Author: Charles Yu, Galaxy; Translated by: Baishui, Jinse Finance

Overview

Solana is a high-performance, low-latency blockchain known for its speed, efficiency, and focus on user experience. Despite initially facing repeated network outages and being closely associated with FTX, Solana has made a remarkable recovery and found a strong ecological foothold in the payment, DePIN, mobile, and consumer end markets. Looking ahead, Solana faces fierce competition from the Ethereum L2 space and must defend its reputation as one of the fastest and most performant blockchains in the world against a new wave of competitors.

Background Information

Solana was launched in 2020 by Solana Labs, which was founded in 2018 by Anatoly Yakovenko (“Anatoly”) and Raj Gokal. Anatoly, who previously worked in systems engineering at Qualcomm, set out to build a blockchain optimized for information throughput and speed to solve the scalability issues facing Ethereum—specifically, “a state machine that is synchronized around the world with the lowest possible latency,” Anatoly said.

The core principles that differentiate Solana from other blockchains include:

Prioritize hardware-based scaling advantages. By maximizing the efficiency of cores, disks, and network cards, Solana is designed to scale elastically over time as hardware improves.

Leveraging time to reach consensus faster. Solana combines the Proof of History (PoH) consensus mechanism with the more common Proof of Stake to quickly sync state with minimal overhead.

Composability through integrated (monolithic) architecture. As a unified ecosystem, all applications built on top of this single blockchain inherit composability, enabling them to seamlessly interact and build on each other.

Other defining characteristics of Solana include:

Fast transaction confirmations. Solana targets a slot time of 400ms, but in practice is typically between 500-600ms (see Solana Explorer). Solana (unlike Ethereum) does not have a native in-protocol memory pool; instead, user transactions are routed directly to validators, resulting in faster execution and shorter confirmation times.

High throughput and scalability through parallelism. Solana has a theoretical throughput of 65k TPS, and it uses a multi-threaded approach to achieve parallel transaction execution (the Solana Virtual Machine (SVM) is designed to process multiple transactions in parallel by utilizing all the cores of the validator machine).

Cheap, predictable transaction fees. Network fees on Solana are fixed at 0.000005 SOL per transaction (about $0.00025 per transaction on average); a local fee market (related to parallel processing) prevents one specific activity on the network from increasing fees for the entire network.

Running a validator node is expensive. Solana validators have high node requirements and high operating costs, including hardware costs (e.g., CPU > 16 cores/32 threads; 512GB+ RAM; 1TB+ SSD), on-chain voting fees associated with each validated block (up to ~1 SOL/day), server costs (estimated at $500/month), and bandwidth (1GB/s download/upload speed minimum, 10GB/s commercial speed preferred). These operating costs of running a Solana validator are estimated to total ~$50,000 per year.

Note: In order to increase the decentralization of the network, the Solana Foundation Delegation Program (SFDP) covers part of the voting costs for participating validators. Helius estimates that if the SFDP is stopped immediately, the approximately 900 participants in the program (accounting for approximately 57% of all Solana validators) will find it difficult to maintain profitable operations.

Over the years, Solana’s unique blockchain design and fee market approach have caused the network to experience periodic downtime or performance degradation. While the circumstances of each outage may vary, most issues are related to network congestion caused by spam transactions (facilitated by Solana’s cheap fixed fee structure). During these periods of congestion, Solana users experience high rates of transaction failures or loss, resulting in a poor user experience.

These issues prompted the network to implement solutions, including (i) optional priority fees to increase the likelihood of transaction acceptance, (ii) a local fee market as described above, and (iii) QUIC and stake-weighted QoS (Quality of Service), which work together to improve communication between nodes and allow block producers to prioritize traffic on the network. After these changes, the stability of the network has increased significantly - only one incident has been reported since the last incident in February 2023.

