Author: Revc, Jinse Finance

Preface

The US presidential election voting day is set for November 5th, Eastern Time. As the biggest political and economic event of the year, it has attracted the attention of global financial markets. On November 2nd, US Vice President Harris and former President Trump both participated in campaign events in North Carolina. Their private jets were parked on the same tarmac, just dozens of meters apart, highlighting the intense state of the race. The fierce competition between Trump and Harris has also triggered price fluctuations in "Trump trades" of asset prices.

The US election result is not expected to be revealed on the voting day or the next day. Reviewing the previous election, due to the close vote counts in swing states, it took four days for each state to tally the ballots, and the final confirmation of Biden's victory was not until November 7th. In this election, the poll gap between Trump and Harris has narrowed, and the ballot counting time in swing states may be even longer.

Before the election, certain economic and data indicators can signal potential political outcomes, providing insights into voters' priority economic concerns. Additionally, asset classes and stock performance typically react as the election approaches and make rapid adjustments after the results are announced.

Overview of Relevant Indicators and Asset Changes:

1. Key Economic Indicators Before the Election

Consumer Confidence Index (CCI): This index measures the optimism of consumers about the economy. Higher consumer confidence benefits the incumbent party, as it reflects public satisfaction with the economy. Lower confidence may indicate dissatisfaction, favoring the challenger.

As of September 2024, the US Consumer Confidence Index (CCI) declined in September to 98.7 (based on the 1985 benchmark of 100), down from the revised August data of 105.6. This decline reflects consumers' concerns about the labor market, although the job market remains healthy, with low unemployment, limited layoffs, and high wage levels.

Analysts note that this decline may reflect consumer concerns about reduced job opportunities and slower wage growth, although the overall economic conditions are still considered healthy.

Overall, despite the CCI decline, consumers' general economic expectations remain relatively optimistic, indicating that while there are some short-term concerns, long-term confidence has not been significantly undermined. This may reflect consumers' adaptability to the economy and financial markets, as well as confidence in future policies and economic recovery.

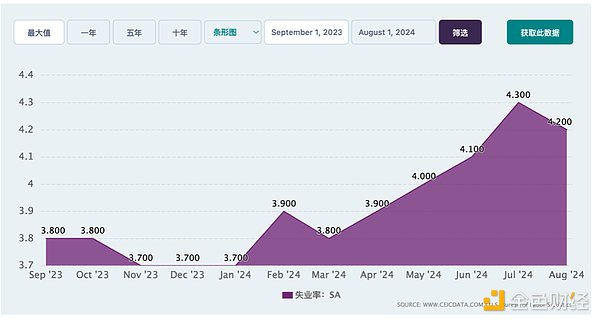

Unemployment Rate: A lower unemployment rate benefits the incumbent party, as it indicates economic stability, while a rising unemployment rate is unfavorable for the incumbent.

As of October 2024, the US unemployment rate was 4.1%. Compared to the previous months, this figure has stabilized, indicating that although external pressures such as hurricanes and new strikes may temporarily affect employment growth, the labor market remains resilient.

The employment situation has an impact on tax revenue, job creation, and the formulation of economic stimulus policies. The stable 4.1% unemployment rate in October 2024 is seen as an effective economic policy in the face of various challenges.

Gross Domestic Product (GDP) Growth: Robust GDP growth benefits the incumbent party, as it indicates the economy is expanding. Slow or negative growth often raises concerns about economic policies, favoring the challenger.

The US GDP growth rate in the third quarter of 2024 was 2.8% on an annualized quarter-over-quarter basis. This growth rate indicates that the economy has grown steadily but slightly slower compared to the previous quarters, showing a strong but cautious expansion. Consumers have continued to drive economic growth despite the higher borrowing rates implemented by the Federal Reserve in 2022 and 2023 to curb inflation.

Inflation Rate: Moderate inflation is usually tolerable, but high inflation near the election may cause voter sentiment to shift towards candidates promising economic reforms.

