Last night, Binance announced the launch of the GRASS perpetual contract, and this news immediately ignited market sentiment, with the GRASS price soaring to $3.5, a new all-time high. The 24-hour trading volume exceeded $700 million, and since its launch on October 29, GRASS has accumulated a cumulative increase of more than 400%. So the question is, what's the secret behind this coin?

Previously, the author wrote an article about GRASS, when the price was only $1.5, and suggested giving it a try! Sure enough, the GRASS price has multiplied several times, and now we'll discuss the latest developments of this coin together, and you can also go back and review the previous article.

Recommended reading:Bucking the trend, a quick review of why Depin protocol Grass has skyrocketed

The Magical GRASS: Black Technology for Data Monetization?

What is GRASS? It is the latest darling in the DePIN track. Simply put, you just hang some data, and GRASS will reward you (TOKEN/POINT), a model that is not only fresh but also quite interesting.Behind it are top-tier VCs like Polychain, as well as investment heavyweights like Deiphi (the driving force behind the once-mighty project LUNA) and Hack, which have injected a lot of trust value into it. These major institutions have directly lifted the sedan chair, and GRASS has taken off like a rocket from the starting line.

Speaking of which, the DePIN operation is not that simple. The reason why GRASS has attracted a bunch of VCs to lift the sedan chair is that it has grasped two words: data. Everyone knows that AI is a must-have for the future of humanity, but AI cannot do without data, and data has long been monopolized by a few major companies.GRASS breaks this monopoly model through decentralization and data traceability. This "democratization of data sharing" sounds nice, but it's simply "paying you for your data", and this move has immediately won the hearts of a large number of loyal users and investors.

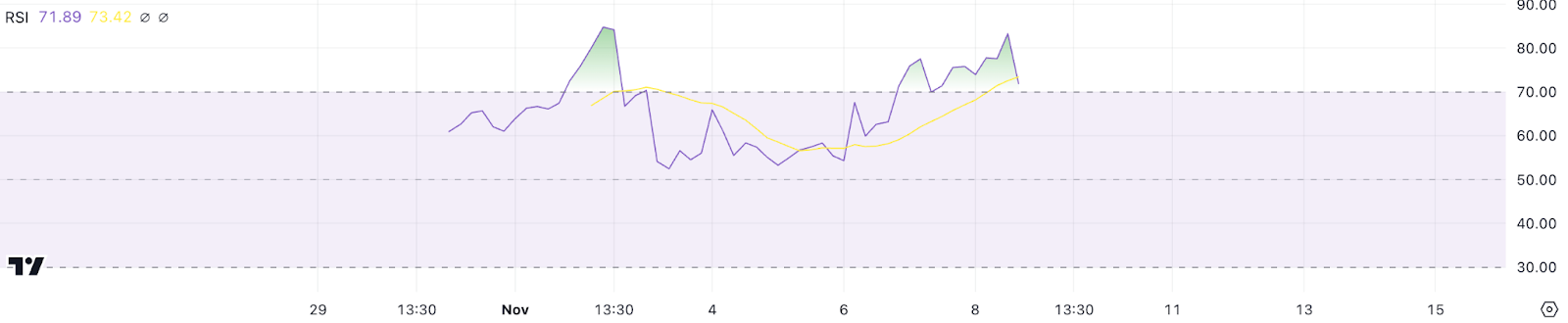

Technical Analysis: RSI Indicator and Potential Pullback Pressure

GRASS's recent price surge is dazzling, let's take a look at the technical analysis.

GRASS's RSI has quickly risen from 55 two days ago to 71.8 after the recent price surge,indicating strong buying pressure and pushing the RSI into the overbought zone. Such a rapid rise shows the market's high attention to GRASS, and the RSI even reached 85 at one point a few days after Grass officially announced the second airdrop.

RSI (Relative Strength Index) is a momentum indicator that measures the speed of price changes. When the RSI is above 70, it usually means overbought, and below 30 means oversold. GRASS's current RSI is 71.8, in the overbought zone, indicating that market enthusiasm may have pushed the price too high and too fast.

However, the RSI has shown a significant pullback since yesterday, perhaps hinting that the market is entering a cooling period, with buying momentum weakening and the price facing potential adjustments.