Additionally, as a long-term solution that will significantly improve Solana’s performance during periods of congestion, Jump Crypto has been leading the development of a new validator client, Firedancer, written in C++. The Firedancer client leverages a unique modular architecture by completely rewriting the functional components of the network, runtime, and consensus. Firedancer has demonstrated the ability to process over 1 million transactions per second (over 10x higher than Solana’s current theoretical maximum of 65k TPS), and is expected to future-proof the Solana network and solidify its position as the “fastest blockchain in the world.” Firedancer will also reduce hardware requirements, making it cheaper to run new validators on Solana, and improve the network’s resiliency by introducing another validator client to run alongside the existing Rust-based Agave client. At Solana’s Breakpoint conference in September 2024, Jump’s chief scientist announced that “Frankendancer” (a temporary non-voting version of the full Firedancer client) was live on mainnet, and that the Firedancer client was live on testnet (the runtime and consensus components of the full Firedancer client are still under development). A specific date for the Firedancer mainnet launch has not yet been determined, but is expected to be sometime in 2025.

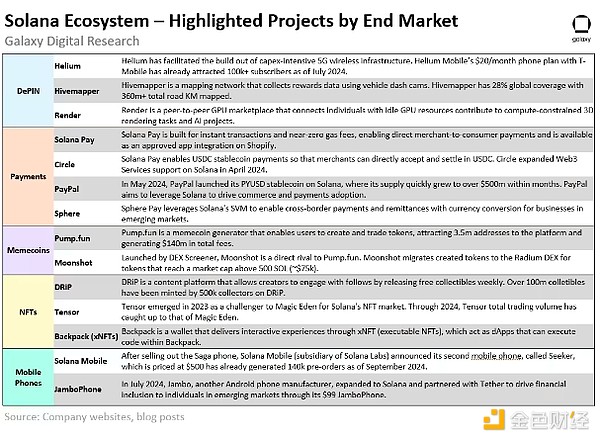

Ecosystem Highlights

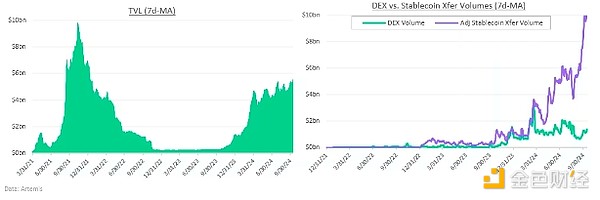

The Solana network and its community were particularly affected by the FTX crash in early November 2022 due to the ecosystem’s relationship with FTX and its CEO Sam Bankman-Fried, who was an early backer of the protocol and an investor in many ecosystem projects. Since then, Solana’s adoption has gradually but steadily picked up, especially in late 2023. Today, Solana has a rich ecosystem of projects across multiple verticals worth noting, including:

Retail (Memecoins/NFTs). Memecoins and NFTs are attracting a new wave of retail users on Solana due to their virality and astronomical earnings potential. Solana has a robust ecosystem of launchpads, marketplaces, and community engagement tools. Memecoin and NFT creators on Solana can leverage tools like Pump.fun or Metaplex to easily mint new tokens with very low deployment costs. Solana is ahead of all other blockchains in token issuance, many of which are memecoins such as dogwifhat (WIF), Bonk (BONK), Jeo Boden (BODEN), and Moo Deng (MOODENG). Additionally, Solana’s state compression enables NFT creators to batch mint NFTs through Metaplex at a much lower cost than using Ethereum.

Payments. Solana Pay aims to go beyond just “paying with crypto” and usher in a new era of payments and commerce. Solana enables users to pay merchants with near-instant confirmations, minimal and predictable fees. Solana Pay is available as an integration plugin option in Shopify-powered storefronts. Solana has been recognized by Circle, Visa, and PayPal for stablecoin settlements. In particular, in the “ Diving Deeper into Solana ” report, Visa highlighted Solana’s high throughput capabilities, multi-threaded approach to supporting parallel transaction execution, low and predictable transaction fees from a localized fee market, and near-instant transaction confirmations.

In early 2024, Paxos, which issues stablecoins including USDP and PayPal’s PYUSD, received regulatory approval from the New York State Department of Financial Services (NYDFS) to offer its products on Solana, making it the second blockchain after Ethereum. Previously, NYDFS-regulated trusts like Paxos were limited to issuing on Ethereum.