The Federal Reserve's preferred inflation indicator, the Personal Consumption Expenditures (PCE) index, grew at an annualized rate of only 1.5% in the previous quarter, down from 2.5% in the second quarter, reaching the lowest level in over four years. Excluding the more volatile food and energy components, the core PCE inflation rate was 2.2%, down from 2.8% in the second quarter.

Although inflation is under control, average prices remain far above pre-pandemic levels, causing dissatisfaction among many Americans and posing challenges for both Harris and Trump's campaign prospects. Most mainstream economists believe that Trump's policy proposals would exacerbate inflation, while Harris's policies would help continue to suppress inflation.

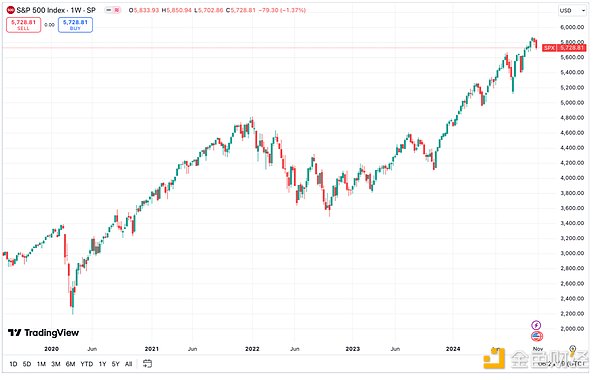

Stock Market Performance: Generally, a strong market supports the incumbent party, while a declining market may harm their prospects. Specific indices like the S&P 500 are often used as predictive indicators: if the market rises in the few months before the election, the incumbent party's chances of winning have historically been higher.

The S&P 500 index has historically been a barometer for election outcomes, with a positive trend in the three months before the election typically signaling a victory for the incumbent party. This pattern has applied to predicting the outcomes of 20 out of the last 24 presidential elections, indicating a strong correlation between the economic sentiment reflected in the S&P 500 and voter preferences. However, the current US stock market has a bubble related to the AI industry, and the correlation between data and indicators will be affected.

In the run-up to the election week, the index has risen nearly 20% so far this year, which can be interpreted as a market signal favorable to the incumbent party or reflecting broader economic confidence.

Despite the significant market gains, in the week leading up to the election, the market experienced a notable decline, with the S&P 500 index falling 1.37% and the Nasdaq index declining 1.5%. This may indicate that investors are feeling anxious in the final moments or repositioning based on potential policy changes after the election.

2. Assets and Stocks Reflecting the Election Outcome

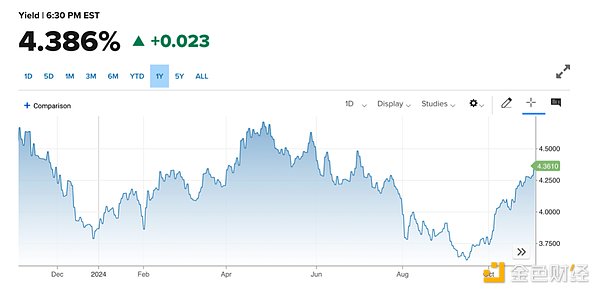

Treasury Yields and Bonds: Bond yields can quickly reflect expected changes in fiscal policy. For example, if a candidate supporting increased spending wins, yields may rise due to expectations of increased government borrowing. Conversely, if a more fiscally conservative candidate is expected to win, yields may stabilize or decline.

The yield on government bonds, especially the 10-year government bond yield, experienced volatility in 2024. The yield rose somewhat before November, which can be explained in various ways. Market observers believe this may reflect expectations of a change in economic policy after the election, especially if there are signs or signals that the Republican party may win, which has historically been associated with different fiscal policies that could affect the yield.

The bond market, especially government bonds and other fixed-income securities, often reacts to expected policy changes. If the market is pricing in a Republican victory, this could mean expectations of changes in fiscal policy such as tax cuts or regulatory reforms, which traditionally could lead to higher yields due to increased borrowing and higher inflation expectations. Conversely, a Democratic victory could bring different fiscal strategies, potentially impacting bond yields through spending plans or tax policies.

Tech stocks: Technology companies often react to potential regulatory changes, particularly around antitrust issues or data privacy regulations. If candidates are seen as likely to implement stricter regulations, tech stocks may face volatility.

