Investment bestseller "Rich Dad, Poor Dad" author Robert Kiyosaki has long criticized the rapid growth of the U.S. national debt, which he says will lead to hyperinflation and ultimately render the U.S. dollar worthless like toilet paper. He has repeatedly called on investors to turn to safer assets such as gold, silver, and BTC.

Rich Dad Says: Plan to Increase BTC Holdings to 100 Coins

Today, Robert Kiyosaki revealed his long-term investment strategy in BTC, gold, and silver, and shared his initial cost and current holdings in BTC.

Robert Kiyosaki said that many people, when faced with the high prices of BTC, gold, or silver, choose to wait and watch for prices to fall, which is a "poor person's mindset".

The language and thoughts of a poor person are:

- BTC price is $76,000. "That's too expensive. I'll wait for the price to come down."

- Gold price is $2,684 per ounce. "That's too expensive. I'll wait for the price to come down."

- Silver price is $32.00 per ounce. "That's too expensive. I'll wait for the price to come down."

He believes that while prices will fall, relying solely on price cannot make you rich, and the key to true wealth is the quantity of assets, not the price per unit. Robert Kiyosaki mentioned that he originally bought silver at $1 per ounce and now owns thousands of ounces; in terms of BTC, he bought his first coin at $6,000 and continued to increase his position as BTC rose to $76,000, and now owns 73 BTC (worth over $5.5 million).

Remember, while the price of each coin is important, ultimately it is the "quantity" of tokens, gold, silver, or BTC that you own that matters more than the "price per unit".

Keep converting fake money to real money, and you will become richer.

Robert Kiyosaki said he hopes BTC will return to $10 per coin, but wishes cannot make one rich. He candidly admitted that he hopes to increase his BTC holdings to 100 coins within the next year (regardless of price).

Lookonchain: BTC Has Not Yet Reached Its Peak

This means that Robert Kiyosaki plans to acquire 27 more BTC in the next year! Looking ahead to the future of BTC, the on-chain data analysis account Lookonchain posted that through the analysis of 5 indicators, the results suggest that BTC has not yet reached the peak of this bull market.

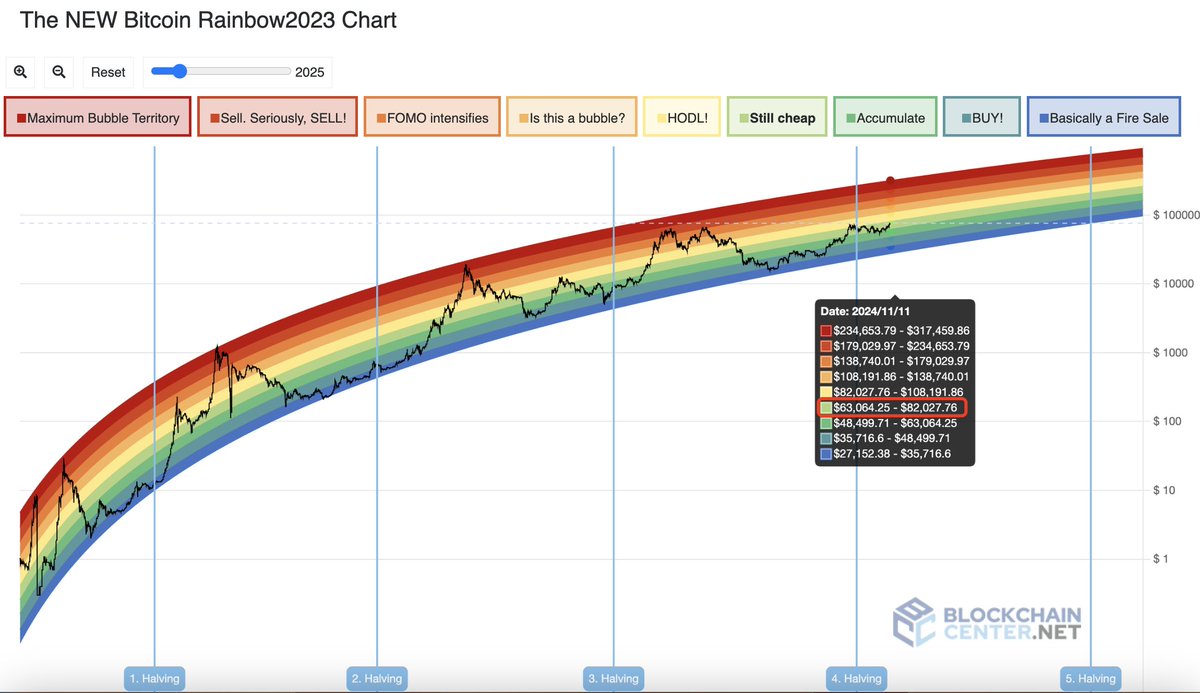

1) Rainbow Chart

The Rainbow Chart is a long-term valuation tool that uses a logarithmic growth curve to predict the potential future price direction of BTC. The new Bitcoin Rainbow2023 chart shows that BTC is still very cheap.