DePIN (“decentralized physical infrastructure”). Solana has a rich ecosystem of DePIN (“decentralized physical infrastructure”) projects. DePIN leverages the financial infrastructure and token incentives of cryptocurrency to build a fair network of physical infrastructure and promote the distribution of ownership. Projects such as Helium, Hivemapper, and Render recognize Solana’s technical advantages, which enable DePIN infrastructure to be deployed at scale at low cost and supported and iterated by the developer/user community - in 2023, both Helium and Render migrated from other chains to Solana, highlighting Solana’s strong network infrastructure, developer tooling, and distribution capabilities as the reason for the migration.

Solana Mobile. Solana Mobile, a subsidiary of Solana Labs, offers an Android phone designed for Web3 and has its own free Solana dApp Store. The Saga phone officially launched in May 2023 for $1,000, initially to limited demand but quickly sold out all 20,000 units produced, thanks to a discounted price of $599 and additional financial incentives from third-party ecosystem projects (i.e., Saga buyers’ coveted BONK airdrops, which are worth more than the initial cost of the phone). As of September 2024, pre-orders for the new $450 Seeker phone (Saga’s successor) have exceeded 140,000, with a planned release in mid-2024. Also at this year’s Solana Breakpoint, Jambo announced the JamboPhone 2, another Android phone integrated with Solana that costs just $99.

New tools introduced this year unlock even more powerful capabilities for project teams on Solana to accelerate adoption and growth in the core end markets listed above.

Blinks/Actions. Solana launched Actions and Blinks (short for “blockchain links”) in June 2024 to easily integrate blockchain transactions into any platform, creating a seamless and intuitive experience for users. Actions are APIs that prompt applications to send signable transactions to users in a variety of environments, such as QR codes, buttons + widgets on mobile and desktop applications, and websites. Actions improves the accessibility of Web3 applications, reduces user friction, and simplifies the process of integrating on-chain transactions into existing websites or applications. Examples of the use of Actions include facilitating face-to-face retail payments using cryptocurrencies via QR codes or integrating blockchain functionality into gaming platforms for in-game marketplace transactions, while Blinks can be used to tip content creators via social media without the need for complex wallet setup.

Token Extensions. Launched in early 2024 as a new Solana token initiative, Token Extensions (fka Token-2022) is rich in native functionality and provides advanced tools including confidential transfers, transfer fees, and permissioned access to meet the requirements of regulated businesses and institutions. Token Extensions unlock new use cases including interest accumulation on yield-yielding assets or governance of RWA issuance. Stablecoin issuers including Paxos have already implemented Token Extensions, leveraging features such as perpetual delegation, metadata pointers, and transfer pegs.

SOL Token / Token Economics

User transaction fees on Solana include:

The network transaction fee or “base fee” is fixed (unlike Ethereum’s variable base fee) at 0.000005 SOL (5,000 “lamports”) per signature.

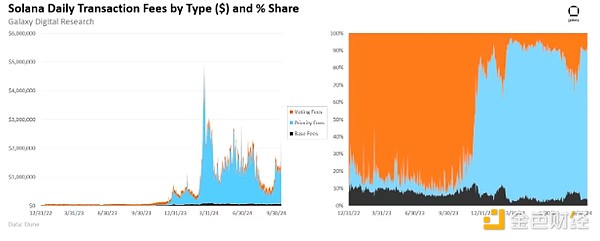

Priority fees (implemented in 2023) are optional payments used to combat network spam and speed up transactions to increase the likelihood of inclusion in a block. Priority fees are a function of the computational requirements of transaction processing. Since the rise of memecoin activity on Solana in late 2023, priority fees have rapidly grown to become the largest component of Solana’s total transaction fees, averaging over 80% of total transaction fees as of 2024.

In addition to paying the base fee for user-initiated transactions, validators participating in the consensus must also submit on-chain voting transactions for each proposed block, and pay the same 0.000005 SOL fixed rate as the base fee. The voting cost may increase to about 1 SOL per day or about 300-350 SOL per year, which is the main operating cost of the validator.

Currently, 50% of all transaction fees on Solana (including base fees, priority fees, and voting fees) are burned. The remaining 50% goes to the current leader who proposed the block.

Looking ahead, the reward distribution structure will soon change with SIMD-0096 (approved by Solana governance in May 2024), which will allow block producers to retain 100% of the priority fees.

