Dispread Research, the research organization of the Web3 consulting firm Dispread, released a report analyzing the causes of the polarization of BTC and altcoin prices on the 30th. Altcoins refer to virtual assets other than BTC.

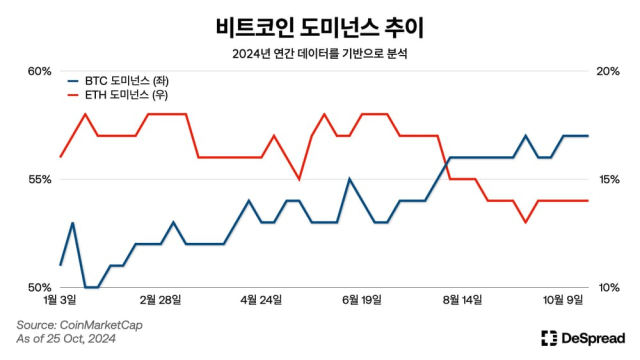

According to the report, the upward trend of altcoins is sluggish, but the upward trend of BTC and memecoins is pronounced. In fact, the dominance of BTC and Ethereum (ETH) this year showed opposite trends. Dominance is an indicator that represents the proportion of the market capitalization of a specific virtual asset in the entire industry. BTC dominance has been steadily rising this year, reaching 57% as of the 9th, but ETH dominance has gradually declined to less than 15% since last August.

Related Articles

- Dispread Research "US Presidential Election Results and Japan's Base Rate Important for Virtual Asset Market"

- Dispread "Stacks and Sei are the most popular virtual assets in Korea this year"

- Bitcoin Breaks 100 Million Won for the First Time in 7 Months

- US Bitcoin Spot ETF Attracted $105 Billion in Inflows in Europe This Year

While BTC dominance has increased, the overall size of the virtual asset market has decreased. The total market capitalization of virtual assets was about $2.6 trillion in March, but decreased to $2.3 trillion on the 25th. This explains that the capital was concentrated on BTC or individual virtual assets, not the entire market growing together.

The increased popularity of memecoins was also cited as a cause of polarization. The report said, "The demand for memecoins listed on decentralized exchanges (DEXs) was higher than on centralized exchanges (CEXs)." According to a survey by The Block, DEX trading volume increased by about 14% this month. This is nearly double the increase in trading volume (7.9%) in February. Memecoins also recorded high trading volume on Radium, a DEX based on Solana, which led the memecoin craze.

On the other hand, the situation of newly emerging altcoins is not good. Starknett (STRK), Zksync (ZK), and Blast (BLAST), which were recently launched and attracted attention as promising projects, have shown poor price performance. Lee Seung-hwa, head of the Dispread Research team, said, "The virtual asset market is experiencing a tailwind due to the lead of Donald Trump, the US presidential candidate, and the improvement of the macroeconomic environment, but unlike the previous bull market, the impact is concentrated on BTC or some memecoins." He added, "We need to pay attention to the changes in the virtual asset market after the US presidential election."

- Choi Jae-heon, reporter

- chsn12@decenter.kr

< Copyright ⓒ Decenter, Unauthorized reproduction and redistribution prohibited >