GRASS's Ichimoku cloud chart shows that GRASS is currently riding above the cloud, with a bright future ahead, as the entire Solana ecosystem seems to be thriving (as of the time of writing, Solana has hit a new high of $205).

The first key support level is around $2.9, near the upper edge of the cloud, where the cloud starts to thicken.

The second key support level is around $2.4.

If GRASS does pull back, this support range may be its "cushion".

Of course, if BTC continues to maintain a strong momentum, and Binance's contracts continue to provide firepower support, GRASS may continue its upward trend and could soon break through the $4 threshold.

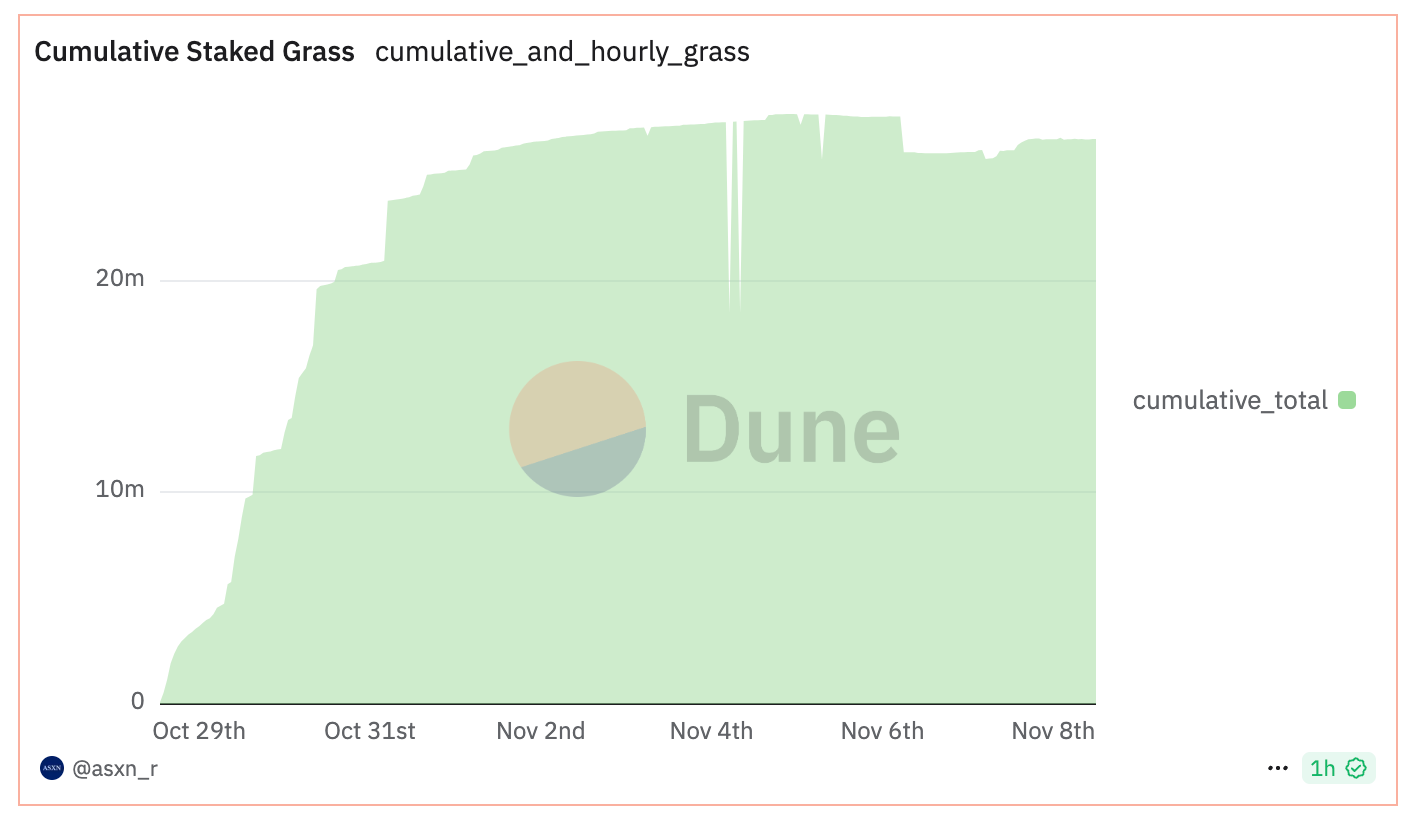

Staking Status: Lock in Chips, Wait for Earnings?