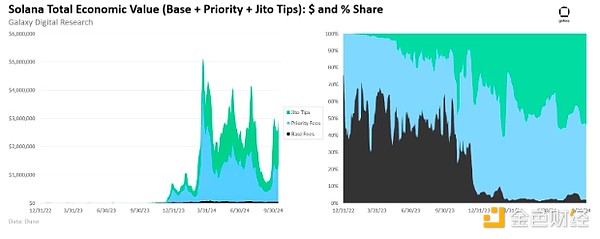

As mentioned earlier, the annual operating cost of running a validator on Solana is approximately $50,000. Validators generate income through (i) inflation commissions, (ii) block rewards, and (iii) MEV (primarily by running the Jito client). Priority fees have historically been consistent with Jito Tips, although Jito Tips tend to exceed priority fees during periods of high economic activity. But since validators only received 50% of profits from priority fees before SIMD-0096 (because 50% was burned), MEV has become a more important source of income for validators.

Other Token Details:

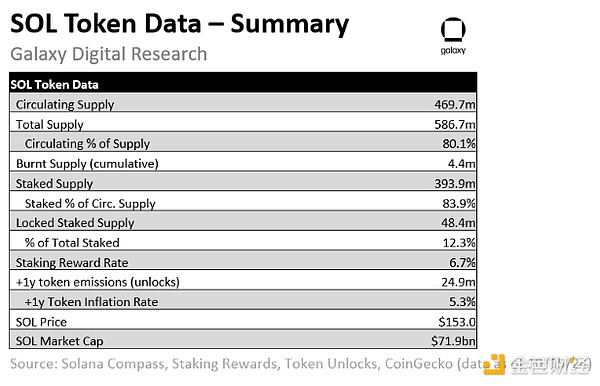

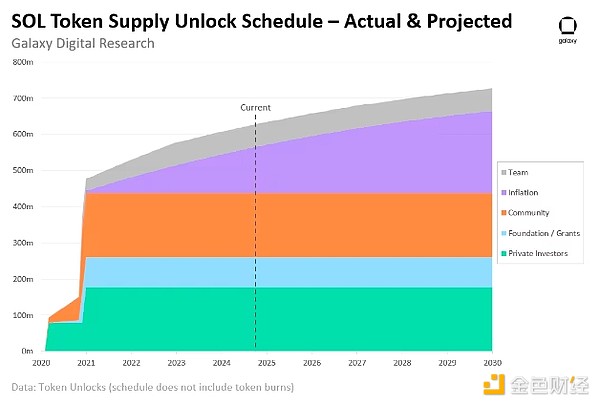

Token inflation: SOL's inflation rate is initially set at 8% and will decrease by 15% each year until it reaches a long-term inflation rate of 1.5%. There is no theoretical supply cap, but if the impact of token destruction is not taken into account, the SOL supply is expected to grow to approximately 737 million by the end of 2030 (an increase of 110 million from the current level, or an increase of 3.0% in inflation over the next 6 years).

Staking: As of October 15, 2024, 83.9% of the circulating SOL supply has been staked, of which 88.4% are running the Solana Labs or Jito-Solana client and earning MEV rewards. There are 1,328 staking validators with an average staked balance of 325 SOL, worth about $50,000 (but in reality, the top 19 nodes hold 33% of the total staked balance). Stakers are currently earning an annual interest rate of 6.3%.

Unlocks: Following a major cliff unlock to private investors and foundations in January 2021, and the completion of the team unlock in January 2023, there will be no additional programmatic unlocks of SOL supply beyond the standard inflation payments to stakers.

Note: Portions of the non-circulating or staked supply may be locked (e.g., as a result of investments in SOL or grants from the Solana Foundation) or subject to bankruptcy proceedings. Other portions of the non-circulating supply may be owned by Solana Labs or the Foundation for its delegation program, where stake is delegated to 1,000+ validators to improve decentralization.