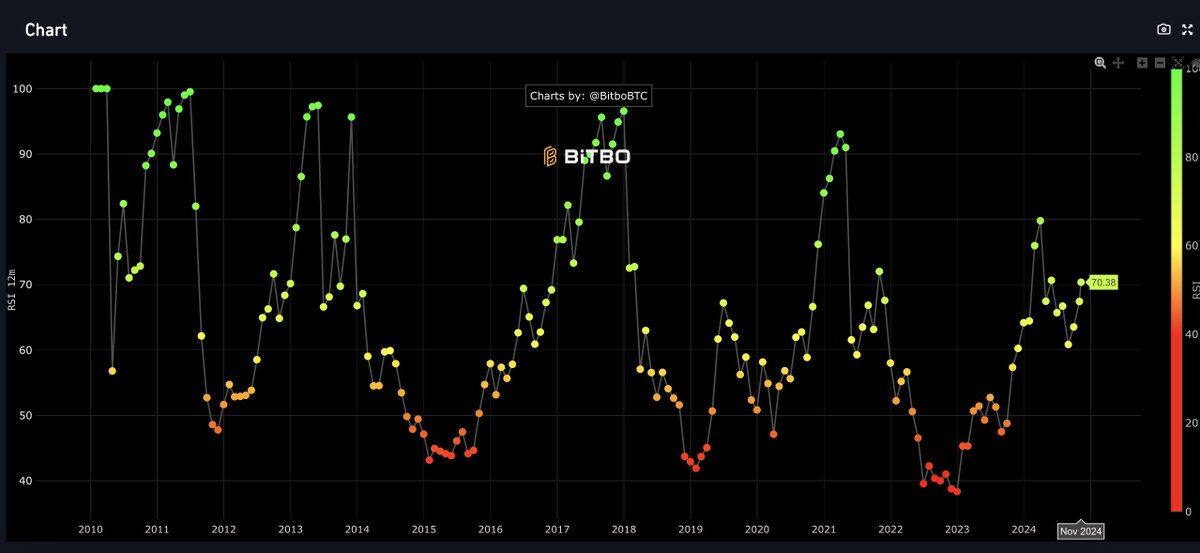

2) Relative Strength Index (RSI)

RSI ≥ 70 means BTC is overbought and may soon fall; RSI ≤ 30 means BTC is oversold and may soon rise.

The current RSI is 70.38, and compared to past bull markets, BTC does not seem to have reached its peak yet.