The Nasdaq 100 index includes many of the largest technology and internet companies, and is often particularly sensitive to policy changes that could impact innovation, taxation, and regulation.

Historically, strong performance in the months leading up to an election often foreshadows a victory for the incumbent party. A clear market decline before the election may reflect investor caution or repositioning in anticipation of policy changes. Election years typically bring positive returns for the Nasdaq 100 index, with November's performance being particularly strong due to the resolution of election uncertainty.

Gold and safe-haven assets: If the election triggers economic uncertainty or geopolitical tensions, investors may turn to safe-haven assets like gold. Gold prices often reflect increased risk aversion.

Gold has historically been viewed as a safe-haven asset, often reacting to geopolitical events, economic policy uncertainty, and market sentiment, all of which tend to intensify during election periods. In the 2024 U.S. election, against a backdrop of political tensions, economic policy debates, and global geopolitical changes, this led to a significant rise in gold prices as investors sought to hedge potential economic turmoil.

Expectations of the election outcome drove a surge in gold prices, reflecting investor concerns and a desire to hedge uncertainty. This pattern is consistent with gold's performance in previous election years, although 2024 saw the largest price increase, potentially signaling deeper economic concerns or expectations of more impactful policy changes.

Historically, in the period after an election, as uncertainty subsides, gold prices may stabilize or even decline slightly, a phenomenon known as the "election cycle" for gold, with prices potentially peaking before the election and then correcting. However, if the election result leads to long-term policy uncertainty or economic instability, gold may remain a favored asset, potentially maintaining or even increasing in value.

If the election outcome is expected to weaken the dollar or promote inflation, for example through increased spending or geopolitical tensions that impact the dollar's dominance, gold may benefit. Conversely, if policies lean towards a stronger dollar, lower inflation, or economic stability, gold may see a correction.

3. Crypto Assets

Bitcoin and other cryptocurrencies: Cryptocurrencies can serve as an alternative hedge against economic and political uncertainty. Regulatory stances may have a significant impact on the market. Favorable candidates may promote growth, while regulatory threats may cause volatility.

With only one day left until the U.S. election results are announced, the crypto market has become increasingly volatile, with Bitcoin and other cryptocurrencies experiencing significant price swings, leading to large-scale liquidations of contract users' positions. Over the past 24 hours, the amount of crypto market user liquidations has reached as high as $350 million.

Over the past week, the price of Bitcoin has generally shown a downward trend, but has also seen intraday rebounds, posing risks of liquidation for both bulls and bears. It is expected that before the election results are announced, Bitcoin will continue to experience two-way volatility, and may then exhibit a unidirectional trend. If Trump wins, Bitcoin is more likely to rise, and vice versa.

4. Foreign Exchange Market

U.S. Dollar: The U.S. dollar typically reflects broader market expectations of economic policy. If the election outcome implies increased federal spending or potential trade policy changes, it may lead to dollar volatility.

The U.S. dollar has shown strength before the election, potentially due to risk-averse sentiment or expectations of major policy changes. However, its performance after the election may depend on whether Trump or Harris wins, with historical data showing different outcomes. Trump's victory may have already led to a stronger dollar due to expectations of deregulation and potentially more aggressive fiscal policies, while a Harris victory may initially weaken the dollar, potentially due to concerns over policy continuity or new regulations.

Summary

From consumer confidence indices to unemployment rates, GDP growth, and core inflation, current data provides both support for the incumbent party's representative Harris and grounds for criticism for Trump. While consumer confidence has declined slightly, the resilience of the job market, steady GDP growth, and controlled inflation are positive factors for the current administration.

The markets, including stocks, bonds, tech stocks, and gold, have shown varying trends - market volatility suggests investor caution, rising bond yields reflect expectations of fiscal policy changes, and gold as a safe-haven asset is in high demand amid increasing uncertainty. The performance of cryptocurrencies reflects market concerns over potential policy and regulatory changes resulting from the election.

From financial markets to the general psychological state of investors, the current economic signals provide a window for predicting the election outcome, while also highlighting the complexity and volatility of global markets during an election year.