Basic indicators

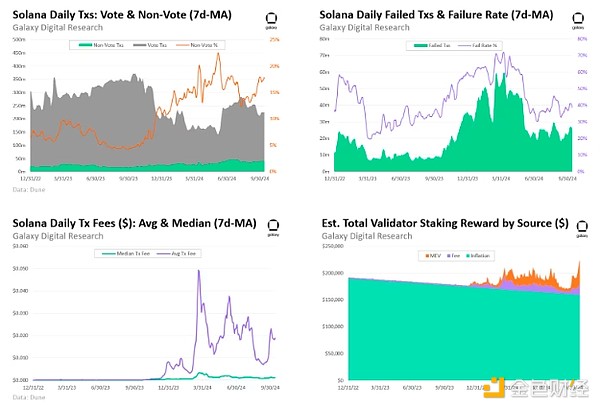

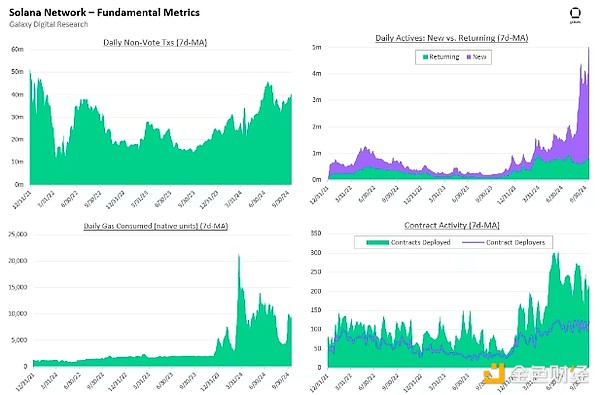

Since voting transactions are conducted on-chain, and every validator votes on every slot (generating over 2k votes per second), non-voting transactions should be considered a better representation of Solana user activity.

Voting fees should also be excluded from calculating Solana’s total economic value, which is the sum of base fees, priority fees, and Jito Tips (data shown in the previous section).

The sources of Solana fees represent the growth of the network. Priority fees have grown to account for over 75% of total network fees, exceeding base fees and voting fees (data shown in the previous section). It is important to monitor the volatility and growth of network transaction fees for non-voting transactions, which have averaged $0.017 so far in 2024.

While Solana’s infrastructure has improved uptime in recent years, failed and lost transactions on Solana remain a common problem. Transaction failure rates have declined from peaks in March and April of this year, when the failure rate for non-voting transactions averaged over 60%. However, it is worth noting that much of the failure rate is attributed to spam transactions from MEV bots.

Solana validator income is important for monitoring the Foundation's spending on the delegation program. Many Solana validators cannot afford the high operating costs and need subsidies from the Foundation. Even if Solana's economic activity has resumed in 2024, native issuance rewards account for more than 80% of the total staking rewards for validators. The Foundation currently subsidizes approximately 50 million SOL to 1,100 validators (about 70% of the total validators), which shows that if the Foundation stops the delegation program, most validators will not be profitable.

Competitive Positioning

Solana’s main competitors by category include:

The Ethereum and L2 integrated blockchain debate in “Modular vs Integrated Blockchains”. The Ethereum ecosystem is vying for technological supremacy through its modular approach, which benefits from a rich ecosystem of project teams, each focused on optimizing one specific infrastructure component. While most of the Solana community decries L2 and application chains, some builders are attempting to combine aspects of both approaches (e.g., by launching Rollups (RollApps) on Solana or SVM-powered L2 on Ethereum), blurring the lines of competition between the two networks.

Consumer and payment-oriented blockchains (e.g. memecoin and NFTs): Base is the second most popular memecoin trading platform, Tron is one of the most used payment platforms, and the TON blockchain takes a mobile-oriented approach to attract retail users (competing with Solana’s Saga and Seeker phones).

Other high-performance, fast blockchains. Solana has experienced increasing competition from other blockchains that take a similar approach to optimizing for speed and employ similar core design elements such as parallel transaction processing. This list includes Move-based chains such as Aptos and Sui, Sei (the first parallel EVM blockchain), and emerging chains that promise sub-second latency and >100k TPS throughput such as Monad and MegaETH. It is also worth noting that block times on Solana (0.45s average) lag behind block times on Aptos, Arbitrum, and Sei (the range for this group is 0.21s - 0.41s respectively)

Future Challenges/Opportunities:

Expanding into new payment flows. Payments on Solana can be a gateway to web3-enabled commerce experiences (e.g., token-gated offers, NFT-based loyalty programs, and airdrop rewards for new customers and increased engagement). While Solana has been praised for its payment viability by companies like PayPal, Shopify, and Visa, we have yet to see strong evidence of commerce-based payments adoption on the network (or any other blockchain). These companies are all looking to drive widespread adoption of new use cases using crypto payment rails, so their work with Solana could help drive significant economic activity on the network.