Since November 6, the staking amount of GRASS has remained above 26 million, indicating investors' confidence in long-term holding.The stability of the staking amount shows that the market has entered a consolidation phase after the short-term hype, and although the staking amount once approached 28 million in early November, the current level of stabilization may indicate a more mature market sentiment.

An increase in the staked GRASS amount usually means that investors have reduced the circulating supply, which helps stabilize the price. However, the excessively rapid price increase in the short term may prompt some investors to gradually cash out their profits, so the subtle changes in the staking indicator are worth watching. A decrease in the staked amount may signal a market pullback,while if the staked amount rises again, it indicates that more long-term holders are re-entering the market at lower prices.

How Long Can GRASS's Potential Last?

Looking back, the reason why the GRASS project can be so hot is, first, the backing of the institutions behind it, and second, it fits the current trends of the data economy and decentralization. The potential of the DePIN track is undoubtedly huge in the future, especially as the demand for AI and big data continues to grow, and everyone is eyeing the "fat meat" of data. As more and more users and capital enter the field, the heat of the DePIN track is expected to continue to rise. In the future, the performance of GRASS may be affected by the overall market, but as long as Bitcoin remains stable, GRASS is also likely to be able to support another wave.

The Windfall of DePIN: Data No Longer the Exclusive Domain of Giants?

Digging deeper, we can find that a number of projects have already emerged in the DePIN track.

Data shows thatMessari predicts that by 2028, the market capitalization of the DePIN market is expected to reach $3.5 trillion, higher than the current market capitalization of Bitcoin (currently $1.5 trillion). This market capitalization forecast has caused a stir in the market, and the value of DePIN has been directly embraced by capital as the "new favorite".

The essence of DePIN is to solve the problem of data being monopolized by a few giants.In the GRASS model, your data will become valuable, and the more you contribute, the more you can earn. Imagine the AI era in the future, when the value of data will soar, and DePIN will be like a potential stock, directly arranged by investors on the "future trend" track.

After the GRASS heat wave, there will be more DePIN projects emerging, and opportunities similar to GRASS will also emerge one after another.

But the question is, how to play this track? In one sentence: you need to reserve server resources and know how to manage them in bulk.

The core idea of DePIN is to integrate the idle computing resources of computers around the world for AI and other needs, and then use blockchain technology to distribute Token rewards to resource contributors. In simple terms, the "means of production" of DePIN is computer resources, and whoever owns the computers and can manage them can earn Tokens. It's like the old days of farming likes or doing LP, whoever knows the tricks can get rich.

Although everyone may want to just use their home computers to run DAWN, the problem is that if you want to manage 100 or 1,000 accounts, it becomes complicated. Hiring someone to help, you never know what's going on behind the scenes; opening your own servers, you also need to consider how to allocate resources reasonably, otherwise it will be a waste. The management and data monitoring of multiple servers are even more troublesome, and the technical requirements are also higher. The entry threshold for participating in the DePIN track is not low, and there is more "scientific" element compared to farming, but the competition pressure is smaller.

However, this is actually a good thing. High thresholds mean relatively fewer entrants, and the opportunities are more precious. The future of the DePIN track is still full of potential.

Conclusion: Is it a dream or a trap, continue to increase leverage or take the money and run?

Overall, GRASS is one of the most eye-catching projects in the current DePIN track, and the launch of Binance Futures has given it many opportunities to reach new heights. However, in the short term, the overbought state has left it facing certain risks of correction. For investors who really want to hold it for the long term, the DePIN track is indeed promising, and GRASS is also expected to continue to enjoy the dividends of the data decentralization wave.

The recent interest rate cut and the start of the cryptocurrency bull market after Trump's election, the future of AI and big data is undisputed, and DePIN is likely to become a force in this. The rise of GRASS is not just a momentary speculative operation, but more like the beginning of a data revolution. Investors who want to seize the opportunity must remain calm in the heat, after all, the ultimate winners are often those who see the track clearly and run fast enough.