryptoQuant community analyst Mignolet attributed some of the buying demand to whales (influential traders) on the cryptocurrency exchange Binance, who appear to be net buyers of the asset, mainly during the Asian trading session.

Bitcoin exchange-traded funds (ETFs) have further driven demand, with a net inflow of 47,000 BTC over the past two weeks.

Major currencies led by Doge (DOGE) have surged. DOGE has risen 15% as Trump continues to be in favor, with Shiba Inu (SHIB) rising 8%. Ethereum (ETH) rose 4.9%, while Cardano's ADA, Solana's SOL, and BNB Chain's BNB rose over 3%.

The broad-based CoinDesk 20 (CD20), a liquidity index tracking the largest tokens by market cap, rose 3.3%.

Tuesday's rise comes as the tone shifts ahead of the November election, and traders expect BTC to hit new highs regardless of whether the Republican or Democratic party wins the US presidential election.

Traders have long believed that a victory for Republican Donald Trump would be a bullish catalyst for the industry, as he supports cryptocurrencies and has promised to make the US a Bitcoin powerhouse.

On the other hand, Democrat Kamala Harris has not made similar commitments, but has stated that she will introduce regulations to protect certain groups. However, some argue that the asset is likely to rise regardless due to several macroeconomic factors.

Cryptocurrency options traders are increasing bets that Bitcoin will hit new highs by the end of November. The open interest in options expiring on November 8th has a strike price as high as $75,000, indicating this is a key market focus area for that period.