Maintain/accelerate momentum in the DePIN vertical. DePIN is one of the most compelling and potentially transformative use cases for blockchain technology. The migration of two of the largest DePIN projects, Hivemapper and Helium, to Solana has attracted other projects to similarly leverage Solana’s technology and ecosystem. That said, with low barriers to entry and the emergence of copycats/forks on alternative platforms, Solana must move quickly to solidify its lead if it wants to dominate the emerging DePIN market.

Convert first-time crypto users using memecoin into loyal, lifelong Solana users. Memecoin has been a strong user acquisition channel for Solana. They have attracted a new wave of crypto users, teaching them how to self-custody and how to submit (and resubmit) transactions with higher priority fees or increased slippage settings to increase the likelihood of success. Memecoin complements DeFi activity, but given the low retention rates and limited user engagement over longer timeframes, there is an opportunity to convert first-time crypto users from Memecoin into loyal, lifelong Solana users. For example, a dedicated mobile strategy using the new Seeker and JamboPhone 2 can leverage Solana Actions/Blinks to drive user engagement on Solana.

Increased Institutional Adoption and Regulatory Acceptance. Despite Anatoly’s tagline of “Blockchain at Nasdaq Speed,” Solana has been relatively slow to gain institutional adoption under the TradFi brand. However, token extensions are not available until early 2024, and Paxos has already adopted them to enhance the token standards for PYUSD and USDP. Additionally, the NYDFS granted Paxos a regulatory license to expand its stablecoin issuance to Solana, becoming its second chain after Ethereum, indicating growing regulatory acceptance of the network.

Restructuring Fee Structure and Improving Validator Economics. Past technical upgrades, including priority fees and stake-weighted QoS, have reallocated network resources to address transaction failure rates and network downtime. However, these solutions have not been completely effective in discouraging spam transactions. Since base fees represent only a small portion of total transaction fees, there is room for them to increase from the current 0.000005 SOL level, which could also ease the profitability challenges of operating a validator. Hardware improvements and the upcoming Firedancer should also reduce the cost of running a validator. As a result, the Solana Foundation may reallocate financial resources from the Foundation’s grant program specifically to various ecosystem initiatives in the aforementioned verticals.

Convince project teams to launch > application chains on Solana. Ethereum L2 and Cosmos provide developers with rich development tools and the ability to customize application-specific chains to meet user-specific needs. These solutions have attracted project teams to launch their rollups to gain benefits such as reduced competition for block space and greater control over the economic value generated by users. Solana must convince project teams that monolithic/integrated chains have technical and social benefits over launching application-specific chains/L2s, which today face fragmentation and lack of composability.

Fend off emerging “Solana killers” and maintain the title of “Fastest/Most Performant Blockchain in the World”. While Ethereum is Solana’s primary competitor, a wave of “next generation” blockchains are beginning to emerge that are targeting Solana. These newer chains take different approaches to optimizing different system components to provide the same speed and throughput advantages that Solana currently offers. Solana will maintain its lead over these emerging competitors by nurturing its community, retaining its existing user base, and releasing technical improvements such as Firedancer to maintain the title of “Fastest Blockchain in the World”. It is important to note, however, that after the launch to mainnet, the network will still be limited by downstream network capabilities and QUIC. Unless 100% of validators upgrade to Firedancer, its maximum impact on the network cannot be achieved, and if they all upgrade, then the benefits of “multi-client” will not be realized.

Upcoming important events/developments

Some important upcoming events/developments and expected timings:

Full Firedancer client (expected 2025)

Solana L2, SVM Rollups, Solana Restaking, and ZK Compression (2024-2025)

Solana Breakpoint Abu Dhabi 2025 (December 2025)