Congratulations to Trump on his official election as President of the United States.

He is also the first U.S. president to openly support Bitcoin and cryptocurrencies. BTC is about to set sail.

The U.S. election voting has been completed, and the results are now being tabulated. At this moment, I am very excited, because with Pennsylvania turning red, Trump's inauguration is basically a done deal, and the Democratic Party's tricks will be hard-pressed to prevent Trump from entering the White House (unless there is an assassination).

The U.S. election dominates the secondary market:

Today we are still focusing on the U.S. election, and BTC in the secondary market has already started to take off since last night, and has now successfully broken through a new high. It's as if someone knew the answer in advance.

BTC has an independent market, MEME has an independent market:

The strongest one is undoubtedly BTC. Trump's previous speech at the Bitcoin conference gave the market confidence in BTC's promise, and now that he has won, both institutions and ordinary users will be frantically buying.

Then there's Doge, which has a very strong connection with Musk, especially after this round of support for Trump, the connection will be even more direct. I estimate that in the future there will be payments on x, so Doge is a long-term positive.

In addition to these two, there are also some on-chain MEME, such as:

Mage Trump Pnut dmaga, with a particular emphasis on Pnut. The squirrel has to some extent also supported Trump's election, so with Trump's victory, it will be a very strong narrative MEME going forward.

Finally, cheer up, the bull market is starting, and the market volatility on the chain will be even crazier.

How will the subsequent market perform?

Let's review the BTC market trend. Starting in November, Trump's winning rate began to decline, while Harris' winning rate began to rise, which was followed by a pullback in the Bitcoin market from its highs.

From this set of data, we can conclude:

When Trump's winning rate is high, it is positive for the crypto market, and the price of Bitcoin rises.

When Harris' winning rate is high, it is negative for the crypto market, and the price of Bitcoin falls.

This is a reflection of market sentiment. Of course, I don't understand politics and don't know the situation in the U.S., and I also believe that politics is darker than the financial market, and the dark machinations within it are unknown to us. But I understand trading and market sentiment, and can truly provide help for our trading ideas.

Looking at historical data, the risk market usually continues to rise for about three months after each election, and this time should be no exception, especially with the "president's" promise, so I think there may be some short-term volatility, but with Trump's election, there will be a better expectation.

First, we need to know why Bitcoin prices rise when Trump's winning rate increases?

It's because Trump promised many crypto-friendly policies during his campaign, and stood on the side of crypto users, so the market believes that Trump's election will bring new support to the crypto market, driving up coin prices.

The current market's positive view on Trump taking office is mainly emotional, and can also be seen from the perspective of the president's winning rate, with the market's rise already discounting Trump's victory in advance.

From this perspective, I believe:

After Trump's victory, the crypto market will first release the emotional boost, driving a short-term surge in prices, but the sustainability will not be strong (after all, it is driven by emotions). Then the early profit-taking positions will start to exit, leading to a price pullback and a retreat in sentiment, followed by an adjustment and waiting for the market to choose a new direction. (You can refer to the BTC ETF market at the time.)

What else is worth looking forward to after the election?

The election is actually just one factor in the cycle, and not even the most important one. In the trend and cycle, we can foresee:

A. The impact of the BTC halving cycle, which often also occurs within the election time frame.

B. FASB will officially take effect in December 2024.

C. The resubmission of SAB121 in 2025 will have a very high pass rate.

D. More importantly, the Federal Reserve's monetary policy has shifted from tightening to easing.

These are all events that will occur in Q4 2024 and Q1 2025, and the monetary policy itself is an ongoing easing, which will continuously raise investors' risk appetite and greatly help stimulate on-chain liquidity.

We are about to witness an unprecedented bull market, with Trump+Musk pro-crypto, and CZ's return, a luxurious bull market, and we will meet at the peak!

That's it for the article, if you like it, please give a follow and a like~

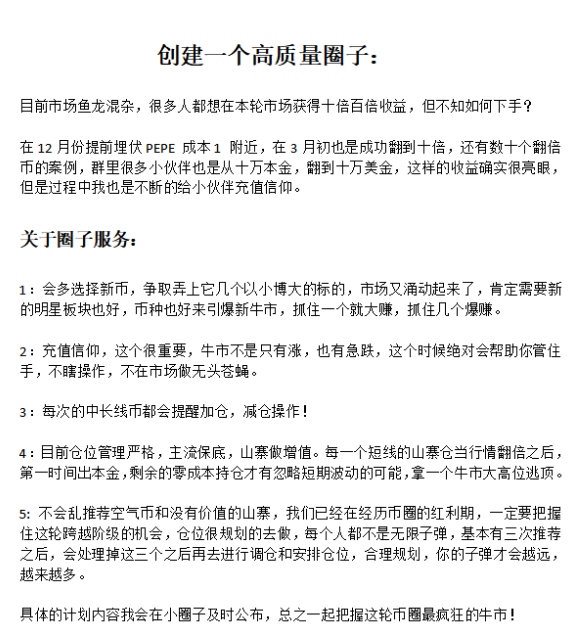

The new discussion group has already been set up! Now preparing to reorganize the discussion group, as long as the overall market returns to an uptrend, there will be many opportunities for Altcoins to explode. If you want to join the group, feel free to message me, and I'll add you one by one!

Creating a crypto welfare group! (I plan to find some low-cap coins with news catalysts in the near future to help everyone recover their losses, as the Altcoin season is about to arrive, I will help everyone seize the opportunities to double their money! The next crypto I will announce in the welfare group!!)

Number of people: Temporarily limited to 50, mainly spot trading

Additionally, we also have a VIP paid group (spot trading) for those who want to join the VIP group, also welcome to contact me to learn more!

Scan the code to join the community!