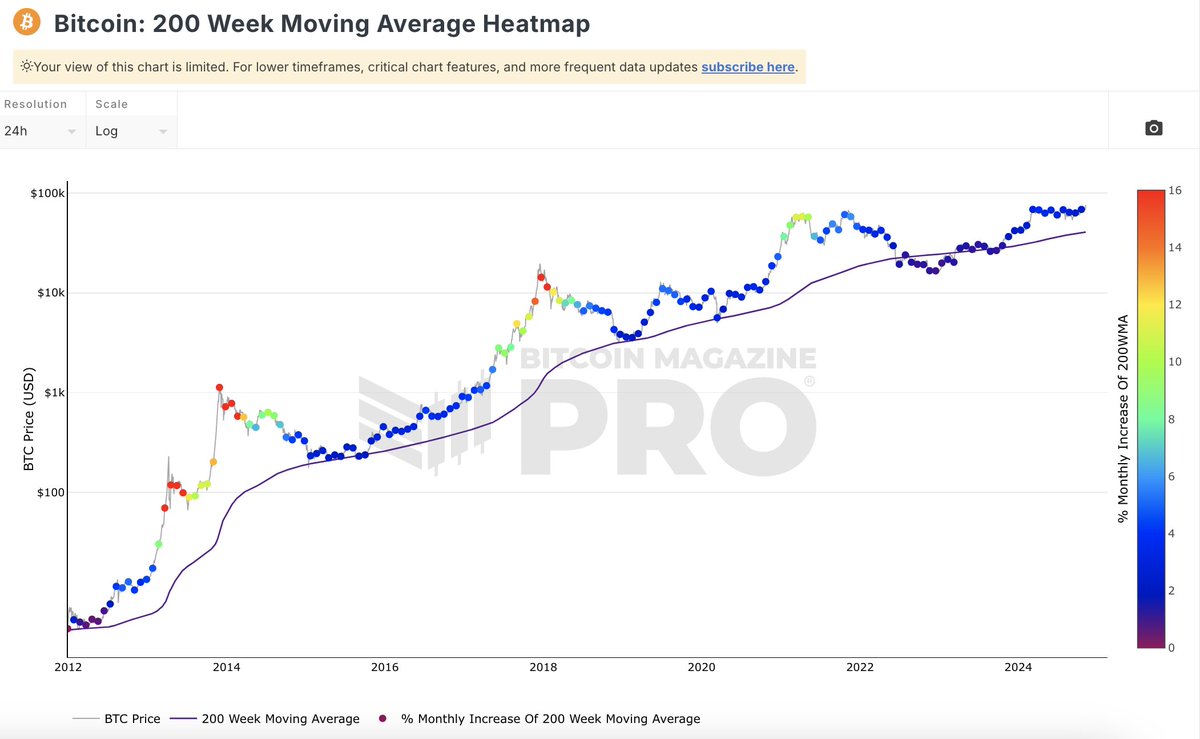

3) 200-Week Moving Average Heat Map

The 200-week moving average heat map shows the current price point is blue, meaning the price top has not yet arrived, and it is time to hold and buy.

4) Cumulative Value Destruction Days (CVDD)

When BTC price touches the orange line, BTC price is undervalued, which is a good buying opportunity.

The current CVDD shows that the top of BTC has not yet been reached.

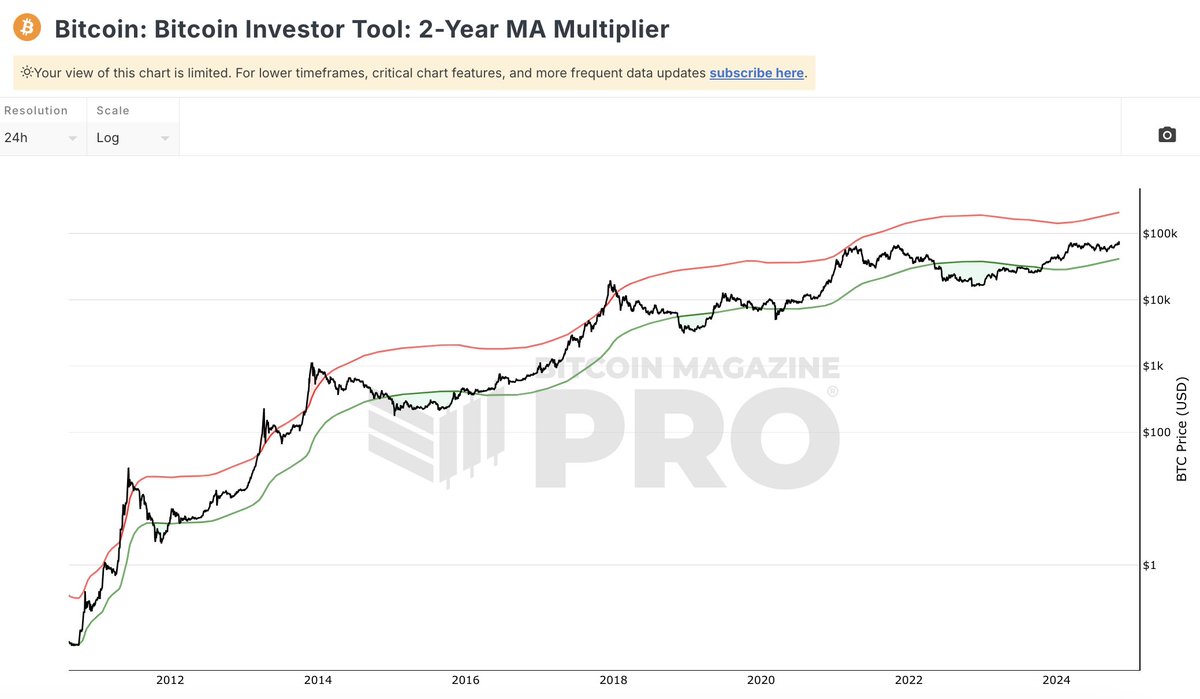

5) 2-Year MA Multiplier

The 2-year MA multiplier shows BTC's price is between the red line and the green line.It has not yet reached the red line, indicatingthe market has not yet peaked.

It is worth noting that on-chain data analysis is often based on past trends to predict the future, but the future may not repeat the historical trajectory, and the history of Bitcoin is only 16 years, with limited historical data available for analysis. Therefore, investors still need to do a good job of risk management when making investment decisions based on these data.